Choosing Your First AP Automation Solution

Tired of manual invoices? Discover how an AP automation solution transforms your workflow. Learn key features, benefits, and how to choose the right platform.

At its core, an AP automation solution is software designed to streamline the entire accounts payable journey—from the moment an invoice lands in your inbox until the final payment is sent. It handles the tedious, repetitive work with minimal human intervention. Think of it as a digital specialist for your finance team, like Mintline, which automatically links bank transactions to receipts, clearing away the manual reconciliation so your team can focus on strategic financial management.

Understanding AP Automation in Today's Business

Picture your accounts payable department as a busy kitchen during the dinner rush. A manual process is like one chef frantically trying to cook every single order by hand. It's chaotic, slow, and almost guarantees a few mistakes will slip through. An AP automation solution, on the other hand, is like a fully staffed, well-oiled kitchen team. Each part of the process is handled efficiently, turning a potential bottleneck into a smooth workflow.

This technology isn't just another program to install; it’s a genuine partner in your business strategy. It captures, processes, approves, and pays invoices digitally, transforming what used to be a tedious administrative chore into a wellspring of efficiency. For any growing business feeling buried under a mountain of paperwork, this change is a game-changer.

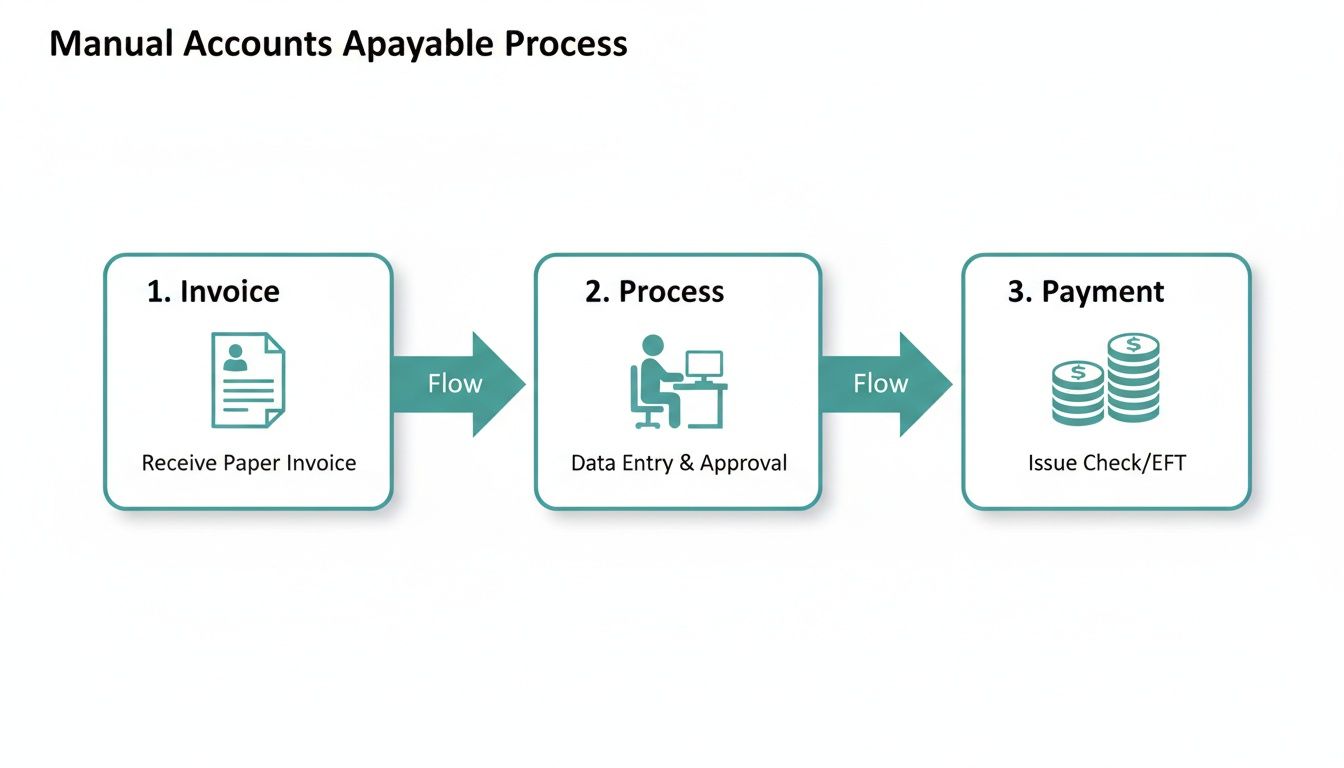

The Problem With Manual AP

To really get why AP automation is so important, you first have to understand the headaches of the traditional accounts payable workflow. The old way is riddled with problems that can seriously slow a business down.

- Time-Consuming Data Entry: Manually typing in invoice details isn't just mind-numbingly slow; it's a breeding ground for human error. One tiny typo can result in paying the wrong amount and create hours of frustrating clean-up work.

- Lost or Delayed Invoices: Paper invoices have a nasty habit of getting lost in the mail, misplaced on someone's desk, or stuck waiting for an approval signature. This leads directly to late payment fees and can sour relationships with your suppliers.

- Lack of Visibility: Without a central system, trying to figure out the status of an invoice is nearly impossible. This guessing game makes forecasting your cash flow a nightmare and turns audit season into a major ordeal.

How Automation Provides a Solution

An AP automation solution tackles these problems head-on. A platform like Mintline, for instance, uses AI to automatically link every bank transaction to its corresponding receipt. That single feature eliminates countless hours of manual matching and wrestling with messy spreadsheets. Instead of chasing paper trails, the system does the heavy lifting for you, creating a perfect audit trail effortlessly.

