A Guide to Intelligent Document Processing

Discover how intelligent document processing uses AI to automate workflows, reduce errors, and transform finance operations. Your ultimate explainer.

Intelligent document processing (IDP) is all about using artificial intelligence to automatically read, understand, and process information from all sorts of documents—think invoices, receipts, and contracts. It takes messy, unstructured data and turns it into clean, organised information your business systems can use straight away. In a way, it’s like having a digital librarian for all your company’s records.

What Is Intelligent Document Processing?

Picture your finance team drowning in a pile of supplier invoices at month-end. Every invoice looks different. Some are PDFs, some are blurry scans, and a few are just photos snapped on a phone. Punching the details from each one into your accounting software is mind-numbingly slow and, let's be honest, a perfect recipe for expensive errors. This is exactly the kind of headache intelligent document processing was built to fix.

IDP isn't just a fancy scanner. It’s a sophisticated automation technology that blends artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) to mimic—and often improve upon—how a human understands documents. It goes way beyond just turning a picture of a document into text.

Beyond Basic Scanning

Traditional Optical Character Recognition (OCR) is a bit like a photocopier that can read. It can see the letters on a page and turn them into digital text, but it has zero clue what any of it actually means. It can't distinguish an invoice number from a phone number unless someone programs a rigid template telling it exactly where to look.

IDP is different because it gets the context.

IDP acts as the intelligent bridge between unstructured documents and structured business data. It doesn't just read the words; it comprehends their meaning, context, and relationship to one another, enabling true end-to-end automation.

This ability to actually interpret information is what makes all the difference. An IDP platform can intelligently find and pull out key data points, no matter where they are on the page or how the layout changes.

The Core Purpose of IDP

At its heart, intelligent document processing is designed to take huge volumes of semi-structured and unstructured documents and convert them into a usable, structured format. Once the data is organised, it can be automatically pushed into other business systems, like an ERP or CRM, with no one having to lift a finger. This delivers some pretty significant wins:

-

Drastic Reduction in Manual Work: It gets rid of the soul-crushing, repetitive task of data entry, freeing up your team for work that actually requires their expertise.

-

Improved Data Accuracy: Taking human hands off the keyboard massively reduces the risk of typos and other data entry blunders that cause payment delays or compliance problems.

-

Accelerated Business Workflows: Processes that used to take days—like approving an invoice or reconciling a bank statement—can now be wrapped up in minutes. The entire operation just runs smoother and faster.

By turning chaotic streams of documents into actionable data, intelligent document processing lays the groundwork for smarter, more efficient business operations. Platforms like Mintline apply this technology specifically to financial document management, making tedious jobs like receipt matching and reconciliation feel almost effortless.

How Intelligent Automation Works

Intelligent document processing isn't a single technology, but rather a coordinated team of specialised AI components. The best way to think about it is like a highly efficient digital assembly line for your documents. Each station has a specific job, turning a chaotic pile of paperwork into organised, ready-to-use data for your other business systems.

To really get a feel for its power, let's break down how this process works, step by step. It all starts with giving the system its "eyes" so it can actually read the document.

The Eyes: Optical Character Recognition

The foundation of any IDP system is Optical Character Recognition (OCR). At its core, OCR is what converts images of text—from a scanned invoice, a photo of a receipt, or a PDF—into text data that a computer can read. It’s the digital equivalent of typing out a book, character by character.

But modern IDP uses a far more advanced kind of OCR. It’s not just about recognising letters anymore. It’s about doing it with incredible accuracy, even when you throw poor-quality scans, weird fonts, or complicated layouts at it. This first conversion is vital because the quality of the OCR output directly affects every step that follows. A clean text layer is the raw material the rest of the system needs to work its magic.

The Brain: AI and Machine Learning

Once the document's text has been digitised, the real intelligence kicks in. This is where the "brain" of the system—powered by Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP)—takes over. It doesn't just see the words; it starts to understand them.

-

Natural Language Processing (NLP): This lets the system understand human language in context. It can tell the difference between a "shipping date" and an "invoice date" because it understands the relationships between the words.

-

Machine Learning (ML): This is the part that allows the system to get smarter over time. Instead of being locked into rigid templates, an ML model learns to spot patterns from thousands of documents. The more invoices it sees, the better it gets at finding the invoice number, no matter where it’s hidden on the page.

