Pro Forma Invoice Meaning Explained

Unlock the pro forma invoice meaning and learn when to use it for your business. A clear guide to Dutch invoicing, quotes, and financial documents.

Think of a pro forma invoice as a 'dress rehearsal' for a real sale. It's a preliminary bill sent to a buyer before any goods are shipped or services are delivered. It lays out what you're selling, the exact price, and all the terms, making sure everything is crystal clear before money legally changes hands.

What a Pro Forma Invoice Really Means for Your Business

Let's break down what this actually looks like in practice. A pro forma invoice is essentially a detailed preview that firms up the commitment between you and your buyer. Unlike a final, legally binding invoice, it’s a non-binding agreement that provides clarity for both sides without creating an official entry in your books. It's a gesture of good faith, setting clear expectations from the get-go.

For businesses, this distinction is absolutely key for staying compliant. Using a pro forma allows you to lock in the terms of a sale—and even secure a deposit—without triggering any immediate tax obligations. That’s because tax authorities don't consider it a "tax point"; only the final, official invoice carries that weight.

Setting Expectations and Keeping Your Books Clean

The main job of this preliminary document is to head off any misunderstandings down the road. It makes sure everyone is on the same page about the crucial details before the transaction moves forward.

These details usually include:

- A complete description of the goods or services.

- The agreed-upon prices, including any discounts.

- Shipping details and estimated delivery dates.

- The payment terms and conditions.

By issuing a pro forma document, you create a transparent and professional sales process. It gives your client a clear document for their internal approvals while protecting you from scope creep or last-minute changes.

This clear separation between pre-agreements and final invoices is fundamental to clean bookkeeping. It’s exactly why modern tools like Mintline are built the way they are. Mintline focuses on matching final, paid invoices to bank transactions, intentionally keeping non-financial documents like pro formas out of your official audit trail. This ensures your financial records remain accurate and compliant, reflecting only completed transactions and preventing preliminary agreements from muddying your accounts receivable.

Pro Forma vs Quote vs Final Invoice: Getting it Right

It’s easy to get tangled up in business jargon, and a common trip-up is confusing quotes, pro forma invoices, and final invoices. They might look similar, but each plays a very different role in the sales journey. Mixing them up can throw your financial reporting off track and even lead to compliance headaches.

So, let's clear up the confusion.

Think of a price quote as the first handshake in a potential deal. It’s an informal estimate you send to a prospective client to kick things off. It's a "here's what this might cost" document, and the details are usually open for discussion. It's not set in stone; it's a conversation starter.

Once your client gives you the nod, you’ll likely send a pro forma invoice. This is a much firmer document. It's a good-faith agreement that lays out all the confirmed details of the sale—the exact items, quantities, prices, and shipping terms—before you deliver anything. It effectively says, "Here's what the final bill will look like."

Finally, after you've delivered the goods or completed the service, you issue the final tax invoice. This is the one that really counts. It's the official, legally binding request for payment. This is the document that gets logged in your accounting system, creates an entry in your accounts receivable, and is subject to tax rules.

