A Guide to the Procure to Pay Process

Master the procure to pay process from requisition to final payment. Learn the core stages, common challenges, and automation strategies to boost efficiency.

The procure-to-pay process, or P2P as you'll often hear it called, is the A-to-Z journey a company takes to buy the things it needs. It starts the moment someone realises they need something—say, a new software licence or a fresh stock of office supplies—and doesn’t end until the final invoice is paid and the books are balanced.

Think of it less as a simple series of tasks and more as the lifeblood of your company’s purchasing operations. A well-managed P2P cycle provides the financial clarity and control that platforms like Mintline are built to perfect.

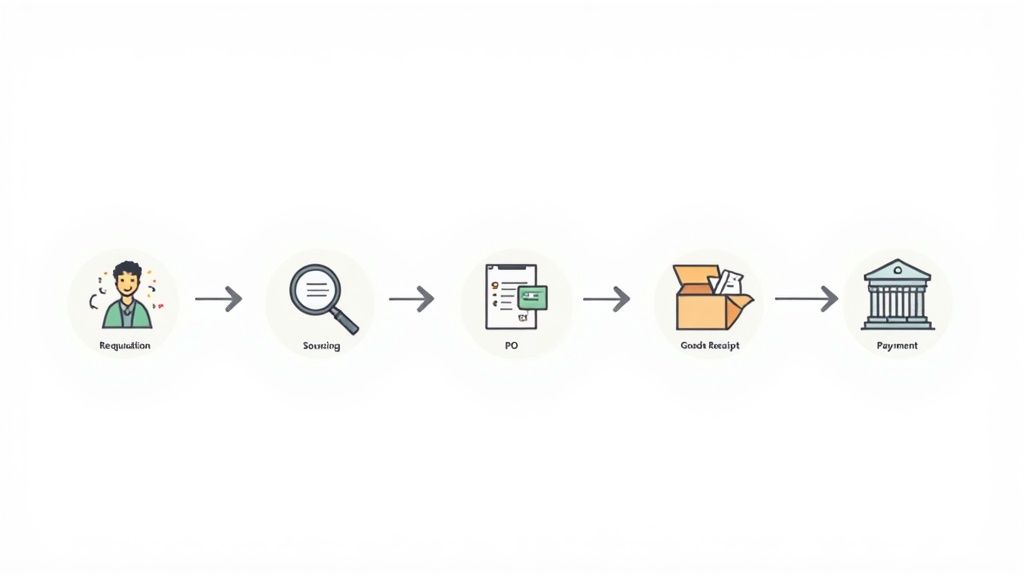

What Does Procure to Pay Actually Look Like in Practice?

It’s easy to get lost in the jargon, but the P2P process is something you’ve likely seen in action many times. It's the end-to-end blueprint that governs how money flows out of the business for goods and services, directly shaping both your efficiency and your bottom line.

Let's walk through a real-world example. Imagine your marketing team needs to launch a major digital advertising campaign.

The P2P cycle sparks to life when the Head of Marketing decides they need a specialised agency to manage the campaign. They draft a formal request outlining the budget, scope of work, and desired outcomes. This initial request is the requisition stage.

Next, the procurement team gets involved. They don't just pick the first agency they find; they research several, request proposals, and negotiate terms. This is sourcing—finding the right partner who offers the best value, not just the lowest price.

Once they've chosen the perfect agency, a formal purchase order (PO) is created. This isn't just a piece of paper; it's a contract. It locks in the services, deliverables, and costs, creating a clear agreement for everyone involved.

As the campaign progresses, the agency delivers the work—creative assets, ad placements, and performance reports. Your marketing team reviews and confirms that the services have been rendered as promised. This confirmation is known as the goods receipt step (even though no physical "goods" were involved).

Finally, the agency sends its invoice. Your finance team doesn’t just pay it blindly. They carefully match the invoice against the original PO and the service confirmation to make sure everything lines up. Once verified, the payment is scheduled and sent. This covers the final invoice processing and payment stages, closing the loop.

Why Is This Process So Foundational for a Healthy Business?

