A Guide to Pro Forma Invoices for Dutch Businesses

Master pro forma invoices with our guide for Dutch businesses. Learn their purpose, legal status, and how to create and manage them effectively.

Think of a pro forma invoice as a 'dress rehearsal' for the real thing. It's a detailed preview of a transaction, sent before any money is due. This isn't a demand for payment; it's a good-faith document that lays out all the agreed-upon details, making sure both you and your client are on the same page before you deliver the goods or services.

What Pro Forma Invoices Really Mean for Your Business

Let's say you're a freelance designer in Amsterdam finishing a big project. Before sending the final, legally binding invoice, you want to triple-check that every detail is correct—the scope, deliverables, hours, and total cost. This is the perfect moment to send a pro forma invoice. It’s essentially a preliminary bill of sale that gives a complete, itemised breakdown of the deal before it's set in stone.

It’s easy to confuse this with a simple quotation, but a pro forma goes a step further. While a quote might just give a single price, a pro forma invoice looks and feels just like the final bill, detailing everything that will appear on it later. This level of transparency is brilliant for preventing sticker shock or misunderstandings, helping you build trust right from the get-go.

For startups and small businesses across the Netherlands, this document is far more than a formality. It’s a vital part of a smooth and organised financial workflow. Once a client accepts the pro forma, you have their commitment in writing, giving you the confidence to move forward with the project.

The Purpose of a Pro Forma Invoice

So, why not just jump straight to the final invoice? The difference comes down to timing, purpose, and legal weight. A pro forma is sent before you ship the goods or complete the service. Crucially, it’s not a legally binding demand for payment and you don't record it in your accounts receivable.

This pre-emptive nature makes it incredibly useful. Here’s where it really shines for Dutch businesses:

- Confirming the Deal: It locks in the agreement on price, quantity, and terms before the transaction is official, nipping potential disputes in the bud.

- Securing Finance: A buyer can show a pro forma invoice to a bank to apply for a loan or letter of credit, as it provides a clear picture of the upcoming purchase.

- Smoothing Customs: For international trade, customs officials often need a pro forma to declare the value of goods for clearance, duties, and taxes.

- Internal Approvals: Larger companies often use them to get internal sign-off on a purchase before they can officially commit the funds.

A pro forma invoice is basically a written commitment from you, the seller, to provide specific goods or services at the agreed-upon price. It turns a verbal agreement into a clear, itemised document that guides the entire transaction.

