What is e invoice: A Guide to Digital Invoicing

What is e invoice? Discover what it is, how digital invoicing works, and the benefits, rules, and how Mintline can help you switch.

Let's be honest, when you hear "e-invoice," your mind probably jumps straight to a PDF attached to an email. It's digital, it's an invoice, so it must be an e-invoice, right?

Not quite. That’s one of the biggest misconceptions out there, and the difference is more than just a technical detail—it’s a complete shift in how your business can handle its finances.

What Is an E-Invoice, Really?

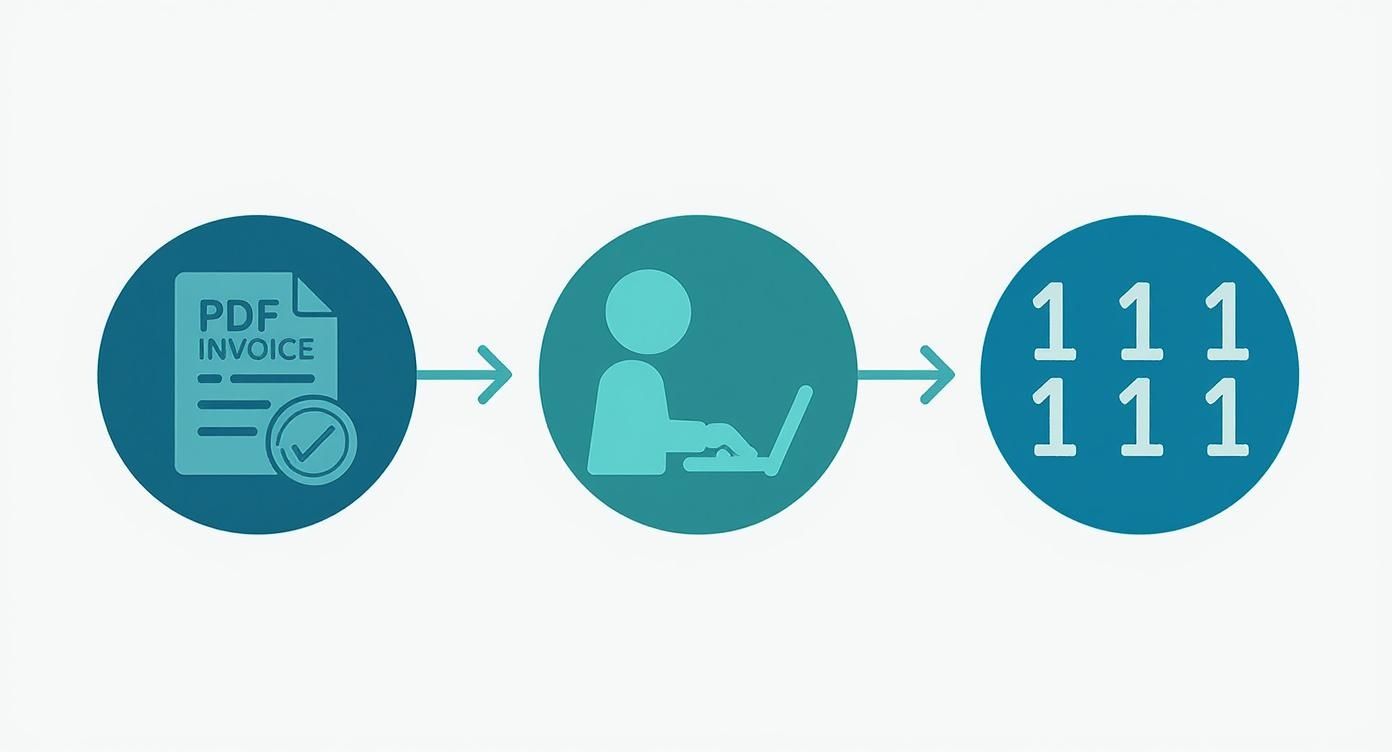

Think of a traditional PDF invoice like a digital photo of a piece of paper. You can see the information—the amount, the due date, the line items—but your accounting software can't. To get that data into your system, someone has to manually type it all in. It’s a static image that requires a human translator.