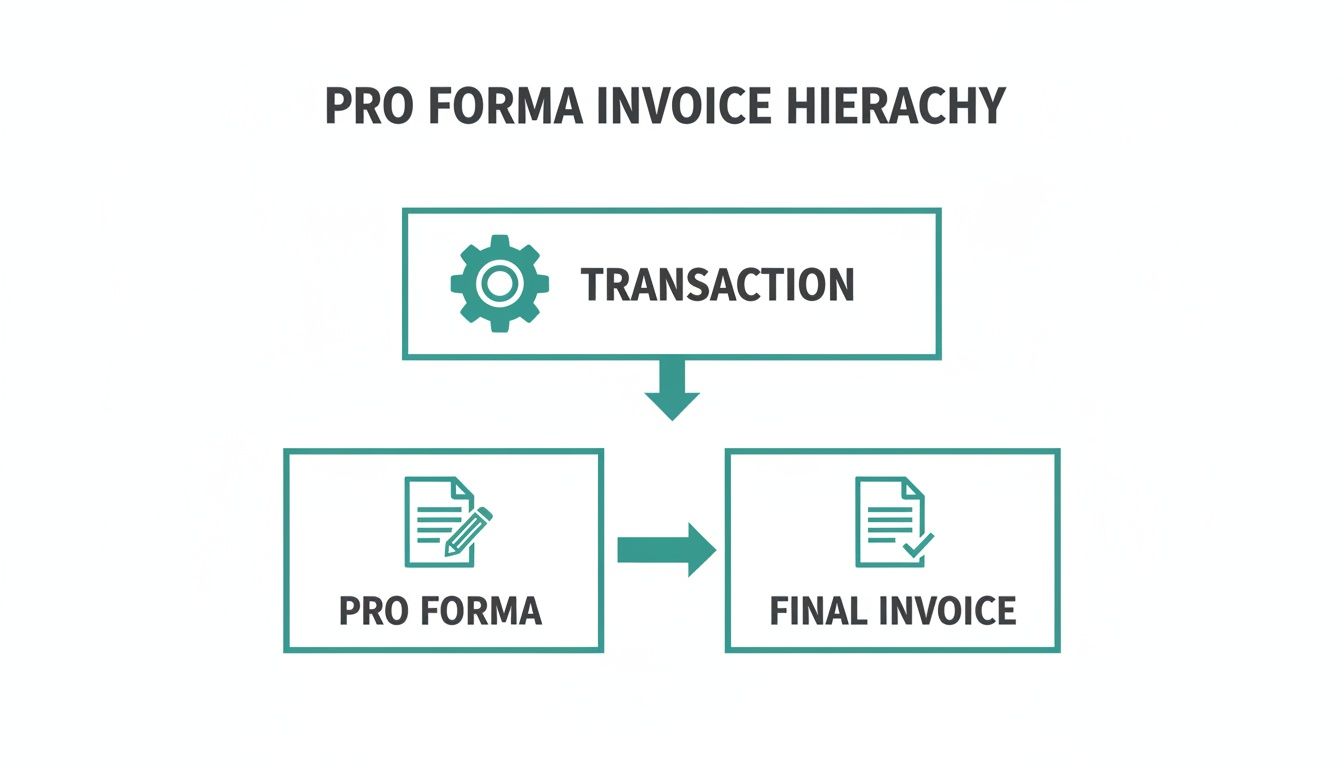

The Transaction Flow Visualised

To make this flow even clearer, here’s a simple diagram showing how a deal moves from a casual chat to a legally recognised sale.

As you can see, the pro forma invoice acts as that crucial middle step, locking in the details before the transaction becomes official.

Comparing Key Business Documents

To break it down even further, here's a side-by-side comparison that highlights the fundamental differences in purpose, legal standing, and accounting treatment for each document.

| Document Type | Main Purpose | Binding Status | VAT & Accounting Impact |

|---|---|---|---|

| Price Quote | To provide an initial, negotiable cost estimate. | Non-binding | None. Not recorded in your accounts. |

| Pro Forma Invoice | To confirm agreed-upon terms before delivery. | A non-binding agreement of intent. | None. Not a tax document; not recorded. |

| Final Invoice | To legally request payment for goods/services. | Legally binding | Creates accounts receivable and triggers VAT. |

At the end of the day, understanding which document to use and when is vital for accurate bookkeeping.

A simple way to remember the difference is this: a quote suggests a price, a pro forma confirms the price, and a final invoice demands the price. Each has a specific, non-overlapping role.

This distinction is precisely why automated systems like Mintline are so valuable. The platform is designed to focus only on the final, fiscally relevant invoices—the ones that need to be matched to bank payments. By design, it ignores quotes and pro formas, which prevents them from accidentally cluttering your official books. This keeps your financial records perfectly clean and compliant without you having to think about it.

When to Use a Pro Forma Invoice

So, when does it actually make sense to send a pro forma invoice? Think of it less as a theoretical document and more as a practical tool that sits right between a casual quote and the final, binding invoice. It’s all about adding clarity and professionalism to your sales cycle.

