What Is a Proforma Invoice and When Should You Use One

Unsure what is a proforma invoice? Our guide explains its purpose, key differences from a regular invoice, and when to use it for your business.

Think of a proforma invoice as a 'dress rehearsal' for a real invoice. It’s a preliminary bill of sale you send to a client before any goods are shipped or services are locked in. Essentially, this document lays out all the critical details to make sure everyone is on the same page before the transaction actually happens.

Understanding the Proforma Invoice

At its core, a proforma invoice is a good-faith agreement, not an actual demand for payment. Its main job is to declare your commitment as the seller to provide specific goods or services at an agreed-upon price. For any business, this document is a vital tool for setting clear expectations and heading off misunderstandings before they can start.

Let’s say you’re a freelancer quoting a large design project. Sending a proforma invoice first allows you to confirm the scope, timeline, and total cost with your client before you pour in any real time or resources. It’s a simple step that gets both parties aligned and builds a solid foundation of trust right from the get-go.

Why It’s Not a Real Invoice

The biggest difference comes down to its purpose and timing. A proforma invoice is sent before the deal is done. Because of this, it isn't legally binding and has absolutely no place in your official accounting records like accounts receivable. It’s purely for informational purposes.

A proforma invoice is the blueprint for a future transaction. It outlines the what, how much, and when, but it doesn't trigger any financial obligation. Think of it as a communication tool first and foremost.

Key Characteristics of a Proforma Invoice

To get a feel for a proforma invoice's role in the sales process, it helps to break down its core features. Here’s a quick summary to help you get started.

Proforma Invoice at a Glance

| Characteristic | Description |

|---|---|

| An Estimate | Provides a precise quote, so the buyer knows exactly what to expect financially. |

| Confirms Details | Helps finalise terms, quantities, and prices before anyone commits. |

| No Accounting Impact | Not recorded as revenue or a debt in your books. It's off the record. |

| Non-Binding | A buyer is not legally obligated to pay based on this document alone. |

In short, these features show that a proforma invoice is a stepping stone, not the final destination.

For a wider view of how different financial documents fit into the payment puzzle, it's worth exploring these insights from payment experts on invoicing. While invoicing practices are always changing—especially with the rise of e-invoicing in the Netherlands—the basic principles of clear financial communication never go out of style.

Understanding this initial step is crucial for a smooth financial workflow, especially for businesses using a tool like Mintline to manage their finances long before a final invoice needs matching up with a bank transaction.

Proforma Invoice vs Commercial Invoice

Getting to grips with the difference between a proforma invoice and a commercial invoice is absolutely essential for anyone managing a business’s finances. They might look quite similar at a glance, but they play completely different roles and have very different consequences for your accounts. It's a common mix-up, and one that can cause real headaches and throw your financial records into disarray.

Here’s a simple way to think about it. Imagine you’re having a custom piece of furniture built. The proforma invoice is the initial design sketch and quote from the carpenter. It lays out the design, the wood to be used, and what the final cost will likely be. It’s a document you both agree on before any work starts.

The commercial invoice, on the other hand, is the final bill you receive after your beautiful new table has been delivered. It’s the official, legally recognised request for payment for the finished product.

The Defining Differences

The whole thing really boils down to two key points: timing and legal status.

A proforma invoice is sent out before any goods change hands or any service is performed. Its job is to make sure everyone is on the same page and to lock in the details of a sale that’s about to happen. Crucially, it’s not a legally binding document. The customer has no legal obligation to pay just because they’ve received one.

A commercial invoice is the opposite. It’s issued after the job is done and the delivery is complete. It acts as an official confirmation that the sale has happened and is a formal demand for payment. This document is 100% legally binding and forms a cornerstone of your official accounting records.

The simplest way to remember it is this: A proforma invoice is a forward-looking estimate to get agreement, while a commercial invoice is a backward-looking record to get paid.

This distinction is massive when it comes to bookkeeping. You should never, ever enter a proforma invoice into your accounts receivable. Because a sale hasn't actually happened yet, it doesn't represent real income. If you record it, you’ll artificially inflate your sales figures and create a confusing mess for your accountant to sort out later.

A Practical Comparison

To make it even clearer, let's put them side-by-side. Seeing the differences lined up like this really helps cement the concepts.

