Why an AI Data Entry Service Outperforms Manual Work

Discover how an AI data entry service boosts accuracy, saves time, and secures your financials. See if automation is the right move for your business.

When you hear the term data entry service, you probably picture someone manually typing details from a stack of receipts and invoices into a spreadsheet. It's the classic way of doing things, but let's be honest—it’s an old-school approach that quietly acts as a bottleneck for any growing business. At Mintline, we see this friction every day, and we've built a powerful AI platform to solve it.

The Real Cost of Old-School Data Entry

For many companies, the routine is all too familiar. Invoices and receipts pile up, either in a physical inbox or as a flood of PDFs in an email. The next step? Hiring a freelancer or pulling someone from your team to painstakingly transcribe every last number, date, and vendor name. This isn’t just a bit inefficient; it’s a direct source of operational friction.

Think of it like a librarian hand-writing the location of every single book on an index card instead of using a digital catalogue. The goal is the same—to record information—but the difference in speed, accuracy, and scale is monumental. That's the efficiency gap businesses are stuck with when they rely on manual data entry.

The Hidden Financial Drain

The most obvious expense is what you pay someone per hour. But the true financial hit comes from the hidden costs that you'll never see on an invoice. Human error is the biggest culprit. A simple typo, a misplaced decimal point, or a misread date can snowball into much bigger problems, such as:

- Inaccurate Financial Reports: Faulty data gives you a warped view of your company's financial health, leading to poor budgeting and flawed strategic plans.

- Delayed Business Decisions: When your team is stuck waiting for data to be entered and double-checked, important decisions get pushed back, costing you real opportunities.

- Wasted High-Value Time: Every hour a skilled employee spends typing out receipts is an hour they’re not spending on analysis, talking to clients, or driving growth.

The real expense of manual data entry isn’t just the labour cost; it’s the opportunity cost. It’s the strategic work that doesn't get done because your team is bogged down in administrative tasks.

The Problem with Slow Turnaround Times

In business, speed is a huge advantage. Manual processes, by their very nature, are slow. The cycle of gathering documents, assigning them out, waiting for the work to be done, and then reviewing everything for mistakes can easily stretch over days, or even weeks. This creates a constant lag in your financial reporting.

By the time you finally get a clear picture of last month’s numbers, you’re already halfway through the current one. This delay makes it impossible to react quickly to market shifts or internal performance trends. To get a real sense of this burden, just think of the common 'spreadsheet nightmare' that can now be solved with practical AI solutions for spreadsheet tasks.

Security and Compliance Vulnerabilities

Handing over sensitive financial documents for manual entry opens up some serious security risks. Emailing spreadsheets full of transaction details or giving temporary staff access to cloud folders creates multiple points of weakness. Without solid access controls and proper encryption, you're exposing your business to data breaches that can tarnish your reputation and result in hefty compliance fines.

This is exactly why modern businesses are shifting towards secure, automated platforms that sidestep these risks entirely, paving the way for a more efficient and secure way of operating.

Manual Outsourcing vs. AI Automation

When it’s time to get data entry off your plate, you’re faced with a big decision. Do you go the traditional route and hire a manual outsourcing service, or do you embrace a modern AI-powered automation platform like Mintline? Both options aim to solve the same problem, but how they get there—and the results you get—are completely different.

Let's imagine two startups to see how this plays out. "CraftCo" decides to hire a freelance data entry service to handle its invoices and receipts. Meanwhile, "ScaleUp" signs up for Mintline's AI platform. Their choices will set them on very different paths.

CraftCo finds a decent freelancer and starts sending over scans. The human touch is nice at first—the freelancer can figure out a coffee-stained receipt or make sense of messy handwriting. But the whole process is linear. It’s limited by one person’s capacity. They work set hours, so when a pile of invoices lands at the end of the month, a backlog builds up instantly.

