Proforma Invoice Means A Guide to This Key Business Document

Understand what a proforma invoice means for your business. This guide explains its purpose, how it differs from a real invoice, and its role in modern trade.

So, what exactly does "proforma invoice means"? Think of it as a preliminary bill of sale that a seller sends to a buyer before the deal is completely locked in. It’s like a formal price quote or a dress rehearsal for the final sale—it lays out all the details of the pending transaction but isn’t an official demand for payment. The main goal is simply to make sure everyone is on the same page before things become official and a final invoice is issued.

Unpacking the Proforma Invoice

Before we get into the nitty-gritty of proformas, it helps to quickly refresh on what an invoice is and why it matters. A standard invoice is a legally binding document that officially requests payment for goods or services you've already delivered. A proforma invoice, on the other hand, fills a different need. It’s more of a good-faith agreement, showing the seller’s commitment to deliver certain products or services at a specific price.

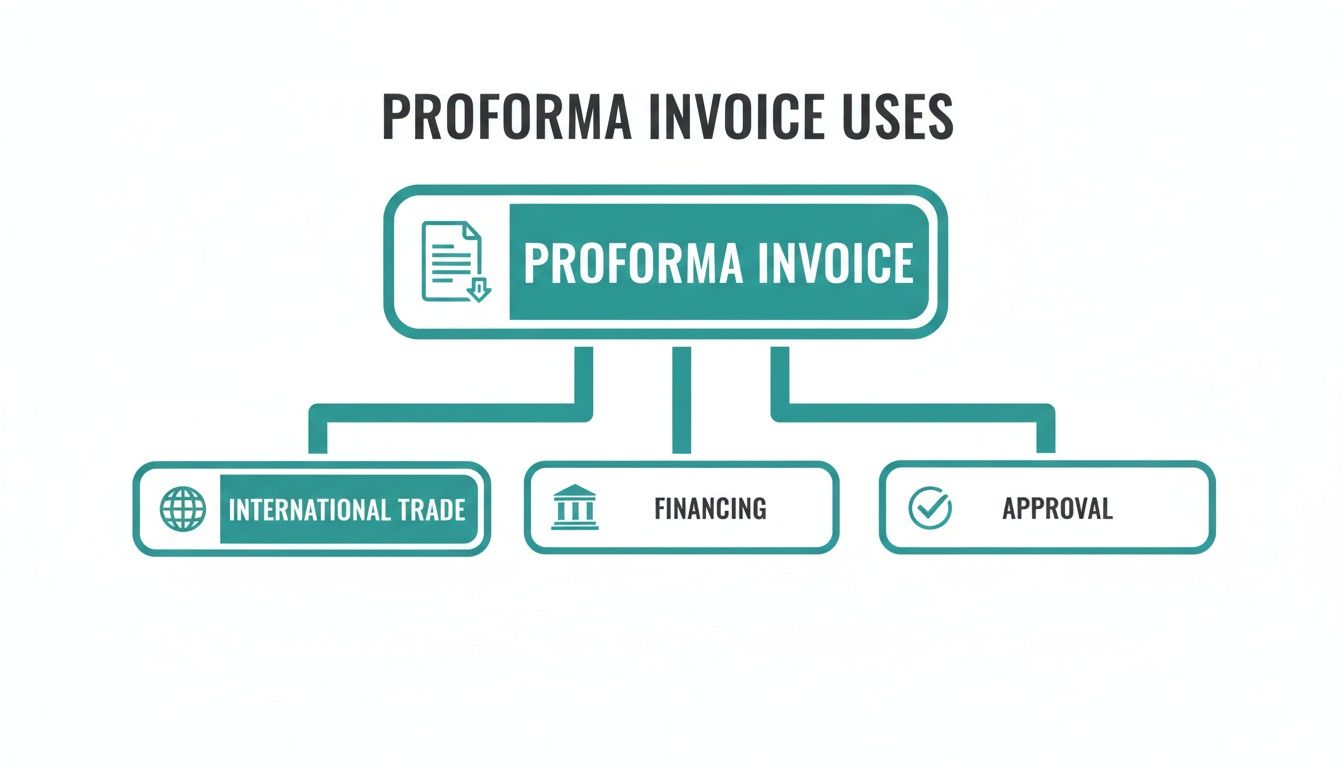

It’s much more than just a casual estimate. It's a formal preview of the final deal. For instance, a buyer might need a proforma invoice to get internal approval for a purchase or to secure financing from a bank. In international trade, it's a critical document for customs, allowing officials to see the value of goods before they're even shipped. We’ll dive deeper into the complete proforma invoice meaning and its practical uses throughout this guide.

A Tool for Agreement, Not Accounting

The most important thing to grasp is its function. A proforma invoice is a commercial tool, not an accounting one. It’s all about aligning expectations between the buyer and seller by clearly outlining the key details:

- Descriptions and Quantities: Exactly what is being sold.

- Pricing: The cost per item and the total expected amount.

- Shipping and Terms: How and when the goods are expected to arrive.

A proforma invoice acts as a provisional agreement. It protects buyers from sudden price hikes and gives sellers the confidence that an order is serious before they commit resources to fulfilling it.

Here in the Netherlands, for example, the distinction is crystal clear. A proforma invoice is purely a commercial document used for quotes, customs declarations, or to arrange prepayment. It is never treated as a fiscal document for VAT deduction or bookkeeping. For that, you need a final, official VAT invoice once the sale is complete. You can find more details on Dutch invoicing practices and see how this principle applies. Learn more about invoicing rules in the Netherlands on eurofiscalis.com.

