Automated document processing: Boost Financial Workflows with AI

Automated document processing accelerates finance workflows, reduces manual data entry, and boosts accuracy with AI-powered tools.

Let's face it: matching receipts and invoices to bank statements by hand is a soul-crushing, chaotic task. Automated document processing takes that entire mess and turns it into a quick, accurate digital workflow. It’s all about using smart technology like Mintline to read, understand, and organise your financial paperwork for you, cutting hours of tedious sorting down to a few minutes of simple review. For any modern business that values its time and accuracy, this isn't just a nice-to-have; it's essential.

Why Manual Reconciliations Are a Thing of the Past

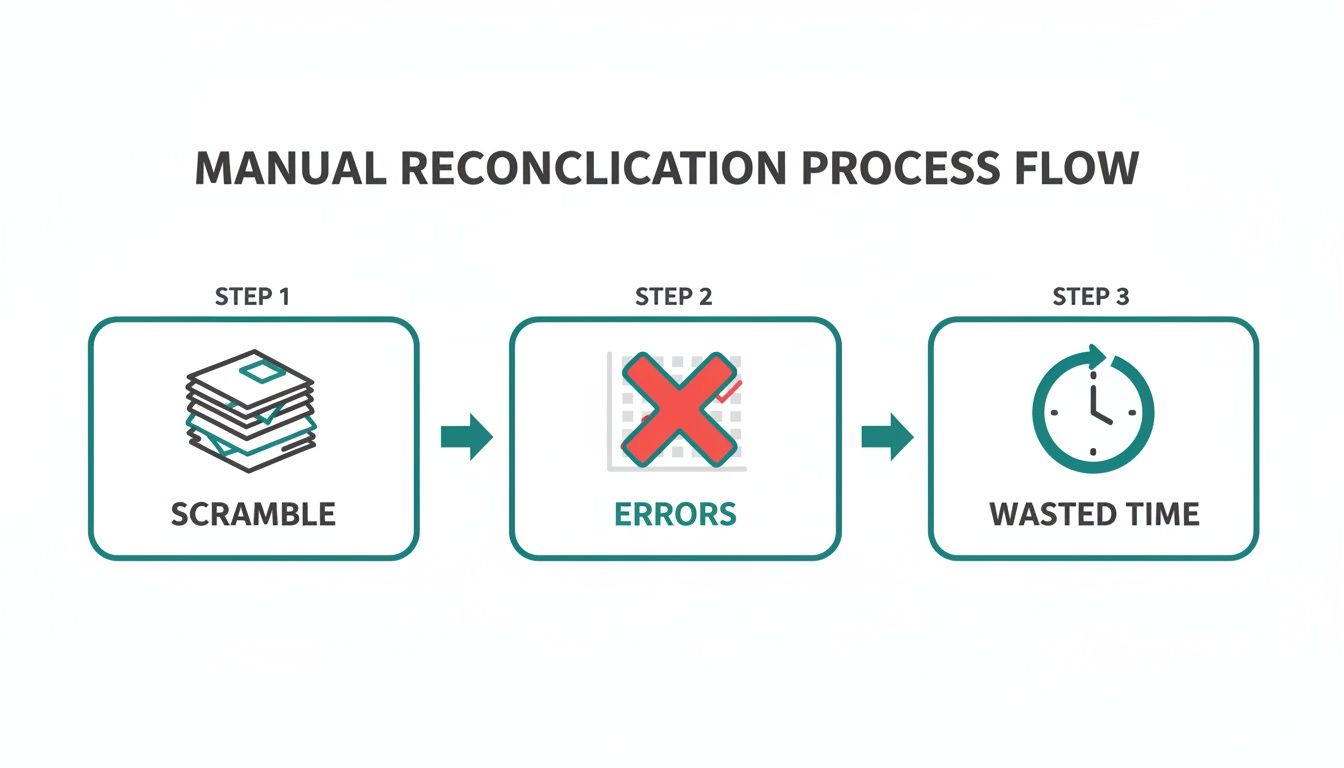

Picture the end of the month. For so many freelancers, startup founders, and even seasoned finance teams, it's a familiar feeling of dread. You're hunting for lost receipts, squinting at endless spreadsheet rows, and painstakingly matching every single transaction to a piece of paper. This old-school method isn't just slow—it's a massive drain on your most valuable resource: time.