ScaleUp, on the other hand, just uploads its documents to Mintline. The AI gets to work immediately, processing hundreds of receipts in minutes, any time of day or night. There are no office hours and no limits on capacity. This 24/7 availability gives ScaleUp a massive speed advantage right out of the gate.

Speed, Scalability, and Accuracy

For CraftCo, growing the business means hiring more people. If their sales jump by 50%, their data entry costs and management headaches grow right along with it. Every new freelancer has to be found, trained, and managed, which introduces fresh complications and more chances for mistakes. The accuracy of their financial records depends entirely on individuals who might have an off day or make a simple typo.

ScaleUp has a much different experience. As their transaction volume shoots up, the Mintline platform just handles the bigger load. The process doesn't change. The cost doesn't balloon in the same way, and the accuracy rate stays consistently high—often better than what a person can achieve with repetitive tasks. Our AI doesn’t get tired or distracted, which means the company's financial reports are always built on clean, reliable data.

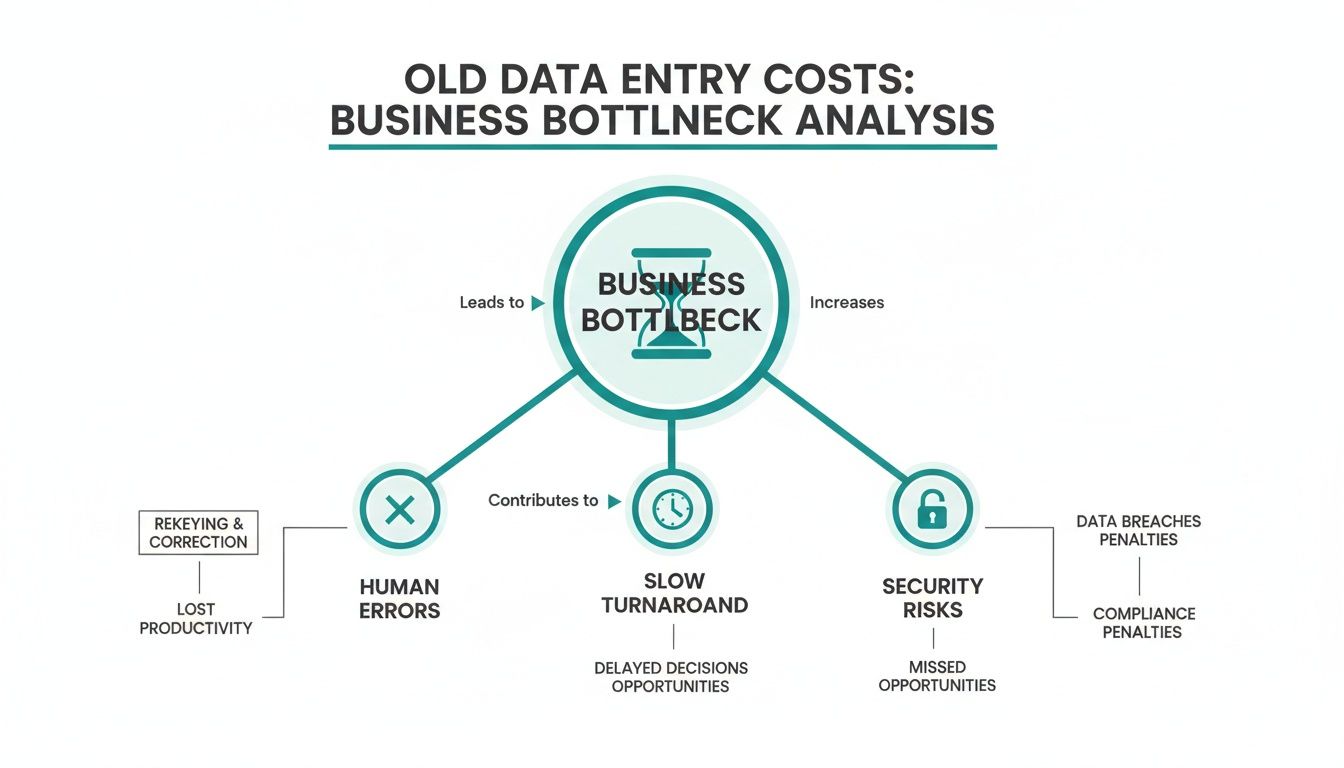

The old manual approach is full of bottlenecks that hold a business back, as this diagram shows.