By automating these routine tasks, finance teams get their time back. They can redirect their expertise toward activities that actually drive growth, like financial analysis and strategic planning. The focus shifts from just processing transactions to providing valuable insights.

This transition from manual to automated isn't just a nice-to-have anymore; it's becoming a necessity. The global market for this technology reflects a worldwide shift in thinking. Valued at roughly USD 6.98 billion in 2025, it's projected to hit USD 7.95 billion in 2026, growing at a compound annual rate of 13.9%. This growth highlights just how critical it is for businesses to modernise their AP processes if they want to stay competitive. You can read more about these accounts payable automation trends and see exactly why so many businesses are making the switch.

So, How Does AP Automation Actually Work?

To really get why an AP automation solution is such a game-changer, you have to look under the bonnet. It’s not just one magic button; it's a series of smart, connected steps that turn a messy pile of invoices into clean, organised financial data. Think of it like a highly efficient assembly line, where each stage adds value and ensures nothing gets missed.

The whole process kicks off the moment an invoice lands in your business—except it no longer gets lost in a physical inbox or a crowded email chain. Instead, it’s funnelled straight into a digital workflow where the real work begins.

Digital Invoice Capture

First things first, the system needs to read the invoice. This is where a technology called Optical Character Recognition (OCR), powered by AI, comes into play. It acts like a super-smart assistant that can instantly read any invoice, no matter the format. Whether it's a PDF from a supplier's system or a photo of a paper receipt snapped on a phone, the software gets to work extracting the critical details.

- Vendor Name: The software figures out who sent the bill.

- Invoice Number: It grabs that all-important unique reference number.

- Due Date: The payment deadline is immediately logged.

- Line Items and Totals: Every financial detail is digitised with incredible accuracy.

Platforms like Mintline use this tech not just for invoices but for bank statements too, creating a rock-solid data foundation from the get-go. This is the core of it all: turning unstructured documents into structured, usable data. If you want to dive deeper into the mechanics, you can learn more about automated document processing and see how it applies across a business.

This flowchart shows just how complicated the old-school manual process is, highlighting all the bottlenecks automation is designed to fix.