A solid procure-to-pay process does far more than just keep the lights on and ensure suppliers are paid. When managed correctly, it becomes a strategic framework that gives you deep financial control and paves the way for smarter growth.

A well-oiled P2P process is the foundation of smart spend management. It elevates procurement from a back-office function to a strategic driver that safeguards cash flow, nurtures supplier partnerships, and ensures every pound is accounted for.

Getting this workflow right brings some powerful advantages to your business:

- Total Financial Visibility: It provides a clear, real-time picture of company-wide spending. You can instantly see who is buying what, from whom, and for how much, making it easier to spot savings opportunities.

- Airtight Budgetary Control: With formal requisitions and POs as standard practice, you can clamp down on unauthorised or "maverick" spending, ensuring departments stick to their allocated budgets.

- Stronger Supplier Relationships: Paying suppliers accurately and on time builds a mountain of goodwill. This trust often translates into better pricing, preferential treatment, and more collaborative partnerships.

- Boosted Operational Efficiency: Standardising and automating the P2P cycle—especially with tools like Mintline for receipt-to-bank matching—slashes manual data entry, cuts down on errors, and frees up your finance team for more strategic work.

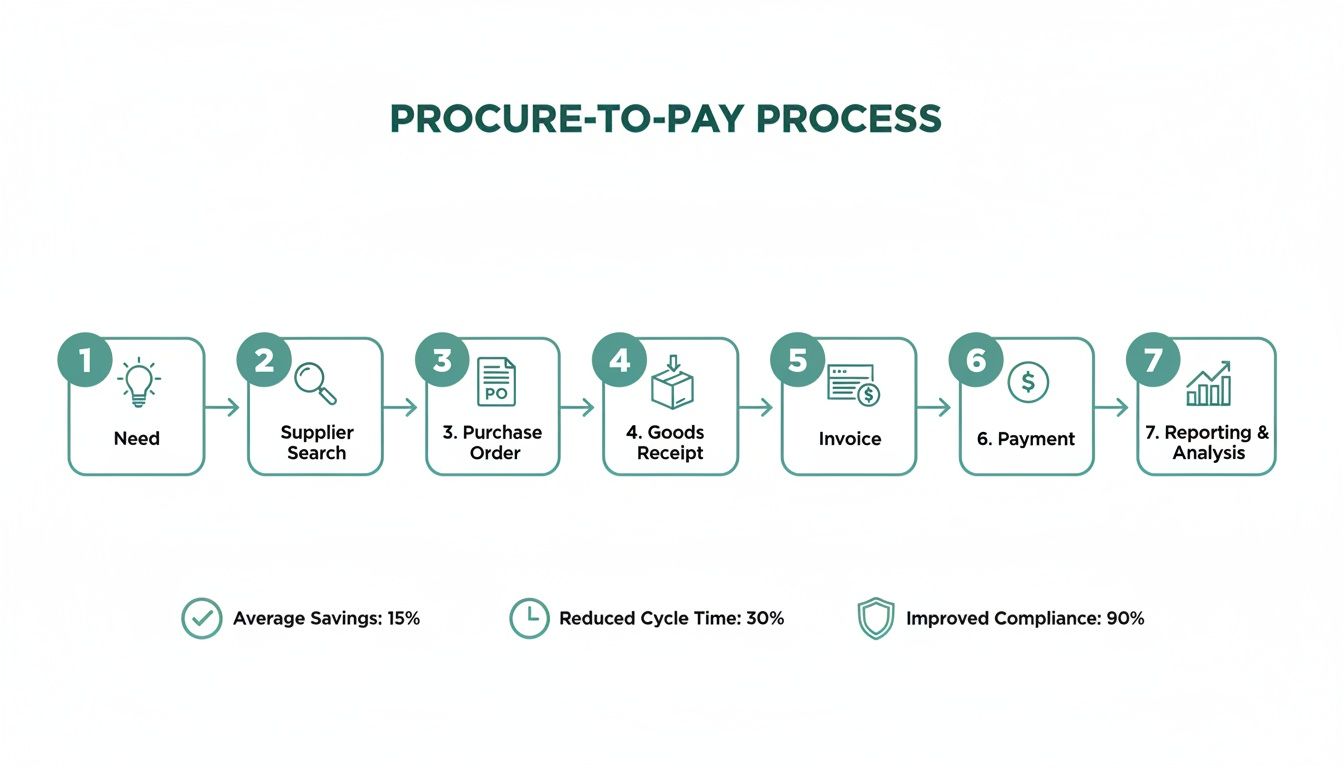

The Seven Core Stages of Procure-to-Pay

To really get a grip on the procure-to-pay process, you have to break it down into its core pieces. Think of it like assembling a high-performance engine; every single part needs to work perfectly and connect seamlessly with the next. The P2P cycle is a chain of seven distinct stages, and each one has a specific job to do, forming a complete purchasing journey from start to finish.

Understanding how these stages flow into one another is the first step. Once you see the full picture, you can start spotting bottlenecks, bringing in smart automation, and turning your procurement function from a cost centre into a real strategic asset.

Let’s walk through each stage of the journey.

A Breakdown of the Procure to Pay Process Stages

Before we dive into the details, this table gives a quick overview of the entire P2P lifecycle. It maps out each of the seven stages, what its main goal is, and the key tasks involved.

| Stage | Primary Objective | Key Activities |

|---|---|---|

| 1. Requisition | Formalise an internal need for goods or services. | Employee identifies a need, completes a purchase requisition form with details and justification, and submits it for internal approval. |

| 2. Sourcing | Find and select the best supplier for the need. | Researching vendors, comparing quotes, running RFPs (Request for Proposals), negotiating contracts, and vetting supplier credentials. |