It’s easy to see how manual work creates a cycle of inefficiency, where slow processing and errors feed into each other, blocking growth.

This move towards automation isn't a small trend; it's a huge shift in the market. The digital transformation market in the Netherlands, for instance, is expected to grow from USD 35.54 billion in 2025 to USD 40.17 billion in 2026. A top driver for that growth? AI and machine learning. This level of investment shows a clear move away from manual work, positioning automation as the new standard for running an efficient business.

A Clear Comparison of Approaches

Putting the two models side-by-side makes the differences even clearer. While a manual service brings a human eye to tricky documents, AI automation delivers a much stronger and more scalable foundation for any business focused on growth.

To really get into the weeds of how this technology works, our guide to automated document processing is a great next step.

Here’s a simple table to break down the key differences.

Manual Data Entry Service vs AI Automation

| Feature | Manual Data Entry Service | AI Automation (e.g., Mintline) |

|---|---|---|

| Speed | Limited by human work hours; slow turnaround for large volumes. | Near-instant processing, available 24/7. |

| Accuracy | Prone to human error, typos, and fatigue. | Consistently high accuracy, often exceeding 99%. |

| Scalability | Difficult and expensive; requires hiring more people. | Effortlessly handles increasing volume with no process changes. |

| Cost Structure | Typically per-hour or per-document; scales linearly with work. | Subscription-based; cost-effective at scale. |

| Data Security | Relies on individual and agency protocols; variable risk. | Centralised security with AES-256 encryption and access controls. |

| Operational Insight | Provides completed data files after a delay. | Offers real-time dashboards and progress tracking. |

Ultimately, the choice is no longer just about getting data entered. It’s a strategic decision between a linear, labour-based solution and an exponential, technology-based one.

For CraftCo, the manual data entry service gets the job done, but it never stops being a recurring admin chore. For ScaleUp, automation turns data entry into a smooth background process, freeing up the team to focus on what actually matters: building the business. For modern companies, it's clear that AI automation isn’t just an alternative—it’s the strategic path forward.

Calculating the True ROI of Automation

When you're weighing up data entry services, it's tempting to just compare an outsourcer's hourly rate against a software subscription fee. But that's only scratching the surface. To really understand the return on your investment (ROI) from automation, you have to look at the whole picture—including all the hidden costs that come with manual work.

Think about it. The cost of manual data entry isn't just the freelancer's invoice. It's also the time your team spends managing them, the endless email chains, and, crucially, the cost of fixing human errors. A single misplaced decimal or typo can take hours to hunt down, quietly draining your resources.

On the other hand, an AI-powered platform like Mintline works on a predictable subscription. That fee covers all your processing, so you can say goodbye to the volatile costs of manual labour. The real win, though, is the ripple effect of efficiency it creates across your entire operation.

Measuring What Truly Matters

To grasp the ROI of automation, you need to measure the value of reclaimed time and the sheer speed it gives your operations. These aren't just fluffy benefits; they directly beef up your bottom line.

Here’s how you can start putting numbers to these gains:

- Founder and Leadership Time: How many hours are you or your senior people sinking into admin instead of strategy? Getting that time back is probably the single biggest return you'll see.

- Faster Month-End Closing: How much quicker can you get your books closed? Having accurate financial reports a week earlier means you can make smarter decisions, faster. That's a huge competitive edge.

- Reduced Error Correction: Think about the hours your team currently wastes chasing down typos and mismatched numbers. Automation all but eliminates this, freeing up your finance experts for more valuable work.

The most powerful ROI comes from shifting your team's focus from mind-numbing chores to strategic initiatives. It turns your finance function from a necessary expense into an engine for growth.