A true e-invoice, on the other hand, is a structured data package built for machines to read. It's created from the get-go in an organised format like UBL (Universal Business Language). This means when it arrives, your accounting system doesn't just see the invoice; it understands it instantly.

A true e-invoice doesn't just digitise the paper; it automates the entire process. This is the core difference that unlocks huge efficiencies, shifting you from simply viewing an invoice to having your systems instantly act on it.

From Digital Pictures to Smart Data

This move from a "digital picture" to a machine-readable data file is a game-changer for businesses in the Netherlands and all over Europe. Instead of your team spending hours on mind-numbing data entry, an e-invoice transmits its information directly from the sender’s system to the receiver’s system. No human intervention needed.

This direct, system-to-system communication delivers some serious perks:

- No More Manual Entry: Say goodbye to the tedious, error-prone task of typing invoice details.

- Near-Perfect Accuracy: When data flows directly between systems, the risk of human error plummets to virtually zero.

- Seriously Fast Processing: Invoices can be received, checked, and approved in minutes, not days or weeks.

E-Invoice vs Traditional PDF Invoice At a Glance

To make the distinction crystal clear, let's break it down side-by-side. This table highlights exactly why a true e-invoice is fundamentally different from the PDFs we're all used to.

| Feature | Traditional Invoice (e.g., PDF) | True E-Invoice (e.g., UBL) |

|---|---|---|

| Format | Unstructured image of data. | Structured, machine-readable data (XML, UBL). |

| Processing | Manual. Requires a human to read and type data into software. | Automated. Software reads and processes the data instantly. |

| Accuracy | Prone to human error (typos, incorrect entries). | Extremely high accuracy; data is transferred directly. |

| Processing Time | Slow. Can take days or weeks for manual entry and approval. | Fast. Processing can be completed in minutes. |

| Integration | Requires OCR technology (often unreliable) or manual work. | Seamlessly integrates with compatible accounting systems. |

| Cost | Higher hidden costs due to manual labour and error correction. | Lower processing costs due to full automation. |

As you can see, while both are "digital," they operate in completely different leagues. The PDF is a step up from paper, but the true e-invoice completely redefines the workflow.

This level of automation might sound complex, but tools like Mintline are designed to make it simple. Mintline slots right into your existing workflow, acting as your smart inbox to receive and process structured e-invoices for you. It ensures your books are accurate and up-to-date, saving you a massive amount of time from day one.

How E-Invoicing Works from Start to Finish

To really get what an e-invoice is, it’s best to see how it travels from one company’s accounting system to another. Sending a PDF is a bit like posting a letter—you send it off and hope someone on the other end opens it and deals with it correctly. E-invoicing, on the other hand, is a fully automated and secure digital handshake. And it all begins with speaking the same language.

For two different software systems to talk to each other, they need a shared format. In the world of e-invoicing, one of the most common is UBL (Universal Business Language). Think of UBL as a universal translator for your financial data. It organises all the important invoice details—amounts, dates, VAT numbers—into a structured XML file. Any accounting software that understands UBL can read it instantly, with zero room for error.

The Role of the Peppol Network

Once your invoice is created in a structured format like UBL, it needs a secure way to get to your customer. Just emailing it would bring back all the security risks and manual work you’re trying to avoid. This is where the Peppol (Pan-European Public Procurement Online) network comes into play.

Imagine Peppol as a private, super-secure postal service built just for business documents. It’s not one single platform but a network of certified Access Points. Your business gets a connection to the network through an Access Point provider, and so does your customer. When you send an e-invoice, it travels safely from your Access Point to theirs, landing directly in their accounting software.

This infographic really highlights the difference between the old way and the e-invoicing flow.

As you can see, e-invoicing completely cuts out the manual, mistake-prone middle steps. It creates a direct, efficient link between your system and your customer's.

A Step-by-Step E-Invoice Journey

So, what does this actually look like in practice? It’s surprisingly straightforward and happens in a flash.

- Creation: You create an invoice in your accounting software, just like you always do. But instead of saving it as a PDF, the system generates a structured UBL e-invoice file.

