A Practical Guide to Payables and Receivables for Dutch Businesses

Mastering payables and receivables is key to business health. Our guide breaks down the process and shows how automation can optimize your cash flow.

Think of your business's finances as breathing. You breathe in cash through Accounts Receivable (AR)—that's the money your customers owe you. You breathe out cash through Accounts Payable (AP)—the money you owe your suppliers. Getting this rhythm right isn't just good accounting; it's essential for survival and growth, and modern tools are designed to make it effortless.

The Two Sides of Your Business Cash Flow

For Dutch freelancers, startups, and SMBs, this financial rhythm is the very pulse of the business. When your financial inhales (receivables) and exhales (payables) are out of sync, it can cause serious trouble. You end up in a cash flow squeeze, struggling to pay staff, invest in new equipment, or jump on growth opportunities when they appear.

It's a delicate balance. A single late payment from a client delays your receivables, which can instantly affect your ability to pay your own bills on time. This creates a domino effect that can strain supplier relationships and quickly damage your reputation.

The Challenge of Manual Tracking

The real headache for many businesses is trying to keep track of all this manually. Juggling spreadsheets, chasing down paper receipts, and painstakingly reconciling bank statements isn't just a drain on your time—it's a recipe for human error. One misplaced invoice or a forgotten payment can throw your entire financial stability off course.

This administrative slog pulls you away from what you should be doing: serving clients and growing your business. It turns a vital financial function into a frustrating, reactive chore. Here in the Netherlands, this problem is very real—late payments now affect an average of 35% of all B2B invoices. The Atradius Payment Practices Barometer shows how these liquidity issues can trip up even the most organised companies.

Managing payables and receivables isn't just about accounting. It's about maintaining the momentum of your business. When cash flow is smooth, you have the freedom to plan, innovate, and expand.

This is exactly the problem modern tools are built to solve. Platforms like Mintline automate the whole cycle by linking bank transactions directly to receipts and invoices, giving you a clear, real-time picture of where you stand. By cutting out the manual grind, you start managing your cash flow proactively instead of just reacting to problems.

For a deeper understanding of how to master the flow of money in and out of your business, delve into this complete guide to payments and receivables. By embracing automation, you ensure your business keeps breathing steadily, so you can focus on its long-term health, not just its bookkeeping.

Accounts Payable vs Accounts Receivable Explained

At the heart of any business's financial health, you'll find two critical, interconnected gears: Accounts Payable (AP) and Accounts Receivable (AR). Getting a handle on the difference isn't just an exercise for your accountant; it’s fundamental to managing cash flow and keeping your company on solid ground.

Think of them as two sides of the same coin. Accounts Receivable is all the money your customers owe you. Accounts Payable is all the money you owe your suppliers. One is cash coming in, the other is cash going out. It's a delicate balancing act, as a delay in collecting your AR can directly squeeze your ability to pay your AP.

Defining the Core Functions

Let's cut through the jargon and look at what these terms actually mean day-to-day.

Accounts Receivable (AR) is simply the sum of all unpaid invoices you've sent to clients for products you've delivered or services you've completed. When you sell something on credit, that future payment is logged as AR. On your balance sheet, AR is classified as a current asset because it’s cash you reasonably expect to have in hand soon—usually within a year.

Accounts Payable (AP), on the flip side, is the total amount you owe to your vendors for things you've bought on credit. When a supplier's invoice lands on your desk (or in your inbox), that amount sits in your AP until you pay it. On the balance sheet, AP is listed as a current liability, representing a short-term debt you’re obligated to settle.

In short, your company's accounts receivable is another company's accounts payable. This simple fact shows just how intertwined business finances really are.

If you want to get into the nitty-gritty of how these entries are recorded and balanced, it’s worth looking into the principles of double-entry bookkeeping. It's the system that ensures every transaction is recorded in at least two accounts, keeping the whole financial picture in balance.

A Side-by-Side Comparison

Sometimes, seeing things laid out visually makes them click. The distinction between an asset (money coming in) and a liability (money going out) is what shapes your entire financial strategy, from daily operational decisions to long-term growth plans.

To make it even clearer, here’s a simple table breaking down how these two functions stack up.

