AI in Accounting: Automate Your Admin with Mintline

ai in accounting helps automate tasks, cut errors, and speed reporting. Discover practical uses and platforms shaping modern finance.

Imagine an accounting assistant who works 24/7, never makes a calculation error, and handles tedious financial admin in seconds. That's the power AI in accounting brings to your business. Specifically, platforms like Mintline are designed to automate the repetitive parts of finance, eliminate errors, and free up talented people for more strategic work.

The New Era of Financial Management

For years, accounting meant drowning in manual data entry, wrangling spreadsheets, and spending countless hours on painstaking reconciliation. This old-school approach is not just slow; it's a breeding ground for human error, leading to costly mistakes and compliance headaches. Artificial intelligence is completely reshaping this landscape, pushing the profession far beyond number-crunching.

Think of AI, and specifically a tool like Mintline, as a hyper-efficient digital assistant for your finance team. Its core purpose is to handle the mind-numbing, rule-based tasks that consume so much time—like matching receipts to bank statements or categorising expenses. By taking over this grunt work, AI paves the way for a finance function that's more forward-looking and insightful.

How the Technology Actually Works

The engine driving AI in accounting is machine learning. This is a type of AI where the system learns from data to spot patterns and make decisions. For example, Mintline uses machine learning to sift through thousands of bank transactions and receipts. It learns to identify vendor names, dates, and totals, becoming faster and more accurate at matching them over time. This continuous learning is what ensures accuracy and minimises the need for manual review.

This isn't a future trend; it's happening now. The rapid adoption of AI in the Netherlands paints a clear picture. As of early 2025, over 3 million Dutch adults use AI tools daily. In business, 95% of companies have started AI projects, and nearly 48% of larger firms have adopted these technologies. The Dutch AI market is set to grow by about 28.56% annually, hitting around US$8.67 billion by 2030, with a strong focus on financial document processing. You can dive deeper into these trends on AI automation in the Netherlands on lleverage.ai.

The table below gives a snapshot of how dramatically things change when you bring AI into your accounting workflow.

Manual vs AI-Powered Accounting At a Glance

| Accounting Task | Traditional Manual Method | AI-Powered Method (e.g., Mintline) |

|---|---|---|

| Receipt & Invoice Processing | Manual data entry from paper or PDF into accounting software. Very time-consuming and prone to typos. | AI automatically scans, extracts, and categorises data from documents in seconds. |

| Bank Reconciliation | Line-by-line manual matching of bank statements against general ledger entries. Can take days each month. | The system instantly matches transactions, flagging only the exceptions that need a human eye. |

| Fraud Detection | Relies on manual spot-checks and identifying anomalies based on personal experience. Easy to miss subtle signs. | AI analyses patterns in real-time to detect unusual spending or duplicate payments, sending instant alerts. |

| Financial Reporting | Involves manually pulling data from different sources and compiling reports in spreadsheets. Slow and often outdated. | Generates real-time, customisable reports and dashboards with a few clicks. |

This comparison makes it clear: AI doesn't just speed things up; it introduces a level of accuracy and efficiency that's simply impossible with manual methods.

From Manual Labour to Strategic Partner

This shift doesn't make accountants redundant—it elevates their role. When routine work is handled by AI, finance professionals can finally turn their attention to higher-value activities that demand human critical thinking.

By handling the meticulous data work, AI empowers accountants to become true strategic advisors, focusing on financial forecasting, business growth strategies, and providing crucial insights that drive better decision-making.

Instead of spending the first week of every month chasing receipts, your team can analyse spending trends, spot cost-saving opportunities, and contribute directly to the company's growth. This powerful partnership between human expertise and machine efficiency is where the future of finance is heading.

How AI Actually Helps with Daily Accounting Tasks

Let’s get practical. Where does the rubber meet the road for finance professionals? The real impact of AI in accounting is in the day-to-day grind, tackling the routine tasks that used to eat up hours. This is where tools like Mintline step in, turning manual slogs into automated wins.