- Transmission: Your software, connected via an Access Point, sends this secure data packet onto the Peppol network.

- Validation: The network instantly checks that the e-invoice is formatted correctly and sends it to the recipient's unique Peppol ID.

- Reception: The e-invoice arrives directly inside your customer's accounting system, without ever hitting an email inbox.

- Processing: Their system reads the data automatically, filling in all the right fields. The invoice is now ready for approval and payment—no manual data entry required.

The entire journey, from creation to reception, is automated. This not only dramatically speeds up the payment cycle but also creates an unchangeable, secure digital record for both parties, which is invaluable for audits.

This process is quickly becoming the norm across the Netherlands. The Dutch e-invoicing market has grown significantly, reaching an estimated size of USD 167.06 million. And it’s not slowing down; projections show it’s on track to hit around USD 679.51 million by 2033, all thanks to digital adoption and the obvious efficiency gains for businesses.

This kind of automation might sound like something reserved for big corporations, but it’s not. Tools like Mintline act as your company's secure gateway to the Peppol network, handling all the technical stuff behind the scenes. This lets you send and receive true e-invoices without any fuss. This powerful workflow is a key part of modern financial management. For a deeper look at how this data is handled, check out our guide on intelligent document processing.

Understanding E-Invoicing Rules in the Netherlands

Getting to grips with the e-invoicing rules is essential for any Dutch business. This isn't some niche technology anymore; it's fast becoming a core part of how we all operate, pushed along by government rules and the simple, undeniable benefits of automation. If you want to stay competitive and compliant, you need to know how this all works.

The most critical rule right now is the Business-to-Government (B2G) mandate. If you supply anything to a public sector body in the Netherlands—be it the central government, a local municipality, or a province—you are legally required to send a proper, structured e-invoice. Firing off a PDF by email just doesn't cut it for these deals anymore.

This mandate was a huge step forward in the country's digital journey. The push for e-invoicing really kicked off back in 2009, focused heavily on those B2G transactions. By 2019, every single local government contracting body was set up to handle e-invoices, marking a clear end to paper-based public procurement. For a deeper dive, check out the overview of Dutch e-invoicing adoption on ecosio.com.

The Current B2B Landscape

So, what about business-to-business deals? While it’s not yet legally mandatory for B2B transactions in the Netherlands, e-invoicing is quickly becoming the default way of doing things. Businesses are switching over on their own because it saves money, slashes errors, and gets them paid faster. If you wait for a government mandate, you’ll just be playing catch-up with competitors who are already seeing these advantages.

The Dutch government is heavily promoting B2B e-invoicing through the Peppol network, which provides a secure and standardised way to exchange documents. That standardisation is the key, as it allows all the different accounting systems out there to talk to each other without any hiccups.

Think of it this way: it’s a strong recommendation that’s rapidly becoming a business expectation. You might not get a fine for sending a PDF today, but your clients and suppliers will increasingly prefer to work with businesses that use e-invoicing, simply because it makes their own lives easier.

Key Standards You Should Know

To make sure everyone’s digital systems are speaking the same language, the Netherlands uses a few specific standards. This avoids the chaos of every software platform using its own incompatible format.

Here are the main ones you’ll encounter:

- Peppol BIS 3.0: This is the main format specification used on the Peppol network. It lays out the exact rules for how invoice data needs to be structured, guaranteeing it can be read and understood by any other system on the network.

- NL-CIUS: This is a "Core Invoice Usage Specification" designed just for the Netherlands. It adds an extra layer of rules on top of the Peppol standard to cover specific Dutch administrative and legal needs.

- Simplerinvoicing: This network was a pioneer in getting Dutch businesses on board with e-invoicing. It has since been fully absorbed into the bigger European Peppol network, making the whole process even more straightforward.

The good news is that platforms like Mintline are built to handle all these technical details for you. You don't need a PhD in invoice formats; the software manages the formatting and transmission automatically, so your invoices always meet the required standards.