Key Differences Between Accounts Payable and Accounts Receivable

| Aspect | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| Definition | The money your business owes to suppliers and vendors for goods or services purchased on credit. | The money owed to your business by customers for goods or services delivered on credit. |

| Balance Sheet | Recorded as a Current Liability. It represents an obligation to pay out cash in the near future. | Recorded as a Current Asset. It represents an incoming cash benefit you expect to receive soon. |

| Core Goal | To manage outgoing payments efficiently, maintain good supplier relationships, and avoid late payment penalties. | To collect incoming payments promptly, maintain customer relationships, and minimise the risk of bad debt. |

| Typical Challenges | Risk of invoice fraud, missing early payment discounts, manual data entry errors, and potential for late payment fees. | Slow-paying customers, invoice disputes, difficulties in tracking overdue payments, and the risk of bad debt. |

Ultimately, mastering the dance between payables and receivables is what separates thriving businesses from those that are constantly struggling. When you efficiently collect what you're owed (AR), you have the cash you need to settle your debts (AP) without breaking a sweat. This is where modern tools like Mintline make a huge difference, helping automate the tracking and reconciliation of these transactions to give you a consistently clear view of where your money is and where it’s going.

Mapping Your Payables and Receivables Workflows

Every invoice, whether it's coming into your business or going out, follows a distinct journey. The first step to getting a real grip on your cash flow and cutting down on admin headaches is to understand this journey—the end-to-end workflow for both your payables and receivables. When you map these processes out, you can pinpoint exactly where things get stuck and start to make them better.

Think of it like tracing a package from sender to recipient. For accounts payable, the journey starts when a supplier's bill lands on your desk (or in your inbox) and doesn't end until that bill is paid and the transaction is recorded. On the flip side, the accounts receivable process kicks off the moment you send an invoice to a customer, and it's only complete when their payment hits your account and is properly reconciled.

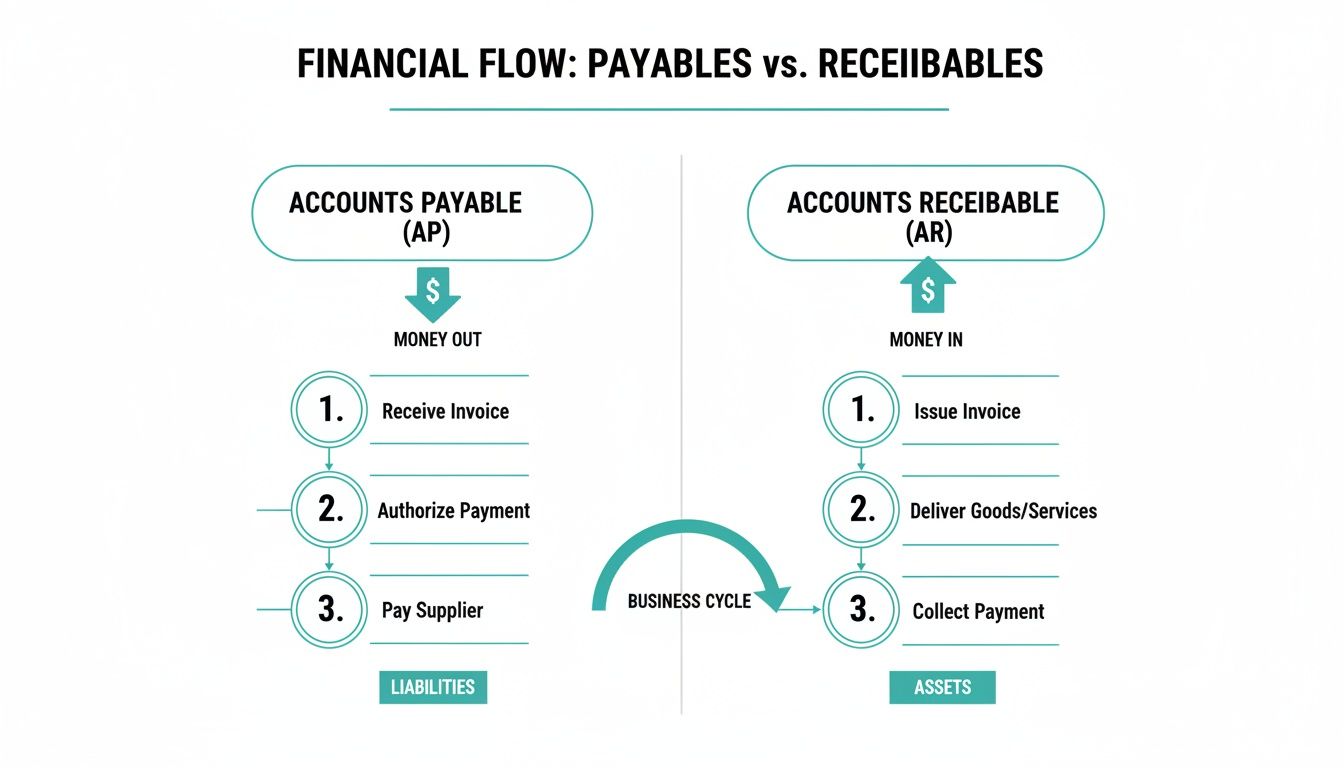

The diagram below gives you a clear visual of these two critical functions and how money flows in and out of your business.