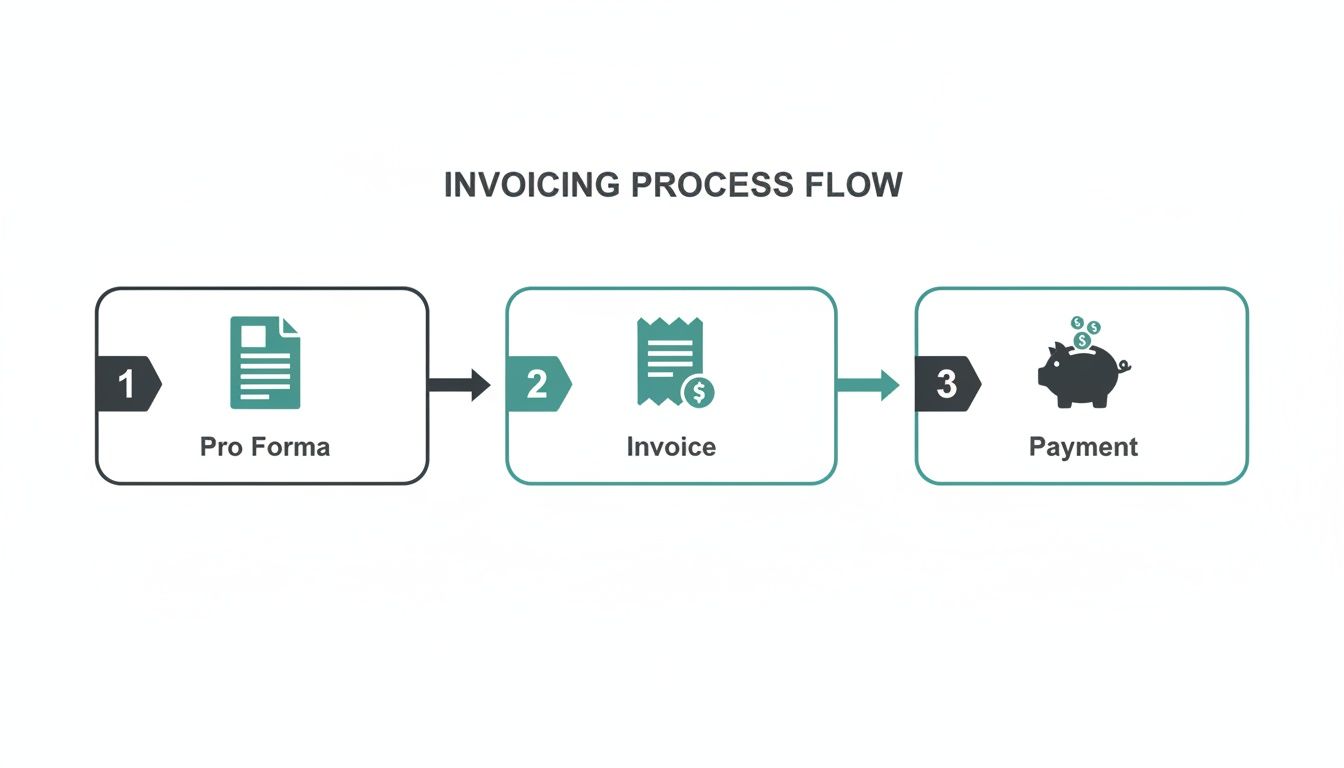

From Agreement to Final Bill

Getting this first step right is key to building a solid financial process. The whole journey begins with this document of intent. Once your client gives the pro forma the green light, the transaction can proceed. Only after you've delivered the work do you convert it into a final, commercial invoice—the official, legally binding document that formally requests payment.

This workflow, from a preliminary agreement to a final bill, paves the way for efficient financial tracking and predictable cash flow. It’s the first piece of the puzzle that, when managed well, leads to clean bookkeeping. Tools like Mintline take this a step further by automating the final, crucial step: matching the bank payment back to the final invoice, neatly closing the loop on the entire transaction.

Pro Forma Invoice vs Final Invoice at a Glance

To make the distinction crystal clear, it helps to see the two documents side-by-side. While they might look similar, their roles in the business process are completely different.

| Feature | Pro Forma Invoice | Final Invoice |

|---|---|---|

| Timing | Issued before delivery of goods/services. | Issued after delivery of goods/services. |

| Purpose | To declare commitment and details of a future transaction. | To officially demand payment for a completed transaction. |

| Legal Standing | Not legally binding. It's a good-faith agreement. | Legally binding. Creates a payment obligation for the buyer. |

| Accounting Impact | Not recorded in accounts receivable or payable. | Recorded as accounts receivable (seller) and payable (buyer). |

| Invoice Number | Does not have a unique, sequential invoice number. | Has a unique, sequential invoice number for legal records. |

| Payment | Payment is not due upon receipt. | Payment is due according to the specified terms (e.g., Net 30). |

As you can see, one is a confirmation, and the other is a call to action. Understanding when to use each is fundamental for professional and clear communication with your clients.

Legal Status of Pro Formas in the Netherlands

When you’re doing business in the Netherlands, it’s crucial to get one thing straight: a pro forma invoice isn’t a real invoice. It’s not a legally binding request for payment. Think of it more as a handshake on paper—a formal quote or a preliminary agreement. It lays out the terms of a deal before it happens, but it doesn't legally oblige the buyer to pay up.

Under Dutch law, an official tax invoice has to meet a strict set of criteria. These rules are in place to keep everything clear for tax purposes, and a pro forma simply doesn't tick those boxes. It exists in a completely different category.

For starters, a final invoice needs a unique, sequential number, which is the backbone of proper bookkeeping. Pro formas don't have this. They also don't make a formal demand for payment, so you shouldn't be adding them to your accounts receivable.

Why Pro Formas Are Not Tax Documents

Here’s where it gets really important, especially concerning Value Added Tax (VAT), or Belasting over de Toegevoegde Waarde (BTW) as it's known here. Since a pro forma isn’t an official invoice, VAT is not officially charged or paid based on it. The moment you become liable for VAT is when you issue the final tax invoice, typically after you've delivered the goods or services.