The Future Is Mandatory B2B E-Invoicing

The biggest shift on the horizon is the European Union's VAT in the Digital Age (ViDA) initiative. This is a massive set of proposals designed to modernise VAT reporting across the EU, and a central piece of the puzzle is mandatory B2B e-invoicing for any transactions that cross borders.

What does this mean for you? Within the next few years, sending and receiving structured e-invoices won't be a choice—it will be a legal necessity for doing business in Europe. The Netherlands is already ahead of the curve digitally and is expected to fall in line with these rules, probably extending the mandate to cover domestic B2B transactions too. Getting on board with e-invoicing now isn't just about efficiency; it's about future-proofing your business for the compliance rules that are just around the corner.

The Real-World Benefits of E-Invoicing

So, we've talked about what an e-invoice is and how it works. But let's get down to what really matters: what can it actually do for your business? The shift from traditional invoicing to true e-invoicing isn't just a minor tweak; it's a fundamental upgrade to your financial engine.

The benefits are real, and they show up in three key places: your bank balance, your team's day-to-day workload, and your overall security.

Financial Savings

The most obvious win is cutting direct costs. Every paper invoice comes with a price tag attached: paper, ink, envelopes, and postage. It might not seem like much per invoice, but multiply that by a year's worth of transactions, and the numbers start to get serious.

But the real financial drain isn't the paper—it's the time. Manual work is expensive. The hours your team spends printing, mailing, and then chasing invoices is time that could be spent growing the business. With a tool like Mintline, all that busywork is handed over to intelligent automation.

Operational Efficiency

This is where e-invoicing really changes the game, especially for busy small businesses and their accountants. Manual data entry is a recipe for disaster. It’s slow, tedious, and a single typo can snowball into incorrect payments, compliance headaches, and hours of frustrating detective work.

E-invoicing completely sidesteps this problem. The data flows directly from the sender's system to the recipient's, making the whole process virtually error-free. This creates some powerful knock-on effects:

- You get paid faster. When invoices land in your customer's system instantly and are ready for processing, approval cycles shrink from weeks down to just days or even hours. That's a huge boost to your cash flow.

- No more manual matching. The structured data allows systems to automatically match invoices against purchase orders and receipts.

- Smoother workflows. Your entire accounts payable process becomes quicker and far more reliable. For a closer look at this, our guide on the definition of accounts payable breaks it down further.

By removing the human data entry step, you're not just saving time—you're building a more accurate, reliable, and efficient financial foundation for your entire business.

Tools like Mintline are built to capitalise on this efficiency. It automatically pulls in e-invoices and matches them against your bank transactions, turning what used to be a month-end nightmare into a process that just hums along quietly in the background.

The table below breaks down exactly how e-invoicing can reshape your day-to-day operations.

How E-Invoicing Transforms Your Business Operations

| Area of Impact | Traditional Method Challenge | E-Invoicing Solution and Benefit |

|---|---|---|

| Data Entry | Manual keying of invoice details from PDFs or paper. High risk of human error (e.g., typos in amounts or supplier details). | Invoice data is automatically ingested from a structured file, eliminating data entry errors and saving an average of 3–5 minutes per invoice. |

| Invoice Approval | Physical routing of paper invoices or emailing PDFs for approval. Slow, difficult to track, and often results in delays. | Automated approval workflows are triggered instantly. Managers are notified and can approve invoices from anywhere, cutting approval times from weeks to 2–3 days. |

| Payment Processing | Manually setting up payments in banking software based on approved invoices. Prone to mistakes and delays. | Approved e-invoices are automatically queued for payment, often integrating directly with banking systems for batch payments. This improves cash flow forecasting. |

| Record Keeping & Audit | Filing paper invoices or saving PDFs in folders. Difficult to search and retrieve, making audits time-consuming and stressful. | A secure, digital, and unchangeable audit trail is created automatically for every invoice. Finding a specific invoice takes seconds, reducing audit preparation time by over 50%. |

As you can see, the impact isn't just about small improvements; it's about fundamentally changing how your financial data is managed for the better.

