acquisition of data: Boosting Finance with Secure Automation

Learn how the acquisition of data reshapes finance with secure automation, practical methods, and scalable workflows.

Data acquisition is the process of collecting information from sources like receipts, invoices, and bank statements, and converting it into a digital format that software can process. For any modern finance team, this is the first and most critical step. It’s how you transform raw financial information into the structured, usable intelligence that drives smart business decisions. Without an efficient data acquisition process, automation is impossible.

With a platform like Mintline, this foundational step is automated, secure, and highly accurate, setting the stage for streamlined financial workflows.

What Is Data Acquisition in Modern Finance?

In your company's financial ecosystem, data acquisition is the central nervous system, pulling in vital signals from every corner of the business. Without a reliable way to collect this information, you're operating with incomplete data, unable to spot crucial opportunities or react to emerging financial trends.

This process is about more than just collecting numbers; it's about building a single source of truth. In the past, this meant manual data entry—a slow, error-prone task. The shift to automated methods, like Mintline's use of direct bank feeds and Optical Character Recognition (OCR), isn't just an upgrade. For a growing business, it's essential for survival.

From Raw Information to Actionable Intelligence

Imagine a pile of raw ingredients. A single receipt or a lone bank statement is like one of those ingredients—useful, but limited on its own. A solid data acquisition strategy is the recipe that brings everything together to create something meaningful: actionable intelligence.

This transformation breaks down into a few key steps:

- Collection: Gathering documents and data from their different sources.

- Conversion: Turning unstructured information, like a photo of a paper receipt, into a digital, machine-readable format.

- Standardisation: Organising all that converted data into a consistent structure so it can be properly analysed and compared.

This methodical approach is exactly what allows a platform like Mintline to automatically match receipts to transactions with such high accuracy. We take a chaotic mix of documents and turn it into a clean, auditable financial record, ready for reconciliation.

The Importance of a Robust Infrastructure

Great data acquisition needs a powerful and secure infrastructure to support it. For businesses operating in Europe, where this digital backbone is located and how well it's maintained are critically important. Mintline leverages best-in-class infrastructure to ensure your data is always secure and accessible.