This manual grind is packed with problems that can seriously hurt a business. When you're dealing with mountains of data, human error is almost a guarantee, leading to expensive mistakes that take even more time to track down and fix. All those hours that could have gone into growing the business, planning strategy, or talking to clients are swallowed by administrative busywork. For any company trying to scale, it’s a bottleneck you simply can't afford.

The Universal Pain Points of Manual Matching

Whether you're a one-person shop or part of a big finance department, the frustrations are the same. The real headaches with handling documents by hand boil down to a few key issues:

- Lost or Missing Documents: Paper receipts have a knack for disappearing, which leads to messy financial records and potential trouble with compliance.

- Costly Human Errors: One simple typo during data entry can wreck an entire report, creating a massive headache to correct. It’s well-known that manual data entry is full of errors, which directly undermines your financial accuracy.

- Wasted Productive Hours: Every hour you spend on manual reconciliation is an hour you can't spend on what actually makes your business money. This administrative burden is a direct hit to your bottom line.

This is exactly where automated document processing comes in. Think of it as your dedicated digital finance assistant. Instead of you sifting through piles of paper, the system does all the heavy lifting.

By automatically creating a link between a bank transaction and its matching document, platforms like Mintline get rid of the root cause of these problems. Our technology builds a bridge, flawlessly connecting your financial activity to its paper trail without you having to lift a finger.

For example, with Mintline, you just upload your bank statements and receipts. Our system is smart enough to read each line item and then automatically scan your documents to find the perfect match based on the vendor, date, and amount. It's a simple idea with a powerful impact, completely changing how businesses manage their financial records.

How Automated Document Processing Actually Works

Let's pull back the curtain and look at how automated document processing really gets the job done. It might sound like a black box of complex technology, but it’s actually a logical, three-stage process. Think of it as a digital assembly line: a document goes in one end, and a perfectly matched, organised record comes out the other.

Imagine you just received a PDF receipt from a supplier. The old way? You’d have to open the file, squint at the key details, hunt down the matching transaction in your bank feed, and then manually type everything into a spreadsheet. With a platform like Mintline, that entire chain of events happens automatically in the background.

Stage 1: The System Learns to Read

First things first, any automated document processing system needs a pair of eyes. This is where Optical Character Recognition (OCR) comes in. OCR technology is what allows the software to scan a document—whether it’s a PDF or an image—and convert the picture of the text into actual, machine-readable characters.

It’s essentially translating a photo of words into text a computer can process and analyse. When you upload a receipt to Mintline, our OCR engine immediately gets to work, reading everything from the supplier’s name to the VAT number and the final total.

Stage 2: The Brain Makes Sense of It All

Okay, so now we have a string of text and numbers, but without context, it’s just digital noise. The next stage is all about adding intelligence to the mix. This is where Machine Learning (ML) steps in, acting as the system’s brain.

Mintline’s ML models have been trained to do more than just read; they understand. The system doesn't just see "€121.00"; it recognises this as the total amount. It knows that "BOL.COM" is the supplier and "24-10-2024" is the transaction date. This is what separates simple OCR from true, intelligent automation.

The real power of machine learning is that it gets smarter over time. Every document you process in Mintline teaches the system a little more about different layouts and formats, constantly improving its accuracy.

This feedback loop means the platform adapts to the specific documents your business uses, from a simple till receipt to a complex, multi-page invoice. If you want to get into the nitty-gritty, you can explore more about the fundamentals of intelligent document processing and how it turns chaos into clarity.

This is the chaos we’re talking about—the old manual process that automation leaves behind.

That flowchart is a perfect snapshot of the scramble, the human error, and the sheer amount of time that manual work burns through.

Stage 3: The Final Click That Connects Everything

Once all the key data has been extracted and understood, the final step is to put it to work. The system now performs intelligent matching, using the information it pulled from the document to find its other half: the corresponding bank transaction.

Mintline’s algorithm instantly scans your connected bank feeds, looking for a transaction that lines up with the receipt's data points:

- Amount: It’s looking for a debit of exactly €121.00.

- Date: It searches for a payment made on or around 24-10-2024.

- Supplier: It checks for a transaction description that includes "BOL.COM".

