Procure to Pay Processes: Streamline Your Workflow with Smart Automation

Learn how to optimize procure to pay processes with automation tips that fix bottlenecks, speed up approvals, and reduce errors.

The procure-to-pay process, often called P2P, covers the complete, end-to-end journey of acquiring goods and services for your business. It begins the moment a need is identified and concludes only when the supplier is paid and the transaction is recorded in your financial system.

Think of it as the central nervous system for your company's spending. A smooth, well-oiled P2P workflow is the foundation of strong financial control, enabling efficient operations. At Mintline, we focus on automating the most tedious parts of this process, turning a complex administrative task into a streamlined, accurate, and rapid workflow.

What is the Procure-to-Pay Process, Really?

Imagine you’re running a busy restaurant kitchen. You need specific ingredients, at the right time, from the best suppliers. The entire flow—from the chef flagging that you're low on flour, to placing the order, receiving the delivery, checking it’s correct, and finally paying the invoice—has to be seamless. That’s the procure-to-pay process in a nutshell.

It's not just a random sequence of buying stuff. It's a structured system that brings order, transparency, and predictability to every single purchase your company makes. For any business looking to grow without chaos, mastering this cycle is essential for maintaining financial health and operational agility.

The Real Goal of a P2P System

So, why put all this structure in place? At its core, a solid P2P system delivers a few critical benefits that strengthen the whole business:

- Spending Control: It’s your best defence against unauthorised or 'maverick' spending. A proper process ensures every purchase aligns with company policy and stays within budget.

- Operational Smoothness: With clear, defined steps for everything from approvals to payments, you eliminate the friction and delays that plague disorganised teams. Things just get done faster.

- Clear Financial Insight: It creates a perfect audit trail for every pound spent. You can see exactly where your money is going in real-time, which is crucial for managing cash flow.

- Better Supplier Relationships: Let's be honest, everyone likes getting paid on time. A reliable payment process builds trust with your vendors, which can open the door to better pricing and preferential treatment down the line.

The procure-to-pay process is more than just procurement; it's a critical financial function that links purchasing activities directly to the accounts payable department. Understanding this connection is fundamental, as our guide on the definition of accounts payable explains.

This entire journey used to be a mountain of paperwork and manual checks. Now, tools like Mintline are changing the game completely. By automating the really tedious parts—like manually matching receipts to invoices—they take a huge administrative headache and turn it into a fast, accurate, and streamlined flow. This frees up your team to focus on what actually matters: growing the business.

Mapping Your P2P Workflow from Start to Finish

To get a real grip on company spending, you first need a clear map of the entire purchasing journey. A solid procure to pay process isn't just a list of tasks someone ticks off; it's a connected workflow. Each step should flow logically into the next, creating a clear, traceable audit trail for every single purchase.

Let's walk through a real-world example. Imagine a growing design agency needs five new software licences for its expanding creative team. This simple request kicks off a seven-stage journey that shows exactly how a structured P2P cycle works in practice.

The whole flow can be simplified into three main activities: Request, Purchase, and Pay.

Thinking about it this way helps clarify how each part of the operation fits into the bigger financial picture. Now, let’s zoom in and break down each of the seven stages.

To really understand the P2P cycle, it helps to see each stage laid out, from the initial need all the way to the final accounting entry. The table below summarises the entire workflow.

The Seven Key Stages of the Procure to Pay Cycle

| Stage | Objective | Key Activities |

|---|---|---|

| 1. Purchase Requisition | To formally request goods or services internally. | An employee identifies a need and submits a detailed request for approval. |

| 2. Purchase Order (PO) | To create a legally binding agreement with a supplier. | Once approved, a PO is generated and sent to the vendor, authorising the purchase. |

| 3. Goods/Services Receipt | To confirm that the ordered items have been delivered as agreed. | The team verifies the delivery and creates a goods receipt note in the system. |

| 4. Invoice Processing | To officially record the supplier's bill and prepare it for verification. | The vendor's invoice is received and its data is captured, either manually or automatically. |

| 5. Three-Way Matching | To verify the invoice is accurate and legitimate before payment. | The invoice, PO, and goods receipt are compared to ensure all details align. |

| 6. Payment | To settle the approved invoice according to the agreed terms. | The finance team schedules and executes the payment to the supplier. |

| 7. Reconciliation | To close the loop and ensure financial records are accurate. | The payment is recorded and matched against bank statements in the accounting system. |

With that overview in mind, let's explore how our design agency's software purchase moves through each of these critical steps.

