Your Guide to the Statement of Account

Understand what a statement of account is, its key components, and why it's crucial for your business. Learn how to read, reconcile, and automate them.

Think of a statement of account as a summary of financial activity between a business and its customer over a set period. It's a single document that lists out all the invoices, payments, credits, and any other adjustments, culminating in a final balance owed.

Your Guide to the Statement of account

Let's use a simple analogy. Imagine you have a running tab with a local supplier you use frequently. Every order you place is like a separate invoice. Every time you settle up, that’s a payment. The statement of account is the supplier handing you a single, neat summary at the end of the month showing everything you bought, everything you paid, and exactly what you still owe.

This is fundamentally different from an invoice, which just details one specific sale. The statement gives you the bigger picture—a bird's-eye view of your entire financial relationship over a specific timeframe, usually a month.

Why This Document Is Essential

Getting to grips with a statement of account is vital for keeping your business finances healthy. It's much more than a simple reminder to pay; it's a key tool for maintaining financial clarity and building trust with your partners. Trying to track dozens of individual invoices and payments without this summary can quickly become chaotic and riddled with errors.

This document serves several important functions:

- Provides a Complete History: It acts as a consolidated log of all activity, making it easy to see the flow of transactions between both parties.

- Simplifies Reconciliation: It gives both the buyer and the seller a straightforward way to compare records and make sure everything matches up.

- Acts as a Payment Reminder: By clearly showing a final balance due, it serves as a polite nudge for payment on all outstanding invoices, not just a single one.

A clear, accurate statement of account is the bedrock of transparent financial communication. It helps prevent misunderstandings, resolves disputes before they escalate, and strengthens professional relationships by keeping everyone on the same page.

In the end, this document turns a whole series of individual transactions into one coherent financial story. It shows where the account stood at the start of the period, what happened along the way, and what the final balance is. Mastering this document is a crucial step towards better cash flow management and more efficient accounting—a process that tools like Mintline are designed to make effortless through automation.

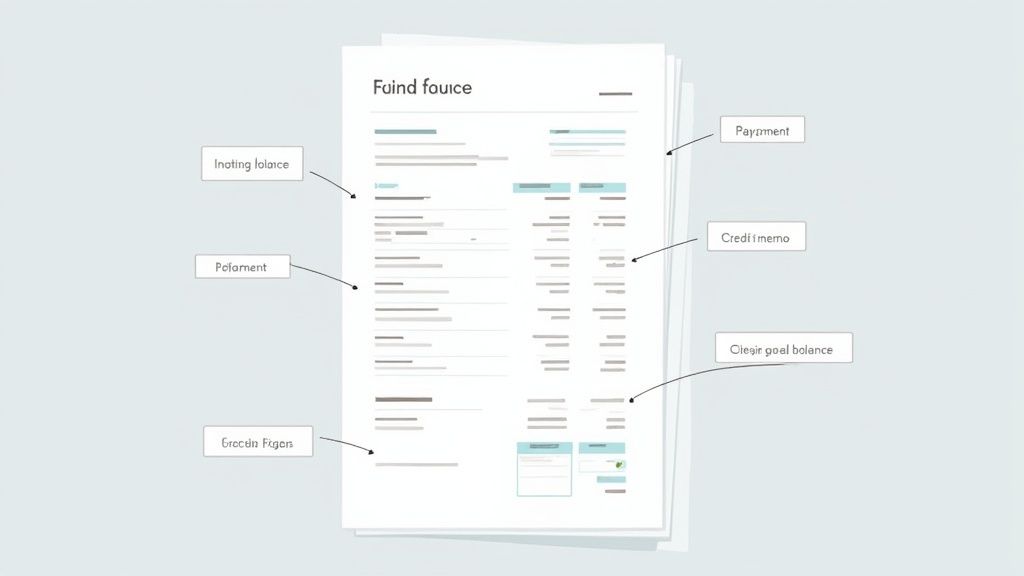

What's Actually on a Statement of Account? Let's Break It Down

To really get a grip on your accounts, you need to understand the story a statement of account is telling. Every section gives you a piece of the puzzle, and once you see how they connect, a potentially confusing document becomes a clear financial snapshot. It’s a bit like learning to read a map—once you know the symbols, you can navigate anywhere.

