Accounts Payable Definition: A Concise Guide to AP

accounts payable definition: Learn what AP is, why it matters, and how automation can streamline payments and improve cash flow.

Think of Accounts Payable (AP) as your business's running tab. It's the total amount of money you owe to your suppliers, vendors, and other creditors for goods or services you've bought on credit. In essence, it's a list of short-term debts that need to be paid efficiently to keep your business running smoothly.

What Is Accounts Payable in Business?

Let's say you run a small café. You order a big shipment of fresh coffee beans, and the supplier sends you an invoice that’s due in 30 days. That invoice doesn't get paid the moment it arrives; instead, the amount owed goes straight into your Accounts Payable. It sits there, waiting to be processed and paid.

This collection of outstanding bills is officially recorded as a current liability on your company’s balance sheet. Why? Because it represents debts you need to settle, usually within a year. Getting a handle on this number is absolutely vital for keeping your cash flow healthy and building a solid financial footing.

Accounts Payable vs. Accounts Receivable

It's common to mix up Accounts Payable with its opposite, Accounts Receivable (AR). The difference is simple but crucial to grasp.

To put it plainly, AP is the money you owe, while AR is the money owed to you.

- Accounts Payable (AP): This is your debt. It represents cash flowing out of your business to pay for things you’ve already received.

- Accounts Receivable (AR): This is your income. It's the cash that will (hopefully!) be flowing into your business from customers who bought from you on credit.

Here’s a quick breakdown to make it even clearer.

Accounts Payable vs Accounts Receivable At a Glance

| Aspect | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| What It Is | Money your business owes to suppliers. | Money your customers owe to your business. |

| Balance Sheet | Recorded as a Current Liability. | Recorded as a Current Asset. |

| Cash Flow | Represents cash outflow. | Represents cash inflow. |

| Example | An invoice you receive from a vendor. | An invoice you send to a customer. |

In short, your supplier’s invoice is your Accounts Payable, but that very same invoice is their Accounts Receivable. Understanding both sides of the coin is fundamental to financial literacy.

Keeping a close eye on your payables is far more than just tedious bookkeeping; it's a core strategic activity. It gives you a clear picture of your immediate financial obligations, helps you sidestep late fees, and is key to maintaining good relationships with your suppliers. A well-oiled AP process ensures every bill is properly checked, approved, and paid on schedule.

For a closer look at the kinds of documents you'll be handling, check out our guide on understanding a statement of account. And with platforms like Mintline, the once-manual grind of tracking and paying bills becomes a much more straightforward, automated flow, letting you get back to what you do best—running your business.

Why Accounts Payable Is a Strategic Function

It’s easy to dismiss accounts payable as just another back-office chore, but that’s a massive missed opportunity. A better way to think of AP is as the strategic control centre for your company's financial health. When you manage it well, you're not just paying bills—you're protecting working capital, maintaining liquidity, and paving the way for sustainable growth.