Proforma Invoice vs Commercial Invoice

| Feature | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Purpose | To give the buyer a precise quote and agree on the terms before the deal is done. | To officially request payment for goods or services that have already been provided. |

| Timing | Sent before the goods are shipped or the service is delivered. | Sent after the transaction is finalised and the customer has received the goods/service. |

| Legal Status | Non-binding. Think of it as a good-faith estimate, not a legal demand for cash. | Legally binding. This creates a formal obligation for the buyer to settle the bill. |

| Accounting Impact | None. It doesn't get recorded in your accounts receivable or recognised as revenue. | Significant. It's recorded as a sale, increasing your revenue and accounts receivable. |

This clear separation is vital for keeping your company's financials healthy and accurate. For businesses automating their workflows, the moment a proforma converts into a final invoice is a key trigger. While a tool like Mintline is designed to match that final, official invoice to its corresponding payment, understanding the documents that come before it ensures the whole process runs smoothly. This is especially true as more companies go digital; you can learn more about this trend in our guide on what an e-invoice is and its growing importance.

When Should You Use a Proforma Invoice?

Knowing what a proforma invoice is is a good start, but the real trick is knowing when to use one. That’s how you turn it from a simple document into a genuinely useful business tool. Think of it this way: a proforma invoice shines in situations where you need to get everything crystal clear and agreed upon before any money changes hands or work begins. It’s a communication bridge, heading off misunderstandings before they can even start.

For many businesses, sending a proforma is the first concrete step in the sales process. It takes a casual conversation or a brief email exchange and turns it into a formal, itemised breakdown that everyone can look at. It’s a smart, proactive way to manage expectations and dramatically lower the risk of a dispute down the line.

To Secure a Deposit or Get Client Sign-Off

If you're a freelancer, run an agency, or provide any kind of service, you know the pain of scope creep. It’s that slow, insidious process where a project just keeps growing beyond what was originally agreed, often leaving you with unpaid work and a strained client relationship. A proforma invoice is your best defence against this.

Before you write a single line of code or design a single graphic, you can send a proforma that details every deliverable, the timeline, and all the costs involved. This forces a clear conversation about the exact scope of work.

- For Freelancers: It's perfect for outlining the different phases of a project and securing that all-important deposit. This not only confirms your client is serious but gives you the cash flow you need to get started.

- For Agencies: Use it to get a client to formally sign off on the full project scope and budget. This creates an agreed-upon baseline before your team invests any creative energy or development time.

Once the client gives the nod to the proforma, it effectively becomes the blueprint for the project. If they ask for something extra later on, it's easy to point out that it's outside the original scope, which then opens the door for a new proforma or an amendment.

Think of a proforma invoice as a firm handshake in digital form. It confirms all the crucial details, making sure both you and your client are on the exact same page before anyone commits time or money.

To Handle International Trade and Customs

When you start shipping goods across borders, the proforma invoice goes from being a good idea to an absolute necessity. Customs officials in most countries demand it to work out duties and taxes before the shipment even leaves your warehouse. It's essentially a declaration of the goods' value.

Try sending a package internationally without one, and you’re asking for trouble. Shipments get stuck at the border for days, held up in customs, or even sent back. A proforma gives the officials all the information they need to process everything smoothly. This includes:

- A detailed description of the goods

- The value of each item

- Shipping information and the country of origin

It's just as critical for your buyer, too. They often need it on their end to apply for an import licence or to arrange a letter of credit with their bank.

To Confirm a Large or Custom Order

Lastly, if your business deals in high-value goods or custom-made products, a proforma invoice is a vital risk management tool. It lets you confirm the exact specifications and the final price with your buyer before you sink money into materials or production time.

Picture a carpenter building a bespoke dining table. The proforma ensures the client has officially approved the type of wood, the exact dimensions, and the final price before a single piece of timber is cut. It protects everyone involved.

In all these cases, the proforma sets the transaction up for a successful outcome. And while a tool like Mintline comes in later to automatically match the final, paid invoice to the bank transaction, getting the proforma right at the start is what makes the whole financial workflow—from quote right through to reconciliation—run like clockwork.

The Anatomy of a Solid Proforma Invoice

Think of a proforma invoice as the blueprint for a future sale. You wouldn't build a house from a rough sketch on a napkin, and you shouldn't start a business transaction with a vague quote. To be truly effective, your proforma needs to be crystal clear, laying out all the essential details upfront.

While it isn't a final bill demanding payment, getting it right from the start builds trust with your client. It shows you’re professional, organised, and serious about the work, preventing any nasty surprises or confusion later on.

The Must-Have Basics

First things first, let’s cover the foundational details. These elements are non-negotiable and ensure everyone knows exactly what they're looking at.

- The "Proforma Invoice" Header: This is the most important part. You need to clearly and prominently label the document "Proforma Invoice" right at the top. This simple act immediately distinguishes it from a final, legally binding commercial invoice.

- Who's Who: Include the full name, address, and contact details for both your business and your client. Getting this right is crucial for clear communication.

- Key Numbers and Dates: Give each proforma a unique reference number for easy tracking. You'll also need to add the date it was issued and, crucially, an expiration date. This tells the client exactly how long your offer stands.