Let's walk through the essential bits you'll find on almost every statement. This isn't just a list of definitions; it’s about understanding the real-world purpose behind each number and line item.

The Anchor Points: Your Opening and Closing Balances

The first and last numbers on the page are your anchors. They frame the entire period at a glance.

- Opening Balance: This is the total amount that was still owing at the end of the previous statement period. It’s the starting line for the current document, carrying over any unpaid balance. If everything was settled, this will be zero.

- Closing Balance: This is the final amount you owe at the end of the current period. It’s calculated by taking the opening balance, adding all the new invoices, and then subtracting any payments or credits. This figure is the main event—it's what needs to be paid.

Looking at these two balances gives you a quick health check on the account. A consistently high opening balance, for example, might flag a recurring payment problem that needs a closer look.

The Heart of the Matter: The Transaction Trail

Between those two anchor points is the core of the statement: a chronological list of everything that happened. This detailed breakdown is your key to verifying the numbers and keeping your records straight. It shows precisely how you got from the opening balance to the closing one.

Here’s what you’ll typically see:

- Invoices: Each new charge will be listed with its own unique invoice number, date, and the amount billed. This makes it easy to cross-reference the statement with the original invoices you have on file.

- Payments: Any payments you've made during the period are clearly itemised, usually showing the date they were received and the amount. This is your confirmation that your payments have landed and been correctly applied.

- Credit Memos: These are refunds or corrections in your favour. A credit memo reduces what you owe and is often issued for things like returned goods or fixing a billing mistake.

The real value of a statement of account comes from this transaction summary. It creates a transparent, itemised history that lets both you and your supplier trace the account's journey and make sure your records are perfectly aligned.

The Little Details That Matter

Beyond the main numbers, a few other elements provide essential context. Always check the Statement Date, which tells you when the document was created, and the Statement Period, which defines the date range for the transactions included (e.g., 1 October - 31 October).

Finally, the statement will outline the Payment Terms (like "Net 30") and provide clear Remittance Information explaining how and where to send your payment.

To make sense of all these details, we've summarised the key components and their functions in the table below.

Key Components of a Statement of Account

| Component | Description | Importance for Business |

|---|---|---|

| Header Information | Includes supplier and customer names, addresses, and contact details. | Ensures the document is for the correct account and provides contact info for queries. |

| Statement Date & Period | The date the statement was generated and the time frame it covers. | Defines the scope of the transactions listed, preventing confusion over timing. |

| Opening Balance | The amount carried over from the previous statement period. | Provides a starting point and flags any previously unpaid amounts. |

| Transaction List | A detailed, chronological list of all invoices, payments, and credits. | Offers a transparent audit trail to verify charges and payments. Crucial for reconciliation. |

| Closing Balance | The total amount owed at the end of the statement period. | This is the key action item—the amount that needs to be settled. |

| Payment Terms & Remittance | Instructions on when and how to pay (e.g., Net 30, bank details). | Clarifies payment expectations and ensures funds are sent to the correct place. |

Understanding these components is the first step, but manually keying in all this information from a PDF is a slow and error-prone process. Learning how to efficiently extract tables from PDF documents can seriously speed up your accounting workflow and boost accuracy.

Once you’re familiar with these elements, you can scan any statement with confidence, spot issues before they escalate, and keep a tight rein on your financial relationships.

Statement of Account vs. Invoice vs. Bank Statement: What’s the Difference?

In the day-to-day of running a business, it's easy to get bogged down in paperwork. Documents start to look alike, and before you know it, you're staring at three different papers that all seem to be about money, but each tells a slightly different story. This is a common trip-up point, especially with the statement of account, the invoice, and the bank statement.