You can see how delays and errors easily creep in at every single step, from the moment an invoice arrives to the final payment.

Automated Three-Way Matching

Once the invoice data is captured, the system puts on its security hat. It performs automated three-way matching, a crucial check that confirms an invoice is legitimate before it goes any further. The software cross-references the invoice against two other key documents in your system:

- The Purchase Order (PO): Does the bill match what your company agreed to buy in the first place?

- The Goods Receipt Note: Did you actually receive the items or services listed on the invoice?

When the invoice, the PO, and the receipt all line up perfectly, the system gives it a green light. It’s a simple but powerful check that stops overpayments, duplicate bills, and even fraud in its tracks. If something doesn't match, the system flags it for a human to look at. No bad data gets through.

Intelligent Approval Workflows

With the invoice verified, it needs to get the sign-off from the right person. Manually, this means chasing managers for signatures, which is a notorious time-waster. An AP automation solution completely transforms this with smart, customisable approval workflows.

You can create rules that automatically send invoices to the right approver based on things like department, project, or cost. For instance, any invoice over £5,000 could go to a department head, while smaller ones get approved by a team lead.

This keeps the momentum going. Managers get a notification, review the details, and can approve payments with a click—even from their phone. Invoices stop getting stuck on people's desks. For a practical look at setting this up, it’s worth reading a guide on how to automate your accounts payable process.

Seamless Accounting Software Integration

The final piece of the puzzle is making sure everything talks to each other. A standalone tool just creates another silo of information. A proper AP automation solution integrates directly with the accounting software you already use.

As soon as an invoice is fully approved, all the verified data is automatically pushed into your general ledger. This completely removes the need for manual data entry—a process where a staggering 88% of spreadsheets contain errors. By syncing clean data straight to your financial records, automation keeps your books accurate, up-to-date, and always ready for an audit. It’s the final step that closes the loop, creating one smooth, efficient system from start to finish.

The Real-World Benefits of Automating Accounts Payable

It’s one thing to understand the technical side of an ap automation solution, but what really matters is how those features translate into actual business growth. The true value isn't found in the software itself, but in the ripple effect it has on your bottom line, your team’s day-to-day, and the overall financial health of your company. When you break it down, the benefits really stack up across three core areas: serious cost savings, a major boost in efficiency, and rock-solid accuracy.

Unlocking Dramatic Cost Savings

The first and most obvious win from automation is the drop in processing costs. Manual AP is full of hidden expenses that quietly bleed your resources. Just think about the hours your team spends on mind-numbing tasks like typing in invoice data, matching documents, and chasing people for approvals. Those are direct labour costs that automation all but eliminates.

Then there are the physical costs: paper, ink, postage, and filing cabinets (or even off-site storage). They might seem small individually, but they add up. An ap automation solution moves the entire process online, making those costs practically vanish.

It's not just a small saving, either. Research shows that automating accounts payable can slash the cost of processing a single invoice by over 80%. If you’re handling hundreds or thousands of invoices a month, that quickly becomes a very significant figure on your P&L.

Supercharging Team Efficiency

Time is your most precious resource, and manual AP is a notorious time thief. Automation hands that time back to you and your team. Invoices can fly from receipt to payment in a matter of days, not weeks. This speed isn't just about clearing a backlog; it opens the door to real financial strategy.

For example, paying suppliers faster means you can finally start capturing those early payment discounts. A typical 2% discount for paying in 10 days might not sound like a game-changer, but over a year, it can mean thousands of pounds in savings. On top of that, paying on time builds much stronger relationships with your suppliers, which can lead to better terms and more flexibility when you need it most.

Take Sarah, a small business owner who used to lose her weekends to a mountain of receipts, painstakingly matching them to bank statements. After adopting an ap automation solution like Mintline, that entire chore was automated. She got her weekends back and, more importantly, could finally focus her energy on growing the business instead of getting bogged down in spreadsheets.