This separation keeps the books clean and avoids confusion. Because it’s not a legally binding request for payment, a proforma invoice never touches your accounts receivable. Its sole purpose is to pave the way for a smooth, transparent final sale, ensuring both sides are in complete agreement before any money or goods change hands. Getting this foundational concept right is vital for any business looking to streamline its financial processes, a core benefit offered by platforms like Mintline.

When to Use a Proforma Invoice

So, when does it actually make sense to send a proforma invoice? Think of it as a crucial step that bridges the gap between a casual price quote and the final, legally binding commercial invoice. It’s not just paperwork; it's a smart move in specific situations to make sure everyone is on the same page before a deal is locked in.

It’s like a formal handshake before you sign the contract. You’d use one when your customer has essentially said "yes" to the purchase, but you're still ironing out the last few details. This simple step can prevent a world of headaches later, ensuring both you and your client agree on the scope, price, and terms before any products are shipped or work begins.

Navigating International Trade

International shipping is where the proforma invoice really shines. When you're moving goods across borders, customs officials need to know the shipment's value to calculate duties and taxes. This is true even if the final payment hasn't been processed yet. A proforma invoice provides exactly that—a clear declaration of value.

For businesses based in major European trade hubs like the Netherlands, this is just part of the daily routine. While a proforma isn't legally mandatory, Dutch customs need precise values and descriptions to process shipments. Exporters and importers depend on these documents to declare the necessary information, especially when goods are sent before the final commercial invoice is ready. It’s a vital tool for a smooth, delay-free customs clearance. You can dive deeper into Dutch VAT and trade procedures on vatcalc.com.

Securing Approvals and Financing

Proforma invoices aren't just for external parties; they play a big part in the buyer's internal processes, too. Many larger companies have strict purchasing rules. A manager or finance department often needs to see a formal document before they'll approve a purchase order, and a proforma invoice fits the bill perfectly.

It lays out a detailed breakdown of the upcoming purchase—item descriptions, quantities, prices, shipping costs—giving the finance team everything they need to review and sign off. It’s a trusted document for making those internal decisions.

On top of that, a buyer might need a proforma invoice to secure a loan or a letter of credit from their bank.