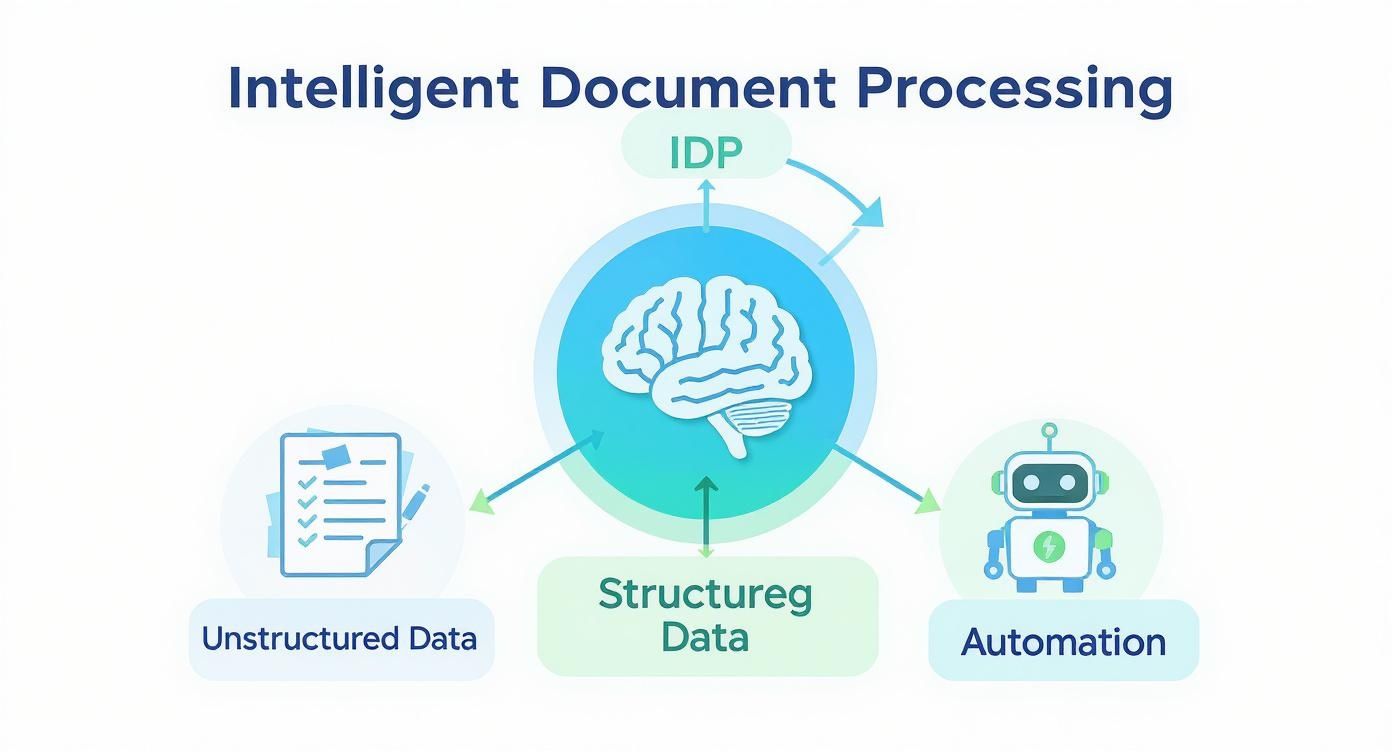

This infographic shows how IDP acts as the brain, transforming messy, unstructured data into structured information that’s ready for automation.

As you can see, the main job is this intelligent conversion, which is what unlocks true automation in business workflows. This cognitive ability is precisely what separates IDP from more basic tools.

The Hands: Data Classification and Extraction

Now that the system has a deep understanding of the document, it can start to take action. The "hands" of the IDP workflow handle two key jobs: classification and extraction.

Classification is about figuring out what kind of document it’s looking at. Is this an invoice? A purchase order? Maybe a bank statement or a contract? The AI looks at the layout, keywords, and overall structure to automatically sort it into the right digital pile.

Once it's categorised, data extraction begins. This is where the system pinpoints and pulls out the specific pieces of information your business actually needs. For an invoice, this could include:

-

Vendor Name

-

Invoice Number

-

Total Amount Due

-

Purchase Order Number

-

Line-Item Details (e.g., quantity, description, unit price)

This extracted data isn't just a jumble of text anymore; it's now structured, meaningful information.

The Nervous System: Validation and Integration

The final step is all about making sure the data is accurate and gets to where it needs to go. This is the "nervous system" of the IDP solution, connecting everything through validation and integration.