When it finds a perfect match, the system automatically links the receipt to the bank transaction. That’s it. The loop is closed. You’ve just turned a piece of digital paperwork into a complete, verified, and audit-ready financial record—without lifting a finger.

Measuring the Payback: It's More Than Just Saving Time

When we talk about automated document processing, it's easy to focus on shaving hours off administrative work. But the real value runs much deeper, impacting your company's financial health and operational agility. For businesses using platforms like Mintline, this shift means moving from a reactive, mistake-ridden process to a proactive, data-driven one.

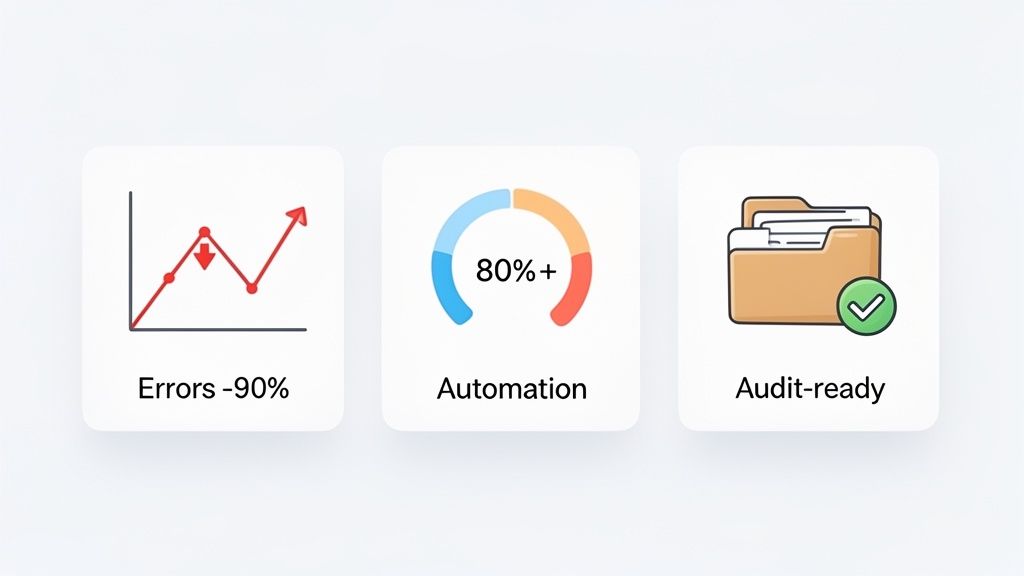

The most immediate win? A massive drop in data entry errors. Think about it: one misplaced decimal point or a misspelled vendor name can spiral into hours of frustrating reconciliation work. Automation virtually wipes out these costly manual mistakes, giving you a reliable financial foundation to build your business on.

Driving for High Automation Rates

The ultimate goal for any finance team adopting this technology is to hit a high automation rate. This number tells you what percentage of your documents are processed from start to finish without anyone needing to lay a hand on them. With a solid platform like Mintline, aiming for an automation rate of over 80% isn't just optimistic; it's entirely achievable.

An 80% automation rate means four out of every five invoices and receipts are intelligently read, matched to bank transactions, and filed away perfectly—all on their own.

That kind of efficiency is a game-changer. It frees up your team from the grind of paperwork and lets them focus on what truly matters: financial analysis, cash flow forecasting, and strategic planning. Your finance function stops being a cost centre and starts becoming a strategic partner to the business.

The Power of an Audit-Ready Digital Trail

Another huge benefit is the creation of a perfect, unbreachable digital paper trail. Every single transaction is automatically linked to its source document, building a crystal-clear record that’s always organised and instantly accessible. This isn’t just about convenience; it’s about compliance and total peace of mind.

When tax season rolls around or an auditor comes knocking, the last-minute scramble for missing receipts is a thing of the past. With Mintline, you can pull a clean, comprehensive report in a single click. For small businesses, accounting firms, and startups, this level of audit-readiness delivers incredible value and security.

The move towards intelligent automation is gathering serious momentum. Dutch companies are leading the charge, with 23% of firms (10+ employees) now using AI technologies—a major jump from the previous year. For bigger companies with over 500 employees, that figure climbs to an impressive 59.2%. The results speak for themselves: businesses are seeing their processing throughput increase by 4x to 7x. You can read more about these insights in the official CBS AI Monitor.