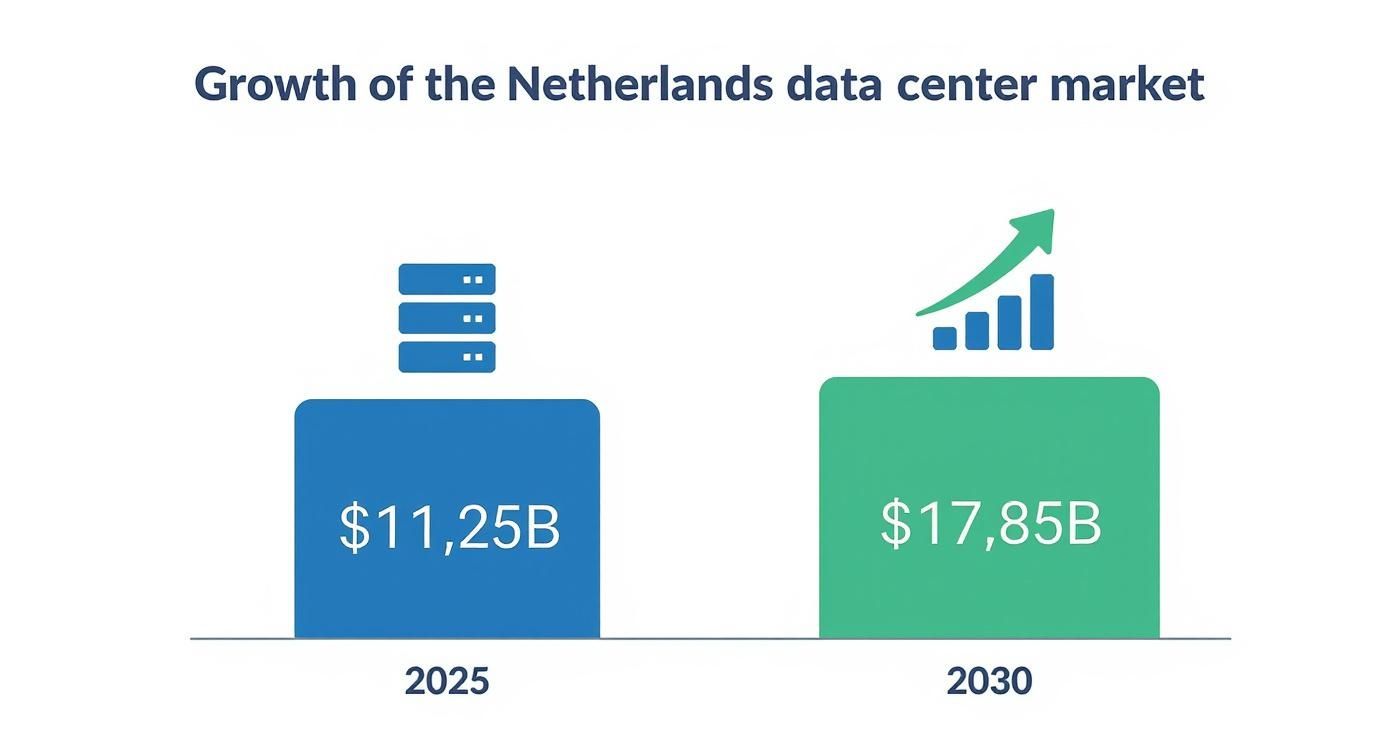

Take the Netherlands' data centre market, for example. It's a major European hub for data management and is expected to grow from an estimated USD 11.25 billion in 2025 to USD 17.85 billion by 2030. That’s a massive jump, and it shows just how much demand there is for reliable infrastructure to handle data-intensive tasks. When major players like Oracle commit USD 1 billion to AI and cloud infrastructure in the country, it underscores the region's role in secure and scalable data processing. You can discover more insights about the Dutch data centre market and what it means for data acquisition.

A Look at the Main Ways to Get Your Financial Data

Not all data acquisition methods are built the same. For any modern finance team, picking the right one can be the deciding factor between falling behind and getting ahead. Moving from old-school techniques to slick, automated systems involves a few key technologies, each with its own quirks and benefits.

Understanding these differences is vital for building an efficient and solid financial workflow. Let's walk through the most common methods, starting with the basics and working our way up to the advanced systems that power Mintline.

The Old Guard: Traditional and Manual Methods

The one we all know is the manual upload. This is where someone has to physically scan a document or save a PDF bank statement, then upload it to the accounting software. It sounds simple enough, but this process is painstakingly slow, eats up valuable time, and is a hotbed for human error. One wrong number typed in, and you could lose hours trying to fix the reconciliation.

Then there's web scraping, which uses software bots to automatically lift data from websites. It's definitely a step up from manual uploads, but scraping can be incredibly fragile. If a website’s layout changes even slightly, the scraper can break, leaving you with gaps in your data. Plus, it sometimes operates in a legal grey area, making it a dicey choice for handling sensitive financial info.

For any finance team, the main goal should be to ditch methods that create risk and kill efficiency. The reliability of your financial data depends entirely on the quality of your acquisition process.

The Automated Game-Changers

This is where the real efficiency gains are made. True efficiency in financial data acquisition comes from automated tech that's both dependable and secure. These methods are the bedrock of modern fintech solutions like Mintline, delivering a level of speed and accuracy that manual processes just can’t compete with.

Direct Bank Feeds and APIs

Direct bank feeds, powered by Application Programming Interfaces (APIs), are the gold standard for collecting transaction data. Instead of someone manually downloading statements, an API creates a secure, authorised pipeline directly between a bank and your financial software.