Validation rules automatically check the extracted information for mistakes. For instance, it can verify that the sum of the line items adds up to the total amount, or check a vendor's name against your list of approved suppliers.

If the system has low confidence in a field—maybe the scan was blurry—it flags it for a quick human check. This human-in-the-loop approach ensures you get near-perfect accuracy without having to manually review every single document.

Finally, the clean, validated data is automatically sent to your other business software, like your ERP or accounting system, closing the loop and completing the automation cycle.

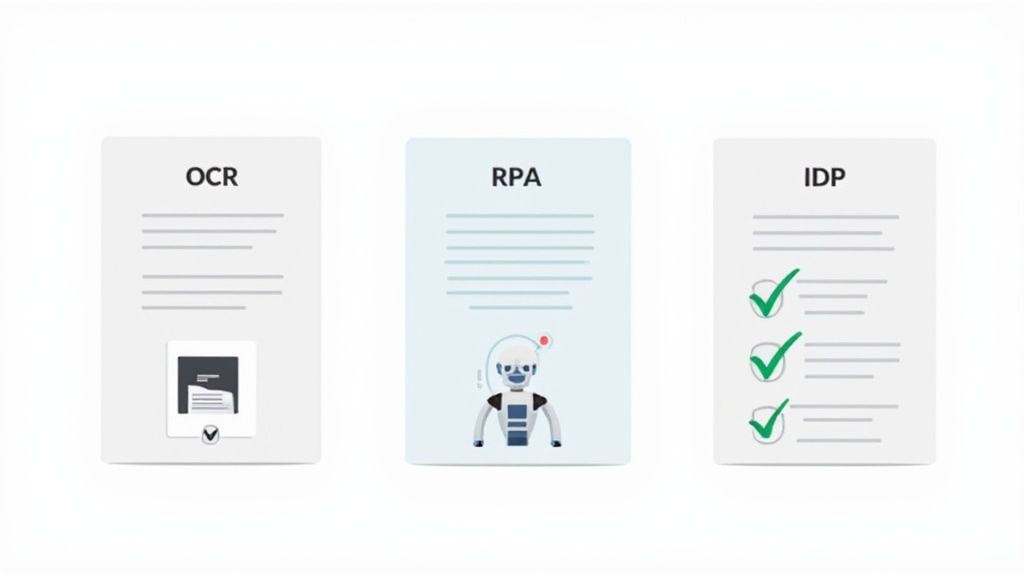

Comparing IDP vs OCR and RPA

In the world of business automation, it's easy to get lost in a sea of acronyms. Terms like OCR, RPA, and IDP are often thrown around as if they're interchangeable, but they're fundamentally different technologies with very different jobs.

Think of them as tools in a workshop. You wouldn't use a hammer to turn a screw, and you wouldn't use a simple screwdriver to build an entire house. Let’s break down what each tool does best—and, just as importantly, what its limits are. This will make it crystal clear where intelligent document processing fits and why it’s so much more than just the sum of its parts.

OCR The Digital Scanner

At its core, Optical Character Recognition (OCR) is the technology that scans an image and turns the letters and numbers it sees into actual text your computer can read. It’s like a digital transcriber, meticulously typing out what’s on a page. But that’s where its job ends.

Traditional OCR is a bit of a one-trick pony. It digitises text but has zero understanding of what that text means. For example, it can read “€1,250.75” from a scanned invoice, but it has no clue that this number represents the “Total Amount Due.” To the OCR engine, it's just a string of characters.

This lack of context means basic OCR hits a wall when faced with real-world complexity:

-

Variable Layouts: If one supplier puts their invoice number at the top and another puts it at the bottom, a rigid, template-based OCR system will get confused and fail.

-

Data Interpretation: It can't tell the difference between a date, a PO number, or a phone number without you building strict, predefined rules for every single document variation.

-

Poor Quality Documents: Blurry scans, skewed pages, or even handwritten notes can lead to a mess of errors, forcing your team to spend hours making manual corrections.

RPA The Rule-Following Robot

Next up is Robotic Process Automation (RPA). An RPA "bot" is a piece of software that mimics repetitive human actions on a computer—think of it as a macro on steroids. It can log into an app, copy data from one system, and paste it into another, over and over again, without getting tired or making typos.

But RPA’s greatest strength is also its biggest weakness: it needs clean, structured, and predictable data to do its job. An RPA bot can’t just open a PDF invoice and start working. It needs someone—or something—to pull out the important data first and line it up neatly in a format it understands, like a spreadsheet.

