Automated Accounts Payable Software with Mintline

Discover how automated accounts payable software can transform your finance team, cut costs, and improve accuracy. A complete guide for modern businesses.

Picture this: your finance team, swamped by stacks of paper invoices, painstakingly typing every last detail into a spreadsheet. It’s slow, expensive, and frankly, a recipe for errors. This is where automated accounts payable software comes in, transforming that chaotic, manual grind into a smooth, digital operation. With a platform like Mintline, you get a digital finance expert on your team, one that handles invoices, approvals, and payments automatically.

Understanding Automated Accounts Payable Software

Think of the old way of doing accounts payable like a clunky, manual assembly line. An invoice comes in, someone types in the data, a manager hunts for a pen to sign it, and eventually, someone else schedules the payment. It’s not just sluggish; every single step is a potential point of failure, leading to duplicate payments or costly missed deadlines.

Automated accounts payable software completely overhauls that workflow. Instead of that disjointed assembly line, you get one smart, connected system. Mintline's software automatically pulls in invoices, whether they're PDFs in an email or scanned paper documents, and uses clever technology to read and understand all the important information.

From Manual Bottlenecks to Digital Efficiency

At its heart, this technology is all about eliminating the manual touchpoints that bog down finance teams. Platforms like Mintline are built to handle the repetitive, thankless tasks, freeing up your people to focus on work that actually adds value. This move from manual to automated isn't just about speed; it brings serious advantages:

- No More Mind-Numbing Data Entry: Mintline’s sophisticated tools capture all the key details—vendor name, amount, due date—so no one has to type them out again.

- Faster Approval Workflows: Invoices are automatically sent to the right person for approval based on rules you set within Mintline. No more chasing down signatures or losing documents in a crowded inbox.

- A Clear View of Your Finances: With all your payables data in one place, you get a real-time picture of your cash flow and what you owe.

This isn't just a niche trend. The Netherlands accounts payable automation market, for example, is expected to grow steadily between 2025 and 2031, thanks to a big push for digital finance across the region. Businesses are quickly realising that investing in these tools cuts down on errors and gets suppliers paid faster. If you want to brush up on the basics, our guide on the definition of accounts payable is a great place to start.

By automating the payables process with Mintline, a business can transform its finance department from a reactive cost centre into a proactive, strategic part of the company. Suddenly, it’s less about just paying bills and more about optimising cash flow and strengthening supplier relationships.

How Mintline's Core Features Drive Financial Efficiency

To really get what automated accounts payable software can do, you need to look under the bonnet. These aren’t just abstract tech features; they're direct solutions to the real-world headaches that bog down finance teams. Each piece of the puzzle within the Mintline platform works together to bring much-needed control and clarity to how you manage your payables.

So, instead of just giving you a dry list of functions, let's break down how Mintline’s core components actually solve the problems you face every day.

The Digital Eye for Invoices

Let’s be honest: manual data entry is the number one bottleneck in any AP process. A single typo can throw everything off, leading to payment mistakes, compliance headaches, and hours spent tracking down the error. This is exactly where Optical Character Recognition (OCR) technology within Mintline steps in, acting like a 'digital eye' for your business.

Mintline's OCR technology instantly reads and pulls the crucial data from any invoice, no matter the format. It doesn't care if it's a PDF in an email or a scanned piece of paper. The software is smart enough to find and extract key details like the vendor name, invoice number, due date, and all the line-item specifics. This completely gets rid of the need for someone to type it all in by hand, freeing up your team from a job that's both mind-numbing and riddled with potential for human error. You can learn more about how Mintline uses advanced tech for this in our guide to intelligent document processing.