Think about the classic headache: managing receipts and invoices. For years, this meant a soul-crushing cycle of printing documents, punching numbers into a spreadsheet, and painstakingly matching every line item against a bank statement. It’s slow, tedious, and a breeding ground for errors.

Now, imagine this: you upload a PDF bank statement or connect your bank feed, and the AI takes over. Mintline reads every transaction, figures out the context, and automatically finds the matching receipt or invoice. The contrast is night and day. What was once a major bottleneck is now cleared in moments.

Automated Receipt and Invoice Matching

At the core of this is a technology called intelligent document processing. In simple terms, it’s AI trained to read and understand financial documents like a person would, but at superhuman speed. If you want to dive deeper, check out our guide on intelligent document processing.

So, instead of an accountant squinting at a pile of crumpled receipts, an AI platform like Mintline gets to work:

- It Extracts the Key Details: The AI instantly spots and pulls out the important bits—vendor name, date, total amount, VAT, you name it.

- It Categorises Expenses Sensibly: Based on past activity, the AI learns to assign costs to the right buckets, like "Office Supplies" or "Travel," without you lifting a finger.

- It Matches Everything to Bank Transactions: The system then cross-references this data with your bank feed, flagging a perfect match almost instantly.

This level of automation keeps your books consistently accurate and up-to-date. The time you get back can be reinvested in work that actually matters.

Intelligent Bank Reconciliation

Bank reconciliation is another monthly monster that AI has tamed. The old way—manually ticking off every ledger entry against the bank statement—isn't just boring; it's where mistakes hide. A single missed transaction can send you on a wild goose chase.

AI-powered reconciliation automates this entire matching game. It can compare thousands of transactions in the blink of an eye, only flagging the few anomalies that need your attention.

Think of AI as your tireless assistant, constantly checking and re-checking your accounts to make sure everything lines up. It transforms reconciliation from a multi-day ordeal into a quick final review, letting you close the books faster and with more confidence.

No more late nights hunting for that one tiny discrepancy. The AI does the heavy lifting and serves you a clean, reconciled report, highlighting anything weird like duplicate payments or unexpected bank charges.

Proactive Fraud Detection and Anomaly Spotting

Beyond making life easier, AI in accounting adds a serious layer of security. Traditional fraud detection is often reactive; you find the problem long after the damage is done. AI, on the other hand, is proactive.

Machine learning algorithms analyse your historical transaction data to learn what "normal" looks like for your business. When something out of the ordinary happens—like an unusually large payment to a new vendor—the system flags it immediately for review. This real-time monitoring can catch fraud before it gets out of hand.

More Accurate Financial Forecasting

Good forecasting is essential for smart business planning, but it's completely dependent on data quality. By ensuring your financial data is clean, current, and correctly categorised, AI provides a rock-solid foundation for forecasting. AI-driven models can then analyse trends and predict future cash flow far more accurately than any manual spreadsheet.

This gives business leaders the ability to make confident decisions backed by solid numbers instead of just gut feelings.

The auditing world is already betting big on this. Deloitte Netherlands announced it will conduct all of its audits using AI starting in 2025. Their generative AI model helps automate compliance checks and flag inconsistencies, tackling both the accountant shortage and regulatory pressure. You can read more about Deloitte's revolutionary embrace of AI on amsterdamai.com. It’s a clear sign that the world's top firms trust AI to maintain the highest standards of accuracy.

Implementing AI in Your Accounting Workflow

Bringing AI into your accounting doesn’t have to be a massive disruption. A smart adoption journey starts with a simple, practical question: what are our biggest financial headaches right now? The goal is to start small, solve a real problem, and build momentum.

Whether you're a freelancer drowning in a shoebox of receipts or a growing company struggling with manual reconciliations, the first step is the same. Identify what’s eating up the most time or causing the most mistakes. Is it chasing invoices? Matching bank transactions one by one? Or just the sheer grind of data entry?