| 3. Purchase Order | Create a formal, legally binding purchase agreement. | Creating a Purchase Order (PO) with item details, quantities, prices, and terms; routing it for approval and sending it to the supplier. |

| 4. Goods Receipt | Confirm that the ordered items have been delivered correctly. | Physically receiving the goods or confirming service completion, inspecting for quality and quantity, and creating a Goods Receipt Note (GRN). |

| 5. Invoice Processing | Verify the supplier's invoice for accuracy and approve it for payment. | Receiving the supplier invoice, performing a three-way match against the PO and GRN, and resolving any discrepancies. |

| 6. Payment | Pay the supplier according to the agreed-upon terms. | Scheduling the approved invoice for payment, executing the payment via bank transfer or other methods, and notifying the supplier. |

| 7. Reconciliation | Close the loop by recording the transaction in the financial system. | Matching the payment to the invoice in the general ledger, archiving all related documents, and analysing the data for reporting. |

This table provides a high-level roadmap. Now, let's explore what actually happens at each of these stops along the P2P journey.

Stage 1: Need Identification and Requisition

Every single purchase, no matter how small, starts with a need. This first stage is where someone in your company—a department, a team, an individual—formally flags that they require a good or service to do their job.

This isn't just a casual chat in the hallway about needing new laptops. It’s a structured request, known as a purchase requisition. This document spells out exactly what’s needed, how many, the expected cost, and why the expense is necessary. It’s the starting gun for the whole P2P process, kicking off an internal approval workflow long before you ever talk to a supplier.

Stage 2: Supplier Sourcing and Vetting

Once the need is approved, the obvious next question is, "So, who are we buying this from?" Welcome to the sourcing stage. This is all about finding potential suppliers, comparing their prices and quality, and making sure they're reliable.

For a simple purchase, this might be as easy as picking a company from your pre-approved vendor list. But for bigger, more strategic buys, this can be a much more involved process. It could mean sending out a formal Request for Proposal (RFP), digging into contract negotiations, and doing thorough background checks to ensure the supplier meets your standards for everything from quality to compliance.

Stage 3: Purchase Order Creation and Approval

With a supplier chosen, it’s time to make things official by creating a Purchase Order (PO). This isn't just paperwork; it's a legally binding contract that confirms your intent to buy. It lays out all the specific details of the deal, creating a crystal-clear agreement between you and the vendor.