This is a fundamental point for anyone managing finances. If you try to record a pro forma in your accounting system or pay VAT based on it, you’ll end up with incorrect financial reports and could run into problems with the Dutch Tax and Customs Administration (Belastingdienst).

The golden rule is simple: a pro forma is for planning, not accounting. It’s a tool to forecast and confirm details, making sure everyone's on the same page before any money changes hands or a taxable event is created.

Key Elements for a Legally Compliant Final Invoice

So, what does it take to turn that preliminary document into something legally solid in the Netherlands? The final invoice must include specific details that a pro forma usually leaves out.

- Sequential Invoice Number: A unique number that’s part of an unbroken sequence.

- KvK Number: Your Chamber of Commerce (Kamer van Koophandel) registration number.

- VAT Identification Number: Your BTW-identificatienummer.

- Clear VAT Breakdown: The exact VAT rates applied and the total amount due.

- Date of Supply: The date the goods or services were actually provided.

Because pro formas don't have these official components, they’re a low-risk, standard part of doing business. They give you a professional way to outline a potential deal without creating a legal or financial obligation too early. Understanding what a pro forma invoice means is key to using it correctly.

Pro Formas in International Trade

While not a legal requirement in the Netherlands, pro forma invoices are incredibly useful in international trade, especially for freelancers and small businesses. They act as a preliminary document to smooth things over with customs or help secure financing from a bank before a deal is finalised.

For example, they're often used to project values for compliance. Businesses with over €1,200,000 in annual intra-Community supplies have to file monthly statistical statements, and the data from pro formas can help get those projections right. You can find out more in this detailed overview from Statistics Netherlands.

How to Create a Perfect Pro Forma Invoice

Putting together a pro forma invoice isn’t really about complex accounting; it’s about clear communication. Think of it as a detailed blueprint for a future sale. A well-crafted pro forma ensures both you and your client are on the same page about every last detail of the agreement. Nailing this document from the get-go heads off confusion, builds trust, and helps speed up your entire sales cycle.

Even though it’s not a legally binding demand for payment, a pro forma invoice should still look sharp and professional. It needs to contain all the information necessary to seal the deal. The real goal here is to create a document so clear and complete that turning it into a final tax invoice later on is a simple, one-click affair.

Essential Components of a Pro Forma Invoice

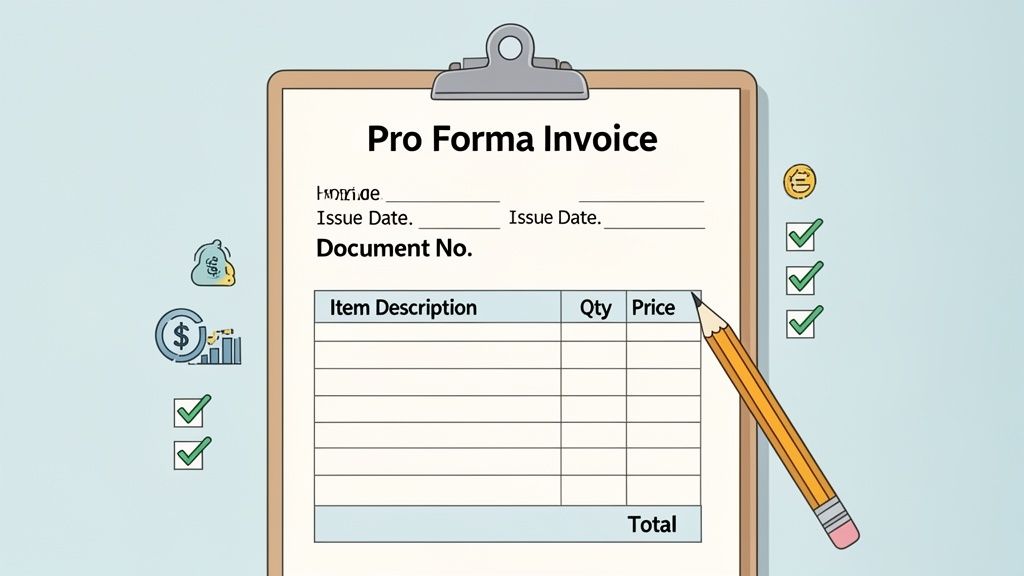

To be effective, every pro forma you send needs to have a few key elements. This is your essential checklist for clarity and professionalism. If you miss these, the document might create more questions than it answers, which completely defeats the purpose.