This connection allows transaction data to flow in near real-time. It’s incredibly secure because it relies on tokenisation and encryption protocols set by the financial institutions themselves. The data arrives structured, clean, and without any manual meddling. At Mintline, we use these secure connections to ensure your bank data is always current and correct without ever risking your security.

Optical Character Recognition (OCR)

APIs are brilliant for bank transactions, but what about all those paper receipts and PDF invoices? That’s where Optical Character Recognition (OCR) steps in. OCR technology scans an image of a document and intelligently pulls out key information like the shop's name, the date, and the total amount.

But the really smart OCR systems, like the one used by Mintline, do more than just read text. They use machine learning to actually understand the document's context, which boosts accuracy even when dealing with messy or unusual receipt formats. This technology is the essential bridge between the physical world of paper and the digital world of automated accounting. To get a better sense of how it all works, you can learn more about intelligent document processing and what it can do.

The push for better data handling is clear when you look at the huge investments being made in the infrastructure that supports it. Take the Netherlands' data centre market, for example.

This chart highlights a massive projected growth, from $11.25 billion in 2025 to $17.85 billion by 2030. It’s a powerful signal that the demand for robust data processing isn't slowing down anytime soon.

Comparison of Financial Data Acquisition Methods

Choosing the right tool for the job is everything. A side-by-side look at these methods makes it easier to see where each one shines.

| Method | Speed & Efficiency | Data Accuracy | Scalability | Ideal Use Case |

|---|---|---|---|---|

| Direct Bank Feeds (API) | Real-time, fully automated | Very high; structured data | Highly scalable | Retrieving all bank and credit card transaction data automatically. |

| Optical Character Recognition (OCR) | Near-instant, automated | High, but can vary by document quality | Highly scalable | Digitising paper receipts, PDF invoices, and other unstructured documents. |

| Web Scraping | Fast, automated | Moderate; prone to breaking | Moderate; requires maintenance | Gathering public data, but not recommended for secure financial info. |

| Manual Upload | Very slow, labour-intensive | Low; high risk of human error | Not scalable | One-off document uploads or when no other option is available. |

Ultimately, no single method is the perfect solution for every single data need. The smartest strategy is often a hybrid one, blending the strengths of different technologies.

Mintline's platform is built on this integrated approach. By pairing secure API connections for bank data with powerful OCR for all supporting documents, we automate almost the entire reconciliation process. This integrated workflow is exactly how Mintline automatically links every transaction to its matching receipt, finally getting rid of messy spreadsheets and saving you countless hours of mind-numbing manual work.

The Critical Role of Data Quality and Preprocessing

Getting your hands on financial data is just the first step. The real magic happens in what comes next. Raw data, whether from a bank feed or a scanned receipt, is like a pile of freshly picked vegetables—full of potential, but it needs to be washed, sorted, and prepped. That essential prep stage is what we call data preprocessing.

If you skip this part, even the most advanced collection tools will let you down. You’ll end up with inaccurate reports and reconciliations that never balance. This is where the process turns messy, inconsistent information into a structured, reliable asset. Smart platforms like Mintline don’t treat this as an afterthought; we weave these quality checks right into the workflow, making sure the data you see is trustworthy from the moment it arrives.

The Essentials of Data Preprocessing

So, how do you transform raw data into a dependable resource? It comes down to a few core tasks. Each one is designed to tackle a common issue found in unprocessed financial info, ensuring the final dataset is clean, consistent, and ready for analysis.

Think of it as a quality control assembly line for your data:

- Data Cleansing: This is your first line of defence against mistakes. It’s all about spotting and fixing inaccuracies, weeding out duplicate entries, and handling missing information. A single payment accidentally logged twice could completely throw off your monthly budget if it isn't caught and removed.