They all track financial activity, sure, but they each serve a very distinct purpose. Mixing them up isn't just a minor inconvenience; it can lead to frustrating payment delays and a real mess in your books. Let's clear up the confusion once and for all.

Statement vs. Invoice

Think of your relationship with a regular supplier. Every time you buy something, they send you an invoice. That invoice is a specific bill for a specific order. It’s a one-off request for payment, detailing exactly what you bought, how much it costs, and when the money is due. It’s transactional.

A statement of account, on the other hand, is like the monthly summary of your entire relationship with that supplier. It pulls everything together: all the individual invoices they sent you, any payments you've already made, and any credits or refunds you've received during that period. It doesn't ask you to pay for one thing; it shows you the total outstanding balance of your account. It's relational.

So, what's the real practical difference?

- An invoice is a direct call to action for a single sale. It’s packed with details like a unique invoice number, a line-by-line breakdown of goods or services, and the payment terms for that specific purchase.

- A statement of account gives you the bigger picture. It's less about the nitty-gritty of one order and more about the overall financial health of your account with that vendor. Its main job is to help both you and the supplier reconcile your records and agree on the total amount owed.

You pay an invoice. You reconcile a statement. Nailing this simple distinction is the secret to keeping your financial records clean. Get it wrong, and you risk paying for the same thing twice or, worse, missing a bill entirely.

It's a distinction that modern accounting tools are built to recognise. For example, Mintline's AI instantly knows whether it's looking at an invoice or a statement, processing each document correctly to ensure your books stay accurate without you having to manually sort them.

What About a Bank Statement?

Just when you think you've got it figured out, the bank statement enters the picture. This one is the odd one out because it doesn't come from your supplier at all—it comes from your bank.

A bank statement is your official record of every single transaction that has passed through your bank account. It lists every deposit, withdrawal, direct debit, bank fee, and transfer. While the payment you made to a supplier will show up on your bank statement, it won’t contain any of the details from the original invoice. It just confirms that a certain amount of money left your account on a certain date.

Here’s a simple way to break it all down:

| Feature | Invoice | Statement of Account | Bank Statement |

|---|---|---|---|

| Issued By | Your supplier or vendor | Your supplier or vendor | Your bank |

| Main Job | Bill you for one specific sale | Summarise all activity on your account | Record every movement of cash |

| Scope | A single transaction | Many transactions over a set period | Every deposit, withdrawal, and fee |

| Your Action | Pay it | Review and reconcile it | Reconcile it with your own books |

Getting a handle on these differences isn't just about good bookkeeping; it connects to the wider economic landscape. When businesses track their finances accurately, it contributes to a clearer national picture. For instance, the Netherlands’ current account balance—a key measure of trade and income—was a healthy 9.9% of GDP in the first quarter of the year. Figures like these, which you can read more about at De Nederlandsche Bank, rely on the precise financial data that starts with individual businesses getting their records right.

At the end of the day, each document is a crucial piece of your financial puzzle. The invoice proves a specific charge is legitimate, the statement of account gives you a complete overview of your relationship with a supplier, and the bank statement confirms that the money actually moved. Making sure all three align is the very foundation of solid financial management.

Why Regular Statement Reconciliation Is a Must

Getting a statement of account is only the first step. The real work—and the real value—is in what you do with it next. Just filing it away without a second glance is like getting a health report from your doctor and never opening it. Regular statement reconciliation is that essential health check for your business finances, a disciplined process that safeguards your cash and strengthens your business relationships.

It’s more than just ticking boxes. It's the moment you confirm that what you think you owe matches what your suppliers and customers believe you do. This process is your main line of defence against the slow financial drain caused by unnoticed errors, missed payments, and even potential fraud.

