What Pro Forma Invoice Means for Your Business

Discover what a pro forma invoice means and how it functions for Dutch businesses. Our guide explains its purpose, legal status, and practical applications.

So, what exactly is a pro forma invoice? In simple terms, it's a preliminary bill you send to a client before you've delivered the goods or finished the work. Think of it as a dress rehearsal for the final bill—it lays out all the details, but isn't an official demand for payment. For businesses using smart platforms like Mintline to streamline their finances, understanding this document's role is key to maintaining accurate records from the very start of a transaction.

Decoding the Pro Forma Invoice

Let's use an analogy. Say you're hiring a carpenter to build a custom piece of furniture. Before they even think about buying the wood, they'll likely send you a document detailing the materials, labour costs, and an estimated delivery date. That document isn't the final bill, but it's a solid agreement on the price and scope of the project. That's a pro forma invoice in action.

It's essentially a provisional bill of sale, sent from the seller to the buyer ahead of everything kicking off. Its main job is to give the buyer a precise breakdown of what to expect financially, making sure everyone is on the same page before the transaction progresses. This simple document is surprisingly powerful for building trust and keeping business operations running smoothly.

Key Functions of a Pro Forma Invoice

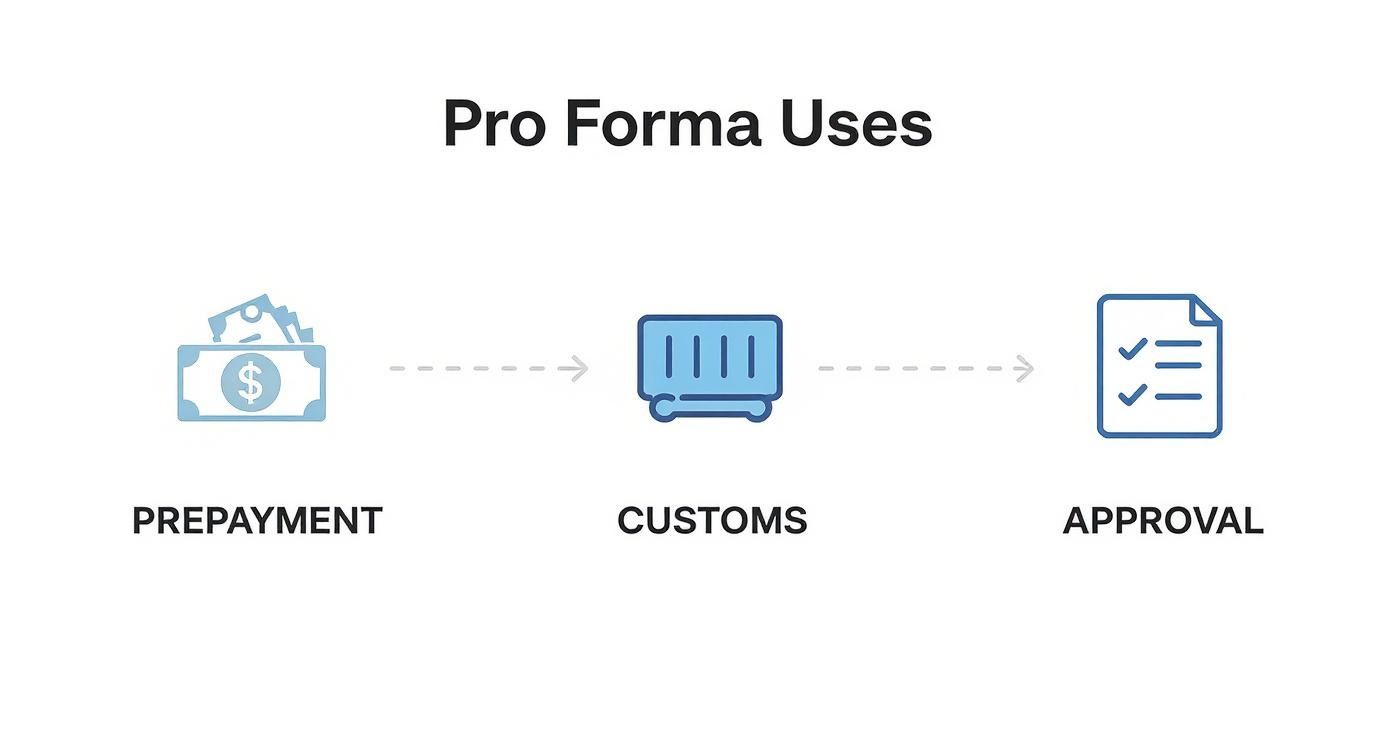

A pro forma invoice isn't just administrative fluff; it’s a genuinely useful tool, especially for more complex transactions. Businesses that prioritise clear financial organisation with tools like Mintline lean on them for several practical reasons:

- Securing Financing: A buyer can take a pro forma invoice to their bank to apply for a loan or a letter of credit. It gives the lender a clear, credible estimate of the transaction's value.