- Data Normalisation: Financial information comes in all shapes and sizes. One system might format dates as

DD-MM-YYYYwhile another usesMM/DD/YY. Vendor names can be just as tricky—is it "NL Services" or "NL Services BV"? Normalisation is the process of getting everything to follow the same rules, creating a uniform format. - Data Enrichment: Sometimes, the raw data just doesn't tell the whole story. Enrichment adds that missing context. This could be as simple as tagging a transaction with a vendor category like "Office Supplies" or adding a location, giving you much deeper insights when you analyse spending patterns.

Why Preprocessing Is Non-Negotiable

Trying to run your finances without preprocessing is like building a house on a faulty foundation. It might look fine at first, but it's only a matter of time before cracks start to show. Bad data has a ripple effect, leading to poor strategic decisions based on numbers that simply aren't right.

The ultimate goal of data preprocessing is to create a single source of truth that the entire finance team can trust. It ensures that every report, forecast, and analysis is built on a foundation of clean, consistent, and contextualised information.

Take OCR, for example. When a system scans a receipt, it might misread a character. Preprocessing algorithms are designed to flag these potential slip-ups for review. To do this, modern systems don't just read text; they understand the relationship between different pieces of information. You can learn more about this process by reading up on key-value pair extraction for documents.

By putting these checks in place, Mintline delivers a much higher degree of accuracy than you'd get from raw OCR alone. It saves your team from the soul-crushing task of manual verification and turns the complicated job of data acquisition into a reliable engine for financial clarity.

Getting Security and Compliance Right in Data Acquisition

When you're handling sensitive financial data, security isn't just a box to tick—it’s the bedrock of your entire operation. The way you acquire that data has a direct line to privacy, trust, and your legal standing. Skimping on this isn’t an option; it’s a fast track to serious financial and reputational damage.

For any serious finance team, a rock-solid security posture is non-negotiable. This means going far beyond basic password protection and building a layered defence. This commitment is what separates professional-grade tools like Mintline from risky shortcuts.

Staying on the Right Side of the Law

The web of data protection regulations can seem intimidating, but most of it boils down to a few core principles. Laws like the General Data Protection Regulation (GDPR) in Europe have really set the global benchmark for how companies must handle personal data, and that absolutely includes financial records.

At the heart of regulations like GDPR is the principle of data minimisation. It’s a simple but powerful idea: only collect and process the data you absolutely need for a specific, legitimate reason. You need a clear data governance policy that spells out what you collect, why you need it, and how long you’ll keep it. This legal framework isn't just about avoiding hefty fines. It’s about building trust with clients and stakeholders.

The Gold Standard for Protecting Data

To meet these legal demands and genuinely protect financial information, you have to adopt proven security technologies. The aim is to create a secure bubble where data is shielded at every step.

A few key practices are fundamental to any strong security strategy:

- End-to-End Encryption: This scrambles your data, making it unreadable from the moment it leaves its source until it safely reaches its destination. AES-256 encryption is widely seen as the gold standard here—it's the same level of security used by banks and governments.

- Secure Data Storage: Where your data lives is just as important as how it gets there. Storing it on reputable cloud infrastructure, like AWS servers located within the EU, means it’s protected by both top-tier digital security and strong regional data privacy laws.

- A Strict No-Sharing Policy: One of the biggest data risks is when information gets passed around to third-party vendors. A firm policy that you will never sell or share data is a critical pillar of trust.

At Mintline, we’ve baked these principles into our platform from day one. We use AES-256 encryption for all data, whether it's on the move or sitting in our system. And our strict policy of never sharing your data with third parties means your financial information stays exactly where it should be: with you.

Security in data acquisition isn't a feature you just add on; it's a whole philosophy. It’s a commitment to using the best encryption, enforcing tight access controls, and being completely transparent about how you handle data.

Earning Trust Through Transparency

Ultimately, a security-first approach is about more than just technology—it’s about earning and keeping trust. When you choose a platform to handle your financial data, you’re placing enormous faith in its ability to protect your most sensitive information.