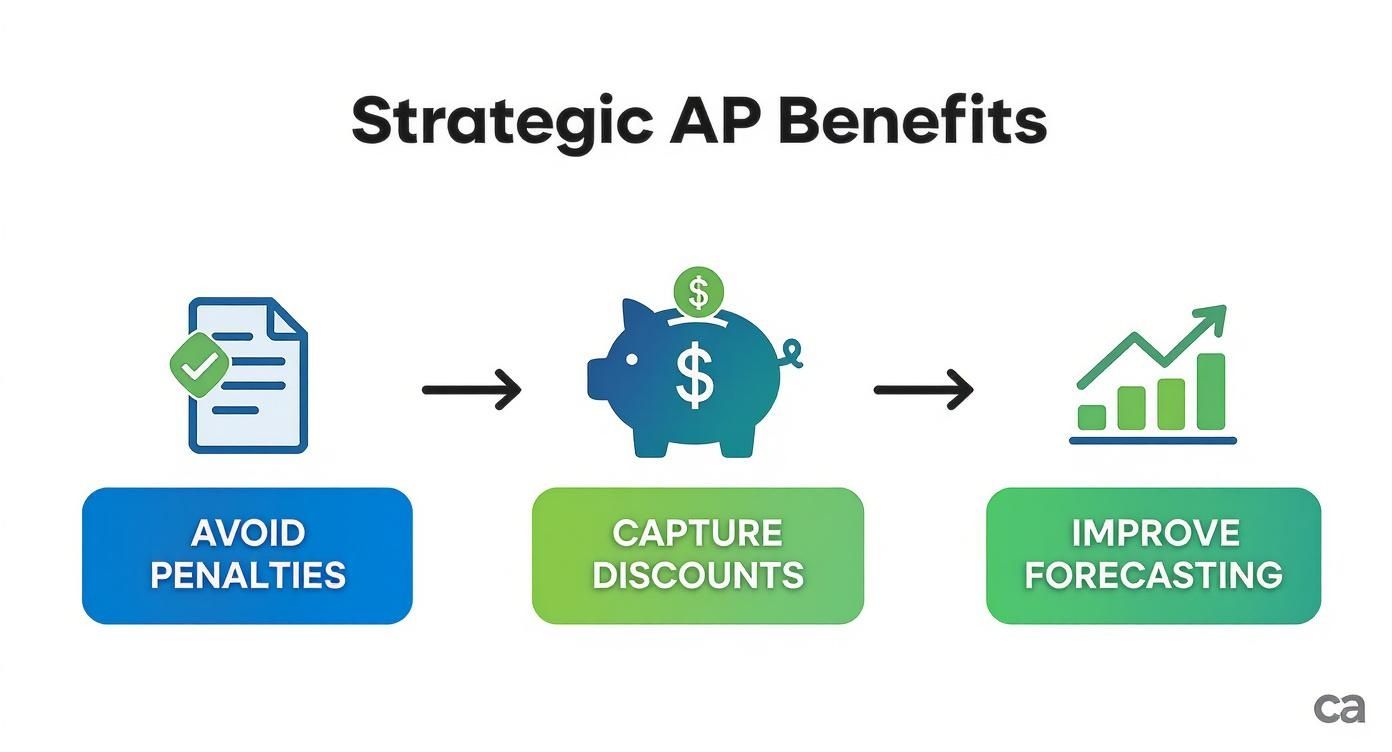

A smooth-running AP process becomes a powerful tool in your arsenal. It steers you clear of late payment penalties that quietly eat away at your profits. Even better, it puts you in a prime position to take advantage of early payment discounts, which can add up to some serious savings over the course of a year.

More Than Just Paying Bills

Great AP management creates ripples far beyond your own balance sheet; it directly shapes your business's reputation. When you consistently pay suppliers on time, you build a name for yourself as a reliable and trustworthy partner.

That reputation is an invaluable asset. Strong supplier relationships, built on a foundation of prompt payments, often lead to better credit terms, priority service when things get hectic, and sometimes even more favourable pricing. Your vendors are simply more willing to be flexible and go the extra mile when they know they can count on you.

A proactive approach to accounts payable turns a routine cost centre into a strategic function that safeguards cash flow, strengthens supplier partnerships, and provides the critical data needed for intelligent business decisions.

Fueling Accurate Financial Forecasting

Clean, accurate AP data is the bedrock of any solid financial plan. Without a clear, real-time picture of your company's obligations, forecasting is little more than guesswork. Every single invoice you process correctly adds another piece to the puzzle, clarifying your cash flow and liabilities.

This clarity is what allows you to create realistic budgets and make strategic decisions with confidence. On a larger scale, these obligations are immense. In the Netherlands, for example, liabilities from accounts receivable and payable represented 17.7% of the Dutch GDP on a non-consolidated basis as of December 2024. This just goes to show how significant these financial commitments are nationally, underlining why meticulous management is so crucial within your own business. You can discover additional financial data from Eurostat to see the bigger picture.