Once you’ve pinpointed those specific pain points, you have a clear target. You know exactly where a tool like Mintline can make the biggest difference, fast.

Start with a Clear Pilot Project

Instead of trying to transform your entire finance department overnight, kick things off with a small, manageable pilot project. This lets you test the technology in a low-risk environment, measure the benefits, and get your team comfortable with a new way of working.

A perfect place to start is by automating receipt and invoice matching. It's a universal chore that platforms like Mintline were specifically built to handle. Getting this one task off your plate can free up dozens of hours every month. That’s a quick, tangible win that builds confidence.

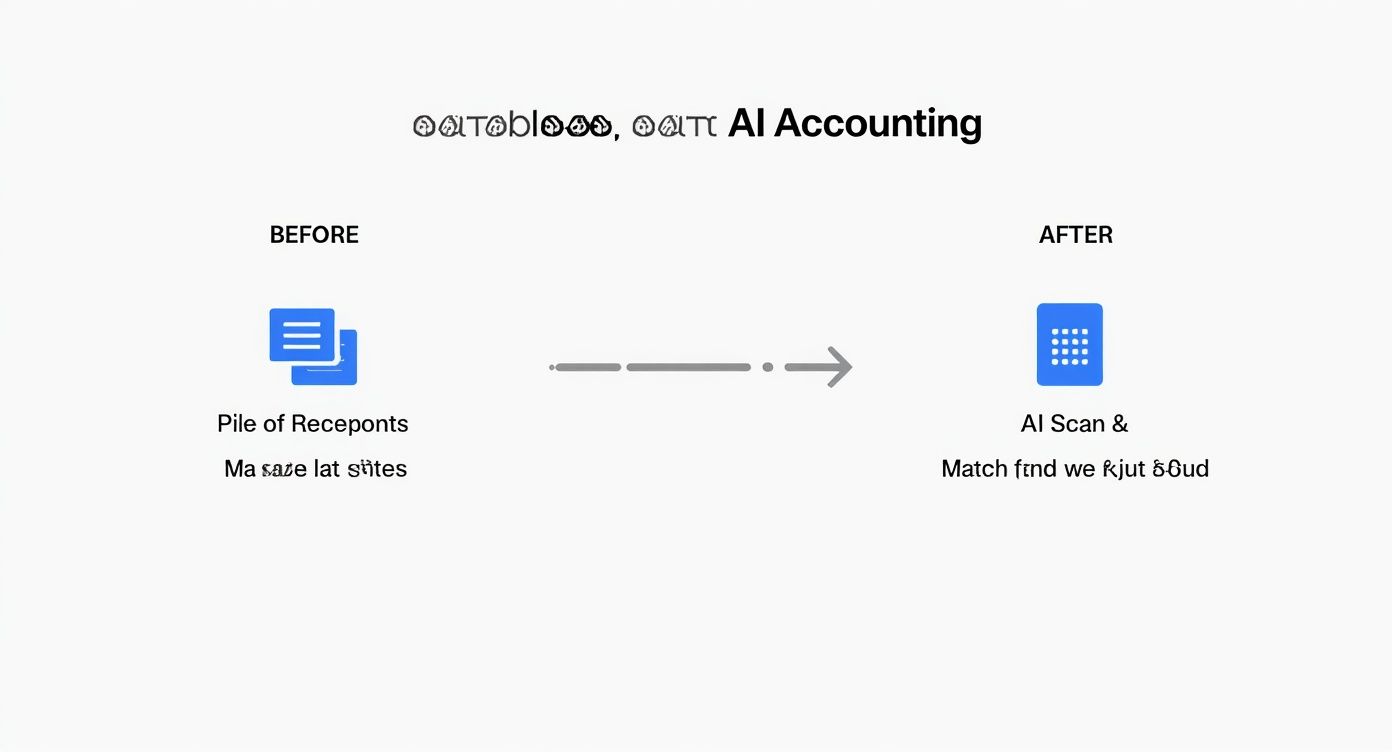

This infographic paints a clear picture of the shift from a manual, messy process to a clean, AI-driven one.