To see the stark contrast, let’s compare the old way of doing things with the new.

Manual vs Automated Document Processing: A Comparison

This table breaks down how a modern platform like Mintline transforms the traditional, manual workflow into a streamlined, intelligent process.

| Metric | Manual Processing | Automated Processing (with Mintline) |

|---|---|---|

| Data Entry | 100% manual. Prone to typos, misspellings, and incorrect data. | Over 95% automated extraction. Our AI captures data with superior accuracy. |

| Error Rate | High. Small mistakes can cause significant reconciliation issues. | Reduced by up to 90%. Built-in validation checks flag potential errors. |

| Processing Time | Minutes per document. A slow, tedious process that scales poorly. | Seconds per document. Handles high volumes effortlessly, 24/7. |

| Document Matching | Manual search and match against purchase orders or bank statements. | Automated matching and bank reconciliation, all in one platform. |

| Audit Trail | Disorganised. Relies on physical files or scattered digital folders. | Always audit-ready. Every document is digitally stored and linked to its transaction. |

| Team Focus | Low-value tasks: data entry, filing, chasing paperwork. | High-value tasks: financial analysis, strategic planning, exception handling. |

| Scalability | Poor. Hiring more people is the only way to handle more documents. | Excellent. The system scales with your business growth without proportional cost. |

Ultimately, the success of your automation efforts comes down to these key metrics. They paint a clear picture of a more efficient, accurate, and compliant business operation. By focusing on error reduction, a high automation rate, and audit-readiness, you can truly grasp the powerful return this technology delivers.

Your Step-by-Step Implementation Roadmap

Bringing a new system into your workflow can feel like a massive undertaking, but it doesn't have to be. Getting started with automated document processing on a platform like Mintline isn’t a huge, disruptive project. It's really just a series of straightforward, logical steps that start paying off right away.

This roadmap will walk you through the entire process, from getting your first documents into the system to having a fully functioning, automated workflow.

It all starts with feeding the system the raw materials it needs to get to work. From there, you're on a clear path to organised, audit-ready financial records.

Step 1: Connect Your Data Sources

You can't automate what the system can't see. So, the first and most important step is getting your financial data into Mintline. Our platform gives you flexible options, so you can pick whatever works best for your current process.

There's no need to change how you already receive your bank statements. You can simply drag and drop the PDF files directly into the system. Mintline’s technology immediately gets to work, pulling out every single transaction line for processing.

For a completely hands-off approach, you can securely link your bank accounts directly. This creates an automated feed where new transactions flow right into Mintline as they happen, making sure your records are always up-to-date without you lifting a finger.

Step 2: Review Initial Processing and Matches

As soon as your data is in, Mintline's AI gets to work. It scans every document you've uploaded—like receipts and invoices—and compares them against your bank transactions. It's looking for clear connections based on the vendor name, date, and amount. This is where you get your first real glimpse of the automation kicking in.

Your job here isn't to do the heavy lifting; it's simply to review the results. You'll see a clean dashboard that organises everything into three simple categories:

- Matched: These are the slam dunks—transactions the AI has confidently linked to a document.

- Proposed: These are highly likely matches that the system flags for your quick approval.

- Unmatched: These are transactions that still need a document or require you to make a manual link.

All you have to do is confirm the AI's suggestions with a click. For anyone serious about automating their finances, understanding the strategy behind this is key. Diving into established accounts payable automation best practices can give you a much deeper insight into making these workflows even better.

Step 3: Establish a Sustainable Workflow

Once you've cleared out the initial backlog, the goal is to build a smooth, ongoing process. This step is all about managing the day-to-day flow of documents and easily handling the odd exception that naturally pops up.

A big part of a solid workflow is dealing with those exceptions. When the system can't find a match for a document, it flags it for your attention. You can quickly search for the right transaction and link it yourself. The cool part is that this simple action helps train our AI, making it smarter for next time.

Mintline’s dashboard also has powerful filters to keep you organised. You can track your progress by filtering transactions by their status (matched, unmatched), vendor, or a specific date range. This gives you a live look at where your finances stand and instantly shows you which documents you still need to chase down.

Establishing this rhythm turns that chaotic, end-of-month scramble into a simple, ongoing task. Instead of blocking out days for reconciliation, you’ll spend just a few minutes each week keeping your books perfect.