Achieving Ironclad Accuracy and Compliance

Let’s face it, human error is inevitable in any manual process. One mistyped digit on an invoice can lead to an overpayment that’s a pain to claw back or an underpayment that sours a supplier relationship. Automation minimises these risks by taking human hands off the keyboard during data entry and validation.

Automated systems are built for precision, ensuring every bit of data is captured correctly from the start. This obsession with accuracy brings a few key advantages:

- Eliminates Costly Errors: It catches duplicate payments and other common mistakes that can quietly drain your profits.

- Creates a Perfect Audit Trail: Every single action—from the moment an invoice arrives to the final approval for payment—is digitally logged and time-stamped. This creates a transparent, searchable record that makes audit season a breeze instead of a nightmare.

- Enhances Financial Visibility: With accurate, real-time data, you get a crystal-clear picture of your company's liabilities at any moment. This allows for much sharper cash flow forecasting and smarter financial decisions.

By turning your AP department into a reliable, error-free machine, automation gives you the peace of mind that comes from knowing your financial records are always accurate and compliant.

What to Look for in a Modern AP Automation Solution

Let's be clear: not all automation platforms are created equal. When you start shopping for an AP automation solution, you’ll find a huge range of options, each with its own bells and whistles. To pick the right one, you need a solid checklist of the features that separate a basic tool from a genuine financial partner.

These core capabilities aren't just about paying invoices faster. They're about giving you real control, clear visibility, and unshakable confidence in your entire financial operation.

AI-Powered Data Capture

The heart of any great AP automation solution is its ability to read and understand documents without a human needing to type anything. This is where Artificial Intelligence, specifically Optical Character Recognition (OCR), comes into play. But you need more than just basic OCR; a modern system uses AI that actually learns and gets smarter over time.

Think of it like hiring a new junior accountant. At first, they might need some guidance, but with every invoice they process, they get better. The system starts to recognise the specific layouts and quirks of your different suppliers, which means higher accuracy and far less need for manual review. This is absolutely critical for dealing with the messy variety of invoice formats every business receives.

This kind of intelligent data capture is a core part of how a platform like Mintline operates, using AI to instantly pull key details from receipts and bank statements, ensuring your data is clean right from the start.

Customisable Approval Workflows

Your business has its own unique structure, and your approval process should match it. A rigid, one-size-fits-all workflow just creates friction. A top-tier AP automation solution must offer flexible, customisable approval chains.

This means you should be able to build rules that automatically send invoices to the right person for a signature. For example:

- By Department: Marketing invoices shoot straight to the Head of Marketing.

- By Amount: Any invoice over £10,000 automatically requires the CFO's sign-off.

- By Project: Bills tied to a specific client project are routed directly to that project manager.

This kind of flexibility prevents bottlenecks and ensures approvals happen fast, without anyone having to chase down the right person.

A truly effective system doesn't force you to change how you work. Instead, it moulds itself to your existing processes, simply digitising and accelerating them for maximum efficiency.

Real-Time Financial Dashboards

Ever find yourself scrambling to answer questions like, "What's the status of that big supplier payment?" or "How much cash do we have committed for next month?" With manual AP, getting those answers is a painful, time-consuming dig through spreadsheets and emails.

A modern AP solution gives you a real-time dashboard that acts as a command centre for your finances. This single screen gives you immediate visibility into the entire accounts payable lifecycle. You can see which invoices are pending, which are approved, and which are scheduled for payment. It's not just a reporting tool; it’s a strategic asset for managing cash flow and making sharp financial decisions on the fly. You always know exactly what you owe and when.

Robust System Integration

An AP tool that can't talk to your other financial software creates more work than it saves. It’s essential that your chosen solution integrates smoothly with your existing accounting system, whether that's Xero, QuickBooks, or another platform.

This two-way connection ensures that once an invoice is approved, all the data flows directly into your general ledger without anyone having to re-key it. This closes the loop, creating a seamless and efficient purchase-to-pay process. By making sure your tools communicate, you build a stronger financial ecosystem. To see how this fits into the bigger picture, it's worth exploring the details of a modern purchase-to-pay software setup.