You can see how AI replaces cluttered, hands-on tasks with a single, automated step, making the whole workflow incredibly straightforward.

Choosing the Right Tools and Integrating Data

With your pilot project defined, it's time to pick your tool. You'll want something user-friendly, secure, and compatible with your existing software. An all-in-one platform like Mintline makes this easy by focusing on one high-impact job: automatically linking every bank transaction to its source document.

A smooth data connection is essential. Modern AI tools make this simple—you can either connect your bank accounts securely or just upload your PDF statements. The AI then gets to work in the background, organising your financial data without you needing a degree in IT. This is a core part of straight-through processing, where a transaction is handled from start to finish with almost no human intervention. You can learn more about this in our article on how straight-through processing works.

Getting your team on board is the final piece of the puzzle. Frame the AI tool not as a replacement, but as an assistant. It's there to handle the boring stuff, freeing them up for more interesting work.

Scaling Up: From Pilot to Full Integration

The journey from a small pilot to wider adoption looks different depending on your company's size. Here's a quick roadmap of what those first steps might look like.

AI Implementation Roadmap by Business Size

| Business Size | First Step | Key Focus | Recommended Tool Type |

|---|---|---|---|

| Freelancer / Solopreneur | Automate receipt capture and categorisation | Eliminating manual data entry and reclaiming time | Mobile-first receipt scanning apps or simple expense trackers |

| Small to Medium Enterprise (SME) | Implement a pilot project for invoice processing or reconciliation | Improving accuracy, reducing processing time, and gaining financial visibility | Integrated accounting platforms with built-in AI modules (e.g., Mintline) |

| Large Enterprise | Form a dedicated team to identify a high-impact use case (e.g., fraud detection) | Ensuring security, compliance, and scalability across departments | Customisable, enterprise-grade AI solutions or dedicated fintech platforms |

This table shows the principle is the same regardless of size: start with a focused problem and choose a tool that fits your immediate needs.

The Dutch financial services sector offers a great real-world example. As of 2024, about 37.4% of these firms in the Netherlands have integrated AI. While that’s a solid start, it shows the rollout isn't happening everywhere at once, even though up to 95% of all Dutch organisations are running AI programmes in some form. Regulators are focused on governance, and upskilling is a priority—53% of finance professionals are actively learning about AI. You can read more about AI's role in the Dutch financial sector on nucamp.co.

The key takeaway is to start small, prove the value, and then scale. Once your pilot project clearly saves time and cuts errors, you can confidently expand AI's role into other areas like forecasting and fraud detection.

This step-by-step approach demystifies implementing AI in accounting. It turns an overwhelming project into a series of logical steps that deliver more value over time.

Navigating Security and Compliance in AI Accounting

Let's be honest: handing over sensitive financial data to a new system can feel like a leap of faith. With cyber threats growing more sophisticated, trust is everything. That’s why modern AI in accounting platforms are built with security at their very core.

When you look at a platform like Mintline, security is woven into its DNA. It starts with basics like end-to-end data encryption. Every financial document and transaction is put into a digital vault using powerful methods like AES-256 encryption. This makes the data unreadable to anyone without the key, whether it's in transit or at rest.

Then there's compliance. For any business with European customers, sticking to the General Data Protection Regulation (GDPR) is non-negotiable. Reputable AI providers get this. They often store data on EU-based servers and have crystal-clear policies promising your information will never be shared without your explicit consent.

Core Security Measures in AI Platforms

A reliable AI accounting tool stands on a few key security pillars. These are the must-haves you should look for.

- Robust Data Encryption: This is your first line of defence, ensuring your financial information is locked down and secure.

- Strict Access Controls: You decide who sees what. This granular control lets you manage which team members can view, change, or export data.