Here’s what you absolutely must include:

- A Clear Heading: The document must be clearly labelled “Pro Forma Invoice” right at the top. This immediately sets it apart from a final, legally binding invoice and manages expectations right away.

- Your Company Details: Include your full company name, address, contact information, and your KvK (Chamber of Commerce) number.

- Client Details: Add your client’s full name and address. Getting this right is crucial for a smooth transition to the final invoice later.

- Issue Date: This is the date you send the pro forma. It helps everyone keep track of the agreement’s timeline.

- Unique Document Number: While it’s not a sequential invoice number, give it a unique reference like PF-001. This makes it easy to find and discuss.

- Description of Goods/Services: Provide a detailed, itemised list of what you’re supplying. Be specific about everything—project milestones, quantities, and scope.

- Pricing Breakdown: Clearly list the price per unit, the quantity, and the subtotal for each line item. No room for guesswork.

- Total Amount: State the total estimated cost. It’s a good idea to note if this amount excludes BTW (VAT), as the final tax invoice will be the official document for tax purposes.

This image shows a standard example of what a pro forma invoice looks like, highlighting the typical fields and structure.

See how the layout looks just like a regular invoice? The key difference is that it’s clearly marked "Pro Forma Invoice" to avoid any legal or accounting mix-ups.

Tailoring Your Pro Forma for Specific Needs

While the core components stay the same, you can—and should—add specific details depending on your business and the deal itself. This extra layer of detail is especially helpful for freelancers and businesses involved in international trade.

Tips for Freelancers and Service Providers

If you're a freelancer in the Netherlands, your pro forma is the perfect place to outline project phases and payment milestones.

For instance, a web developer could break down a project into 'Phase 1: Design Mockups', 'Phase 2: Development', and 'Phase 3: Launch', attaching a specific cost to each. This gives the client a clear roadmap and justifies the total cost before any work even begins.

Tips for International Transactions

For startups and small businesses dealing with clients across borders, crystal-clear communication is vital to avoid expensive delays.

- Specify the Currency: Always state the currency (e.g., EUR, USD) to prevent any payment mix-ups caused by fluctuating exchange rates.

- Include Incoterms: If you're shipping goods, add the relevant Incoterms (International Commercial Terms) like FOB (Free On Board) or EXW (Ex Works). These globally recognised terms define who is responsible for what during the delivery process.

- Add an Expiry Date: Mention how long the quote is good for (e.g., “Valid for 30 days”). This protects you if the costs of your materials or services suddenly change.

By including these tailored details, your pro forma invoices become much more than just a price quote. They become powerful tools for managing client expectations and protecting your business interests.

Using Pro Formas for International Trade

When Dutch businesses look beyond their borders, the pro forma invoice stops being just a handy document and becomes an absolutely critical piece of the puzzle. In fact, you could say international commerce is its natural habitat. It acts as a universal language between exporters, importers, and customs agents, preventing the whole process from grinding to a halt at the border.

Picture this: a Dutch startup sends its first big shipment to a non-EU country. The container arrives, but customs officials have no clue what's inside or what it's worth. This is exactly the kind of costly delay and confusion a pro forma invoice is designed to prevent.

Navigating Customs with Clarity

The single most important job of a pro forma invoice in global trade is to smooth the way for customs declarations. Long before a final, commercial invoice is ever issued, customs authorities need a reliable valuation of the goods to work out duties, taxes, and import fees. The pro forma delivers just that—a detailed breakdown of the items, their quantities, and their value.

Think of it as a declaration of intent. It gives officials all the information they need to process the shipment without a fuss. It’s a trusted preview that helps clear the goods efficiently, well before any money has changed hands.

Here’s how a pro forma invoice keeps things moving:

- Valuation for Duties: It allows customs to calculate the necessary import taxes and tariffs ahead of schedule.

- Preventing Delays: By providing a clear record of the shipment’s contents and value, it dramatically reduces the chance of your goods getting stuck in inspection.

- Securing Import Licences: In many countries, the importer needs to show a pro forma invoice to their government just to get permission to bring the goods in.

For an exporter, the pro forma invoice is the key that unlocks international borders. It’s a document of good faith that satisfies regulatory requirements and keeps your supply chain moving without friction.