Financial institutions look at a proforma invoice as concrete proof of an upcoming sale. It gives them the details they need to feel confident in approving and releasing funds to the buyer, which helps get the deal done.

This makes it an indispensable tool for big-ticket sales or when you're working with new customers who need to arrange their finances. By sending one, you're giving your buyer the official paperwork they need to clear their internal hurdles and move forward.

Proforma Invoice vs Commercial Invoice vs Quote

Getting your head around the differences between a quotation, a proforma invoice, and a commercial invoice is absolutely crucial for keeping your business running smoothly. At first glance, they can all look a bit similar, but they each play a very distinct role in the sales journey. Mixing them up can cause real headaches, from accounting mistakes and late payments to simple misunderstandings with your customers.

Think of it like this: the sales process is a timeline. Each of these documents is a milestone, guiding you and your client from that first flicker of interest all the way to the final payment.

The First Handshake: The Quotation

A quotation is where the conversation begins. It’s your first, informal offer to a potential customer who’s asked about your products or services. A quote is really just an estimate—it gives them a ballpark idea of the cost, but nobody is committed to anything just yet.

Its main job is to kick off a negotiation. Since it isn't legally binding, you can easily change or even withdraw a quote. It's the most flexible of the three documents, designed purely to see if there's interest and start talking about price and what’s included.

Once a quote gets the nod, the proforma invoice steps in as the next formal move.

As you can see, the proforma invoice is a vital tool for everything from international trade and securing finance to getting that all-important internal sign-off on a purchase.

The Formal Agreement: The Proforma Invoice

Okay, so the client has agreed to the terms on your quote. What's next? This is where you issue a proforma invoice. A proforma invoice signals that things are getting serious. It’s a formal, good-faith agreement that lays out all the specific details of the sale before it’s set in stone.

This document shows you're committed to providing certain goods or services at the price you’ve both agreed on. But here’s the key part: even though it looks almost identical to a final invoice, it is not a demand for payment. You absolutely should not be entering it into your accounts. Think of it as a final checklist to make sure everyone is on the same page before the deal becomes official.

The Final Bill: The Commercial Invoice

Finally, we have the commercial invoice. This is the last and most formal document in the whole process. It's a legally binding demand for payment that you send after you’ve delivered the goods or finished the work. This is the one your accounts team will log as accounts receivable and use for tax purposes.

Unlike the documents that came before it, a commercial invoice creates a legal duty for the buyer to pay up. It means the deal is done from your side, and the payment clock has officially started ticking. Making sure that transition from proforma to commercial invoice is slick and error-free is exactly where tools like Mintline come in, helping to automate the workflow and keep everything organised.

The simplest way to remember the difference is through their function: A quote estimates, a proforma invoice confirms, and a commercial invoice bills.

To really nail down the differences, let’s lay them out side-by-side.

Proforma Invoice vs Commercial Invoice vs Quotation

This table breaks down the unique role each document plays in the sales cycle.

| Attribute | Quotation | Proforma Invoice | Commercial Invoice |

|---|---|---|---|

| Purpose | To provide an initial price estimate and start negotiations. | To confirm the terms of a pending sale before it is finalised. | To officially request payment for delivered goods or services. |

| Timing | Issued at the very beginning of the sales conversation. | Issued after a buyer commits but before the final delivery. | Issued after goods are shipped or services are completed. |

| Legal Status | Not legally binding. | Not legally binding for payment. | Legally binding document for payment. |

| Accounting | Not used for accounting. | Not recorded in accounts. | Recorded in accounts receivable and used for VAT. |

Seeing them compared like this makes it clear how each document has its own specific time and place. Using them correctly isn't just good practice—it's essential for clear communication and a healthy cash flow.

How to Create a Proforma Invoice That Works

Putting together a solid proforma invoice isn't just about ticking boxes; it's your first real step in setting clear expectations with a customer. Think of it as a professional handshake on paper. Even though it isn't a bill, this document lays out the terms of your agreement and gives the buyer all the details they need to give you the green light. Nailing this part builds trust and avoids any "I thought you meant..." conversations down the line.