Step 4: Export Audit-Ready Records

The final step brings everything together. It's time to turn your perfectly organised data into clean, usable records for your main accounting system. With all your transactions correctly matched to their documents, you now have a complete and verified financial history.

With a single click, you can export all this data in a format that's ready to be imported directly into your accounting software. This completely removes the risk of typos and other manual entry errors that can happen at the final stage of bookkeeping. If you're curious about how Mintline handles trickier data sets, you can learn more in our guide on data extraction from tables.

This simple four-step process takes the mystery out of getting started. It shows that adopting automated document processing isn't some complex, drawn-out project, but a series of manageable steps that lead directly to major time savings, better accuracy, and complete peace of mind.

How to Choose the Right Automation Platform

Picking the right automated document processing solution is a big decision. Get it right, and you’ll boost efficiency, tighten up security, and improve your bottom line. Get it wrong, and you’re stuck with a clumsy tool that creates more problems than it solves. With so many platforms on the market, it’s crucial to focus on what really matters for your business.

This is especially true here in the Netherlands, where the appetite for this technology is exploding. The market is projected to jump from USD 55.8 million to a massive USD 334.7 million by 2030. That’s a 29.2% growth rate every single year. It’s clear that Dutch businesses are serious about automating their financial admin, and Mintline is designed to meet this demand. You can get more details on this trend from the Dutch intelligent document processing market report on Grandview Research.

Prioritise Uncompromising Data Security

Before you even think about features, start with security. This is non-negotiable. You're handing over sensitive financial data, and there’s simply no room for error. A platform worth its salt will be completely transparent about how it protects your information.

Drill down into the specifics. For example, at Mintline, we use AES-256 encryption—the same level of security your bank uses—to make sure your data is unreadable to anyone who shouldn't see it. We also host everything on secure, EU-based AWS servers, which keeps you compliant with the region's strict data privacy laws.

Assess Accuracy and User Experience

The whole point of an automation platform is to pull data from documents and match them up correctly. So, how good are its Optical Character Recognition (OCR) and matching algorithms? Ask vendors for their accuracy rates and, just as importantly, how their system copes when it sees a document layout for the first time.

But pinpoint accuracy is useless if the platform is a nightmare to navigate. Mintline is built on a clean, intuitive design. Your team will be able to:

- Quickly review and approve AI-suggested matches.

- Fix the odd exception without a five-step process.

- See what’s happening at a glance on a clear dashboard.

The goal is to free up your team’s time, not saddle them with the new chore of wrestling with a complicated system. To get a better handle on the tech behind this, take a look at our guide to the best OCR software for financial documents.

Ensure the Platform Can Scale with You

Your business isn't static, and your software shouldn't be either. The platform that works for you as a freelancer should still be the right fit when you hire your first employee or grow into a larger firm. Scalability isn’t just about processing more documents; it’s about having a flexible plan that grows alongside your business.

We designed Mintline specifically for this journey. We have everything from a free plan for those just starting out to full enterprise packages with dedicated support and Service Level Agreements (SLAs). This way, you only pay for what you use, with a clear path to scale up when you're ready.

A truly scalable solution provides a seamless growth trajectory. You shouldn't have to switch platforms and migrate all your data just because your business is successful.

Calculate Your Potential Return on Investment

Finally, any new tool has to make financial sense. Figuring out the potential Return on Investment (ROI) is the best way to build a solid business case. The easiest place to start is by estimating how much time your team currently sinks into manual document handling each month.

Let’s run a quick example.

Sample ROI Calculation:

- Hours Spent Monthly: 20 hours

- Average Hourly Rate: €40

- Current Monthly Cost: 20 hours * €40/hour = €800

- Mintline Subscription Cost: €50/month

- Time Saved with 80% Automation: 20 hours * 0.80 = 16 hours

- Monthly Savings: (16 hours * €40/hour) - €50 = €590

This simple calculation already shows a clear win, and that's before you even factor in the value of fewer errors and better compliance. When making your choice, a good guide to document management software can offer more perspective on features that directly impact compliance and ROI.

By carefully weighing these four areas—security, accuracy, scalability, and ROI—you can confidently pick a platform that not only fixes today’s headaches but is ready to support your growth tomorrow.

Where Do You Go From Here?