- Internal Budget Approval: In larger companies, a purchasing department often needs a pro forma to get the green light from finance before they can officially commit to a major purchase.

- Navigating Customs: When trading internationally, customs officials often require a pro forma invoice to work out duties and taxes before the goods even leave the warehouse.

At its core, a pro forma invoice is a planning document. It creates a shared understanding of costs and terms, heading off potential disputes down the line by making sure expectations are crystal clear from the start. It’s a declaration of commitment, not a demand for payment.

Here in the Netherlands, a pro forma invoice is treated as a preliminary commercial document, not a formal tax invoice. It’s common practice for customs clearance and arranging prepayments, particularly in international trade, but it isn’t a legal requirement under Dutch or EU VAT law. You can find more detailed guidance on quoting and invoicing in the Netherlands from official financial resources.

When to Use a Pro Forma Invoice in Your Business

Knowing the right moment to send a pro forma invoice can make a huge difference in your business operations. It helps prevent costly misunderstandings and keeps transactions running smoothly. Think of it as a crucial communication tool that lays out a clear agreement before any goods change hands or services begin.

This document really shines in a few specific, real-world scenarios where clarity and commitment are everything. It’s essentially a formal handshake that puts the terms of a deal on paper, acting as a detailed estimate that both parties agree on before moving forward. This is especially useful for businesses dealing with complex projects or international trade, where you need to lock down financial and logistical details early on.

Securing Prepayments and Managing Cash Flow

One of the most common reasons to issue a pro forma invoice is to request a prepayment or deposit from a client. If you're a manufacturer or service provider, this initial payment is often vital for covering the cost of raw materials or resources needed to get started. For example, a custom furniture maker might send a pro forma invoice to a customer to get 50% upfront before buying expensive wood.

This simple step ensures you have the cash flow to begin the project without digging into your own operational funds. It also confirms the buyer's commitment, which lowers the risk of them backing out after you've already invested time and money.

Navigating International Trade and Customs

For Dutch businesses involved in exporting, a pro forma invoice is absolutely essential. International customs authorities often require it to calculate duties and taxes before a shipment is even sent. The document provides a clear declaration of the goods' value, description, and quantity.

A pro forma invoice gives customs officials a transparent look at the shipment's contents and value, allowing for a smoother, faster clearance process. Without it, goods can get stuck in transit, leading to significant delays and unhappy customers.

Imagine a Dutch flower exporter sending a large shipment to Japan. They would use a pro forma invoice to let the Japanese customs agency calculate import tariffs in advance. This ensures all the paperwork is in order for a seamless delivery.

Facilitating Internal Budget Approvals

In larger organisations, getting internal approval for a purchase can be a drawn-out process. A buyer's finance department often needs a formal document detailing the expected costs before they can release the funds.

This is where the pro forma invoice comes in. A software company providing a bespoke solution can issue a pro forma that details the project scope, development costs, and implementation timeline. The client can then use this document to get the necessary budget sign-off from their management, making sure the financial side is sorted before any work begins.

It’s also a key tool for buyers who need to apply for an import licence or secure a letter of credit from their bank. Using these documents effectively simplifies processes that would otherwise slow things down. Solutions like Mintline help manage the entire document lifecycle, from initial quotes to final invoice matching, reducing the administrative load of these workflows. Looking into tools for automating accounts payable can also help.

Pro Forma vs. Commercial Invoice: The Critical Differences

It’s one of the most common mix-ups in business finance: confusing a pro forma invoice with a commercial one. They might look similar on the surface, but they play vastly different roles and carry entirely different legal weight. Getting this right is absolutely essential for keeping your books clean and your business compliant.

Think of a typical transaction as a three-step journey. It usually kicks off with a quote, which is really just an initial estimate to get the conversation started. Once the buyer is on board, you issue a pro forma invoice to lock in the details of the agreement. The journey ends with the commercial invoice, the official, legally recognised bill sent after you’ve delivered the goods or services.

Legal Power and Financial Recording

The single most important distinction comes down to legal standing. A pro forma invoice is not legally binding. You can think of it as a good-faith agreement or a confirmed promise. It shows the seller is committed to the price, but it doesn't create an obligation for the buyer to pay. For this reason, it stays out of your official books—you don't log it in your accounts receivable.