A Practical Scenario for a Dutch Startup

Let's bring this to life. Imagine "EcoBike," a small Amsterdam-based company building sustainable electric bicycles. They’ve just landed their first order from a retailer in Canada.

Before a single bike is assembled, EcoBike’s finance team issues a pro forma invoice. This document lays out the deal: 20 e-bikes at €1,500 each, specifies the shipping terms (Incoterms), and confirms the currency is EUR.

The Canadian retailer then uses this pro forma for two crucial tasks. First, they take it to their bank to arrange a letter of credit, which guarantees payment once the shipment is confirmed. Second, they submit it to Canadian customs to pre-declare the shipment, giving officials a heads-up and allowing them to calculate duties in advance.

This simple document ensures there are no nasty surprises at the border. When the bikes finally ship, the final commercial invoice will perfectly match the pro forma, making the entire transaction seamless and predictable from start to finish. To make sure your own pro formas are correctly structured for situations like this, checking out various samples of proforma invoice is a great way to get started.

How Pro Formas Improve Cash Flow Management

A pro forma invoice isn't just a preliminary bill; it's a powerful tool for shaping your business's financial future. For small and medium-sized businesses (SMBs) in the Netherlands, where steady cash flow is the difference between surviving and thriving, this document can be a game-changer. It takes a potential sale and turns it into a concrete financial projection you can actually work with.

When a client accepts your pro forma, it becomes far more than a simple quote. It's a documented commitment, giving you a solid forecast of incoming revenue. This isn't just useful for your own internal planning—it’s also a powerful signal to banks and investors. They can see you have a predictable pipeline of income, which makes assessing risk and securing capital much easier.

Unlocking Early Financing with Factoring

Let's face it, waiting 30, 60, or even 90 days for an invoice to be paid can put a real squeeze on your operations. This is where a practice called invoice factoring comes into play, and pro forma invoices are the first step. Factoring essentially lets you sell your outstanding invoices to a specialised company (the "factor") for a small discount, giving you the cash almost immediately.

A pro forma invoice perfectly sets the stage for this. When you show a factoring company an accepted pro forma, you're proving that a deal is locked in and a final invoice is on its way. This often allows them to pre-approve the cash advance, so you get the funds you need without the long wait.

A pro forma invoice acts as a financial forecast you can take to the bank. It transforms a future promise of payment into a present-day asset, giving you the liquidity needed to invest in growth, cover operational costs, or manage unexpected expenses.

This strategy has become incredibly popular, especially in the current economic climate. Factoring, which hinges on the projections established in pro forma invoices, saw massive growth in the Netherlands as businesses looked for quick access to capital. Wholesale trade firms were at the forefront, accounting for over 50% of the €90 billion factoring market in 2023. They use pro formas to set the 'as if' billed amount, which allows factors to advance 80-90% of the invoice's value right away. You can explore more data on this trend on Statista.com.

Creating a Clear Path from Projection to Payment

Beyond just securing financing, the clarity a pro forma brings is a huge benefit on its own. It officially kicks off a transaction that you can track right from the very beginning. This is where tools like Mintline really shine, creating a smooth journey from the initial projection all the way to the final payment clearing your account.

This organised process means every step is neatly documented. Once the pro forma is approved and you've delivered the goods or services, it's converted into a final invoice. Later, when the payment lands in your bank, Mintline can automatically match that transaction to the correct invoice, closing the loop. No more manual reconciliation, just a clean, audit-ready trail. You can learn more about how to manage your accounts payable and receivable in our detailed guide.

This kind of organisation delivers two major wins:

- Reduced Administrative Burden: It frees you from messy spreadsheets and the tedious task of manually matching payments to invoices.

- Improved Financial Oversight: You get a real-time, accurate picture of your company's financial health, making it much simpler to forecast cash flow and make smarter business decisions.

Automating Your Workflow from Pro Forma to Payment

Handling pro forma invoices manually is a real headache, especially when your business starts to grow. You're probably juggling spreadsheets, digging through email chains for approvals, and then painstakingly copying details to create the final invoice. It's not just slow; it's a recipe for mistakes, messy records, and delayed payments that can seriously stunt your company's momentum.

The biggest drain isn't just the tedious work itself. It's the hours it steals from your finance team—time that should be spent on strategy, not bogged down in admin. Thankfully, modern automation can turn this chaotic process into a smooth, hands-off workflow.