Uncompromising Security

Last but certainly not least, you’re entrusting this platform with your most sensitive financial data. Security isn't a feature; it's a prerequisite. Look for solutions that offer enterprise-grade protection as standard.

Here are a few key security elements to check for:

- Data Encryption: Your data should be protected both in transit and at rest, using strong standards like AES-256.

- Secure Hosting: The platform should use reputable cloud infrastructure providers.

- Data Privacy Policies: Look for clear policies on data ownership. For instance, Mintline ensures all data is hosted securely within the EU and is never shared with third parties.

Choosing an AP automation solution with these essential features will lay a strong foundation for a more efficient, accurate, and secure financial future for your business.

How to Choose the Right AP Automation Partner

Picking an AP automation solution isn’t just about buying a piece of software. It’s about finding a long-term partner who will be there as your financial operations grow and change. The best partner gives you more than a list of features; they deliver a platform that scales with your business, an experience your team actually enjoys using, and security you don't have to think twice about.

Choosing wisely means looking beyond the slick marketing and focusing on what really matters for your company. Let’s break down how to evaluate potential vendors and find a partner whose technology and support genuinely line up with your goals.

Evaluate True Scalability

Scalability is more than just handling a higher volume of invoices. Real scalability means the solution can adapt as your business evolves—from a one-person-show tracking a few expenses to a full finance department managing intricate approval chains. The platform you choose today needs to be the platform that still works for you in three years.

You need to ask potential partners some tough questions about their growth path:

- Tiered Plans: Do they have flexible plans? Can you start small and add features as you grow? For example, a platform like Mintline offers everything from a free plan for freelancers to comprehensive enterprise options.

- Performance Under Load: How does the system hold up when it’s processing thousands of transactions a month, not just a few hundred? Ask for proof.

- Feature Evolution: What does their product roadmap look like? A good partner is always investing in their platform to solve tomorrow's problems, not just today's.

A truly scalable AP automation solution saves you from the massive headache of a forced migration down the road, just because you became too successful for your initial tool.

Prioritise the User Experience

Let's be honest: the most powerful software is worthless if your team hates using it. Getting everyone on board is the only way to see a real return on your investment, and that all comes down to an intuitive user experience (UX). A clunky, confusing interface will lead to mistakes, low adoption, and your team eventually going back to their old spreadsheets.

A great UX should feel clean, logical, and require almost no training. As you look at different platforms, put yourself in your team's shoes. Can they find what they need on the dashboard, approve invoices, and export data without digging through a user manual? Solutions like Mintline have zeroed in on this, creating a simple review screen that turns a painful reconciliation chore into a quick confirmation of smart suggestions.

The goal is to find a platform that feels less like a chore and more like a helpful assistant. It should reduce friction, not create it, empowering your team to work faster and with greater confidence.

Scrutinise Security and Compliance

When you’re dealing with financial data, there’s simply no margin for error. Security and compliance are absolute deal-breakers. Your AP automation partner must have an ironclad commitment to protecting your company's most sensitive information, and you need to ask very direct questions to confirm it.

Start with the basics of data protection:

- Data Encryption: Is all your data—whether it's in transit or sitting on a server—protected with robust encryption like AES-256?

- Data Residency: Where is your data physically stored? For any business in the Netherlands or the wider EU, keeping data hosted within the European Union is often a must for GDPR compliance.

- Privacy Policies: Does the vendor have a rock-solid, transparent policy that they will never share or sell your data?

Platforms like Mintline are built on a foundation of trust, using secure AWS hosting right here in the EU and guaranteeing your data remains yours, and yours alone. Choosing a partner who is open and serious about security lets you focus on your business, knowing your financials are in safe hands.

Taking the Plunge: Your Step-by-Step Guide to AP Automation

Making the switch to an automated system can feel like a massive undertaking, but it doesn't have to be. By breaking the project down into a clear, manageable roadmap, you can make the transition smooth and start seeing results fast, all without throwing your daily operations into chaos.