A commercial invoice, however, is the real deal. It’s a legally binding document that represents a formal debt the buyer owes you. This is the document that gets entered into your accounting system, hitting your accounts receivable and becoming part of your official revenue. For anyone using a platform like Mintline to manage their finances, telling these two apart is fundamental to keeping accurate, audit-ready records.

This flow is often used to secure prepayment, clear customs, or get internal sign-off before the actual sale is finalised.

As the visual shows, the pro forma is a preparatory step—it smooths the way for the transaction before it becomes official.

Comparing Key Commercial Documents

To make this crystal clear, let's lay out the key differences between a pro forma invoice, a commercial invoice, and a simple quote. Each one has a specific job to do at a specific point in the sales process.

| Attribute | Pro Forma Invoice | Commercial Invoice | Quote / Offer |

|---|---|---|---|

| Purpose | To declare commitment and outline final transaction details before shipment or service delivery. | To officially request payment for goods or services already delivered. | To provide an initial price estimate and open negotiations. |

| Legal Status | Not legally binding. It is a good-faith agreement, not a demand for payment. | Legally binding. It creates a formal obligation for the buyer to pay the specified amount. | Not legally binding. It is a preliminary offer that can be accepted, rejected, or negotiated. |

| Accounting Impact | None. This document is kept outside of official accounting records like accounts receivable. | Yes. It is recorded as a sale in the seller's books and as a payable in the buyer's. | None. A quote has no impact on financial statements until a sale is confirmed. |

| Timing in Sale | Issued after a buyer commits but before the final delivery of goods or services. | Issued after the goods have been shipped or the services have been rendered. | Issued at the very beginning of the sales process, during the initial inquiry phase. |

In the end, using the right document at the right time is all about creating clarity for everyone involved and maintaining accurate financial records. This kind of precision is even more important as invoicing becomes more digital, a topic we explore further in our guide explaining what is an e-invoice.

Crafting a Professional Pro Forma Invoice

A sharp, well-structured pro forma invoice isn't just a piece of paper; it's your first step towards a smooth, hassle-free transaction. Think of it as the architectural blueprint for the deal. The more detail and clarity you put in upfront, the less chance there is for costly delays or frustrating misunderstandings down the line.

Putting one of these together is all about getting the details right from the very beginning. A solid pro forma gives your client all the information they need to greenlight the order with confidence, setting clear expectations for everyone involved.

Key Details to Include on Your Pro Forma Invoice

To do its job properly, your pro forma needs a few non-negotiable elements. These details ensure that your buyer, their accounts department, and even customs officials (for international shipments) are all on the same page.

Here’s a quick checklist of the must-haves:

- Clear Identification: The document absolutely must be labelled "Pro Forma Invoice" right at the top. This simple heading immediately separates it from a final, legally binding commercial invoice, preventing any accidental payments.

- Unique Reference Number: Every pro forma should have its own unique number. This makes it incredibly easy to track and discuss, ensuring you and your client are always talking about the same document.

- Seller and Buyer Information: Make sure you include the full names, addresses, and contact details for both your business and your buyer. Getting this right is crucial for any official paperwork.

- Important Dates: You must include the date the pro forma was issued. I also highly recommend adding a validity or expiry date. This lets the client know exactly how long your quoted prices and terms are good for.

Think of a well-organised pro forma invoice as the definitive guide for the upcoming sale. It solidifies the agreed-upon terms and gives the buyer a reliable document they can use for internal approvals or even to secure financing.

Breaking Down the Goods and Terms

Once you've covered the basics, the real substance of the pro forma is the detailed breakdown of the sale. This is where you spell out exactly what you're providing and the conditions of the deal, leaving no room for guesswork.

Your itemised breakdown should include:

- Description of Goods or Services: Give a clear, detailed description of each item. Don't forget to include quantities, the price per unit, and the total price for each line.

- Total Amount Due: Clearly show the subtotal, any estimated taxes (and be sure to label them as estimates), shipping costs, and the final grand total.

- Payment and Delivery Terms: State your payment terms clearly (e.g., 50% upfront, net 30). If you're trading internationally, this is where you'd include Incoterms to define who's responsible for what during shipping.

- Currency: Always specify the currency for the transaction. It's a small detail that prevents major headaches, especially with cross-border sales.

When you're thinking about layout and presentation, it can be helpful to review best practices for creating effective document templates. Using a tool like Mintline can also ensure your financial documents always look professional, simplifying everything from the initial agreement to the final payment reconciliation.

Navigating VAT and Legal Status in the Netherlands

When you’re doing business in the Netherlands, it’s crucial to understand how a pro forma invoice fits into the tax puzzle. While it’s a fantastic tool for getting a deal started, it has a very specific—and limited—status with the Dutch Tax Administration (Belastingdienst). Getting this right keeps your books clean and saves you from some serious headaches down the line.