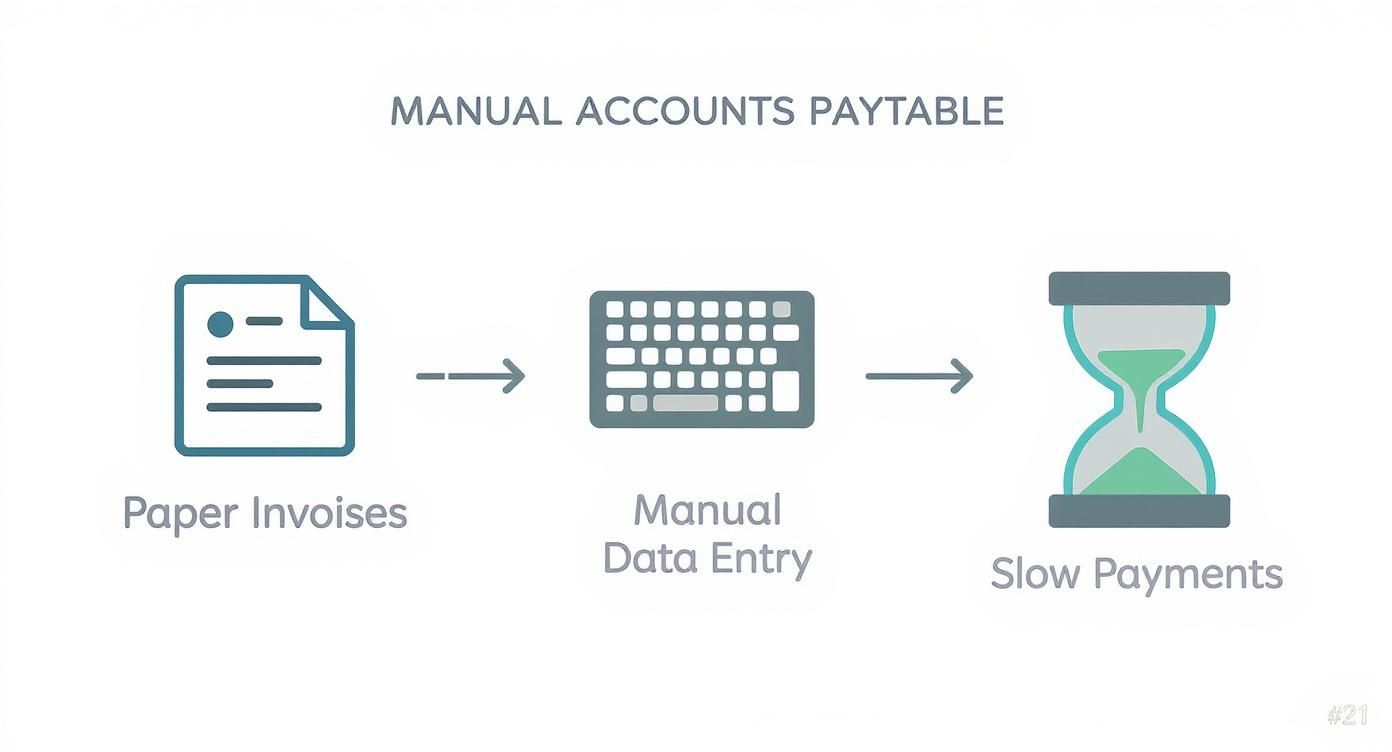

The diagram below paints a clear picture of just how clunky and slow the manual AP process really is.

You can see how a paper-based system creates a domino effect of inefficiency, from shuffling physical documents around the office to payments going out late. Mintline solves this.

The Financial Detective for Accuracy

Once an invoice’s data is in the system, how do you know it’s actually correct and ready to be paid? Without automation, someone has to manually dig through old emails and filing cabinets to find the matching purchase order and delivery receipt. This can easily eat up days of valuable time.

This is where automated three-way matching in Mintline acts as your 'financial detective'. It systematically checks the invoice details against the purchase order (PO) and the goods receipt note (GRN).

- Invoice vs. Purchase Order: Does the quantity and price billed match what we originally agreed to order?

- Invoice vs. Goods Receipt: Did we actually receive the goods or services we're being invoiced for?

If all three documents line up, Mintline automatically clears the invoice for payment. But if there’s a mismatch—say, the price is wrong or the quantity is off—the system immediately flags it for a human to look at. This simple check stops overpayments and potential fraud dead in their tracks, before a single cent leaves your bank account.