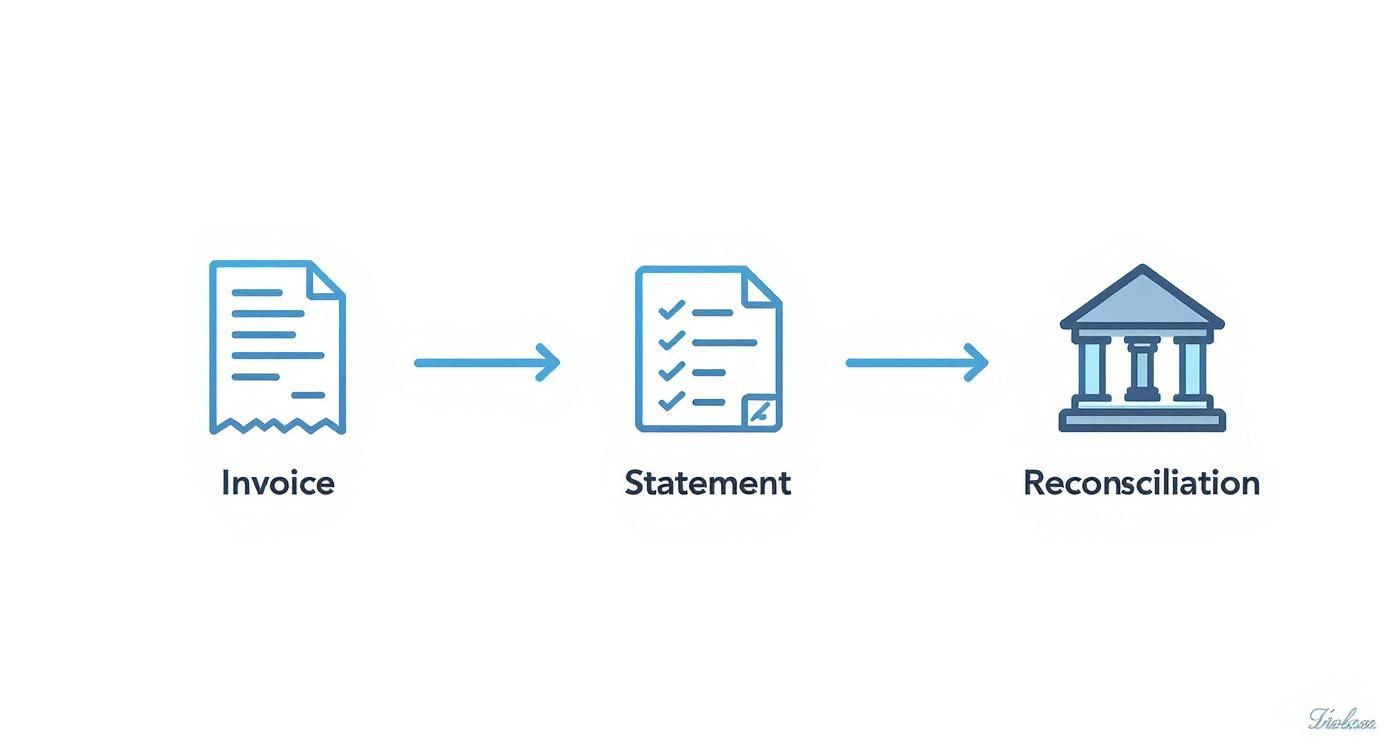

This infographic shows the typical journey from a single transaction to full reconciliation, highlighting where the statement of account fits in.

As you can see, the statement bridges the gap between individual invoices and the final confirmation of payment in your bank records.

As you can see, the statement bridges the gap between individual invoices and the final confirmation of payment in your bank records.

The Reconciliation Process: A Step-by-Step Guide

At its core, reconciliation means matching the transactions on the statement of account against your own internal records. Think of it as detective work, carefully comparing two sets of stories to find where they align and where they don't. While the exact details might change from business to business, the fundamental steps are always the same.

Here’s a practical guide to get it done right:

- Gather Your Documents: Before you start, pull together all the necessary paperwork for the period. This means your copies of all invoices listed on the statement, proof of payments made (like bank transfer confirmations), and any credit notes you've received.