Ultimately, getting a grip on accounts payable is all about control. With your AP organised, you can confidently answer the big questions:

- How much cash do we need to have on hand next week?

- Can we actually afford that key investment this month?

- Are we making the most of our available capital?

Tools like Mintline give you this control by handling the tedious parts of the process automatically. This provides instant visibility into your financial position and frees you up to focus on strategy, not paperwork.

Walking Through the Manual AP Workflow

To really get why modern accounts payable tools are such a game-changer, you first have to understand the old-school process they’re designed to fix. Picture this: an invoice doesn't pop up neatly in a system. It lands on a desk as a piece of paper, or maybe it’s a PDF buried in someone's chaotic inbox. That’s the starting line for a long, fragile, and frankly, frustrating journey.

The first hurdle is just getting the invoice to the right person. In a busy office, paper gets lost. It ends up on the wrong desk, gets buried under a stack of other documents, or just disappears. It’s no surprise that manual data entry alone costs businesses an average of €15.96 per invoice. That’s not just a number—it’s precious time your team is wasting on a task that offers zero strategic value.

The Chain of Manual Hurdles

Once someone finally has the invoice in hand, the real work begins. An AP clerk has to manually type every single detail into the accounting software: the supplier's name, invoice number, date, every line item, and the grand total. This is a minefield for human error.

One simple typo can spiral into a major headache—think overpayments, paying the same bill twice, or throwing your financial records completely out of whack. After the data is in, the invoice needs to be coded to the correct general ledger (GL) account, which requires a sharp eye and a solid understanding of the company's chart of accounts.

Then comes the part everyone dreads: getting it approved.

- Chasing Approvals: The clerk has to physically hunt down the right manager to get a signature. But what if that person is travelling, on holiday, or just swamped with meetings? The invoice just sits there, creating a bottleneck that stalls everything.

- Verification Gridlock: Many purchases require a three-way match. This means someone has to manually pull up the invoice, the original purchase order (PO), and the goods receipt note (GRN) to confirm you’re only paying for what you actually ordered and received. If the numbers don't line up, it triggers an investigation, piling on even more delays.

If you want to see how technology untangles this mess, you can learn how Intelligent Document Processing pulls out and validates this data automatically, cutting these manual steps out of the picture.

This infographic shows how getting strategic with your AP process can help you dodge penalties, snag early payment discounts, and get a much clearer view of your financial future.

As you can see, making each step of the AP process work better has a direct impact on your company’s financial stability.

The Final, Painful Steps

At long last, after navigating the maze of data entry, coding, and approvals, the invoice is finally ready to be paid. But even this involves more manual work, like scheduling payment runs, printing out cheques, or logging into the bank to set up transfers. The final step? Filing the paper invoice away in a dusty cabinet.

The manual AP workflow is a sequence of time-consuming, error-prone tasks that drain resources and offer zero visibility. Each step introduces a risk of delay, mistakes, or lost documents, making it an unsustainable process for any growing business.

The whole process is slow and completely opaque. It's almost impossible to know the exact status of any invoice at any given time, which leads to calls from unhappy suppliers and a skewed view of your company’s real liabilities. This is the exact operational drag that platforms like Mintline are built to eliminate.

The Real Dangers of an Outdated AP Process

Running your accounts payable on a manual or outdated system is a bit like trying to navigate a busy motorway with a map from last century. It’s not just slow; it’s downright dangerous. The risks go well beyond a few administrative headaches—they can seriously impact your cash flow, operational stability, and even your company's reputation.

The most obvious problem is the sheer cost of inefficiency. Think about all the time your team spends just typing in invoice details, chasing down managers for an approval, or hunting through filing cabinets. Every single one of those hours is an hour they could have spent on work that actually moves the needle. This administrative quicksand quickly drives up your cost-per-invoice and bogs down the entire finance team.