A solid PO will always include:

- A unique PO number for easy tracking

- Detailed descriptions and quantities of what you're buying

- The prices you both agreed on

- Delivery dates and the shipping address

- Payment terms and conditions

Once created and approved internally, the PO is sent to the supplier. From their perspective, this is the green light to get the order ready. This document is absolutely vital because it sets expectations right from the start and acts as the single source of truth for the rest of the process.

Stage 4: Goods or Services Receipt

This stage is all about confirmation. When the delivery truck pulls up or the consultant finishes their project, your team has to check that what was delivered actually matches what was ordered on the PO. The proof of this step is typically a goods receipt note (GRN) or a service acknowledgement.

Think of this as a crucial quality control checkpoint. It's where you confirm you got the right items, in the right quantity, with no damage, and up to the quality standards you expected. If you skip this step, you open yourself up to paying for incomplete orders or shoddy products.

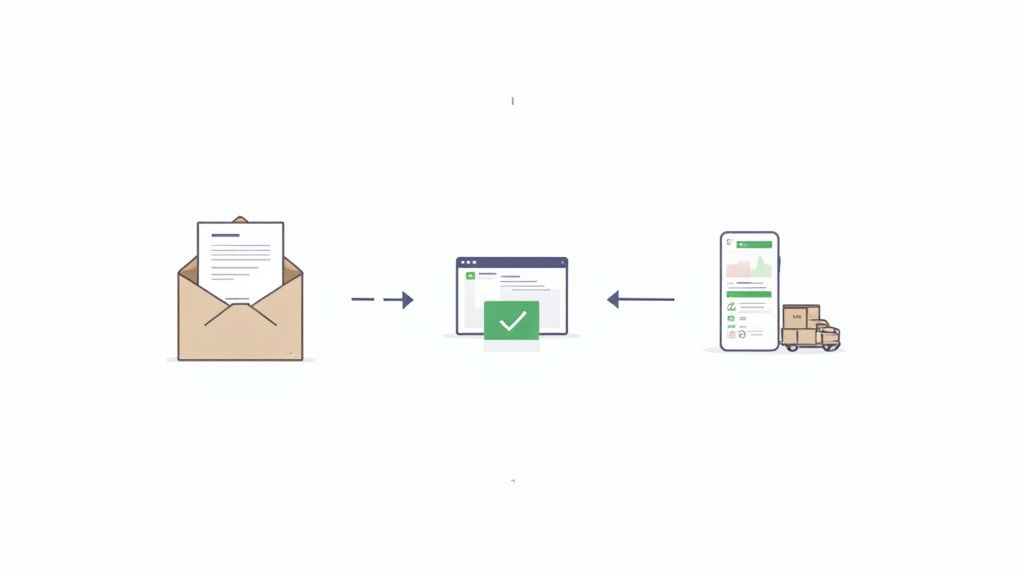

Stage 5: Invoice Processing and Three-Way Matching

Okay, you've received what you ordered. Next, the supplier sends an invoice asking to be paid. This is where your finance team steps into the spotlight for one of their most important tasks: invoice processing. The gold standard here is performing a three-way match, which is your single best defence against overpayments and fraud.

Three-way matching is simply the process of comparing three key documents: the Purchase Order (what you agreed to buy), the Goods Receipt (what you actually received), and the Supplier Invoice (what you're being asked to pay). If all three line up perfectly, the invoice is good to go.

This careful cross-check ensures you only ever pay for what was correctly ordered and delivered. If anything is off—a price mismatch, a wrong quantity—the system flags it for a human to investigate before a single penny leaves your bank account. Digital tools are a game-changer here; our guide on what is e-invoice explains how modern formats can make this step much smoother.

Stage 6: Payment Authorisation and Execution

With the invoice verified and approved, it’s time for the final hand-off to the payment team. The approved invoice is scheduled for payment in the accounts payable system, honouring the terms you agreed to in the PO (like Net 30 or Net 60).