- Compare Line by Line: Start at the top. Check that the opening balance on the statement matches the closing balance from your last reconciled one. Then, work your way down the transaction list, ticking off each invoice and payment on both the statement and in your own accounting software.

- Identify Discrepancies: This is the critical part. As you compare, you’re on the lookout for any mismatches. These are the red flags that need a closer look.

This methodical check-in is where you uncover small issues before they snowball into major problems.

Spotting and Solving Common Discrepancies

Discrepancies are bound to happen, but leaving them unresolved can disrupt your cash flow and damage supplier relationships. Being able to spot them quickly is a key financial skill.

Keep an eye out for these frequent issues:

- Missed Payments: The statement shows an invoice as unpaid, but your records confirm you’ve sent the money. This could be a simple timing issue, or it might mean the payment was misallocated on their end.

- Duplicate Charges: An invoice is listed twice, inflating what you owe. This is a surprisingly common slip-up, especially when data is entered manually.

- Unapplied Credits: You returned some goods and got a credit note, but it hasn't been deducted from your total balance on the statement.

- Incorrect Amounts: The amount shown on the statement for a particular invoice doesn't match the figure on the original invoice you received.

When you find a discrepancy, act fast. Contact the supplier's accounts department straight away, provide clear evidence from your records (like an invoice number or payment reference), and follow up in writing to keep a paper trail. Proactive communication gets things sorted much quicker and shows you’re on top of your finances.

The Business Case for Diligent Reconciliation

Regular reconciliation isn't just about catching mistakes; it delivers real benefits that directly impact your bottom line and operational efficiency. It's a cornerstone practice for any financially healthy business.

Here are the key advantages:

- Improved Cash Flow Management: By making sure you only pay what you truly owe, you stop cash from needlessly leaving your business. It also helps you accurately forecast your upcoming payments.

- Fraud Prevention: Scrutinising statements regularly can help you spot unauthorised charges or phantom invoices early, acting as a powerful deterrent against fraudulent activity.

- Stronger Supplier Relationships: When you proactively find and resolve issues, you build a reputation as a diligent and trustworthy partner. This creates goodwill and can even lead to more favourable terms down the line.

- Accurate Financial Reporting: Clean, reconciled accounts mean your financial statements—like your profit and loss report and balance sheet—are actually reliable. This is absolutely critical for making smart business decisions.

Ultimately, diligent reconciliation turns a reactive, problem-solving chore into a proactive, value-adding process. This methodical approach is the core idea behind many modern finance technologies. For instance, you can see how automation achieves perfect record-matching in our guide to straight-through processing, which applies similar principles to eliminate manual checks entirely. By making reconciliation a non-negotiable monthly habit, you build a resilient financial foundation for your business.