For a lot of businesses, particularly freelancers and creative agencies, the most common reason is to lock in a deposit. When you're about to kick off a project with a new client, a pro forma formalises their commitment. It gives them an official document they can use to process an advance payment, protecting your time and cash flow before you dive into the work.

Clearing Customs and Internal Hurdles

Pro forma invoices are also a lifesaver in international trade. Customs officials often need to see a declaration of value before goods are even shipped. A pro forma provides all the necessary details for a smooth clearance process, without creating a final, legally binding sale on your books just yet.

On the buyer’s side, this document often plays a crucial role in their internal processes. Big companies can't just pay based on a conversation; they need a formal document to get the green light from their finance department.

A pro forma invoice gives the buyer exactly what they need for internal sign-off—a clear, itemised breakdown of costs and terms. Crucially, it doesn't create a payable in their accounting system until the deal is actually confirmed.

This makes it a key step in any well-structured procure-to-pay process, keeping both buyer and seller perfectly in sync. If you want to dive deeper into streamlining that entire workflow, check out our guide on the procure-to-pay process.

In short, a pro forma is your go-to document in a few key situations:

- To request a deposit: It solidifies the client's commitment before any work begins.

- For customs declarations: It declares the value of goods for international shipments ahead of time.

- To help buyers get approval: It provides a professional document for your client's internal finance or purchasing procedures.

Using a pro forma in these moments helps eliminate misunderstandings, makes your client interactions more professional, and ensures everyone has a clear record of the agreement before the final bill is sent.

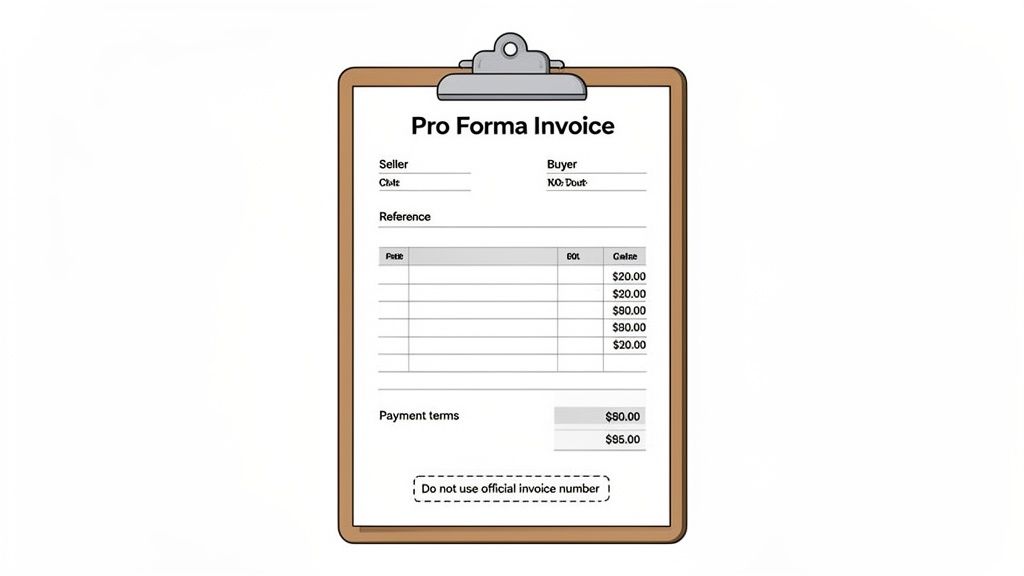

What Goes Into a Professional Pro Forma Invoice?

Even though it’s not an official tax document, a professional-looking pro forma invoice is a powerful tool for building client trust. Think of it as the blueprint for the final sale. Its structure should be clear, detailed, and almost identical to the final commercial invoice you’ll send later. Getting this consistency right from the start prevents confusion and helps speed everything up.