- Secure Cloud Infrastructure: Top-tier platforms partner with giants like Amazon Web Services (AWS), leveraging their billion-dollar investment in physical and digital security.

- GDPR and Regulatory Compliance: A platform that openly adheres to data privacy laws is a clear signal they take protecting your information seriously.

These measures create a solid defensive wall. But the real game-changer is how AI moves security from a passive defence to an active strategy.

How AI Actively Enhances Your Security

It might sound strange, but bringing AI into your accounting can actually make your processes more secure. Traditional methods often rely on random spot-checks, which means things can easily slip through the cracks. AI, on the other hand, is like a digital watchdog that never sleeps.

AI doesn't just protect your data; it uses data to protect your business. By learning the normal rhythm of your financial transactions, it can instantly flag anomalies that a human might miss, transforming security from a reactive chore into a proactive defence.

Imagine a machine learning algorithm that has analysed your company's spending patterns for the last year. It knows what's normal. So, if a duplicate invoice pops up or a payment is suddenly sent to an unknown bank account, the system flags it instantly. That’s the real power of AI in accounting—it spots the subtle red flags far quicker than any person could.

This proactive stance is fast becoming the norm. Research from 2025 highlights that firms of all sizes now use AI to analyse financial documents and pinpoint anomalies. This not only speeds up internal reviews but also dramatically improves the accuracy of compliance checks.

By combining foundational security like encryption with the intelligent oversight of AI, platforms like Mintline don't just ask for your trust. They earn it by building a system that actively works to keep your financials safe.

Measuring the True ROI of AI in Accounting

So, you're considering AI for your accounting workflow. The big question always comes down to this: is it actually worth it? When we talk about AI in accounting, figuring out the return on investment (ROI) isn't just about comparing a software subscription to a salary. The real value is measured in what you get back—in time, accuracy, and strategic ability.

To make a solid case for adopting AI, you need to look beyond cost savings. You have to measure how it makes your entire financial operation stronger. That means tracking the hard numbers and paying attention to the less tangible benefits.

Key Metrics to Track Before and After AI

Before you sign up for a tool like Mintline, you need a baseline. You have to know where you're starting from to see how far you've come.

- Time Spent on Manual Tasks: How many hours a month are you or your team really spending on things like matching receipts, reconciling bank statements, or pulling reports? Get an honest number.

- Error Rate: Manual data entry leads to mistakes. How often are they happening? More importantly, how much time does it take to find and fix them? Every correction costs time and money.

- Financial Closing Time: How many days does it take to close the books each month? This number is a fantastic indicator of your overall financial efficiency.

Once your AI solution is in place, track these same metrics for a few months. The change you see is the direct result of automation. If your team suddenly gets back 15-20 hours a month that used to be lost in reconciliation, you've got a powerful and undeniable ROI metric.

Calculating the Full Value

With your before-and-after data, you can start putting a real number on your return. The easiest way is to look at time saved. Multiply the hours reclaimed by the average hourly cost of your finance team. That simple calculation often proves the investment was worth it on its own.

But the true magic of AI isn't just doing old tasks faster. It’s about freeing up your people to do entirely new, higher-value work.

All that time saved from mind-numbing admin can now be poured into strategic financial analysis, better cash flow forecasting, or even offering advisory services. Suddenly, your finance function isn't just a cost centre—it's a strategic driver for the business. Accountants get to be the advisors they were trained to be, guiding decisions instead of chasing paperwork. That shift is a huge part of your ROI.

Building Your Business Case with Mintline

A platform like Mintline makes this whole process easier. The dashboards give you a live look at how many transactions are being automated, so you can see the value from day one. It instantly shows you the impact and flags the few items that still need a human touch.

This kind of built-in reporting gives you the hard data you need to show colleagues this isn't just another software expense. It’s a smart move to boost productivity and slash risk. The clear and fair options on the Mintline pricing page let you pick a plan that makes sense for your size, so the ROI is obvious from the start.