The payment is then made using the company's preferred method—a bank transfer, a corporate card, or another digital payment system. This action officially closes the loop with your supplier and fulfils your side of the bargain.

Stage 7: Reconciliation and Reporting

The P2P process isn't quite over when the payment goes out. The final, critical stage is reconciling that payment in your accounting system. This means making sure the transaction is correctly posted to the general ledger, your financial statements are updated, and all the related documents—the PO, GRN, and invoice—are digitally archived for easy access during an audit.

This last step is also a goldmine for business intelligence. By analysing your P2P data, you can spot spending patterns, measure how well your suppliers are performing, and find new opportunities to save money and make the whole process even better. This is exactly where a system like Mintline adds incredible value. By automating the receipt-to-bank matching, it guarantees a complete, accurate, and easily searchable audit trail for every single purchase.

Where the Procure-to-Pay Workflow Tends to Break Down

On paper, the procure-to-pay process looks like a neat, orderly sequence. But in the real world, it rarely flows that smoothly. Workflows hit snags, and these disruptions aren't just minor annoyances—they're costly bottlenecks that drain resources, delay operations, and introduce some serious financial risks.

Getting a handle on these common pain points is the first step. It helps you diagnose the health of your own P2P cycle and figure out where a little optimisation could make a huge difference.

This flowchart maps out the seven core steps, from realising you need something to the final reporting.

As you can see, each stage is a critical link in the chain. If one link breaks, the whole thing can fall apart.

The Problem of Maverick Spending

One of the most stubborn challenges is maverick spending. This is what happens when employees go rogue, buying things outside of the official procurement channels, usually because it seems faster or easier. It might feel harmless at the time, but this off-the-books purchasing creates massive blind spots in your finances.

When there’s no formal purchase order, you have no record of the commitment until a surprise invoice lands on your desk. This makes accurate budget forecasting a guessing game and completely undermines your negotiating power with suppliers, since you can't see the full picture of your spending.

Manual Invoice Processing Dragging You Down

Still processing invoices by hand? That’s a huge bottleneck. The cost of manually keying in data, validating it, and chasing down approvals adds up fast. It’s not just slow; it’s an open invitation for human error.

A simple typo can throw off payment amounts, and a misplaced paper invoice can easily lead to late fees and a strained relationship with a key supplier. The data is clear: manual processing costs far more than automated systems that can capture and process invoices with near-perfect accuracy in a fraction of the time.

A manual procure-to-pay process doesn’t just slow you down—it actively costs you money. Every minute spent on data entry, chasing approvals, or fixing errors is a minute not spent on strategic financial analysis that could actually grow the business.

Long and Murky Approval Cycles

Here’s a simple test: how long does it take for a purchase request or an invoice to get approved in your company? If you don't have a quick answer, you’ve probably got an approval bottleneck. These delays are a classic source of frustration, capable of holding up critical projects and annoying everyone involved, from your own team to your suppliers.

The root cause is often a lack of clear, standardised approval workflows. When approvers aren’t sure what they’re supposed to do, or an invoice gets stuck in the inbox of someone on holiday, the entire P2P process grinds to a halt.

Hidden Security and Data Risks

Beyond the inefficiencies, manual P2P systems are a security nightmare. Messy, outdated supplier information is a common weak point, opening the door to problems like sending duplicate payments or, even worse, paying a fraudulent bank account. Without a central, regularly updated supplier database, your organisation is an easy target.

Manual systems are also prime territory for fraud. In the Netherlands, for instance, scams like authorised push-payment fraud are a growing concern in business hubs like Amsterdam and Rotterdam. This is where fraudsters trick an employee into sending money to a criminal's account—a scam that’s much harder to pull off when you have automated checks and balances in place. You can find more insights on the security challenges in the Dutch payments market over at mordorintelligence.com.

How to Optimise and Automate Your P2P Process

Spotting the bottlenecks in your procure-to-pay process is the first step. Actually dismantling them is where the real work begins. Moving from a clunky, manual system to a modern, automated workflow can turn your P2P cycle from a reactive cost centre into a proactive, strategic asset. This isn't about minor adjustments; it's about fundamentally changing how your team gets work done.