Nailing the details gives your client everything they need for internal approvals and paves the way for a smooth transaction. When you put together your pro forma, it needs to look like a serious, well-considered business document.

Your Essential Checklist

To do its job properly, every pro forma invoice needs a few specific, non-negotiable elements. Use this as your quick checklist to make sure you don't miss a thing and that your client understands exactly what they’re looking at.

Here’s a breakdown of what to include:

- A Clear Title: The document must be clearly labelled "Pro Forma Invoice" right at the top. This is the single most important detail to distinguish it from a final, legally binding invoice.

- Seller and Buyer Details: Make sure you have the full name, address, and contact information for both your business and your client. No shortcuts here.

- Unique Reference Number: Give it a distinct reference number, like PF-001, for easy tracking. This helps you connect it to the original quote and, eventually, the final invoice.

- Detailed Descriptions: List every single product or service with precise descriptions. Include quantities, the price per unit, and the total amount for each line item.

- Payment Terms: Clearly state the expected payment terms. This could be something like "Payment due upon receipt of final invoice" or details about a required deposit.

The most critical detail to leave out is a sequential invoice number from your official accounting system. Using one of your real invoice numbers would accidentally turn the pro forma into a legal document and create a real mess in your books.

This careful separation is absolutely vital. It ensures that automated bookkeeping tools, such as Mintline, can correctly identify and ignore these preliminary documents. This prevents them from being mistakenly logged as accounts receivable, keeping your financial records perfectly clean and accurate.

Navigating Tax and Bookkeeping Rules

When using pro forma invoices, the most important thing to remember is this: a pro forma has no legal standing for tax purposes. It’s a commercial document, not an official one, which means it exists completely outside of your formal bookkeeping and has zero impact on your tax obligations.

You absolutely cannot use a pro forma to declare output tax to the authorities. Likewise, your client can't use it to reclaim input tax. That role is reserved exclusively for the final, legally compliant tax invoice with its unique sequential number. This isn't just a minor detail; it's a core principle of financial law. For more on this, you can find helpful guidance for entrepreneurs over at efaktura.nl.

Avoiding Common Bookkeeping Pitfalls

One of the biggest mistakes a business can make is to log a pro forma invoice as an account receivable. If you do this, you’re instantly inflating your financial reports with income you haven't technically earned and isn't legally owed yet. This can throw off your business planning and create serious compliance headaches. Getting this right starts with a solid understanding of a proper double-entry bookkeeping system.

The core principle is to treat pro forma invoices as non-financial supporting documents. They are part of the sales conversation, not the official accounting record. The real financial event only occurs when the final invoice is issued.

This is precisely why we designed Mintline the way we did. Our platform is built to focus only on matching final, legally recognised invoices to their corresponding bank payments. By design, Mintline ignores preliminary documents like quotes and pro formas. This approach safeguards the integrity of your books and ensures your audit trail is clean and accurate from the very beginning. Managing these details effectively is just one piece of the puzzle; exploring options like outsourcing finance and accounting can also help streamline your overall financial operations.