Tighter Security

Relying on emailed PDFs is a security risk. Emails can be intercepted, invoice details can be doctored, and convincing phishing scams can trick your team into paying fake bills. This kind of invoice fraud is a serious threat that costs businesses dearly every year.

E-invoicing through a secure, closed network like Peppol is like using a private courier for your financial data. The information is sent directly and securely to the intended recipient, with no chance for it to be intercepted or tampered with along the way.

Every transaction also creates a crystal-clear, unchangeable digital audit trail. This makes it incredibly simple to trace an invoice's journey from start to finish, which is a massive help for audits and compliance. You get peace of mind knowing your data is protected and your records are always accurate.

How to Start Using E-Invoicing

Making the switch to e-invoicing can feel like a daunting technical project, but it’s more straightforward than you might think. By breaking it down into a few practical steps, you can get your business running on automated, structured invoices without any major headaches. This is a roadmap for business owners, not tech experts.

Step 1: Look at Your Current Process

Before you can build something better, you need a clear picture of what you have now. Take a moment to map out your current invoicing workflow, from the second an invoice lands in your inbox until it’s finally paid and filed away.

To find the weak spots, ask yourself a few honest questions:

- How many hours are spent just typing invoice data into our system?

- Where do mistakes and typos usually creep in?

- What’s the number one reason our payments get delayed?

- If an auditor asked for an invoice from six months ago, how long would it take to find?

Pinpointing these bottlenecks is the first real step. You'll likely discover that most of your problems come from manual handling, a lack of visibility, or misplaced documents—all things a solid e-invoicing system is built to fix.

Step 2: Choose the Right Tool

Once you know what needs fixing, it's time to find the right technology. The key is to pick a tool that doesn’t just digitise your old problems but actually solves them. For most businesses in the Netherlands, that means finding a solution that can connect your existing accounting software directly to the Peppol network.

This is where a platform like Mintline comes in. Think of it as your secure gateway that handles all the technical heavy lifting of receiving and processing true, structured e-invoices. It’s designed to slot right in with the tools you already use, ensuring every e-invoice is automatically captured, its data extracted, and queued up for reconciliation.

The goal isn't just to stop using paper; it's to create a fully connected system where invoice data flows effortlessly from receipt to reconciliation. Mintline is built to bridge this gap, delivering true efficiency.

This seamless data flow is what makes straight-through processing a reality for small and medium-sized businesses. To get a better handle on this powerful concept, check out our guide on what straight-through processing means and how it can completely change your financial operations.

Step 3: Get Your Key Partners on Board

Technology is only half the battle. For e-invoicing to really work, you need your key business partners—both customers and suppliers—to join you. Start by making a list of your most frequent or high-volume trading partners.

Reach out and explain why you're making the switch. Frame it as a win-win: faster processing for you means faster payments for them. Give them clear, simple instructions on how to send you e-invoices via Peppol. Often, a friendly email is all it takes to get the ball rolling.

Keep the conversation supportive. Reassure them that modern tools make the process simple on their end, too. You might be surprised—many of them are probably already using e-invoicing and will be happy to connect with you more efficiently.

Step 4: Start Small, Build Momentum

Don't feel like you have to flip a switch and move everyone to e-invoicing overnight. A phased approach is almost always the best way to go, causing the least disruption.

- Pick a Pilot Group: Start with a small, manageable group of 3-5 trusted suppliers or customers who are open to trying it out with you.

- Test the Workflow: Use this pilot to process a few real invoices. It’s the perfect way to test your new tool and workflow in a live setting, iron out any kinks, and build your confidence.

- Gather Feedback: Check in with your pilot partners. How did it go for them? Use what you learn to fine-tune your instructions and onboarding process.

- Expand Gradually: Once you're comfortable, you can start rolling out e-invoicing to the rest of your business partners.

This methodical approach lets you learn and adapt as you go, setting you up for a smooth and successful rollout. By starting small, you can score some early wins and build momentum, making it much easier to get everyone else on board. Before you know it, what started as a small pilot will become your standard, automated way of doing business.