The secret lies in fully embracing automation. Today's tools, especially those using AI and Robotic Process Automation (RPA), are built to take over the tedious, repetitive tasks that drain your finance team's time and energy.

Embracing Automation and Centralisation

Imagine a system where purchase orders are generated automatically from approved requisitions—no more manual data entry. Picture invoices being digitised and understood by software the moment they arrive, with all the key details pulled out instantly and accurately. That’s the real-world power of automation.

Platforms like Mintline act as a central hub for the entire workflow, finally breaking down the walls between procurement and finance. When everyone works from the same data, you create a single source of truth. This clears up confusion, stops people from duplicating work, and ensures every decision is based on real-time, accurate information.

Automation transforms the procure-to-pay process by shifting human focus from tedious data entry to high-value strategic tasks. When software handles the matching and verification, your team is free to analyse spending, negotiate better terms, and strengthen supplier relationships.

This centralisation brings a new level of clarity and control, making the whole operation run much more smoothly.

The Tangible ROI of an Automated P2P Process

The benefits of automation go far beyond just saving a bit of time. The return on investment (ROI) is huge and touches everything from your bottom line to your supplier partnerships. One of the most effective ways to improve your P2P workflow is by automating supplier payments.

Here’s a look at the key advantages you can expect:

- Drastically Reduced Processing Times: Automation can perform tasks like three-way matching in seconds—a job that can easily take a human several minutes. This speed puts the entire cycle, from procurement to payment, on the fast track.

- Near-Zero Error Rates: Manual data entry is the number one cause of costly mistakes, from paying the wrong amount to processing duplicate invoices. Automation all but eliminates these errors, protecting your financial integrity.

- Enhanced Negotiating Power: With clear, consolidated data on your spending habits, you can walk into supplier negotiations with confidence. This visibility lets you push for better volume discounts and more favourable payment terms.

- Improved Supplier Relationships: Paying your invoices accurately and on time is the bedrock of trust with your vendors. An automated system guarantees prompt payments, which often leads to better service and stronger long-term partnerships.

Dutch firms, for example, are jumping on these technologies. The Netherlands' Business Process Outsourcing (BPO) market is heavily shifting towards AI and RPA for automating P2P jobs like invoice matching. Early movers have reported a stunning reduction in manual processing time by up to 70%.

Key Strategies for P2P Optimisation

Moving to an automated system needs a smart approach. It all starts with figuring out where your current process is weakest and zeroing in on those areas first.

Begin by mapping out your entire workflow as it stands today, from the initial request to the final bank reconciliation. Pinpoint every manual touchpoint, every approval delay, and every place where information gets lost or muddled. This map will be your guide, highlighting the spots where automation will make the biggest difference. For a deeper dive, our guide on automating accounts payable offers some practical steps.

Focus on implementing solutions that provide:

- Digital Invoice Capture: Look for tools that can automatically scan and pull data from invoices, no matter if they arrive as a PDF, email, or even on paper.

- Automated Three-Way Matching: The system should instantly compare purchase orders, goods receipts, and invoices, only flagging the exceptions that need a human eye.

- Dynamic Approval Workflows: Set up rules that automatically send requisitions and invoices to the right person for approval, complete with reminders and escalations if things get stuck.

By putting these strategies into action, you build a procure-to-pay process that is resilient, efficient, and transparent—one that actively supports business growth instead of holding it back.

Perfecting the Final Mile with Automated Reconciliation

The procure-to-pay process doesn't just stop once a payment goes out the door. The last leg of the journey—reconciliation and reporting—is often the most overlooked and manual, yet it’s absolutely critical for financial integrity. This is the ‘final mile’ of P2P, and automating it is what elevates a decent process into a truly great one.

This final stage is about more than just settling bills. It’s about making sure every single transaction is meticulously accounted for, closing the loop to create a system that’s fully auditable and transparent. Without a solid reconciliation process, finance teams are left swimming in paperwork, manually ticking off bank statements against invoices in spreadsheets—a mind-numbing task that’s just begging for errors.