With Mintline's automated matching, you’re building a powerful safeguard right into your payables process. It ensures you only pay for what you ordered and received, protecting your company’s bottom line with every single transaction.

The Smart Traffic Controller for Approvals

We’ve all been there—chasing managers for invoice approvals is a massive source of frustration and delay. Invoices get buried in inboxes, sit on the wrong desk for weeks, or get sent to the wrong person entirely. This leads to missed early payment discounts and can even strain your relationships with key suppliers.

Mintline's intelligent approval workflows are the 'smart traffic controllers' that fix this mess. You can set up custom, multi-level approval chains based on rules that make sense for your business. For example:

- Marketing invoices under €500 go straight to the Marketing Manager.

- IT invoices over €5,000 need a sign-off from both the Head of IT and the CFO.

- Any invoice tied to a specific project is automatically routed to that project’s lead.

These rules ensure every invoice lands with the right person without anyone having to lift a finger. Approvers get an instant notification and can approve or reject the invoice straight from their email or a mobile app, which dramatically speeds up the whole cycle. This level of organisation turns a chaotic paper trail into a smooth, predictable, and fully auditable workflow.

The Tangible Business Benefits Of AP Automation

Moving to an automated accounts payable system like Mintline is about more than just speeding things up; it delivers real, measurable results that strengthen your business from the ground up. When you step away from manual processes, you set off a positive chain reaction. It starts with immediate cost savings and extends all the way to tighter security and better relationships with your suppliers. This is where AP automation software really proves its worth, changing the accounts payable department from a cost centre into a strategic asset.

Driving Direct Cost Reductions

One of the first things you’ll notice is a serious drop in operational costs. Manual invoice processing is surprisingly expensive when you add up all the hours your team spends on data entry, checking details, and chasing down approvals. Automation gets rid of most of these tedious tasks, freeing up your finance experts to focus on work that actually moves the needle.

But the savings don’t stop at labour costs. Late payment fees, which often pop up in cluttered manual systems, can be completely eliminated with Mintline. Even better, an organised system lets you consistently take advantage of early-payment discounts from suppliers. Those small percentages might not seem like much at first, but they add up to a significant sum over the year.

Automated accounts payable software can cut the cost per invoice by up to 80%. This huge saving comes from less manual work, no more late fees, and capturing those valuable early-payment discounts.

Enhancing Accuracy And Security

Let’s be honest, manual data entry is a recipe for human error. A single misplaced decimal point or a mistyped digit can lead to overpayments, duplicate payments, or compliance headaches that are expensive and frustrating to fix. Mintline boosts accuracy by using technology like OCR to pull data from invoices perfectly, every time.

This boost in accuracy is also your best defence against fraud. By automatically matching invoices against purchase orders and delivery receipts (a process known as 3-way matching), a platform like Mintline makes sure you only pay for what you actually ordered and received. Any discrepancies are flagged instantly, stopping dodgy or incorrect invoices long before they get near the payment stage. The system also creates a clear digital audit trail, which makes staying compliant with financial regulations much simpler.

Strengthening Supplier Relationships

Your suppliers are more than just vendors; they’re partners. How you handle payments directly affects these crucial relationships. Paying late or unpredictably creates tension, erodes trust, and can lead to less favourable terms for your business down the line.

AP automation software ensures your suppliers get paid on time, every single time. That kind of reliability builds goodwill and makes your company a client people want to work with. When suppliers know they can count on you for prompt payment, they’re more likely to offer better pricing, prioritise your orders, and see you as a true strategic partner rather than just another transaction.

The move towards AP automation is picking up speed across Europe. The market is expected to grow at a compound annual growth rate (CAGR) of 10.6% from 2025 to 2032. While Germany is currently at the forefront, the Netherlands is catching up fast, thanks to its excellent digital infrastructure and a growing appreciation for the benefits. To get the most out of this shift, businesses are adopting new strategies, like the 10 Accounts Payable Best Practices for 2025 Success.