Stage 1: Purchase Requisition

It all starts with a recognised business need. Long before any money is spent, someone has to raise their hand and say, "We need this."

Following our example, a senior designer at the agency sees they need five new software licences to get new hires up and running. They don’t just email their boss; they submit a formal purchase requisition through the company’s system. This request details the exact software, the quantity (five licences), the estimated cost, and a clear business reason.

Crucially, this isn't an order. It's an internal request for approval.

Stage 2: Purchase Order (PO)

Once the department head gives the thumbs-up, the requisition moves over to the finance team. This is where the request becomes official.

Finance creates a Purchase Order (PO), which is a legally binding document sent to the software vendor. It acts as the official green light for the purchase and contains everything the vendor needs to know: a unique PO number, the specific items, the agreed-upon price, and any delivery terms.

Stage 3: Goods/Services Receipt

With the order placed, the cycle shifts from procurement to fulfilment. This is where the business confirms it got what it paid for.

The software vendor emails the five digital licence keys. The IT department then steps in to verify that all licences are the correct version and are working properly. Once confirmed, they create a "goods receipt note" in the system. This digital handshake confirms that what was ordered on the PO has been successfully delivered.

Stage 4: Invoice Processing

A few days later, an email lands in the accounts payable (AP) inbox: the vendor's invoice. It lists the same five licences and requests payment.

This is often where the first major bottleneck occurs. For many businesses, it means someone has to manually type all the invoice details into the accounting system. It’s here that platforms like Mintline make a huge difference by using AI to automatically extract key data, eliminating manual entry and the risk of human error.

Stage 5: Three-Way Matching

Now for the most important checkpoint in the entire process. This is where the AP team validates that the company is only paying for what it actually ordered and received. Get this wrong, and you open the door to all sorts of problems.

The core of financial control in P2P lies in the matching process. It’s the definitive checkpoint that prevents overpayments, duplicate invoices, and payments for goods that never arrived.

The finance team (or an automated system) performs a three-way match. They meticulously compare three documents:

- The Purchase Order (what we asked for)

- The Goods Receipt (what we got)

- The Invoice (what we were billed for)

In our agency's case, everything lines up perfectly—five licences at the agreed price. The invoice is immediately approved for payment. With Mintline, this matching can happen automatically, flagging only exceptions for human review.

Stage 6: Payment

With the invoice fully vetted and approved, it’s queued for payment. The finance department schedules the payment based on the terms negotiated with the vendor, like Net 30 days. When the due date arrives, the payment is processed via bank transfer.

Stage 7: Reconciliation

The final step is all about closing the loop. The payment is logged in the company's accounting software, and the transaction is matched against the corresponding entry on the bank statement. This ensures the books are balanced and provides a complete, accurate record of the entire transaction from start to finish. The P2P cycle is now complete.

Where Procure-to-Pay Processes Usually Break Down

No matter how well you map out your procure-to-pay process on paper, it’s bound to develop some cracks in the real world. These weak spots often start small—a minor data entry mistake, a delayed approval—but they have a nasty habit of snowballing into wasted time, costly errors, and strained supplier relationships.

Spotting these common failure points is the first step to building a P2P system that’s robust and genuinely efficient, not just one that looks good in a flowchart.

So many of these breakdowns stem from one core issue: an over-reliance on manual work. Think about it. A simple typo during invoice data entry can cause a mismatch that grinds the entire payment process to a halt. Suddenly, your accounts payable team isn't focused on strategic financial management; they're stuck playing detective, hunting down a single clerical error.

Manual Errors and Mismatched Documents

The classic point of failure is, without a doubt, the three-way matching stage. When a business is juggling paper documents or wrestling with spreadsheets, comparing the purchase order, goods receipt, and invoice is painfully slow and riddled with risk. A tiny difference in quantity, an old price, or a slightly different item description is all it takes to trigger an exception, kicking the invoice into a long and frustrating review queue.