An RPA bot is like a hyper-efficient assembly line worker. It can perform its task flawlessly thousands of times, but only if you hand it the exact parts it needs, in the correct order. It can't sort through a messy box of assorted components on its own.

This is the exact spot where many automation projects get stuck. A company invests in RPA to automate invoice processing, only to discover their shiny new bots are sitting idle because they can't make sense of the incoming invoices.

IDP The Intelligent Bridge

This is precisely where intelligent document processing comes in. IDP acts as the smart bridge between messy, unstructured documents and the rule-based systems that need clean data, like RPA. It accomplishes what OCR and RPA can't do alone: it reads, understands, and structures information from complex documents, no matter the layout or format.

IDP uses AI to grasp context, making it light-years ahead of basic OCR. For instance, enterprises here in the Netherlands that have adopted advanced IDP are seeing incredible gains in straight-through processing. It’s not uncommon for top performers to process over 95% of documents automatically without any human intervention. Compare that to traditional OCR, which often tops out below 60% accuracy on complex documents. You can find more data on how intelligent document processing is transforming industries in recent market reports.

To make the comparison even clearer, here’s a quick breakdown of how they stack up.

IDP vs OCR vs RPA A Capability Comparison

| Capability | Basic OCR | RPA (Robotic Process Automation) | IDP (Intelligent Document Processing) |

|---|---|---|---|

| Primary Function | Converts images to raw text | Automates rule-based digital tasks | Extracts and understands data from documents |

| Data Handling | Only handles structured text | Requires pre-structured data to work | Processes unstructured and semi-structured data |

| Adaptability | Relies on rigid templates | Follows strict, pre-programmed rules | Learns and adapts to new document layouts via AI |

| Use Case Example | Digitising a printed book page | Copying data from a spreadsheet to a CRM | Automatically processing invoices of any format |

When you look at it this way, it’s clear that IDP doesn’t really replace OCR or RPA. It makes them better. IDP delivers the clean, structured, and reliable data that RPA bots need to do their jobs, finally connecting the dots and enabling true end-to-end automation.

Finance Use Cases for Intelligent Document Processing

While the tech behind intelligent document processing is impressive, its real worth shines when you see it tackle the everyday grind of a finance and accounting team. These departments are often buried under a mountain of repetitive, document-heavy tasks where one tiny slip-up can snowball into a major headache.

IDP isn’t about making things a little bit faster; it’s about fundamentally changing how core financial workflows get done. Let's move away from theory and look at three specific scenarios where IDP delivers a powerful, tangible return on investment.

Automated Invoice Processing

For countless businesses, the accounts payable process is a notorious bottleneck. It's a painfully manual cycle: open an email, download a PDF invoice, maybe even print it out, then punch all the data into an accounting system. The real kicker? Every supplier’s invoice looks different, which makes old-school, template-based automation completely unreliable.

The "Before" Picture: A finance clerk spends hours every week hand-keying data from hundreds of different supplier invoices. They’re hunting for the vendor name, invoice date, PO number, and all the line-item details, then carefully typing everything into the ERP. It’s slow, mind-numbing, and a breeding ground for human error, leading to late payments, missed early-payment discounts, and friction with suppliers.

The "After" Picture with IDP: An intelligent document processing platform is set up to automatically grab invoices right from an email inbox. Using its built-in AI, it instantly spots and pulls out all the critical information, no matter how the invoice is formatted. The system then double-checks the data—say, by matching the PO number against the original purchase order in your system—before pushing it directly into your accounting software for a final payment approval.

This shift transforms accounts payable from a manual data-entry station into a strategic, automated function. The team stops typing and starts focusing on handling exceptions and analysing spending, which drastically cuts processing costs and skyrockets accuracy.

This isn't some far-off concept; it's happening right now. The intelligent document processing market in the Netherlands, for instance, is expanding at a remarkable pace, driven largely by the finance and banking sectors. Standalone IDP tools command about 61.83% of the market's revenue, showing a clear preference for specialised solutions. With a projected growth rate of 32.1% annually between 2025 and 2030, Dutch companies are voting with their budgets. You can dig into the detailed projections to understand more about this regional growth.

Bank Statement Reconciliation

Matching up bank statements with your internal books is another one of those critical but often dreaded monthly chores. For businesses juggling thousands of transactions, it can feel like looking for a needle in a haystack. Manually ticking and tying every single line item is an enormous drain on your team’s time and energy.

The "Before" Picture: An accountant downloads a PDF bank statement and prints it out. They then settle in for a few days of painstakingly comparing each transaction on the statement to the entries in the company's general ledger. It’s monotonous and mentally exhausting.