Manual AP vs Automated AP A Clear Comparison

To really see the difference, let’s put the old way of doing things side-by-side with an automated approach using Mintline. The numbers speak for themselves.

| Metric | Manual AP Process | Automated AP with Mintline |

|---|---|---|

| Cost Per Invoice | €15 - €25 | €3 - €5 |

| Processing Time | 10-20 Days | 1-3 Days |

| Error Rate | 3-5% | <0.5% |

| Early Payment Discounts | Rarely Captured | ~80% Captured |

| Team Focus | Data Entry, Chasing Approvals | Analysis, Strategy, Optimisation |

| Audit Trail | Paper-Based, Hard to Trace | Digital, Instant, Searchable |

This table shows it clearly: automation isn't just a minor improvement. It’s a fundamental upgrade that makes your AP function faster, cheaper, and far more accurate.

Ultimately, by using a solution like Mintline, your accounts payable department transforms. It stops being a reactive team just pushing paper and paying bills. It becomes a proactive force for financial health, driving savings, reducing risk, and building the strong supplier partnerships that fuel real, sustainable growth.

How To Calculate Your Return On Investment

Bringing in AP automation software is a serious investment, not just another line item on the expense report. To get the green light from leadership, you need to build a rock-solid business case that spells out the financial wins. The best way to do that? A clear, straightforward Return on Investment (ROI) calculation that frames the whole conversation around real gains and predictable costs.

Think of it this way: it’s like swapping out your company's old, gas-guzzling delivery vans for a new fleet of efficient electric ones. Sure, there's an upfront cost, but the savings on fuel, maintenance, and vehicle downtime quickly make up for it. AP automation does the exact same thing for your finance department, delivering a clear and surprisingly fast payback.

Identifying Your Tangible Savings

The first step in crunching the numbers is to pin down exactly where you'll be saving money. These aren't just vague benefits; we're talking about measurable financial gains that directly fatten your bottom line. You need to look beyond the obvious and think about every little area where automation cuts costs.

Let's start with the big one: reduced invoice processing costs. Manually handling a single invoice—from data entry and chasing approvals to scheduling the payment—can cost anywhere from €15 to €25 in staff time. With a solution like Mintline, that cost can drop to as low as €3 to €5 per invoice.

If your company processes 500 invoices per month, cutting the cost by just €12 per invoice adds up to a massive €72,000 in annual savings on labour alone. Often, that single figure is enough to justify making the switch.

But don't stop there. You also need to add up the money you'll save by preventing costly mistakes and missed opportunities. These include:

- Late Payment Penalties: Manual systems are notorious for letting deadlines slip by. Go back and see what you paid in late fees last year—that entire amount is pure savings with an automated system.

- Early Payment Discounts: Did you know many suppliers offer a 1-2% discount for paying early? An automated system makes it easy to catch these opportunities every time, turning what was once a missed chance into a reliable source of savings.

- Fraud Prevention: This one is tougher to put a number on, but the cost of just one fraudulent payment can be devastating. Features like automated 3-way matching and digital audit trails are powerful defences that dramatically reduce your financial risk.

Factoring in Your Upfront Costs

Once you have a solid estimate of your savings, it's time to look at the other side of the equation: the costs. Being completely transparent about these expenses is crucial for building a credible case. The total investment usually breaks down into a few main parts.

The most significant cost is the software subscription fee. Platforms like Mintline typically offer different pricing tiers based on how many invoices you process and the features you need. This lets you pick a plan that fits your budget and can grow with your business.

You'll also need to account for a few one-time costs to get everything up and running:

- Implementation and Onboarding: This covers the initial setup, getting the system configured just right, and connecting it to your existing accounting software.

- Team Training: Even the most intuitive platforms have a bit of a learning curve. Be sure to factor in the time your team will need to get comfortable with the new system for a smooth rollout.

When you lay out the tangible savings right next to the clear, manageable costs, you can calculate a precise payback period. This completely changes the conversation from "Can we afford this?" to "How quickly can we start saving?" and makes it obvious that AP automation is a smart investment in your company's financial health.