First things first, the title is everything. You absolutely have to label the document "Proforma Invoice" right at the top, big and clear. This one simple step is crucial. It stops anyone from accidentally logging it as a real invoice in their accounting software, which, trust me, can create a massive headache for everyone involved.

What to Include in Your Proforma Invoice

With the title sorted, you need to fill it out with the right details. A good proforma invoice is basically the full blueprint for the deal you're proposing. Every piece of information has a job to do, all aimed at making sure you and your customer are on the same page.

Make sure your document always includes these key bits:

- Who's Who: The full names, addresses, and contact details for both you (the seller) and your customer (the buyer).

- A Unique Reference Number: Even though it’s not an official invoice number, a unique ID makes it much easier to track and talk about later.

- Important Dates: Note the date you created it and, most importantly, an expiry date. You can’t hold a price forever, so be clear about how long your offer stands.

- The Nitty-Gritty Details: Break down exactly what you're providing. List each product or service with a clear description, quantity, price per unit, and the total for each line.

- Payment Terms: How do you want to be paid? When will the final invoice be due? Is there a deposit required? Spell it all out.

- Delivery Info: Add the estimated shipping costs, where it's going, and a realistic timeframe for when they can expect to receive it.

By getting all this down, you’re giving your customer a complete picture. They can make their decision without having to come back with a list of questions, which speeds up the whole process.

Don't Forget the Disclaimer

To protect yourself from any accounting mix-ups or legal confusion, you need a clear disclaimer. This is just a short statement that reminds the recipient that this isn't a legally binding bill. It’s a simple addition that can prevent a lot of future hassle.

A straightforward phrase like "This is not a VAT invoice" or "This is a proforma invoice and not a request for payment" placed somewhere obvious does the trick. It makes sure the document is used for its real purpose: confirming the terms before the deal is done.

At the end of the day, a well-made proforma invoice is a tool for clear communication. When you structure it properly and include all the necessary info, you project professionalism and make the sales journey smoother. It gives your customers the confidence to say "yes," knowing exactly what will be on the final commercial invoice. And if you want to keep things consistent and professional every time, platforms like Mintline can automate the whole process for you.

The Shift to Digital Proforma Invoicing

The days of printing, signing, and mailing paper documents are thankfully fading into the background. Just as the traditional invoice has gone digital, the proforma invoice is right there with it. This move isn't just about convenience; it’s a smart, strategic step towards making your business operations a whole lot more efficient and accurate.

Modern procurement and invoicing software has completely changed the game. Instead of building a document from scratch every time, your team can now generate and send a professional digital proforma invoice with just a few clicks. This does more than speed things up—it drastically cuts down on the manual entry errors that cause frustrating delays.

The Benefits of Going Digital

Switching to digital proforma invoices brings some serious advantages that help businesses stay competitive. It’s about much more than saving a few trees; it creates a smoother, more reliable process for everyone involved.

Here’s what you gain:

- Faster Approval Cycles: Digital documents fly. They can be sent, received, and approved in minutes, not days, helping you close deals much faster.

- Reduced Errors: When you automate, you all but eliminate the risk of typos or calculation mistakes. The numbers are right from the very beginning.

- Seamless Conversion: With a single click, a digital proforma can be transformed into a final, legally-compliant invoice, ensuring all the data stays consistent.

This shift towards structured electronic documents fits perfectly with where business is heading. In the Netherlands, for instance, the government already requires e-invoicing for all its business-to-government (B2G) transactions. While it’s not yet mandatory for B2B deals, this push encourages suppliers to go digital with all their documents, including proformas. You can read more about the Dutch e-invoicing market on imarcgroup.com.

Adopting digital proforma invoicing isn't just about modernising a single step; it's about preparing your business for a future where data automation is the standard for financial management.