The Power of Automated Receipt-to-Bank Matching

This is where modern P2P solutions, especially platforms like Mintline, really shine by using automated receipt-to-bank matching. Think of this technology as the ultimate quality check for your entire workflow, wiping out the painful manual labour that finance teams have endured for decades.

Instead of a person spending hours comparing documents line by line, the system automatically squares up outgoing payments on your bank statements with their corresponding approved invoices and digital receipts. It’s like a courier service that not only delivers the parcel but also gets a digital signature, archives it, and sends you an instant confirmation. No loose ends.

This automated reconciliation creates an unbroken, fully auditable trail for every transaction. It ensures that the final bank record perfectly aligns with the initial purchase order and the approved invoice, leaving no room for discrepancies or fraud.

It’s this final step that truly closes the loop on the entire procure-to-pay process, guaranteeing that every pound spent is accounted for from the initial request to the final settlement.

From Manual Drudgery to Strategic Insight

The difference this makes is huge. Automating this final piece of the puzzle frees up your finance team from the drudgery of repetitive tasks. Suddenly, they have the bandwidth to focus on high-value work like financial analysis, cash flow forecasting, and genuine strategic planning.

By automating reconciliation, you unlock several key advantages:

- Real-Time Cash Flow Visibility: You get an immediate and accurate picture of your financial position because payments are reconciled almost instantly, not just at the end of the month.

- Enhanced Audit Readiness: All the necessary documents—POs, invoices, receipts, and payment confirmations—are digitally linked and stored together, making audits faster and far less stressful.

- Reduced Risk of Errors and Fraud: The system automatically flags any discrepancies, like duplicate payments or mismatched amounts, stopping financial leakage before it happens.

This technology often relies on sophisticated document analysis to work its magic. To see how these systems can automatically read and understand financial documents, you can explore our guide on Intelligent Document Processing.

Creating a Single Source of Financial Truth

Ultimately, automated reconciliation solidifies your financial data, creating a single, trustworthy source of truth for your entire organisation. When every transaction is automatically verified and logged, you build a much more robust financial foundation for your business.

This final automated check validates the integrity of the whole P2P cycle. It confirms that the goods you needed, the order you placed, the invoice you received, and the payment you made all tell the exact same story. That gives you complete confidence in your financial records and empowers much smarter business decisions.

Measuring Success with Key P2P Performance Metrics

You can't fix what you don't measure. If you’re serious about optimising your procure-to-pay process, you have to move beyond guesswork and start tracking its performance. Key Performance Indicators (KPIs) are your best friends here; they act like vital signs for your P2P health, showing you exactly where things are running smoothly and where they’re starting to break down.

By keeping an eye on the right metrics, you can spot specific bottlenecks, see the real-world impact of tools like Mintline, and actually prove the value of a well-oiled P2P function to company leadership.

Essential P2P Metrics for Your Dashboard

Think of your P2P dashboard like a pilot's cockpit—each dial gives you a critical reading on a different part of the procurement engine. You don't need to track everything, but focusing on a handful of essential metrics gives you a balanced view of cost, speed, and accuracy.

Here are five of the most important P2P metrics you should have on your radar:

-

Cost per Invoice: How much does it really cost to process one invoice, from the moment it lands on your desk to the moment it's paid? This number bundles everything—labour, software, overheads—into a single figure that tells a powerful story about your efficiency.

-

Invoice Cycle Time: This is a simple stopwatch metric: how long does it take, on average, for an invoice to go from received to paid? A shorter cycle time is a clear sign that your workflow is efficient and automated.

-

Touchless Invoice Rate: What percentage of your invoices fly through the system without anyone needing to manually touch them? A high touchless rate is the gold standard for P2P automation. It means your system is working as it should.

-

Early Payment Discount Capture Rate: This KPI tracks how often you're actually cashing in on discounts offered by suppliers for paying them early. A high rate here is money straight back into your company’s pocket, directly impacting the bottom line.