This kind of document chaos is exactly what modern tools are designed to solve. Platforms like Mintline, for example, use AI and OCR technology to lift data directly from documents automatically. This dramatically cuts down on human error and can flag genuine discrepancies in seconds, not hours.

Another huge headache is "maverick spending"—those purchases made outside of the official procurement channels. This completely bypasses all the controls you’ve so carefully put in place. The result? Budget overruns, non-compliant purchases, and a complete lack of visibility until the unexpected invoice lands on your desk.

Approval Delays and Bottlenecks

A P2P process is only as fast as its slowest approver. When a purchase requisition or an invoice gets stuck in someone’s inbox for days on end, it creates a serious bottleneck. These hold-ups often mean you miss out on early payment discounts and, even worse, get hit with late payment fees that eat directly into your profits.

A slow approval process doesn't just cost money in late fees; it damages trust. Suppliers who are consistently paid late may become reluctant to offer favourable terms in the future, impacting your entire supply chain.

At a larger scale, poor data accuracy can have massive economic consequences. In the Netherlands, for instance, challenges in accurately reporting contract values in public procurement have been a persistent issue. Despite legal requirements, in 2022, at least half of contracting authorities failed to report these values correctly, impacting transparency across a combined procurement volume of approximately €116 billion in 2024. This just goes to show how critical data integrity is—a problem that starts with getting P2P data entry and reporting right from the very beginning. You can explore more on how systematic oversight is improving Dutch procurement reporting.

Measuring the Health of Your P2P System

To catch problems before they spiral out of control, you need to be tracking the right metrics. Think of these Key Performance Indicators (KPIs) as a regular health check for your procure-to-pay process.

- Invoice Processing Time: This measures the average time from when an invoice lands on your desk to when it’s paid. A long cycle time is a red flag, often pointing to approval bottlenecks or matching issues.

- First-Time Match Rate: What percentage of your invoices sail through the three-way match on the first try without any manual meddling? A low rate here is a clear sign that your earlier processes, like PO creation, are broken.

- Cost Per Invoice: This calculates the total cost to process a single invoice, factoring in labour, software, and everything else. Automation is the single most effective way to drive this number down.

Keeping a close eye on these KPIs gives you the hard data you need to pinpoint weaknesses. Once you start addressing these specific failure points, you can turn your P2P workflow from a constant source of friction into a powerful engine for financial control and operational efficiency.

How Automation Smooths Out Your P2P Workflow

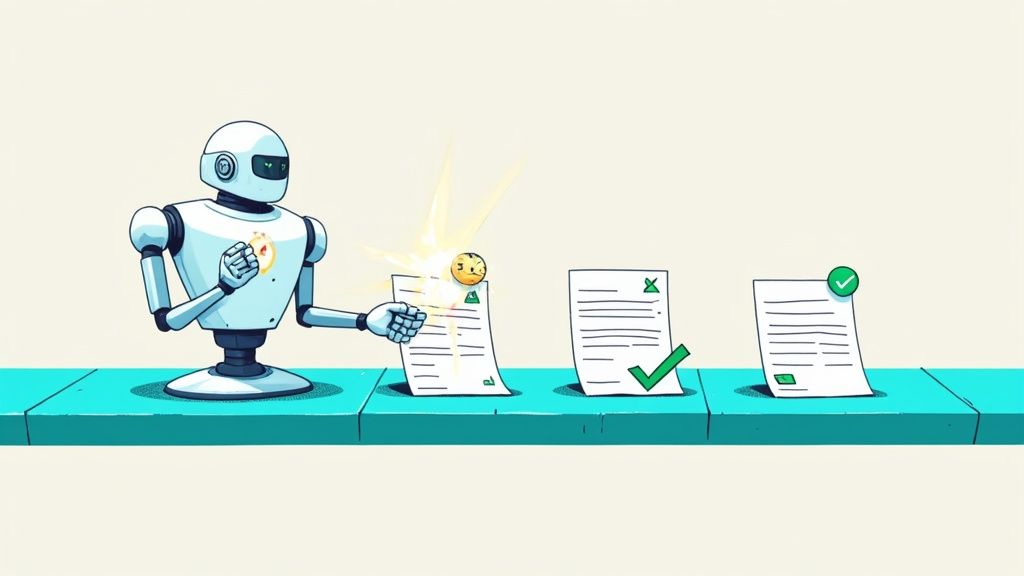

This visual from Mintline’s platform perfectly illustrates how automation transforms a manual, error-prone task like document processing into a smooth, self-driving operation. By taking manual data entry out of the picture, the system ensures accuracy from the very start, directly tackling one of the biggest failure points in traditional procure to pay processes.