The Financial and Strategic Pitfalls

Beyond the day-to-day grind, the financial risks are even more alarming. Manual systems are breeding grounds for expensive errors and, unfortunately, deliberate fraud. Without automated checks and balances, it's far too easy for things to slip through the cracks.

Here’s where it really starts to hurt:

- Duplicate Payments: It sounds basic, but paying the same invoice twice is one of the most common and costly mistakes in a manual workflow.

- Invoice Fraud: Without a rock-solid, automated verification process, it’s much easier for a fake or inflated invoice to get approved and paid.

- Missed Discounts: Many suppliers offer discounts for paying early. When your process is slow, you miss out on these opportunities, which is literally like turning down free money.

- Late Payment Penalties: Damaging supplier relationships is bad enough, but the late fees that often come with them directly eat into your profit margins.

When you add all this up, you're left with a blurry, unreliable picture of your company's financial health. If you don't have a real-time view of what you owe, you can’t manage your cash flow properly. That uncertainty can lead to unexpected cash shortages and bad strategic decisions.

An outdated AP process keeps you in a constant state of financial guesswork. It opens the door to needless costs, fraud, and cash flow emergencies, turning what should be a straightforward function into a major business liability.

How It Affects the Bigger Picture

The fallout from a messy AP process spreads far and wide, impacting your entire business. Late payments, for example, are a primary reason supplier relationships turn sour. When your vendors constantly have to chase you for what they're owed, it erodes trust and could lead to them offering you less favourable terms down the road.

This isn't just a hypothetical problem. In the Netherlands, strong accounts payable management is crucial for B2B financial health. A recent study showed that while 61% of B2B invoices were paid on time, a staggering 35% were overdue. This really underlines the struggle Dutch businesses have in keeping their payments on track. You can dive deeper into these payment trends and strategies in the Atradius Payment Practices Barometer.

And then there's audit season. A disorganised, paper-based system can turn an audit into an absolute nightmare. The frantic scramble to locate specific invoices and piece together payment trails is stressful, time-consuming, and a massive compliance headache. By stepping away from these old-school methods, platforms like Mintline give you the control and clarity needed to turn AP from a high-risk burden into a well-managed, strategic part of your business.

How Mintline Transforms Your Accounts Payable

When you’ve wrestled with the risks and headaches of a manual workflow, it’s easy to see why we need a better way to handle accounts payable. Automation isn't just about making things a little faster; it’s a complete overhaul of how your business manages its financial commitments. This is exactly where a platform like Mintline comes in, turning a messy, error-prone process into something simple and streamlined.

The change starts the second an invoice lands in your inbox. Forget about typing in details by hand. Mintline uses smart technology like Optical Character Recognition (OCR) to instantly read and pull out all the crucial information. Vendor names, invoice amounts, and due dates are captured with precision, wiping out typos and saving you from hours of mind-numbing data entry.

Getting that data right from the start is the foundation for everything else. It means the information driving your financial decisions is clean and correct from the get-go.

Creating Intelligent and Automated Workflows

Once Mintline has the invoice data, it puts it to work. The platform sets up smart, automated approval workflows that route invoices to the right person for review, instantly. No more chasing managers down the corridor or waiting for someone to get back from their holiday to sign off on a payment. The system just handles it.

This automation also tackles one of the most vital checks: the three-way match. Mintline can automatically cross-reference an invoice with its purchase order and the receiving report, flagging any mismatches for a closer look. This simple step ensures you only ever pay for what you actually ordered and received, giving you a powerful grip on your spending.

The difference this makes is enormous:

- Drastically Reduced Processing Times: A process that used to drag on for days or even weeks can now be wrapped up in a fraction of the time.

- Enhanced Accuracy: Automated matching and validation all but eliminate the human errors that cause overpayments or duplicate invoices.