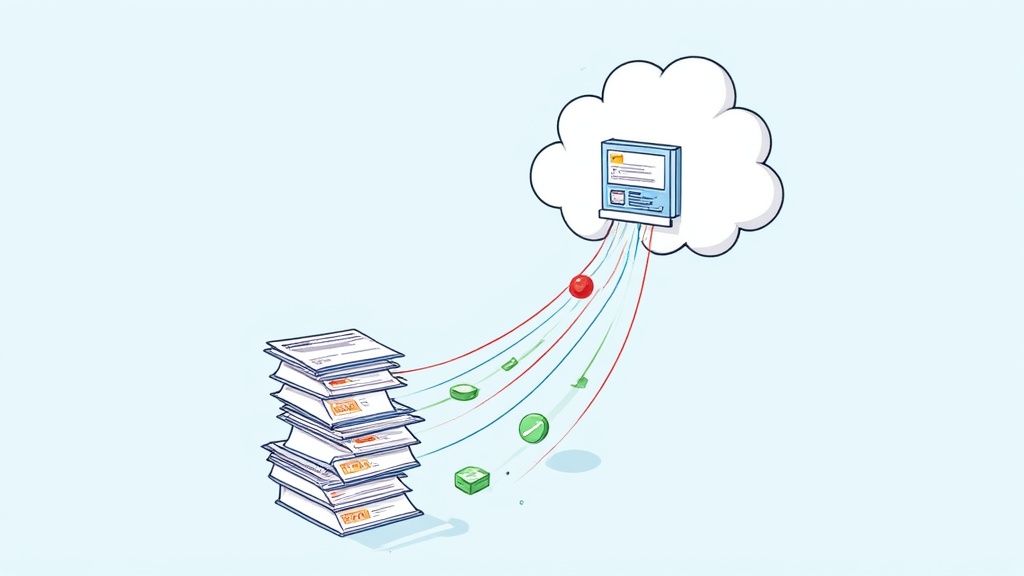

How Mintline Takes the Pain Out of Statement Processing

Anyone who's spent hours cross-referencing a supplier statement against a pile of invoices knows the drill. It's tedious, mind-numbing work where a single missed detail can cause payment headaches, sour a good supplier relationship, or throw your financial reports out of whack. This is where old-school bookkeeping grinds against the gears of a modern business – and it’s exactly where automation makes a world of difference.

We built Mintline to get rid of that friction for good. Our platform transforms the entire process of handling a statement of account from a manual, error-prone chore into a slick, accurate, and automated workflow. Instead of your team losing hours to a manual line-by-line check, Mintline gets the job done in minutes.

From Manual Grind to Automated Precision

At its core, Mintline’s magic lies in its ability to actually understand your financial documents. When you upload a statement of account, our platform doesn't just see a static PDF file; it sees live, structured financial data waiting to be organised.

Here’s a quick look at what’s happening under the hood:

- Intelligent Data Extraction: The system instantly scans the statement, pulling out every key detail with pinpoint accuracy—invoice numbers, dates, amounts, and the closing balance. No manual data entry needed.

- Automatic Transaction Matching: Next, it automatically cross-references every line item on the statement against your own records, like the invoices you've received or payments you've made.

- Instant Discrepancy Flagging: The moment it finds a mismatch—maybe a missing invoice, an unapplied credit note, or a wrong amount—it flags it for your team to review. This means you spot potential problems long before they escalate.

By taking the manual back-and-forth out of the equation, Mintline all but eliminates the risk of human error. It ensures that every figure on a statement is verified against a trusted source document in your system, giving you a reliable and accurate financial picture every single time.

This isn't just about saving time. It's about building a rock-solid foundation of financial integrity for your business.

A Clear Path to Audit-Ready Books

Mintline is designed around clarity and control. We give your team a central dashboard where you can see the status of every single statement at a glance. No more wondering what’s been checked and what’s still waiting.

Here's a snapshot of the Mintline interface, showing you just how clear that overview can be.

The whole point of the dashboard is to give you an immediate handle on your accounts payable workflow, highlighting what's done and what needs your attention.

The whole point of the dashboard is to give you an immediate handle on your accounts payable workflow, highlighting what's done and what needs your attention.

This streamlined approach delivers real, tangible benefits:

- Faster AP Cycles: With automated matching and flagging, you can approve and pay statements much faster, which is great for keeping your suppliers happy.

- A Perfect Audit Trail: Every single action taken in Mintline is logged, creating a transparent, traceable history for every transaction. Audits suddenly become a lot less stressful.

- One-Click Exports: Once a statement is reconciled, you can export clean, organised, and audit-ready data straight into your accounting system.

This level of detail matters. Accurate financial reporting is crucial on a national scale, too. In the Netherlands, for example, robust financial accounts underpin the country's strong position in global markets, with a balance that represents a significant portion of its GDP. This big-picture clarity is built on diligent, company-level accounting—a principle you can see at work in these insights into the Dutch financial account from EUROSTAT.

The Mintline Advantage in the Real World

Picture your month-end close. The old way involved a finance team member sifting through a folder of PDF statements, manually ticking them off against a spreadsheet of invoices.