The End of Manual Data Entry

For years, the biggest bottleneck in the procure-to-pay cycle has been the simple act of getting information off an invoice and into an accounting system. This manual step isn’t just slow; it’s a breeding ground for typos and mistakes that cause mismatches and hold up payments.

Smart automation completely rewrites that script. Platforms like Mintline use Optical Character Recognition (OCR) and artificial intelligence to read invoices the second they arrive. Think about an invoice landing in your inbox and, moments later, all the key data—vendor name, invoice number, line items, and amounts—is automatically extracted and categorised without a human ever touching it.

This isn’t just about being faster. It’s about being right. When you remove human data entry, you eliminate the single most common source of errors that derails the three-way matching process, giving your First-Time Match Rate a massive boost.

Supercharging Three-Way Matching

Once the invoice data is captured perfectly, the next logical move is to validate it automatically. Instead of a team member manually digging up a purchase order and a goods receipt to compare them against the invoice, an automated system does it in an instant.

A solution like Mintline can compare the digitised invoice against the corresponding PO and receipt data already in your system.

- Perfect Match: If all three documents line up, the invoice is automatically approved and sent to the payment queue. No human intervention needed.

- Minor Difference: If there's a small, acceptable variance (like a few pence difference from rounding), the system can be told to approve it based on your pre-set rules.

- Major Exception: If there’s a serious mismatch, like the wrong quantity or price, the system flags it and routes it straight to the right person for a closer look.

This exception-based approach means your team stops wasting time on the 95% of invoices that are perfectly fine and can focus their expertise on the 5% that actually need attention. This is how you slash your Invoice Processing Time from weeks to days, or even hours.

The market for these solutions is growing fast for a reason: the results speak for themselves. The global procure-to-pay solution market was valued at USD 7.76 billion in 2024 and is projected to climb significantly. Studies have shown that companies embracing automated PO systems can cut administrative costs by up to 40%, while error rates plummet by over 70%.

Gaining Real-Time Financial Visibility

One of the most powerful benefits of automating your procure to pay processes is getting a live, real-time view of company spending. When invoices are handled manually, there's often a big delay before that liability shows up in your financial system.

With an automated workflow from Mintline, spending data is captured and categorised as it happens. This gives finance leaders an accurate, up-to-the-minute picture of cash flow and commitments, which makes forecasting and budgeting far more reliable. This direct line of sight is crucial for maintaining tight financial control.

If you want to dig deeper, our guide on automating accounts payable offers more detail on how to transform this critical function. To see how the 'procure' side of P2P can be transformed, explore insights into Robotic Process Automation for Procurement Processes.

Your P2P Automation Implementation Checklist

So, you're ready to automate your procure-to-pay process? Fantastic. It doesn't have to be a massive, daunting project. With a methodical approach, you can move from manual chaos to automated efficiency without pulling your hair out.

The first step is always the same: know where you're starting from. You need to map out your entire P2P workflow as it exists today—from the moment someone requests a purchase to the final payment reconciliation. This isn't just a box-ticking exercise. It’s about finding the real-world pain points, like sluggish approvals or the invoice mismatches that always seem to pop up at month-end.

Once you have that clear picture, you can start building something better.

Define Roles and Choose Your Tools

With your process mapped out, it’s time to get specific about who does what. Assign clear ownership for every stage, from who creates a purchase order to who gives the final nod for payment. This simple step wipes out confusion and builds accountability right into your procure-to-pay process.

Next up is choosing the right software. You'll want a solution that’s easy for your team to pick up and that plays nicely with your existing accounting tools. A platform like Mintline is built to attack the most mind-numbing parts of the cycle, like invoice and receipt matching, which makes it a great choice for businesses that want to see results fast. As you put your plan together, it’s smart to prepare for any bumps in the road by reading up on overcoming AI implementation challenges to make the transition as smooth as possible.

Key takeaway: A successful rollout is about more than just technology—it's about process and people. A well-defined workflow with clear roles, backed by a user-friendly tool, is your foundation for real, lasting efficiency.