- Complete Visibility: You can see the exact status of any invoice at any time, giving you a live, up-to-the-minute picture of your liabilities and cash flow.

Building a Foundation for Effortless Compliance

Beyond just speed and accuracy, Mintline creates a secure, digital audit trail for every single transaction. From the moment an invoice is received to the final payment, every action is logged and easy to find. When audit season rolls around, there’s no need to spend days digging through filing cabinets. You have a complete, organised record ready to go. You can find out more about how this technology is changing the game in our guide on the role of AI in accounting.

This move toward automation is more than just a passing phase. The rapid uptake of automated financial systems in the Netherlands makes this crystal clear, with fintech platforms experiencing major growth. For instance, Airwallex reported a massive 199% revenue jump from the Netherlands in Q2 2023 compared to the previous year as its active customer base tripled. This surge shows just how hungry Dutch companies are for smarter accounts payable solutions.

Mintline takes your accounts payable from a manual cost centre and turns it into a strategic, automated function. It gives you the speed, accuracy, and visibility you need to manage cash flow effectively and makes compliance a simple, stress-free part of your business.

Still Have Questions About Accounts Payable?

Even with a clear definition, a few questions always pop up when people are trying to get their heads around accounts payable. Let's tackle some of the most common ones so you can feel confident putting this knowledge to work in your own business.

What's the Difference Between an Invoice and a Purchase Order?

This is a classic. Think of it this way: a Purchase Order (PO) is what you send to a vendor before you buy something. It’s your official request, locking in what you want, how much of it, and the price you've agreed on. It’s essentially the start of the conversation.

An invoice comes at the end. It's the bill your vendor sends you after they've delivered the goods or services, officially asking for payment. The gold standard in a solid AP process is something called a "three-way match," where you line up the invoice, the PO, and the delivery receipt to make sure everything adds up before you pay.

Why Is Accounts Payable a "Current Liability"?

You'll see accounts payable listed as a current liability on your balance sheet, and there’s a simple reason for that. It’s a short-term debt—money you owe that you're expected to pay off within the next year (or your business's typical operating cycle).

This keeps it separate from long-term debts, like a five-year business loan. Keeping a close eye on your current liabilities is crucial for managing your cash flow. It gives you a real-time snapshot of your company's financial health and your ability to pay the bills on time.

How Can a Small Business Improve Its AP Process?

If you're running a small business, the biggest leap forward you can make is to stop doing everything by hand. Adopting a simple automation tool like Mintline is the single most effective change you can make. Manual processes are just too slow and full of little errors that can really hurt a small operation.

When you automate the repetitive tasks, a small business can suddenly manage its bills with the kind of precision you'd expect from a huge finance department. It frees you up to focus on growing the business, not shuffling papers.

These tools take over the tedious bits, like typing in invoice details or sending follow-up emails for approvals. The result? Fewer mistakes, more time for your team to focus on meaningful work, and a crystal-clear view of what you owe at any given moment.

What Key Metrics Should I Track for AP Performance?

To know if your AP process is actually working well, you need to measure it. Tracking a few key performance indicators (KPIs) will quickly show you where things are running smoothly and where the bottlenecks are.

Here are the big ones to watch:

- Days Payable Outstanding (DPO): On average, how many days does it take you to pay a supplier after you get their bill?

- Cost Per Invoice Processed: This tells you how much time and money you're spending to process a single invoice.

- Invoice Exception Rate: What percentage of your invoices need some kind of manual fix or investigation? A high rate here signals a problem.

- Early Payment Discount Capture Rate: Are you taking advantage of discounts for paying early? This metric shows you how much money you're saving—or leaving on the table.

Ready to turn your accounts payable from a manual headache into a strategic part of your business? Mintline uses AI to automatically link every transaction to its receipt, which gets rid of errors and hands you back hours of your time. Discover how Mintline can streamline your finances today.