Choosing The Right AP Automation Partner For Your Business

Picking the right AP automation software isn't just another purchase—it’s a long-term strategic move that will fundamentally change how you manage your finances. With so many options out there, it’s easy to get distracted by flashy features. The key is to look deeper and focus on the core things that will truly make a difference for your business, both now and in the future.

A structured approach is your best bet. Think of it like a checklist that helps you cut through the noise and find a partner that solves today's headaches while also being able to grow alongside you.

The first, and most important, question to ask is simple: will this tool play nicely with our existing financial setup? Even the most powerful platform is a liability if it locks your data away in a separate system. That’s why seamless integration isn’t just a nice-to-have; it's absolutely essential.

Assess Core Technical Capabilities

Your AP automation software should feel like a natural part of your accounting system, not some awkward, bolted-on extra. For instance, a solution like Mintline should be able to plug directly into the ERP or accounting software you already use. This creates a smooth, two-way street for your data, getting rid of tedious manual entry and ensuring everyone is working from the same, accurate numbers.

Next, think about the future. Your business isn't going to stand still, so your AP solution shouldn't either. As your invoice volume grows or you expand your operations, the software needs to keep up without skipping a beat. It's crucial to ask potential vendors how their platform scales. Can it handle a sudden spike in invoices? Can it manage workflows across different business entities?

A truly scalable solution adapts to your needs, ensuring you are investing in a platform for the future, not just a fix for today. This foresight prevents the costly and disruptive process of switching systems down the line.

Prioritise Security And Support

In this day and age, you simply can't afford to be casual about data security. When you’re vetting vendors, dig into their security protocols and compliance certifications. A partner worth their salt will be completely open about how they safeguard your sensitive financial information.

There are a few non-negotiables to look for:

- Data Encryption: Make sure your data is locked down tight, both when it’s moving and when it’s stored. Look for strong standards like AES-256.

- Compliance Certifications: For any business operating in the Netherlands or across the EU, compliance with regulations like GDPR is critical.

- Secure Infrastructure: A platform hosted on a trusted cloud provider like AWS, with data centres located within the EU, adds another solid layer of security and regulatory peace of mind.

Finally, never overlook the importance of good, old-fashioned customer support. When something goes wrong or you just have a quick question, you need a team you can count on. Use your demo calls to ask about their support channels, typical response times, and what their onboarding process looks like. A real partner, like Mintline, is invested in your success and will offer the hands-on support needed to get you up and running smoothly and keep things optimised down the road.

By focusing on these four pillars—integration, scalability, security, and support—you can cut through the marketing fluff and choose an AP automation partner that genuinely fits your business goals.

A Simple Guide To Implementing AP Automation

Making the switch to a new system can feel like a huge mountain to climb, but getting AP automation software up and running doesn't have to be a painful process. With a clear plan, the move from manual, paper-shuffling chaos to a slick, automated workflow can be smooth and surprisingly quick. A structured approach, like the one we use for Mintline onboarding, takes the guesswork out of the equation and ensures a stress-free rollout.

This isn't just about flicking a switch on a new piece of software. It’s about carefully guiding your organisation through a positive change. By breaking the implementation down into a few manageable steps, you can build confidence across your team and get everyone on board for a successful launch. The aim is to make the transition so seamless that your team will soon wonder how they ever got by without it.

A Structured Four-Step Rollout

A successful implementation follows a logical path, making sure no detail gets missed. This deliberate, step-by-step approach helps manage everyone's expectations, keeps disruption to a minimum, and gets your team comfortable with the new way of working.

Here’s a simple but effective roadmap:

-

Initial Setup and Configuration: This is where the foundation is laid. You’ll work closely with your vendor—like us at Mintline—to get the system configured just right. This means setting up user roles, defining approval workflows that match your company’s policies, and connecting the software to your accounting system so data can flow freely.

-

Clean Data Migration: All that historical vendor data is gold. The next step is to carefully move this information—supplier details, payment terms, old invoice records—into the new platform. A clean import is critical; it ensures that from day one, your system has the accurate data it needs to run smoothly.