This side-by-side view really highlights that while AP and AR are moving in opposite directions, they both demand the same things at every stage: accuracy, speed, and crystal-clear documentation.

The Typical Accounts Payable Workflow

At its core, the AP process is all about managing what your company owes to its suppliers. Get this wrong, and you’re looking at late payment fees, damaged vendor relationships, and missed early payment discounts. A single invoice usually travels through these steps:

- Invoice Receipt: It all begins when an invoice arrives from a supplier, either as a paper document in the mail or, more commonly, as a digital file via email.

- Data Entry and Verification: Someone has to take all the key details—supplier name, invoice number, amount, due date—and key it into your accounting system. This is a massive bottleneck for teams still doing it by hand, and it's where mistakes love to hide.

- Approval Routing: The invoice then gets forwarded to the right manager for a sign-off. This is another classic delay point, especially if approvers are swamped or the invoice gets buried in a crowded inbox.

- Payment Processing: Once approved, the payment is scheduled and sent out, usually through a bank transfer or another preferred method.

- Reconciliation: The final step. You match the payment that went out with the original invoice in your books to officially close the loop.

This is exactly where tools like Mintline step in to fix the weak spots. By automatically extracting data from invoices with OCR technology and matching it directly to bank transactions, the time-consuming manual entry and reconciliation work simply disappears. Hours of work become minutes.

The Standard Accounts Receivable Workflow

The AR process is how your company actually collects its money. An inefficient AR cycle means you get paid slower, which directly squeezes your cash flow and your ability to pay your own bills. A standard AR workflow usually breaks down like this:

- Invoice Creation: An accurate invoice is put together, making sure it has all the crucial details like services provided, payment terms, and the due date.

- Invoice Delivery: The invoice is sent off to the customer, and you confirm they’ve received it.

- Payment Monitoring: Your team keeps a close eye on all outstanding invoices, tracking which payments are coming up and which ones are late.

- Collections and Reminders: The moment an invoice goes overdue, the collections process starts. This usually means sending polite reminders or making follow-up calls.

- Payment Application: When the cash finally comes in, it needs to be correctly applied to the corresponding open invoice in your accounting software to mark it as paid.

A slow or disorganised workflow on one side inevitably affects the other. Delays in collecting receivables directly limit your ability to manage payables, creating a cycle of financial pressure that can be difficult to escape.

Understanding these individual steps is crucial. For a deeper look into the whole purchasing cycle from beginning to end, check out our dedicated guide on the procure-to-pay process. By mapping out your existing payables and receivables workflows, you create a blueprint that shows every inefficiency, giving you a clear path forward.

Wrestling with Common Pain Points and Risks

If you've ever managed payables and receivables, you know it can feel like a constant uphill battle. Late payments, disputed invoices, and the ever-present risk of fraud aren't just minor annoyances—they're real threats that can choke your cash flow and stunt your company's growth.

The solution is to stop firefighting and start building a fortress. Instead of just reacting to problems, the goal is to create solid systems that prevent small hiccups from turning into full-blown financial crises. It’s all about smart risk management powered by intelligent automation.

Taming Your Accounts Receivable Challenges

When it comes to getting paid, the number one headache is almost always late payments. A single delayed payment can throw your entire cash flow forecast into disarray, leaving you scrambling to cover your own bills.

This problem often gets tangled up in invoice disputes. A client might quibble over a line item or claim the invoice never arrived, triggering a back-and-forth of emails and phone calls that only pushes payment further down the road.

To get in front of this, you need a few robust controls in place.

- Set the Rules Before You Start: Create a crystal-clear credit policy. Define your payment terms, lay out any late fees, and explain your collections process. Getting clients to agree to this upfront eliminates a world of "I didn't know" excuses later on.

- Let Automation Do the Nagging: Manually chasing payments is a time-suck and it's easy for things to fall through the cracks. An automated system can send invoices the moment work is done and fire off polite reminders for upcoming or overdue payments. You stay on their radar without the administrative drain.

Good receivables management isn't about hounding people for money. It's about building a smooth, professional process that makes it incredibly easy for your clients to pay you on time.