The Future: Where AI and Accountants Work Together

The conversation around AI in accounting often drifts towards a common fear: will robots take our jobs? But that’s looking at it all wrong. The reality is far more collaborative.

Think of AI not as a replacement for the accountant, but as the most powerful assistant you've ever had. It thrives on the high-volume, repetitive work that eats up a finance professional's day. It can process mountains of data, match transactions, and spot strange patterns with a speed and precision humans can't sustain.

But that automation isn't the whole story. It’s the beginning of a much-needed evolution for the profession.

From Crunching Numbers to Guiding Strategy

Tools like Mintline are built specifically to take over this foundational legwork. By automatically linking every bank transaction to its source document—like an invoice or receipt—Mintline clears the decks. This allows accountants to finally step away from tedious data entry and into the role of a true strategic advisor.

AI doesn't replace human expertise; it sharpens it. It takes care of the 'what' and 'when' of financial data, freeing up professionals to focus on the much more valuable questions: 'why' and 'what's next?'

This shift is happening right now. Once the administrative grunt work is off their plate, accountants can put their brainpower where it truly counts.

- Deeper Client Relationships: With clean, real-time data always ready, you can offer proactive advice on everything from cash flow to profitability.

- Real Business Insights: You can finally spend time analysing trends and giving clients the kind of critical insights that help them make smarter decisions.

- A Focus on Growth: By cutting down on administrative drag, finance professionals become a core part of the strategic planning process, directly contributing to business growth.

A Smarter Way to Work

The future of accounting isn't humans versus machines. It’s about human expertise made better, faster, and more insightful with machine efficiency. The most successful accountants will be the ones who see AI not as a threat, but as an essential tool for delivering more value.

This change leads to more engaging work for accountants and better financial outcomes for the businesses they serve. Adopting AI in accounting is a strategic move towards a more insightful, efficient, and valuable future for the entire profession.

Answering Your Questions About AI in Accounting

Diving into AI for your bookkeeping can bring up a few questions. Let's tackle some of the most common ones to give you a clearer picture of how tools like Mintline can fit into your day-to-day.

Is AI in accounting only for huge corporations?

Not anymore. That’s a common misconception, but modern AI accounting platforms are built for everyone. They’re scalable, affordable, and incredibly useful for freelancers, startups, and small businesses.

Tools like Mintline are designed to crush the tedious tasks—like matching receipts to transactions—that eat up time for solo entrepreneurs and small teams. This frees you up to focus on growing your business.

How secure is my financial data on an AI platform?

This is a big one, and rightly so. Reputable AI platforms treat security as their top priority. They use bank-level encryption, secure cloud servers, and strict controls over who can access what.

In fact, AI often makes your finances more secure. It can spot unusual transactions or potential fraud much faster than a person ever could, adding an extra layer of defence.

For example, a platform like Mintline uses AES-256 encryption—the same standard trusted by banks—and stores all data on secure, EU-based servers. This means it’s fully compliant with strict privacy laws like GDPR, turning security from a worry into a genuine strength.

Will I need to be a tech whizz to use AI accounting software?

Absolutely not. The best AI accounting tools are designed to be incredibly user-friendly, with no special technical skills needed. The AI does all the heavy lifting in the background.

If you can use your mobile banking app, you'll feel right at home with a modern AI platform. The whole point is to simplify your work, not to give you another complicated system to learn. Everything from uploading a receipt to approving a match is designed to be simple and intuitive.

Can AI completely replace my accountant?

AI is a powerful assistant, not a replacement. It’s brilliant at handling high-volume, repetitive work with speed and accuracy. This frees up your accountant to focus on what they do best: strategic advice, financial planning, and solving complex problems that require a human touch.

The real power comes from AI and accountants working together. The AI acts as the ultimate assistant, getting the grunt work done perfectly. This allows your accountant to step in and provide the high-value insights that really help you move your business forward.

Ready to stop chasing receipts and start focusing on growth? Discover how Mintline can automate your financial admin in minutes. Explore Mintline and sign up for free.