By making this transition, you’re getting your business ready for what's next. Once you understand what an e-invoice is, it’s easy to see how a digital proforma is the logical first step towards a fully automated, audit-ready financial system. This is exactly where platforms like Mintline come in, helping you make the shift and ensuring every document—from the initial agreement to the final payment—is tracked, matched, and perfectly organised.

Automate Your Invoicing Workflow with Mintline

Knowing what a proforma invoice means is a great start, but the real magic happens when you optimise how you create and manage them. Let's be honest, manually piecing together quotes, proforma documents, and then final invoices is more than just slow. It’s a minefield for human error.

A single misplaced decimal or an incorrect quantity can cause a domino effect, messing up your entire accounting cycle, delaying payments, and leaving clients frustrated. Nobody wants that.

This is exactly where automation completely changes the game for your financial operations. Instead of losing hours to tedious admin, you can set up a system that takes care of the entire document journey. Imagine clicking a button to turn an approved quote into a polished proforma invoice, and then, with another click, converting it into the final commercial invoice once the deal is sealed. That’s the kind of efficiency Mintline brings to the table.

From Manual Hassle to Automated Flow

When you automate your invoicing workflow, you’re not just saving time; you're getting rid of the bottlenecks that choke your cash flow. The entire process becomes smooth and connected, guaranteeing that every document is consistent and accurate from the initial handshake to the final payment request. A platform like Mintline builds a perfect, audit-ready trail for every single transaction.

This kind of organised system delivers real, tangible benefits that you'll feel straight away:

- Get Paid Faster: Automation drastically cuts the time between getting a 'yes' and sending the invoice, which naturally speeds up your payment cycle.

- Eliminate Costly Errors: Taking manual data entry out of the equation means every document that goes out is precise and professional.

- Strengthen Client Relationships: A seamless, error-free process builds trust. It shows your clients you're organised, reliable, and easy to do business with.

When you put an automated system in place, you stop spending your days chasing paperwork and start focusing on what actually grows your business. To really boost efficiency, it's worth checking out different business process automation examples to see what's possible.

At the end of the day, a streamlined workflow isn't just a nice-to-have back-office upgrade—it's a real strategic advantage. It frees up your team, sharpens your financial accuracy, and creates a much better experience for your customers. You can learn more about how to get started with automated accounts payable software and see how a tool like Mintline can bring your whole financial process into the modern age.

Common Questions About Proforma Invoices

Even when you've got the basics down, a few practical questions about proforma invoices always seem to pop up. Nailing these details will help you use them correctly and with confidence, keeping your financial records clean and organised.

Is a Proforma Invoice Legally Binding?

In a word, no. A proforma invoice isn't a legally binding document. It’s best to think of it as a good-faith agreement or a formal quotation, not an enforceable contract for payment.

While it shows the seller's commitment to the agreed-upon price and terms, the buyer has no legal obligation to pay based on this document alone. That legal duty only kicks in once a final commercial invoice is issued.

Can You Use a Proforma for Accounting?

Definitely not. Since a proforma invoice isn't an actual demand for payment, it has no place in your official books. It should never be recorded in your accounts receivable or used for VAT reporting.

Think of a proforma invoice as existing before the official transaction. Only the final, legally compliant commercial invoices should enter your accounting system, as they represent a real sale and a legal obligation to pay.

Should You Keep Copies of Proformas?

Yes, it’s a smart move. While the legal requirements for document retention usually focus on official fiscal documents like commercial invoices, hanging on to your proformas is simply good business practice.

Keeping them gives you a complete paper trail of the transaction. It clearly documents how the final terms of a sale were negotiated and agreed upon, which can be a lifesaver if any disputes or questions come up later.

Ready to stop chasing receipts and automate your financial workflow? With Mintline, you can automatically link bank transactions to documents, eliminating manual work and ensuring your records are always audit-ready. See how it works at https://mintline.ai.