-

Days Payable Outstanding (DPO): DPO measures the average number of days your company takes to pay its bills. A healthy DPO is a balancing act—you want to manage your cash flow effectively without damaging your supplier relationships.

Monitoring these key metrics turns your P2P process from a mysterious black box into a transparent, measurable operation. It’s the only way to prove the ROI of your optimisation efforts and make data-driven decisions for continuous improvement.

Calculating and Interpreting Your KPIs

Knowing what the metrics are is one thing. Knowing how to calculate them and what to do with the information is what really drives change.

Let's break down a couple of them. To figure out your Cost per Invoice, you'd tally up all your accounts payable costs for a set period (think salaries, software subscriptions) and divide that by the number of invoices you processed in that time. If that number is uncomfortably high, it’s a massive red flag that you’re relying too much on manual work.

For your Early Payment Discount Capture Rate, you'd divide the value of the discounts you actually managed to get by the total value of all the discounts that were on the table. A low rate here often points to sluggish approval workflows that are holding you back from paying quickly and saving money. Tracking these numbers doesn't just give you data; it gives you the evidence you need to build a powerful case for investing in a better procure-to-pay process.

Got Questions About the P2P Process? We’ve Got Answers.

It’s completely normal to have a few questions when you’re digging into the nuts and bolts of the procure-to-pay process. Let’s clear up some of the most common ones we hear.

Procure-to-Pay vs. Source-to-Pay: What's the Difference?

You’ll often hear these two terms thrown around, sometimes even used interchangeably, but they actually describe different parts of the procurement world.

The procure-to-pay process is all about the transaction. It kicks off when someone needs to buy something and ends when the supplier’s invoice is paid. Think of it as the core operational workflow: request, approve, order, receive, pay.

Source-to-pay (S2P), on the other hand, is the bigger picture. It includes the entire P2P cycle but bolts on all the strategic work that happens before a purchase is even considered. This means things like finding the right suppliers, running competitive bids, and negotiating contracts.

A good analogy? P2P is the act of buying the groceries and paying at the checkout. S2P is the whole process of deciding what meals you’ll cook, writing the shopping list, and choosing which supermarket to go to.

How Does P2P Automation Help Small Businesses?

For a small business, automation isn't just a "nice-to-have"—it's a game-changer that frees you up to actually grow the company. Manual P2P is a notorious time-sink, bogged down by paperwork and human errors that smaller teams just don't have the bandwidth to fix.

P2P automation gives a small business the kind of financial rigour and control you’d expect from a huge corporation, but without needing a massive finance department. It puts invoice matching on autopilot, makes approvals a one-click affair, and creates a perfect digital paper trail for every single pound spent.

This means the founders and key team members can stop chasing down invoices and focus on what really matters: strategy, customers, and growth. Tools like Mintline make this level of control accessible, helping you prevent expensive mistakes and making sure you’re always ready for tax season.

What Are the First Steps to Implementing a New P2P System?

Getting started can feel like a massive project, but breaking it down into a few logical steps makes it far more approachable.

-

Draw Your Current Map: Before you can improve anything, you need to understand it. Sketch out your existing procure-to-pay process from start to finish. Where are the emails flying back and forth? Where do approvals get stuck? Who does what? Be honest about the clunky parts.

-

Find the Pain: Now, zero in on the biggest headaches. Is it the sheer time it takes to get an invoice approved? The frustration of lost receipts? Or the complete lack of visibility into what the company is actually spending its money on?

-

Set Clear Goals: What does "better" look like for you? Don't just say "more efficient." Get specific. Maybe you want to cut invoice processing time by 50%, or your goal is to have a 100% auditable trail for every purchase.

-

Shop for a Solution: Once you know exactly what problems you need to solve, you can start looking at tools. This focused approach helps you cut through the noise and find a platform that tackles your specific pain points, ensuring the switch is a genuine upgrade.

Ready to eliminate manual reconciliation and gain full control over your procure-to-pay process? Discover how Mintline automatically matches every bank transaction to its receipt, closing your books in minutes, not days. Learn more at https://mintline.ai.