-

Run a Pilot Programme: Before you roll it out to the entire company, it's a smart move to run a pilot test with a small, dedicated group of users. This gives you a chance to test the workflows in a real-world setting, collect honest feedback, and tweak anything that isn't quite right. It’s the perfect way to iron out any kinks and create a few internal champions for the new system.

-

Team Training and Full Launch: Once the pilot is a success, the final step is to train the whole team and go live. Clear communication is absolutely key here. Make sure everyone understands how the new system benefits them directly and feels confident in their new, automated role.

Best Practices For A Smooth Transition

Bringing in new technology is as much about people as it is about the software. The rapid adoption of AP automation in Dutch finance departments makes this clear. Globally, 62% of organisations are now making the switch to stamp out manual errors and get invoices paid faster. The results speak for themselves: top-performing teams can shrink their invoice cycle to just over 3 days, a massive leap from the industry average of 17.4 days. You can learn more about the powerful impact of these tools and what's shaping the future of AP automation in 2025.

To ensure a successful rollout, focus on clear communication and a strong partnership with your vendor. A great software provider is more than a tool; they are a support system dedicated to helping you achieve your goals.

Throughout the entire process, remember to lean on your vendor's support team. At Mintline, we guide our clients through every single step, offering the hands-on expertise needed to guarantee a fast and effective transition. This partnership is what turns a simple software installation into a genuine transformation of your AP tasks and, ultimately, your entire procure-to-pay processes. By following these steps and best practices, your business can confidently adopt an automated system and start seeing the benefits almost immediately.

Frequently Asked Questions About AP Automation

Switching to automated accounts payable software is a big move, so it’s completely normal to have questions. You're changing a core part of your financial operations, and you need to be sure it's the right decision. We've put together answers to the most common questions we hear to help you get the clarity you need.

Think of these as the critical details you need to know, covering everything from day-to-day invoice handling to long-term security and the financial payback. The answers show how a modern platform like Mintline isn't just about swapping manual tasks for software—it's about fundamentally improving how your business handles its money.

How Does The Software Handle Complex Approval Workflows?

One of the biggest wins with AP automation is how it handles those tricky, multi-step approval chains that always cause delays. Instead of you having to track down the right person and chase them for a signature, you can set up custom rules that automatically send invoices where they need to go.

It’s surprisingly simple. For instance, you could create rules like:

- Invoices from the marketing department? They go straight to the head of marketing.

- Anything over €10,000? It automatically gets forwarded to the CFO for a final sign-off.

- Is an invoice tied to a specific client project? The system sends it to the project manager first.

This rules-based approach means every single invoice follows your company policy to the letter, all without anyone lifting a finger. It gets rid of the bottlenecks and makes the whole approval process move much, much faster.

What Level Of Security Protects Our Financial Data?

When it comes to your financial data, security can't be an afterthought. Reputable platforms like Mintline are built with serious, top-level security baked in from the start. That begins with powerful data encryption, like AES-256, which scrambles your information so it's protected whether it's being sent across the internet or just sitting on a server.

For any business operating in the Netherlands, GDPR compliance is a must. The best software providers take this seriously, storing your data on secure, EU-based servers—often using trusted cloud services like AWS. This creates a fortress for your data, keeping it safe from unauthorised access and making sure you stay on the right side of regulations.

How Quickly Can We Expect A Return On Investment?

The great thing about AP automation is that the return on investment (ROI) shows up much faster than with most other business software. You start seeing the savings almost right away, and they come from a few different places. The biggest one is the huge drop in manual work; we're talking about invoice processing costs falling by as much as 80%.

On top of that, you stop wasting money on late payment penalties and can finally start taking advantage of early-payment discounts. When you add up these direct savings with the lower risk of fraud and fewer costly errors, most businesses find the software pays for itself well within the first year. It’s a smart investment that delivers real financial results.

Ready to eliminate manual data entry and gain full control over your finances? Mintline uses AI to automatically link every bank transaction to its corresponding receipt, turning hours of monthly admin into just a few minutes. Discover how Mintline can transform your accounts payable process today.