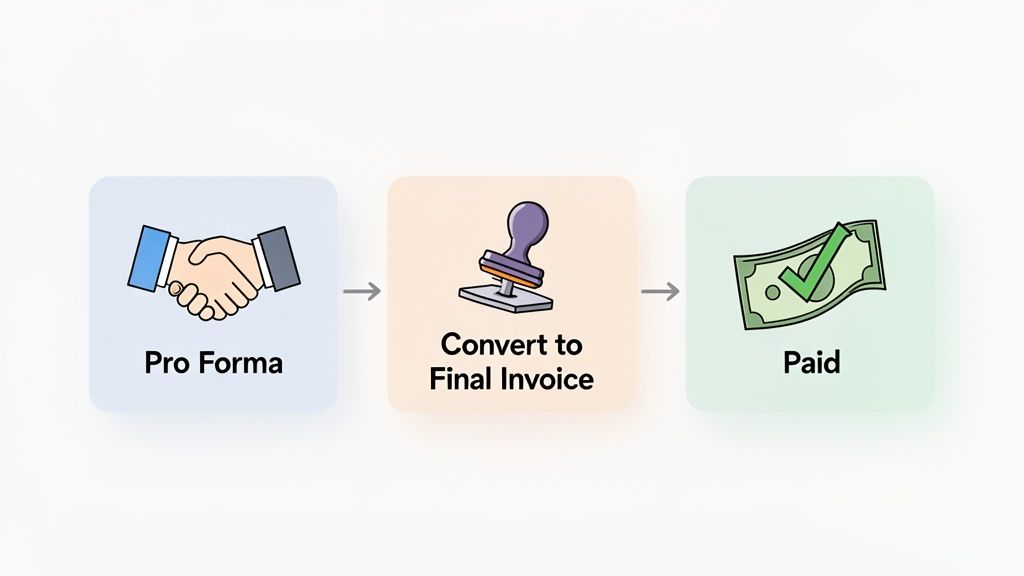

From Pro Forma to Paid: A Smooth Workflow

Getting from the initial handshake to the final payment can feel chaotic if you don't have a clear system in place. A good, professional workflow makes all the difference, creating clarity for both you and your client while setting up your bookkeeping for success. It’s all about turning that preliminary agreement into a neatly closed and reconciled transaction.

Here's how that simple and effective flow works in practice:

- Create and Send: You start by issuing a detailed pro forma invoice. This document locks in the scope, price, and terms, acting as a solid agreement before any actual work or delivery begins.

- Get the Green Light: Once the client agrees to the terms, or perhaps pays a deposit based on the pro forma, you’ve got a confirmed order.

- Convert to the Final Invoice: Now, you generate the official, legally compliant tax invoice. It must have a unique, sequential invoice number from your accounting system, as this is the formal request for payment.

Tying the Workflow to Automation

This is where things get really efficient. Once you send out that final invoice, modern tools can take over the heavy lifting. Platforms like Mintline can automatically match an incoming bank payment directly to that final invoice, instantly reconciling your accounts. This simple step wipes out hours of tedious admin work, ensuring every transaction is tracked, accounted for, and ready for an audit.

For a deeper dive into making your entire financial operation smoother, from start to finish, it's worth exploring the different strategies for automating invoice processing.

Juggling PDFs, e-invoices, and even paper formats for quotes and final invoices creates a huge reconciliation headache. While regulations may require e-invoicing for certain contracts, that mandate often only covers final invoices, leaving pro formas out of the loop.

A clean pro forma process linked to an automated back-end creates a truly seamless system. It’s a workflow that removes friction and guarantees your financial records are always spot on.

This kind of smart integration is exactly what automated invoicing software is designed to do. It transforms what was once a multi-step administrative chore into a simple, error-free operation.

Common Questions About Pro Forma Invoices

Let's clear up a few common questions that entrepreneurs often have when they start using pro forma invoices.

Is a Pro Forma Invoice Legally Binding?

Not at all. Think of a pro forma invoice as a professional handshake on paper, not a binding contract. It’s simply a good-faith agreement outlining the specifics of a potential sale before everything is locked in.

This means a buyer has no legal obligation to pay you just because you've sent them a pro forma. Payment only becomes due once they accept the terms and you issue a final, official commercial invoice.

Can I Record a Pro Forma Invoice in My Books?

You shouldn't. A pro forma invoice doesn't belong in your official accounting records as an account receivable. Since it's not a final tax document, adding it would throw off your financial reports and give a misleading picture of your income.

It’s best to track them separately as part of your sales pipeline. This is exactly why smart bookkeeping tools like Mintline are designed to recognise and ignore pro forma documents during automated matching processes, preventing them from cluttering your books.

Once the customer pays based on the pro forma, you absolutely must issue a final, official tax invoice. This new invoice needs its own sequential number and is the only legal document that matters for your tax records and your client's bookkeeping.

Ready to stop manually matching receipts and close your books in minutes? Mintline automates the entire process, so you can focus on what matters. Discover how Mintline can transform your bookkeeping.