That trust is earned when a provider is upfront about its security practices. This means being clear about where data is stored, what encryption standards are in place, and who can access the information. For instance, by stating clearly that all data is stored on secure EU-based servers and is never shared, Mintline gives finance teams the clarity and assurance they need to work confidently.

By putting security and compliance first, right from the start, you turn your data acquisition process from a potential liability into a secure, reliable asset.

Putting It All Together: Automating Your Receipt-to-Transaction Matching

So far, we’ve covered the building blocks: getting good data, cleaning it up, and keeping it secure. Now, let’s see how these ideas come to life in a task that every finance team knows all too well—matching receipts to their corresponding bank transactions.

This single, often tedious, monthly chore is the perfect example of how smart automation can turn a manual headache into a fast, accurate, and reliable process. Automated receipt-to-transaction matching is where secure bank feeds, intelligent OCR, and solid data preprocessing all click into place. This is the core of what Mintline delivers: hours of administrative work saved and a massive reduction in the risk of human error.

How the Automated Matching Workflow Works

Let's walk through the Mintline process. Instead of someone on your finance team manually cross-referencing bank statements with a pile of scanned receipts, our automated system does the heavy lifting. The whole workflow is designed for accuracy.

It all starts by bringing in two streams of data at the same time:

- Transaction Data: The system uses a secure API to create a direct, encrypted link to your business bank accounts. All the key details—merchant name, date, and amount—flow straight into the platform in a clean, structured format.

- Receipt Data: At the same time, you or your team can upload receipt images or PDF invoices. The platform’s OCR engine gets to work, scanning each document to intelligently pull out those same key data points: the merchant, the date, and the total amount.

Once both sets of data are in the system, the smart matching can begin. The platform looks for connections between the two, comparing multiple data points to be sure before it suggests a match.

Getting to High Accuracy with Multi-Point Matching

The secret to reliable automation is to look beyond a single point of comparison. A basic system might just search for a matching amount, but that can easily cause mistakes. Mintline's intelligent platform takes a much more sophisticated approach.

Our matching algorithm triangulates information by checking for agreement across a few key fields:

- Merchant Name: Does the shop name on the receipt line up with the merchant description on the bank transaction?

- Transaction Amount: Is the total value identical?

- Transaction Date: Do the dates on both documents fall within a reasonable window of each other?

By requiring a match on multiple points, the system can propose pairings with near-perfect accuracy. This multi-point check is what allows finance teams to finally trust the automation and step away from manual, line-by-line reviews.

And if the system can't find a confident match? It simply flags the transaction for a quick human look, ensuring nothing slips through the cracks. This approach is also great for handling more complex documents; for a closer look, our guide on how to extract tables from PDF files goes into more detail.

Strategic Acquisition on a Bigger Scale

This intense focus on getting and integrating data efficiently isn't just a trend for individual companies; it’s a reflection of a much larger economic strategy.

Take the Netherlands, for example. Historically, mergers and acquisitions (M&A) have been a key way for Dutch companies to acquire new technology and data capabilities. Between 1985 and 2018, there were a staggering 22,484 deals worth around USD 2.23 trillion.

With the Dutch M&A market forecast to hit USD 12.09 billion in 2025, it's clear that acquiring data strategically is at the heart of competitive growth. On a macro scale, this mirrors exactly what individual businesses achieve on a smaller scale with platforms like Mintline.

Driving Strategic Growth with Better Data

Getting your data acquisition process right does more than just make things run smoother; it’s a direct investment in your company’s future growth. When clean, up-to-the-minute financial information flows effortlessly from where it’s created straight into your systems, it stops being simple bookkeeping. It becomes the lifeblood of smarter forecasting, sharper insights, and a more competitive business.

This change in mindset shifts the focus from just saving time on admin to building a real competitive edge. Companies that master data acquisition are simply more agile. They can react faster to actual spending patterns, build budgets with pinpoint accuracy, and forecast their cash flow with a lot more confidence.