Think of these controls as your first line of defence. They bring much-needed structure and predictability to the often-chaotic world of collections.

Guarding Against Accounts Payable Risks

On the payables side of the fence, the risks can be even more daunting. Sure, processing hundreds of invoices is a heavy administrative lift, but the real dangers are fraud and simple human error. A fake invoice slipping through or an accidental duplicate payment can mean money walking right out the door.

The sheer scale of these balances highlights their economic importance. In the Netherlands' financial sector, for example, other accounts receivable and payable liabilities stood at a staggering 17.70% of GDP. When you pair that with data showing 35% of B2B invoices are overdue, you start to see just how critical it is to get a handle on this financial drag. You can explore more about these financial sector liabilities on Trading Economics.

Protecting your business means putting strict verification processes in place. It's simply non-negotiable.

The Power of Three-Way Matching

One of the most powerful controls in your payables arsenal is three-way matching. It’s a straightforward but incredibly effective process where you check three documents against each other before an invoice gets paid:

- The Purchase Order (PO): What your team officially agreed to buy.

- The Goods Receipt Note: What your team can confirm was actually delivered.

- The Supplier Invoice: What the supplier is asking you to pay for.

If the quantity, price, or item descriptions don't match perfectly across all three, the payment is immediately flagged for a human review. This simple cross-check is your best defence against overpayments, billing errors, and fraudulent invoices. Tools like Mintline automate this, instantly highlighting mismatches between transaction data and receipt details to speed up verification.

By weaving these kinds of controls into your payables and receivables workflows, you’re not just managing money—you’re building a financial safety net to protect your bottom line.

How Automation Can Get You Out of Financial Admin Hell

If you’ve ever felt like you’re drowning in a sea of invoices or spent an entire afternoon trying to match payments to statements, you know the soul-crushing reality of manual financial admin. The old-school way of managing payables and receivables is a constant battle—a world of messy spreadsheets, chasing down paper receipts, and mind-numbing data entry that’s just begging for errors. It’s reactive, inefficient, and a total drain on your time and energy.

But what if you could change the entire dynamic? Imagine swapping that financial chaos for clarity and confidence, proactively managing your cash flow instead of just reacting to the next fire. This is exactly what automation brings to the table. It completely reframes the conversation from problems to possibilities.

The image above nails this "before and after" story. On one side, you see the slow, painful slog of manual work. On the other, a smart, streamlined system that brings a sense of calm and control to your finances.

From Manual Grind to Automated Flow

At its heart, the promise of automation is brilliantly simple: it gets rid of the tedious tasks that hold back freelancers, finance teams, and accounting firms. Instead of spending hours punching invoice details into a keyboard or painstakingly checking bank statements against a pile of receipts, you can let intelligent tech do the heavy lifting.

Think about the traditional, clunky workflow for a single invoice. It’s a painful multi-step process:

- Save or print the invoice. The first hurdle is just getting the document into your system.

- Manually type everything in. Someone has to key in the supplier's name, invoice number, amount, and due date.

- Play detective with your bank statement. Once a payment goes through, you have to hunt through your transactions to find the matching line item.

- Mark as paid and file it away. Finally, you update your records and stash the receipt, crossing your fingers you can find it again during tax season.

Every single one of these steps is a potential pitfall. A simple typo could lead to paying the wrong amount, a lost receipt can turn into a compliance nightmare, and the time wasted is a massive hidden cost. Automation takes this broken process and transforms it into a smooth, connected flow.

How Mintline Changes the Game

Platforms like Mintline are built specifically to tackle these headaches. They automate the most time-consuming parts of managing payables and receivables by combining direct bank connections with AI-powered document processing.

Forget manual data entry. Mintline’s Optical Character Recognition (OCR) technology automatically scans your receipts and invoices, pulling out all the key information. This data is then intelligently matched to the corresponding transactions that are pulled directly from your linked bank accounts.

The real breakthrough here is the end of manual reconciliation. By algorithmically matching receipts to transactions based on the vendor, amount, and date, the system reduces hours of monthly admin to just a few minutes of review.

This kind of automation delivers real-world benefits. For a freelancer, it means simplicity and more billable hours. For an accounting firm, it translates to massive efficiency gains, fewer errors, and the freedom to offer high-value advisory services instead of just grinding through bookkeeping. Security is also a top priority, with robust encryption and EU-based data storage to keep your sensitive financial information safe.

By putting everything in one place, you get a single source of truth for your finances. Every transaction is digitally tied to its source document, creating a clean, audit-ready trail that’s always organised and accessible. You can dive deeper into the tech that makes this happen in our guide to intelligent document processing.