Nailing this first section means that from a single glance, your client gets the context and the timeline they’re working with.

Getting into the Financial Nitty-Gritty

With the basics sorted, the real heart of the proforma is the financial breakdown. This is where you spell out the specifics of the potential deal, leaving absolutely no room for misinterpretation. A detailed breakdown here is your best defence against future disagreements over project scope or cost.

Pro Tip: It's always a good idea to add a simple disclaimer like, "This is not a tax invoice." This small sentence reinforces the document's purpose as a quote and protects you from any unintended accounting or legal headaches.

Here’s what to include in the financial section:

- A Detailed Breakdown: List every single product or service. Give each one a clear description, quantity, the price per unit, and the total for that line item. Be specific!

- The Bottom Line: Clearly show the subtotal, any taxes that might apply (like VAT), shipping costs, and the final grand total. Don't make your client do the maths.

- Payment Terms: If you need a deposit or have certain payment conditions, this is the place to state them. For example, "50% deposit required to commence work."

By including all these key elements, your proforma invoice becomes much more than just a price list. It acts as a comprehensive agreement-in-principle that sets clear expectations for both sides. This kind of clarity is the first step towards a smooth financial workflow, long before a tool like Mintline even gets involved to match the final paid invoice to its bank transaction.

How Proforma Invoices Fit Into Your Workflow

Knowing what a proforma invoice is and when to use it is one thing. But figuring out where this unofficial document actually fits into a busy workflow? That's the real challenge. Since it’s not a final, legally binding bill, how do you handle it without messing up your official accounting records?

The trick is to treat the proforma as a pre-accounting document. It belongs in your sales pipeline or quoting system, not your accounts receivable ledger. This separation is crucial. If you mix proformas with final invoices, you’ll artificially inflate your revenue figures and create a massive headache when it comes time for reconciliation.

Think of it as a draft—an agreement in principle that lives outside your formal books until the deal is sealed.

From Proforma to Paid: The Full Cycle

The journey from a simple quote to a final, settled payment has a few key milestones. A proforma invoice gets the ball rolling by making sure everyone is on the same page about the terms before any real commitment is made.

Once your client gives the proforma the green light, the real work begins. You deliver the goods or perform the service you promised. Only then does the document get promoted to a commercial invoice—the official, legally binding request for payment that you log in your books. This conversion is the critical handoff from the sales process to your accounting workflow.