Think of it less like flipping a switch and more like a carefully planned journey. The goal is a thoughtful transition that brings your team on board and sets your finance department up for long-term success.

Step 1: Get to Know Your Current Process (The Good, The Bad, and The Ugly)

Before you can improve your process, you need to understand it inside and out. Start by mapping your entire accounts payable workflow, from the moment an invoice arrives to the final payment confirmation. This is where you need to be brutally honest.

Where do invoices consistently get stuck? Which tasks are eating up the most time and manual effort? Pinpointing these friction points does two crucial things: it helps you choose a solution that actually solves your real-world problems, and it gives you a clear baseline to measure your success against later on. This initial deep dive is the foundation for everything that follows.

Step 2: Rally the Troops and Build Buy-In

Let's be clear: the most powerful software on the planet is useless if your team doesn't want to use it. Don't just announce a new system out of the blue. Instead, get your people genuinely excited about what’s changing for the better.

Frame the new ap automation solution not as a threat, but as a tool to eliminate the most tedious parts of their jobs. Show them how it will liberate them from mind-numbing data entry and the endless chase for approvals, freeing them up to focus on more strategic work that actually adds value. When your team sees automation as a way to make their own work lives better, adoption happens naturally.

Pro Tip: Start small to win big. Kick things off with a pilot programme in a single department or for a specific invoice type. This lets you iron out any kinks on a smaller scale, prove the value quickly, and create enthusiastic champions who can help drive the company-wide rollout.

Step 3: Plan Your Data and People Strategy

With your chosen solution ready to go, it’s time to get into the nuts and bolts. Work closely with your new provider to create a solid plan for migrating all your essential information—vendor details, open invoices, and payment histories—into the new system. A good partner will guide you through this to make it as painless as possible.

At the same time, get training sessions on the calendar. Modern platforms like Mintline are built to be user-friendly, but a proper walkthrough ensures everyone feels confident from the get-go. Investing in good training flattens the learning curve and helps your team start capitalising on the new system's power immediately, giving you a faster return on your investment.

Frequently Asked Questions About AP Automation

It's completely normal to have questions when you're looking at new technology, especially when it involves your company's finances. To help you feel confident about your decision, we've put together straightforward answers to the questions we hear most often about AP automation.

Is an AP Automation Solution Secure?

Absolutely. Any serious platform in this space is built with security as its foundation. They use tools like end-to-end encryption, often AES-256, to keep your data safe whether it's being sent or just sitting on a server. The best providers also use highly secure cloud infrastructure.

For example, a platform like Mintline stores all sensitive financial information on secure AWS servers located within the EU. It also has a strict policy against ever sharing your data with third parties, so you can be sure your information stays yours.

Will AP Automation Replace My Accounting Team?

Not at all—the goal is to empower them. An AP automation solution is designed to handle the tedious, repetitive work that bogs your team down, like manual data entry, matching documents, and chasing approvals. This doesn't make your finance professionals obsolete; it makes them more strategic.

By freeing your team from administrative overload, you unlock their true potential. They can shift their focus to high-value work like financial analysis, more accurate budget forecasting, and optimising cash flow. They move from being data processors to strategic advisors for the business.

Can a Solution Be Customised for Our Unique Process?

Yes, flexibility is key. Modern AP automation software is designed to mould itself to your specific ways of working, not force you into a one-size-fits-all system that doesn't quite fit.

You should look for features like customisable approval workflows, flexible data export options that match your reporting style, and solid integrations with the tools you already use. This adaptability ensures the AP automation solution slots right into your existing processes, just making them faster and more reliable.

Ready to eliminate manual receipt matching and close your books in minutes, not hours? Discover how Mintline uses AI to automatically link every bank transaction to its receipt, giving you a perfect, audit-ready trail with zero effort. Get started for free with Mintline.