The Ideal Automated Workflow

Picture a system where your invoicing just flows. No more manual nudging at every step. This is where Mintline transforms your financial operations. Instead of just managing documents, you can automate the entire journey from pro forma to payment reconciliation, freeing up valuable time and ensuring perfect accuracy.

Here’s what that seamless process looks like:

- Issue the Pro Forma: First, you send a professional pro forma invoice to your client to get the ball rolling and confirm the details.

- Convert to Final Invoice: Once they give you the green light, one click is all it takes. The system instantly converts the pro forma into a legally binding tax invoice and assigns the next sequential invoice number automatically.

- Receive Payment: The client pays, and the money lands in your bank account.

- Automatic Reconciliation: Here's the magic. Mintline’s smart platform sees that payment come in and instantly matches it to the right final invoice. The loop is closed, no manual data entry required.

This end-to-end automation does more than just save time. It eliminates the tedious task of manual reconciliation, slashes the risk of human error, and gives you a clear, audit-ready view of your finances at any given moment.

Staying Compliant in a Digital World

Automation is also crucial for keeping up with new rules. Take the push for e-invoicing in the Netherlands. It shows how pro forma invoices are being adapted for digital compliance. While B2B e-invoicing isn't mandatory yet, many businesses are already digitising their pro formas to work more efficiently. Remember, final invoices are still legally due by the 15th of the following month.

For businesses moving a lot of goods, Statistics Netherlands even requires digital statements, using pro forma data to help build financial forecasts. It's all part of a larger effort to shrink the EU's massive €61 billion VAT gap. You can read more about the evolution of e-invoicing regulations in Europe on Fintechfutures.com.

By automating the journey from pro forma to final payment, you create a single source of truth for your finances. Every transaction is accounted for, every document is organised, and your books are always up-to-date.

Ultimately, automation is about buying back your time and giving your business the financial clarity it needs to thrive. Instead of getting lost in the weeds of paperwork, you can focus on what actually drives growth: building relationships and scaling your company. To explore this further, check out our guide on how to automate your accounts payable process.

Your Top Questions About Pro Forma Invoices Answered

When you’re dealing with paperwork that isn't quite the final bill, it’s natural to have a few questions. Let's tackle some of the most common queries about pro forma invoices so you can feel confident using them.

The whole process is pretty straightforward. It starts with a preliminary agreement and moves toward a finalised sale once everyone's on the same page.

As you can see, the pro forma is just the first step. The official invoice only comes into play after the terms are set in stone and the work is done or the goods have been shipped.

Is a Pro Forma Invoice Legally Enforceable?

In short, no. A pro forma invoice is not a legally binding document.

It’s best to think of it as a highly detailed quote or a gesture of good faith between you and your client. It lays out all the specifics of a potential sale, but it doesn't create a legal obligation for the buyer to pay. The actual demand for payment only happens once you issue the final, official tax invoice.

What if Changes Are Needed After a Pro Forma Is Issued?

That's perfectly fine—in fact, that's one of their main purposes! Since pro formas are just preliminary drafts, they’re meant to be flexible.

If a client wants to change the quantity, adjust the scope, or tweak any other detail, you can simply update the pro forma and send over the new version. This back-and-forth is a key part of the process, making sure both sides agree on everything before the deal is locked in.

Can I Use a Pro Forma for My Accounting Records?

Definitely not. This is a critical point: a pro forma invoice should never find its way into your official books, like your accounts receivable ledger.

It represents a potential sale, not a confirmed one. Recording it as actual income would throw off your financial reports and could lead to serious compliance headaches, especially with things like VAT. Save your bookkeeping for the final, numbered tax invoices only.

What Is the Difference Between a Pro Forma and a Credit Note?

These two documents are essentially opposites. A pro forma invoice is sent before a final invoice to outline what a future payment will look like.

A credit note, on the other hand, is issued after a final invoice has already been paid or recorded. Its job is to correct a mistake, process a refund, or cancel out an amount that was previously billed.

Think of it this way: A pro forma invoice builds up to a sale by confirming what will be owed. A credit note reduces an amount that is already owed, acting as a financial correction after the fact.

Stop wasting hours matching receipts to invoices. Mintline uses AI to automatically link every bank transaction to its corresponding document, giving you clean, audit-ready books in minutes. Discover how Mintline can automate your finances.