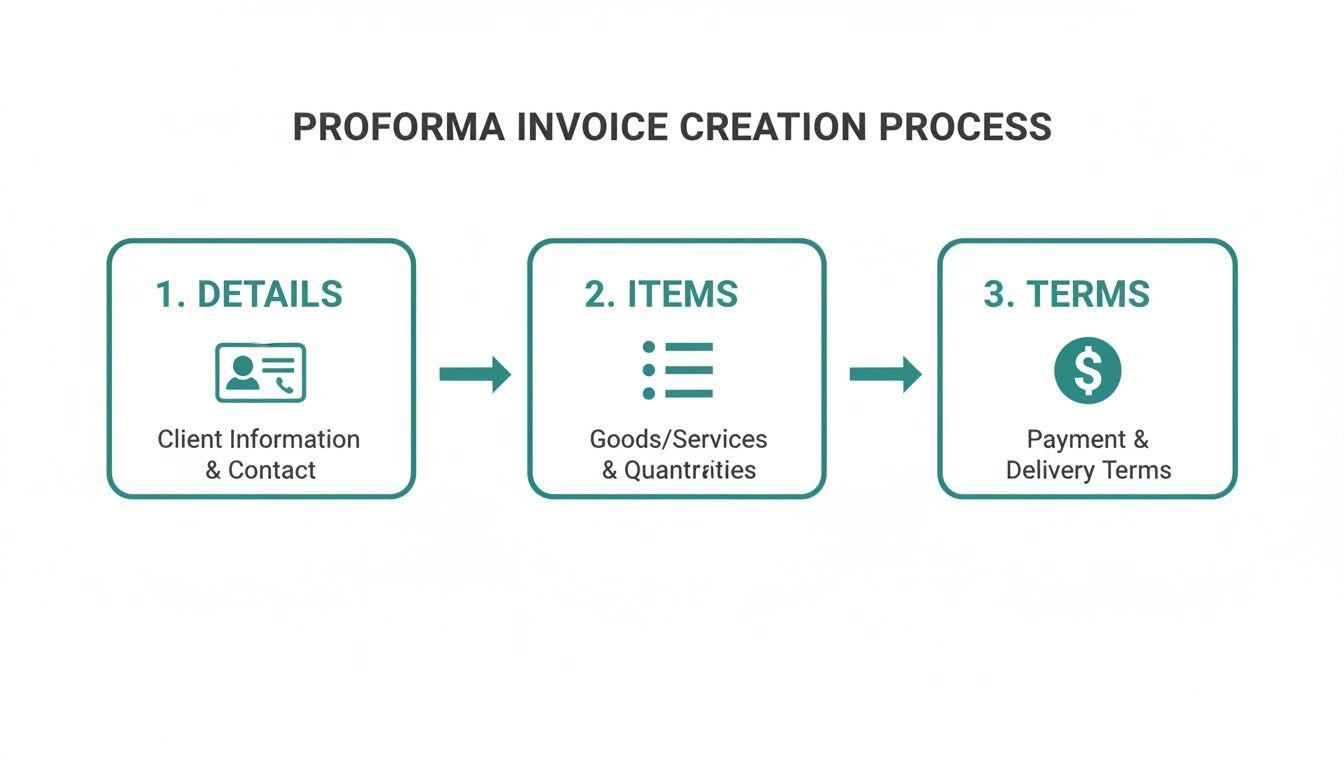

Creating the initial proforma is pretty straightforward, as the process below shows.

As you can see, a solid proforma starts with clear contact details, itemises everything you're offering, and lays out the terms. It really just sets the stage for a smooth transaction down the line.

Automating the Final, Critical Step

The last piece of the puzzle is connecting the payment to the final commercial invoice. This final step, known as reconciliation, is often the most tedious and error-prone part of the entire workflow. Manually digging through bank statements to match payments with the right invoices can eat up hours, especially if you’re juggling a high volume of transactions.

This is exactly where a platform like Mintline makes a world of difference. Once the commercial invoice is paid, Mintline’s AI-powered system kicks in. It automatically links the bank transaction to its corresponding invoice, so you can say goodbye to manual matching and messy spreadsheets.

By automating the final reconciliation step, you create a seamless and complete audit trail. This links the initial agreement (the proforma) to the final bill (the commercial invoice) and the settled payment, ensuring total accuracy and transparency.

This kind of automation closes the loop, turning what was a disjointed workflow into an efficient, connected system. To manage your proforma invoices and other financial documents well, picking the right tools is a big deal. You can find some great resources on selecting the best accounting software to support your workflow.

What's more, bringing in automation tools doesn't just save you a ton of time; it also dramatically cuts down on the risk of human error. For any business looking to grow, adopting automated invoicing software is a smart next step. By creating a clear path from proforma to reconciled payment, you can get back to focusing on your business instead of getting buried in admin.

Answering Your Top Questions on Proforma Invoices

Alright, let's clear up some of the common head-scratchers people have about proforma invoices. Getting these details right can save you a lot of confusion, especially if you're freelancing or running a small business.

Is a Proforma Invoice a Legal Contract?

In a word, no. A proforma invoice is not a legally binding contract. Think of it more like a handshake agreement on paper—a good-faith estimate that lays out what a potential sale will look like. Your client isn't obligated to pay you just because you've sent one.

It's the precursor to a real agreement. Once everyone agrees to the terms outlined in the proforma, you move forward, and that's when a legally binding commercial invoice comes into play.

Can I Use a Proforma for My Bookkeeping?

Definitely not. Proforma invoices have no place in your official accounting records. You can't use them to record sales or track who owes you money because, at this stage, no money is officially owed. The deal isn't done yet.

Think of proformas as living outside your official books, in your sales pipeline or quoting system. They only cross over into your accounting world once the job is done and you issue a final, commercial invoice.

Keeping them separate is key to accurate financial reporting. If you want to dive deeper into what gets logged in your books, our guide on the difference between accounts payable and accounts receivable is a great place to start.

When Does It Turn Into a Commercial Invoice?

The switch happens the moment your client gives you the green light on the terms, and you've delivered the goods or finished the work. That's your cue to issue the final commercial invoice (sometimes called a tax invoice).

This final document is the real deal. It’s the official demand for payment that you’ll record in your accounting software, and it creates the legal requirement for your client to pay up.

How Does Mintline Fit Into This?

While the proforma itself doesn't involve a payment, it's the first step in a process that ends with a final bill and money in your bank account. Once that final commercial invoice is paid, Mintline's AI gets to work, automatically finding that invoice and matching it to the payment that just landed in your bank feed.

It completely takes manual reconciliation off your plate. Your books stay accurate, up-to-date, and ready for anything—no frantic searching required.

Ready to stop chasing receipts and close your books faster? Mintline uses AI to automatically link every bank transaction to its corresponding invoice or receipt, turning hours of monthly admin into just a few minutes. See how Mintline can automate your financial workflow today.