From Operational Task to Strategic Asset

You can only make data-driven decisions if you can trust the data you're looking at. A modern approach to data acquisition guarantees that the information you're feeding into your financial models is complete, accurate, and current. This kind of reliability turns financial data from a backward-glancing record into a powerful tool for looking ahead.

Think about how this impacts core business functions:

- Improved Forecasting: With a real-time view of your expenses and income, you can predict your future cash position much more reliably.

- Deeper Spending Insights: Clean, categorised data shows you exactly where the money is going, helping you spot cost-saving opportunities or double down on what’s working.

- More Accurate Budgeting: Budgets based on precise historical data aren't just wishful thinking; they're realistic financial roadmaps that guide growth.

A Catalyst for Corporate Growth

This intense focus on data quality isn't just a theory; it's reflected in major economic trends, particularly in tech-savvy regions. The Netherlands, for example, has become a European powerhouse in technology and digital data, and you can see it in the M&A activity.

Between 2015 and 2019, the number of tech-related mergers and acquisitions in the Netherlands shot up from 55 to 122—a 122% jump. By 2019, the average deal was worth around €426 million, which really shows how acquiring data capabilities has become a central part of corporate strategy.

This trend highlights a crucial point. Bringing in modern tools like Mintline to nail your internal acquisition of data isn't just an operational tweak. It's a fundamental investment in the long-term health and competitiveness of your company. As you can read in the full research about Dutch tech M&A trends, solid data handling is now at the very heart of what makes a company valuable.

Frequently Asked Questions About Data Acquisition

We’ve covered a lot of ground on the methods and importance of solid data acquisition. To wrap things up, let's tackle some of the most common questions finance teams have when they start looking to clean up their workflows.

What’s the First Step to Automating Data Acquisition?

The best place to start is with your biggest headache. Pinpoint the single most time-consuming manual task your team deals with—is it keying in invoice details, chasing down receipts, or manually logging bank statements?

Once you’ve identified that pain point, you can look for tools built specifically to solve it. A platform like Mintline, with features like advanced OCR and secure bank feeds, is designed to tackle these core challenges head-on. Kicking off with a focused pilot project is a great way to show a quick win and get everyone on board for more automation down the line.

How Secure Are Modern Data Acquisition Methods Like API Integrations?

It’s a fair question, and the answer is that reputable platforms use bank-level security to keep your information locked down. When you’re vetting a potential solution, there are a few key security features you should always look for.

These non-negotiable security protocols include:

- Tokenisation: This clever process swaps sensitive data (like a credit card number) for a unique, non-sensitive placeholder called a token.

- End-to-end encryption: Make sure the platform uses standards like AES-256, which is the gold standard for protecting data both in transit and when it's sitting on a server.

Honestly, these modern methods are far more secure than old-school habits like emailing spreadsheets full of sensitive data or passing around USB drives.

A core principle of secure data acquisition is ensuring your information is protected at every stage. This involves robust encryption, secure storage, and a transparent policy against sharing data with external parties.

Can Automated Data Acquisition Work with Multiple Bank Accounts and Currencies?

Absolutely. In fact, one of the biggest wins of a modern financial automation platform is its ability to pull together and standardise data from all over the place. These systems are designed to handle that kind of complexity without breaking a sweat.

Mintline uses secure API connections to link up with all your different bank accounts and credit cards, no matter which bank they're with. It also normalises the data, which is a fancy way of saying it converts different currencies into one consistent format for you. This is exactly what makes reconciling all your accounts a straightforward, almost effortless, process.

Ready to eliminate manual receipt matching and close your books in minutes, not days? Mintline uses secure, AI-powered automation to link every transaction to its receipt, giving you a crystal-clear, audit-ready financial record. Discover how Mintline can transform your financial workflow.