Ultimately, embracing automation isn't just about saving time—it's about building a more accurate, resilient, and scalable foundation for the financial health of your business.

What’s Next? Putting Smarter Financial Management into Action

Knowing the difference between payables and receivables is a great start, but the real magic happens when you put that knowledge to work. Making the leap from understanding the concepts to actively managing them is what truly fuels business growth. This is where we get practical, with clear, targeted steps you can take to get a handle on your finances, no matter your company’s size.

The path forward isn't one-size-fits-all. A freelancer’s needs are worlds apart from a fast-growing startup or an established accounting practice. The trick is to find an approach that solves today's problems while setting you up for whatever comes next.

For Freelancers: Get Your Time Back

If you’re a freelancer, time is your most precious resource. Every minute you spend wrestling with paperwork is a minute you’re not earning. Your goal should be to find a simple, no-fuss system that keeps your finances in order without becoming another chore.

A great first step is to get all your financial documents in one place. Stop letting invoices and receipts gather dust in your inbox or a shoebox. A tool that lets you capture and store everything digitally is a game-changer. Something like the free tier from Mintline is perfect for this, as it can automatically link your bank transactions to your receipts. Taking this one simple step creates a clean, organised record that makes tax season infinitely less painful.

For Startups: Build a Foundation to Scale

For startups, the challenge is building a financial engine that can keep up with your growth. The manual spreadsheets and email chains that work when you have ten transactions a month will completely fall apart when you hit one hundred. You need scalable payables and receivables systems from the get-go—it’s not a luxury, it’s a necessity.

Start by automating your invoice and receipt matching. A platform that hooks directly into your bank feeds and uses AI to do the heavy lifting of reconciliation is a must. This not only cuts out hours of manual work but gives you a real-time snapshot of your cash flow. That clarity empowers you to make smarter, faster decisions about hiring, new investments, and your next big move.

For Finance Leads and Accounting Firms: From Bookkeeper to Advisor

If you’re a finance lead or run an accounting firm, your goal is to evolve from reactive data entry to proactive, strategic advising. Your team’s talent is wasted chasing down documents and ticking boxes on bank statements. The future of the profession is in high-level guidance, and that means you have to free your people from the grunt work.

Automation isn't about replacing your team; it's about upgrading their role. When you let technology handle the repetitive tasks, you empower your staff to focus on what humans do best: financial analysis, forecasting, and offering the kind of strategic advice that helps clients truly succeed.

By bringing in a platform that automates the whole reconciliation workflow, you can serve more clients with better accuracy and less effort. It’s a shift that turns your practice from a simple bookkeeper into an indispensable strategic partner.

Common Questions About Payables and Receivables

Let’s tackle some of the common questions that pop up when you're managing the flow of money in and out of your business. Here are a few practical answers to help clear things up.

| Question | Answer |

|---|---|

| What's the very first thing I should do to improve my receivables collection rate? | Start by setting crystal-clear expectations. Your most powerful first step is creating a solid credit policy and making sure your payment terms are spelled out on every single invoice. When there’s no room for guesswork, you’ve already won half the battle. After that, setting up automated reminders for late payments is a game-changer. It keeps your invoice at the top of your client's to-do list without you having to chase them down manually. |

| How can automation actually reduce the risk of invoice fraud? | Think of automation platforms like Mintline as your digital gatekeeper. They use a powerful technique called three-way matching, where the system automatically checks the purchase order, the goods receipt, and the invoice to make sure they all align perfectly. If something doesn't match—say, the quantity is wrong or the price is off—the system flags it instantly. This stops a bad payment in its tracks. By taking human error out of the equation, you create a fraud-resistant, fully traceable record for every single payment. |

| Is it better to pay suppliers early or right on the due date? | From a pure cash-flow perspective, paying on the due date is usually the standard advice. It keeps cash in your business for as long as possible, giving you more flexibility. However, there's a big exception: early payment discounts. Many suppliers will offer you a small percentage off if you pay sooner. You just need to do some quick maths. If the discount saves you more money than you could earn by holding onto that cash, then paying early is a smart move that directly boosts your profit. |

These are just a few of the everyday challenges in managing payables and receivables. Getting the fundamentals right puts you in a much stronger position to manage your cash flow effectively.

Ready to take control of your payables and receivables? See how Mintline automatically links every bank transaction to its receipt, eliminating manual work and giving you complete financial clarity. Explore the platform at https://mintline.ai to get started for free.