We’ve covered a lot of ground in this guide, walking through how automated document processing actually works, from the basic concepts right through to what it looks like in the real world. The main takeaway should be crystal clear: moving on from manual financial admin isn't just a nice-to-have for efficiency anymore. It’s become essential for any business that wants to stay sharp and competitive.

The old days of digging through shoeboxes for receipts and battling with complex spreadsheets are, thankfully, coming to an end.

This kind of technology brings three huge wins to the table. First, there's the sheer speed – what used to take days of painful month-end reconciliation can now be done in minutes with Mintline. Second is the jump in accuracy. Our AI-powered system doesn't make the same typos a human can, which saves you from costly errors. Finally, you get built-in compliance, with a perfect, audit-ready digital paper trail created for you automatically.

Moving from Admin to Ambition

For founders and finance leaders, this is about so much more than just clawing back a few hours. It’s about completely re-channelling your focus.

When you lift the weight of all that tedious administrative work, you free up your team's most valuable resources: their time and brainpower. Instead of getting bogged down verifying individual transactions, they can zoom out and work on the bigger picture—analysing cash flow, exploring new market opportunities, or fine-tuning your business model.

Platforms like Mintline are built to spark this exact change. We handle the repetitive, detail-heavy work of matching documents so you can operate at a higher, more strategic level.

That shift, from being an administrator to becoming a strategic driver, is the real power of financial automation. It’s about creating the breathing room your business needs to grow.

Ultimately, adopting automated document processing is the single best move you can make towards a more organised and robust financial future. The technology is no longer some far-off concept; it’s here, it’s accessible, and it delivers results you can see almost immediately.

Ready to see what that looks like for your business? Experience the clarity and control that comes with true financial organisation. You can start with Mintline’s free tier today and take your first step towards leaving manual reconciliations in the past.

Frequently Asked Questions

Jumping into new technology always brings up a few questions. We've gathered the most common ones we hear about automated document processing to give you clear, straight-to-the-point answers. Here’s what you need to know about how platforms like Mintline can make a real difference in your business.

How Secure Is My Financial Data?

This is usually the first question people ask, and for good reason. When it comes to financial data, security isn't just a feature; it's the foundation of everything. Top-tier platforms treat it with the seriousness it deserves.

At Mintline, for example, we secure your data with AES-256 encryption – the same standard trusted by major banks and financial institutions worldwide. All your information is stored on secure, EU-based cloud servers (AWS), so it's also protected by some of the strictest data privacy laws on the planet. This layered defence ensures your financial records are locked down tight from the moment they enter our system.

What Kinds of Documents Can I Process?

A good system has to be flexible enough to handle the mix of paperwork that lands on your desk every day. Mintline is built to manage a wide variety of financial documents with impressive accuracy.

You can expect to process all the usual suspects, including:

- Invoices from all your suppliers and vendors.

- Receipts for business expenses, whether they're digital files or scanned paper copies.

- Bank statements, even with their different layouts and formats.

Our platform accepts common file types like PDF, JPG, and PNG, so you can easily upload documents from any source. The whole idea is to bring all your financial paperwork into one clean, manageable workflow.

How Accurate Is the AI Matching?

The performance of the AI is really where the magic happens. Thanks to machine learning, Mintline is not only highly accurate right out of the box but also gets smarter over time by learning from your specific documents.

Our platform regularly hits automatic matching rates of over 80-90%. Think about that for a moment: the vast majority of your invoices and receipts are correctly paired with their bank transactions without you having to lift a finger. That’s a massive reduction in tedious manual review time.

What Happens If a Document Can’t Be Matched?

Even the smartest AI will occasionally come across something it can't match with 100% certainty. When this happens, the system doesn’t just give up. It’s designed to make fixing it simple and fast.

Unmatched documents are never lost in the shuffle. They’re flagged and set aside in a clear, easy-to-use interface, showing you exactly what needs a second look.

From there, you can quickly link the document to the right transaction. This isn't just a one-time fix. Every time you make a correction, you’re teaching our AI. It learns from your input, improving its accuracy and making it less likely to stumble on a similar document in the future.

Ready to stop drowning in paperwork and bring some real clarity to your financial workflow? Mintline offers a powerful, secure, and intuitive platform to automate your document processing from start to finish. See for yourself how much time you can get back.