The "After" Picture with IDP: The platform ingests the bank statement PDF in seconds. Its AI engine reads and structures every transaction—date, description, amount, everything. It then automatically matches these transactions against the records in your accounting system, flagging the few discrepancies that need a human eye. What used to be a multi-day ordeal is now a task that can be knocked out in under an hour.

Expense Report Management

Let's be honest: nobody enjoys managing employee expense reports. It’s a mess of crumpled receipts, inconsistent submissions, and endless back-and-forth. Chasing down employees for missing paperwork and squinting to read the faded ink on dozens of tiny receipts is the definition of inefficiency.

The "Before" Picture: Employees submit a jumble of receipts, often just blurry photos from their phones. Someone on the finance team has to decipher each one to find the vendor, date, and total, then manually enter all of it into the expense system.

The "After" Picture with IDP: An employee simply snaps a photo of their receipt and uploads it. The IDP solution instantly pulls out the key data, categorises the expense (like "meals" or "transport"), and populates the expense report. The platform can even be taught to enforce company policy by automatically flagging out-of-bounds claims.

In each of these examples, the pattern is identical. Intelligent document processing takes a high-volume, error-prone manual process and turns it into a fast, accurate, and automated workflow. This frees up your skilled finance professionals to focus on work that actually adds value—like financial analysis, forecasting, and strategic planning—delivering a clear and compelling ROI.

How to Implement an IDP Solution Successfully

Taking the leap into intelligent document processing can feel like a massive project, but you don't have to boil the ocean. The most successful rollouts happen in strategic, phased stages. It’s not about automating everything overnight; it's about building momentum by picking the right battles first. A solid plan from the get-go is your best guarantee for choosing the right partner and seeing a real return on your investment.

The journey starts long before you look at any software. First, you need to get crystal clear on what you're actually trying to accomplish. Are you aiming to slash invoice processing time from days down to a few hours? Is the main goal to kill the data entry errors that are gumming up your payment cycles? Or maybe you just want to liberate your finance team from mind-numbing manual work so they can focus on analysis that matters.

Define Your Business Objectives First

If you don’t have specific goals, you have no way to measure success. It’s that simple. You need to identify the exact pain points you want to solve. Start by mapping out which document workflows are causing the most headaches. For many, accounts payable is the perfect starting point—it’s repetitive, swamped with documents, and has a direct line to your cash flow and supplier relationships.

Setting clear, quantifiable objectives is the most critical first step in any IDP implementation. Goals like "Reduce invoice processing costs by 30%" or "Achieve 90% straight-through processing for purchase orders" provide a clear benchmark for success and guide your entire strategy.

Once you know your objectives, map out your current process. I mean every single step, from the moment a document lands on your desk (or in your inbox) to how its data finally makes its way into your systems. This map will shine a spotlight on the biggest bottlenecks and show you exactly where an IDP solution will make the biggest difference.

Choosing the Right IDP Vendor

With your goals and process map in hand, you're ready to start evaluating vendors. Think of this as choosing a partner, not just buying a piece of software. A detailed checklist is essential to make sure the solution you pick not only fits your needs today but can also grow with you.

This decision is especially critical in such a fast-moving market. The adoption of intelligent document processing in the Netherlands reflects what's happening globally, with the Dutch market projected to expand at a compound annual growth rate of 32.1% between 2025 and 2030. This boom is driven by a demand for real-time processing and better data security, making a thorough vendor check non-negotiable. You can discover more insights about these market trends on Research and Markets.

As you weigh your options, put these crucial criteria at the top of your list:

-

Security and Compliance: Does the vendor meet strict standards like GDPR? Where will your data live? Look for non-negotiables like end-to-end encryption and clear data residency policies, especially when dealing with sensitive financial information.

-

Integration Capabilities: The most powerful IDP tool is worthless if it can't communicate with your other systems. Check for seamless, pre-built integrations with your ERP, accounting software, and other business-critical applications.

-

Transparent Accuracy Metrics: Ask vendors how they measure and report on accuracy. They should be upfront about their straight-through processing rates and be able to walk you through their human-in-the-loop process for handling the exceptions.

-

Scalability and Uptime: The platform needs to handle your current document volume without breaking a sweat, but it also has to be ready for your future growth. Ask about their service level agreements (SLAs) to ensure you're getting a reliable service with minimal downtime.

-

Flexible Data Export: How easily can you get your cleaned-up, structured data out? A good solution will support multiple export formats (like CSV, JSON, or XML) to ensure it plays nicely with all your downstream systems and reporting tools.