Here’s the golden rule: a pro forma invoice is not a valid VAT document. This is the single most important thing to remember. You can't use it to officially charge VAT, and you certainly can't use it to reclaim VAT. Think of it as a draft, a good-faith estimate that lays out the terms of a sale before anything is set in stone.

Because it isn't legally binding, a pro forma invoice doesn't create a "tax point." That's the exact moment a transaction becomes official in the eyes of the tax authorities. The real deal only happens when a final, legally compliant tax invoice is issued, which has to tick all the boxes required by both Dutch and EU law.

The Shift from Pro Forma to Tax Invoice

Moving from that preliminary pro forma to a final tax invoice is where the magic happens. This final invoice is the document that matters. It’s where you must correctly apply the right Dutch VAT rate—be it the standard 21%, the reduced 9%, or the 0% rate for certain goods and services.

This is the document that goes into your official bookkeeping. For anyone just starting out, a solid guide on setting up a company in the Netherlands can be a lifesaver, covering these kinds of essential legal details. Using a smart platform like Mintline ensures that only these final, valid invoices are matched to your transactions, keeping your financial records accurate and ready for any audit. It leverages clever tech, similar to modern OCR for scanners, to pull data accurately from official documents, not drafts.

Pro Forma Invoices and E-Invoicing Systems

This lack of legal muscle also means pro forma invoices are left out of formal e-invoicing systems like Peppol. These networks are built for legally binding documents, not for preliminary quotes. While e-invoicing is currently only mandatory for business-to-government (B2G) transactions in the Netherlands, the writing is on the wall—it's becoming the standard for faster payments and smoother tax reporting everywhere. A pro forma simply doesn't have the legal status to play in that arena.

Ultimately, treating a pro forma invoice as anything other than a preliminary agreement is a significant compliance risk. The final commercial invoice is the only document that solidifies the transaction, triggers VAT obligations, and officially enters your financial records.

Common Questions About Pro Forma Invoices

Even when you've got a good handle on what a pro forma invoice is, some practical questions always seem to pop up. Knowing exactly when and how to use these documents is key to keeping things running smoothly with your clients. Let's clear up some of the most common queries we hear.

Think of this section as tying up the loose ends, making sure you can use pro forma invoices confidently and correctly. Getting these details right helps keep your financial admin organised, especially if you're using a tool like Mintline to manage your documents.

Is a Pro Forma Invoice a Legally Binding Contract?

In short, no. A pro forma invoice is not a legally binding contract. It's more like a handshake deal on paper—a good-faith agreement where you, the seller, commit to a certain price and terms. While it can become part of the final sales agreement once your client agrees, the pro forma itself doesn't legally force them to buy anything.

The actual, legally enforceable demand for payment comes later with the commercial invoice. This distinction is critical: the pro forma sets the stage, but the commercial invoice is the final bill that holds up in legal terms.

Can I Use a Pro Forma Invoice for My Accounting?

You should never use a pro forma invoice for your official bookkeeping. Since it’s not a final sale or a confirmed debt, it has no place in your accounts receivable or as recognised revenue. It exists completely outside of your formal accounting records.

Only the final commercial invoice, which confirms the goods are shipped or the service is complete, should be logged in your accounting system. That's the document that affects your financial statements and is used for tracking revenue and tax.

Keeping them separate is vital for accurate books. Financial admin platforms like Mintline are built to work with final, legally recognised documents, ensuring your records are always correct and audit-ready.

Does a Pro Forma Invoice Become a Commercial Invoice?

A pro forma invoice never automatically turns into a commercial invoice. They are two distinct documents, each with its own job to do. Once the client gives the nod to the pro forma's terms and you've delivered the goods or services, you must issue a brand new document: the final commercial invoice.

Think of the pro forma as the blueprint for the sale. The commercial invoice is the finished building—the official record that creates the legal obligation for your client to pay up.

Should I Include VAT on a Pro Forma Invoice in the Netherlands?

Even though a pro forma has no official standing for tax, it’s good practice to include an estimated VAT amount. This gives your client a clear and honest picture of the total potential cost, which helps them with their own budgeting and getting approvals.

Just be sure to label it clearly as an estimate (for example, "Estimated VAT at 21%"). This avoids any mix-ups. The final commercial invoice you issue later is where you must show the correct, legally required VAT amount to stay compliant with Dutch tax law.

Ready to stop chasing receipts and keep your financial documents perfectly organised? With Mintline, you can automatically match every transaction to its invoice, saving hours of manual work and ensuring your books are always accurate. Discover how Mintline can simplify your financial admin today.