Standardise Policies and Get Your Team Onboard

With your people and tools sorted, the next move is to standardise your purchasing policies. Think simple, clear rules for how employees request goods, get approvals, and handle invoices. This consistency makes the whole system much easier to manage and, crucially, much easier to automate.

Finally, don't skimp on training. You need to show your team not just how to use the new system, but why it makes their lives easier by cutting out tedious manual work. Good training ensures everyone is pulling in the same direction and helps you get the most out of your investment. For a closer look at handling documents better, our guide to intelligent document processing is a great next step.

Even before you fully implement a system like Mintline, a few small tweaks can make a big difference right now.

Quick Wins for Immediate Impact:

- Create Standardised PO Templates: Get everyone using the same purchase order template. This ensures all the essential information is there every time, making matching a breeze later on.

- Set Up a Central Invoice Inbox: Create a single, dedicated email address (like invoices@yourcompany.com) for all supplier invoices. No more hunting through individual inboxes.

- Establish Clear Approval Hierarchies: Document exactly who needs to sign off on what, based on the purchase amount or department. This simple chart can dramatically speed up authorisations.

These small adjustments can deliver noticeable improvements straight away, building momentum for your bigger P2P automation goals.

Have Questions About P2P? We Have Answers.

As companies get serious about sharpening their financial operations, a lot of questions pop up around the procure-to-pay process. We've gathered some of the most common ones here to give you clear, straightforward answers and help you navigate the tricky spots.

What's the Difference Between P2P and S2P?

Think of Procure-to-Pay (P2P) and Source-to-Pay (S2P) as two different zoom levels on your procurement activities. They both involve buying things, but their scope is what sets them apart.

P2P is all about the "how" of buying. It’s the operational, nuts-and-bolts part of the process: someone requests an item, it gets approved, a purchase order is sent, the goods arrive, an invoice comes in, and you pay it. It’s focused purely on getting individual purchases done right.

Source-to-Pay (S2P), on the other hand, is the bigger picture. It includes the entire P2P cycle, but it also covers all the strategic work that happens before you even think about buying something. This means analysing the market, finding and vetting potential suppliers, negotiating contracts, and managing those supplier relationships for the long haul. S2P is the complete journey, from finding the best partners to final payment.

Why Is Automation a Big Deal for P2P?

Running your procure to pay processes manually is like trying to navigate a cross-country road trip with a crumpled paper map. You might get there eventually, but it's going to be slow, you’ll probably take a few wrong turns, and you have no idea what the traffic is like up ahead. Automation is your GPS. It cuts out the manual data entry mistakes that cause most invoice mismatches and payment bottlenecks.

Automation turns P2P from a reactive, paper-shuffling chore into a proactive, strategic advantage. It handles the repetitive slog, freeing up your team to manage exceptions, analyse spending, and negotiate better deals.

Modern tools like Mintline bring AI and OCR into the mix, automatically lifting data from invoices and performing three-way matching in a flash. This doesn’t just accelerate the entire cycle; it also creates a crystal-clear digital audit trail for every single purchase, giving you much tighter financial control and making compliance a breeze.

How Does a Good P2P Process Affect Our Suppliers?

A smooth, efficient P2P process tells your suppliers you’re a professional, reliable partner. When you pay them on time, every time, you build trust. That kind of goodwill can pay you back in very real ways—think better pricing, more flexible payment terms, or being first in line for service when things get busy.

On the flip side, a chaotic P2P system that’s full of delays and mistakes can really damage your reputation. Suppliers might start demanding payment upfront or, in worst-case scenarios, simply stop working with you. It’s also worth remembering that how you buy things has a ripple effect. In the Netherlands, for instance, certain public procurement styles have been connected to a decline in job quality, leading to high workloads and insecurity for contracted workers. This is a powerful reminder that procurement isn't just about transactions. For a deeper dive, check out the research into Dutch public procurement practices. A fair and efficient process truly benefits everyone in the supply chain.

Ready to stop chasing receipts and start closing your books in minutes? Mintline uses AI to automatically link every bank transaction to its receipt, eliminating manual work and giving you perfect, audit-ready records. Discover how Mintline can transform your financial workflow today.