Taking the time to dig into these factors will help you sidestep the common pitfalls of implementation. It ensures you find a partner who can deliver a reliable, secure, and effective intelligent document processing solution that genuinely understands your financial workflows. Of course, transparent pricing is also a major piece of the puzzle; you can explore a breakdown of different tiers to see how Mintline’s pricing plans might align with your specific needs.

Got Questions About Intelligent Document Processing?

Stepping into new technology always raises a few questions, and that's a good thing. When it's something as fundamental as your document workflows, you need to be absolutely sure before making a move. So, let’s clear the air and walk through the most common queries we hear from businesses looking into intelligent document processing.

Getting these answers straight will pull back the curtain on the technology, showing you exactly what you can expect from a modern IDP solution. We'll touch on how it handles messy, real-world documents, how accurate it really is, and—of course—how it keeps your sensitive financial data safe.

How Does IDP Handle All My Different Document Layouts?

This is usually the first question people ask, and it gets right to the heart of what makes IDP so different from older tech. Traditional automation tools were incredibly rigid. They relied on templates, which meant if a supplier tweaked their invoice layout—even a tiny bit—the whole system would break. Automation would grind to a halt, and you'd be back to manual entry.

Intelligent document processing completely sidesteps this problem. Instead of being locked into fixed templates, it uses flexible machine learning (ML) models.

Here’s a simple analogy: you don’t need a specific template to know you’re looking at a cat. You've seen thousands of them—different breeds, colours, and poses—so your brain just gets the concept of "cat." An IDP platform's ML model works the same way. It's been trained on hundreds of thousands of documents, so it learns to recognise the idea of an "invoice number" or a "total amount" by looking at context, nearby keywords, and where that data usually sits. It isn't just looking for data at a fixed coordinate on the page.

This is the key. The system’s ability to learn and adapt means it can handle a huge variety of documents right out of the box. Better yet, it gets smarter and more accurate as it processes more of your specific documents. It won’t get thrown off just because a new supplier’s invoice looks different.

What Kind of Accuracy Can I Realistically Expect?

No technology is perfect 100% of the time, but modern IDP solutions get impressively close. It's common to see accuracy rates that exceed 95% for structured and semi-structured documents. This is a massive improvement over basic OCR tools, which often stall out around 60-70% accuracy on anything but the most pristine, high-quality scans.

But the real goal isn't just high accuracy; it's reliable accuracy. This is where a human-in-the-loop validation process becomes your secret weapon.

Here’s how it works: the IDP system assigns a confidence score to every single piece of data it extracts. If the score is high (say, 99%), the data flows through automatically without anyone needing to lift a finger. But if the score is low—maybe because of a blurry photo or an unusual layout—the system flags that one field for a quick human check.

This hybrid approach gives you the best of both worlds:

-

The vast majority of your documents fly through the system in seconds (straight-through processing).

-

Your team only spends a few moments checking the handful of exceptions.

-

The result? You achieve near-perfect data accuracy without the soul-crushing task of manually reviewing every line of every document.

It’s a smart workflow that’s fast, efficient, and incredibly reliable. You can find more practical guides for optimising business workflows on the Mintline blog.

Is My Sensitive Financial Data Secure with IDP?

For any finance team, security isn't just a feature; it's a deal-breaker. Trusting a third-party platform with sensitive documents like invoices and bank statements demands total confidence. That’s why enterprise-ready IDP solutions are built from the ground up with multiple layers of security to guard your information.

When you're looking at different vendors, make sure these security features are on your checklist:

-

End-to-End Encryption: Your data needs to be scrambled and unreadable both when it's travelling over the internet (in transit) and when it's sitting on a server (at rest). Look for AES-256 encryption, which is the industry gold standard.

-

Strict Access Controls: You need to be in the driver's seat, deciding who sees what. Role-based access controls ensure that team members can only view the specific information they need to do their jobs.

-

Compliance Certifications: The platform must comply with major data protection laws like GDPR, especially if you do business in the EU. A good vendor will be transparent about where your data is stored, ideally offering EU-based data centres.

Any IDP provider worth your time will be completely open about their security measures. They should be able to provide clear documentation showing you exactly how they protect your organisation’s most valuable asset: its data.

Ready to stop chasing receipts and start automating your financial records? Mintline uses AI to automatically link every bank transaction to its matching document, turning hours of manual work into minutes. Get started with Mintline for free and experience seamless financial organisation.