The Future of Invoicing Is Already Here

E-invoicing isn't some far-off concept or just another efficiency tool. It’s quickly becoming the standard for digital finance across Europe, and the days of treating it as an optional extra are numbered. New regulations are on the horizon that will make structured electronic invoices a legal must-have, completely changing how businesses manage their financial data.

This shift is being pushed forward by major regulatory changes, especially the European Union's VAT in the Digital Age (ViDA) proposals. At its core, ViDA is designed to bring value-added tax systems into the 21st century and build a more transparent digital single market.

What the ViDA Proposals Mean for You

The ViDA initiative is poised to bring in two critical changes that will directly impact your business operations:

- Mandatory B2B E-Invoicing: If you’re involved in any cross-border transactions within the EU, you’ll soon be required to send and receive structured e-invoices. No more PDFs or paper.

- Real-Time Digital Reporting: You’ll also need to report transaction data to tax authorities almost instantly, pulling it directly from your invoicing software.

This creates a powerful reason to get on board now. Waiting until the deadline hits will likely lead to a panicked rush to comply. In contrast, businesses that adopt e-invoicing early will be ready, relaxed, and a step ahead of the competition.

Thinking about e-invoicing today isn't just about getting an edge; it's about making sure your business is ready for the inevitable regulatory wave. This is soon going to be the minimum requirement for compliance.

We’re already seeing this change happen at a local level. For instance, the Dutch Ministry of Finance has laid out a plan to expand digital reporting and e-invoicing, which aligns with the EU’s goals. This could mean Dutch businesses will soon have to digitally report every single cross-border B2B invoice using a standardised electronic format. You can get the full details on these EU-level proposals on the official site.

For tax authorities, this new world offers much-needed transparency and a smarter way to fight VAT fraud. For businesses like yours, it simplifies cross-border trade and makes compliance easier—as long as you have the right systems in place.

This is exactly where tools like Mintline come in. By automating how you receive and process structured e-invoices, Mintline helps ensure your financial records are always accurate, compliant, and ready for digital reporting. Getting started with a user-friendly tool now doesn't just tick a compliance box; it sets you up to succeed in an increasingly automated European economy.

Common Questions About E-Invoicing

Diving into a new system always brings up a few questions. To help clear up any confusion about what e-invoices are and how they actually work, we've put together answers to the most common queries we hear from businesses just like yours.

Is an E-Invoice Just a PDF Sent by Email?

This is the most common point of confusion, but the answer is a firm no. Think of a PDF invoice as a digital photograph of a paper document. Your accounting software can't read it, so someone on your team still has to manually key in all the details.

A true e-invoice is completely different. It’s a structured data file, like a UBL (Universal Business Language) file, designed for one computer system to talk to another. When it lands in your inbox, your software instantly understands it and populates all the fields automatically. This simple difference eliminates manual data entry, slashes the risk of human error, and gets you paid faster.

Do I Need to Be a Tech Whiz to Use This?

Absolutely not. While the technology running in the background—like the Peppol network and structured data formats—is sophisticated, the tools you'll use are designed to be incredibly simple.

You don't need to understand how an engine works to drive a car. The same principle applies here.

Solutions like Mintline handle all the technical heavy lifting for you. They act as a user-friendly bridge, connecting to your existing software and managing all the complex parts of the e-invoicing network behind the scenes. It’s all about making powerful technology accessible to everyone, no matter their technical skill level.

How Secure Is E-Invoicing Compared to Email?

It’s worlds apart. Sending an invoice over a dedicated network like Peppol is drastically more secure than emailing a PDF. Emails can be intercepted, targeted by phishing scams, and are a prime target for invoice fraud, where a criminal can change the bank details on a PDF without you ever knowing.

The Peppol network is a closed, secure system. It uses encrypted, point-to-point connections, which means your invoice goes directly from your system to your client’s, with no vulnerable stops along the way. This built-in security gives you a trustworthy audit trail and protects your business from the kinds of payment fraud that keep business owners up at night.

Ready to stop chasing receipts and automate your bookkeeping? Mintline uses AI to automatically link every bank transaction to its corresponding document, turning hours of manual work into minutes. Discover a smarter way to manage your finances at https://mintline.ai.