The Mintline way? Your team logs in, and the platform has already done the heavy lifting. It’s processed the documents, automatically matched 95% of the transactions, and created a short, simple list of the three items that need a quick human review.

Your team can then focus their expertise on resolving those specific discrepancies in minutes and export the finalised data. A task that used to eat up an entire day is now finished before their first coffee gets cold. This is the power of intelligent document processing, a concept we dive into more deeply in our article on the topic: https://mintline.ai/blog/intelligent-document-processing.

This is so much more than a time-saver; it’s a strategic shift. It frees your finance experts to focus on valuable analysis and planning, rather than getting bogged down in repetitive admin. With Mintline, you're not just processing statements—you're building a smarter, more resilient financial operation.

Common Questions About Statements of Account

To wrap things up, let's tackle some of the practical questions that often pop up when you're dealing with a statement of account in the real world. Think of this as a quick-fire FAQ to clear up any lingering doubts and help you handle these documents with confidence.

How Often Should I Send a Statement of Account?

The most common rhythm is monthly. This schedule usually hits the sweet spot—it gives your customers a regular, predictable summary of their account without burying them in paperwork. A monthly statement allows them to keep their own records tidy and manage their payments on a consistent basis.

But that’s not set in stone. If you have a client with a constant stream of transactions, sending a statement every two weeks might make more sense. It keeps the document from becoming a sprawling, intimidating list. On the flip side, for an account that only sees a transaction every now and then, a quarterly summary might be all you need.

The real key here is consistency. Once you pick a schedule, stick to it. This manages expectations, encourages prompt payment, and builds a solid, professional relationship. It's also where automated platforms like Mintline shine, as they can send statements on any schedule you set without you ever having to think about it.

Ultimately, a reliable schedule helps everyone keep their books clean and builds a foundation for a smooth financial partnership.

What Should I Do If I Find a Discrepancy?

Spotting an error on a statement is always a bit jarring, but the trick is to deal with it quickly and logically. Don't just let it slide.

First things first, check your own records. Pull out your copies of the invoices, payment receipts, or any credit notes you have and compare them against the statement line by line. You need to be sure the mistake isn't an oversight on your end.

Once you’ve confirmed the error, get in touch with the sender's accounts department right away. Be specific. Instead of just saying "the balance is wrong," point to the exact problem and provide document numbers—like an invoice reference or payment confirmation—to back up your claim. This gives them a clear starting point to investigate.

It’s always a good idea to put this in writing (an email is perfect) so you have a clear trail of the conversation. And critically, don't pay the disputed amount until the issue is sorted. Most businesses want to keep their relationships healthy and will work with you to fix mistakes quickly. Using a system that automatically flags these mismatches can turn a potential headache into a simple two-minute task.

Can a Statement of Account Replace an Invoice?

In a word: no. A statement of account is not a substitute for an invoice, and mixing them up can cause some serious bookkeeping and tax headaches. They look similar, but they play very different roles.

An invoice is the official, legally recognised bill for a specific set of goods or services. It’s the primary document you need for tax purposes, like claiming back VAT, because it contains all the detailed, itemised proof of a sale. It’s the source of truth for a single transaction.

A statement of account, on the other hand, is a summary. It’s more like a report card for the account over a certain period, listing out all the invoices, payments, and credits to show the final balance due. It’s an incredibly useful tool for chasing payments and reconciling the books, but it doesn't have the legal standing or detail of an invoice.

Here's the simplest way to think about it:

- An Invoice is the bill for a specific job.

- A Statement of Account is the running tally of all the bills and payments.

You need both for a healthy accounting process. The invoices prove what was sold, and the statements make sure everything gets tracked and paid correctly over time.

Ready to stop chasing receipts and manually reconciling statements? Mintline uses AI to automatically link every transaction to its source document, giving you clean, audit-ready books in minutes. Discover how you can automate your finances today at Mintline.ai.