A Practical ROI Calculation

Let's break it down with a simple example. Say your finance lead spends 10 hours a month manually matching bank transactions with receipts. If their fully-loaded cost to the business is €50 per hour, that one task is costing you €500 every single month.

Annually, that adds up to a staggering €6,000 for just one repetitive job.

Suddenly, the financial argument becomes crystal clear. The annual subscription for Mintline is often just a fraction of that cost, offering an immediate and significant return. And remember, the platform doesn't just do the task—it does it faster and with near-perfect accuracy, which only compounds its value.

When you shift your perspective from a simple cost comparison to a holistic ROI analysis, the case for automation becomes undeniable. You're not just buying a data entry service; you're investing in a more efficient, accurate, and scalable way to run your business. For a deeper dive into how this tech is reshaping finance, check out our guide on the role of AI in accounting. It’s this strategic shift that helps modern businesses stay nimble and focused on what really matters: growth.

How Automation Strengthens Your Data Security

When you’re dealing with sensitive financial information, security isn't just a nice-to-have feature—it’s the entire foundation of trust. For any business looking at a data entry service, this has to be a deal-breaker. The problem is, traditional manual processes often create huge security gaps that fly completely under the radar.

Think about the old way of doing things. It's often riddled with risks that we've come to accept as normal. We email invoices and bank statements back and forth, give freelancers access to shared cloud drives, or rely on spreadsheets with zero access controls. Each of these steps is a potential point of failure—an opportunity for data to be mishandled, intercepted, or exposed, creating a real headache for GDPR compliance.

Automated platforms, on the other hand, are built from the ground up with a security-first mindset, specifically designed to plug these kinds of holes.

Moving From Manual Risk to Automated Defence

An automated system like Mintline takes the human element out of the most vulnerable parts of the data transfer process. Instead of attaching a file to an email and hitting send, you upload documents directly into a fully encrypted environment. Right away, you’ve shrunk your company's attack surface and gained complete control over who lays eyes on your financial data.

This isn’t just about convenience; it's a fundamental upgrade to your company’s security posture. It means that sensitive information is no longer sitting exposed in someone’s inbox or downloaded onto an unsecured personal computer.

By automating data handling, you're not just making things faster. You are actively building a more secure and resilient financial operation by design, not by chance.

The entire workflow happens inside one secure ecosystem. This centralised approach means every action is logged, access can be tightly controlled, and you have a clear audit trail—something manual methods can never truly provide.

Core Security Features of an Automated Platform

Platforms like Mintline are built on a bedrock of robust security principles to protect your data at every turn. Here’s what that looks like in practice:

- AES-256 Encryption: This is the gold standard for data protection, the same level used by banks and governments. It makes your data completely unreadable to anyone without authorisation, both when it's being stored (at rest) and when it's being sent (in transit).

- Secure, EU-Based Infrastructure: Where your data lives physically is crucial for compliance. Mintline uses secure AWS infrastructure located right here in the European Union, which guarantees your information is stored in line with strict GDPR regulations.

- No Third-Party Sharing Policy: This one is simple but critical. A firm policy of never sharing your data with third parties ensures your financial information stays confidential and is only used to process your documents.

The Netherlands data centre market, which forms the backbone for secure services like Mintline, is set to grow from USD 1.23 billion in 2024 to an incredible USD 3.39 billion by 2030. This expansion is powered by over 90% renewable energy, giving businesses access to highly secure and reliable EU-based platforms with minimal delay. You can read more about this powerful infrastructure on the Dutch News website.

Your Security Evaluation Checklist

When you're vetting any data entry service—whether it’s a manual team or an automated platform—run it through this checklist to make sure your financial data will be properly protected:

- Is my data encrypted at rest and in transit? Don't settle for anything less than a clear confirmation of strong encryption like AES-256.

- Where is my data physically stored? Make sure the data centres are located in a region that meets your compliance needs, like the EU for GDPR.

- What are your access control policies? You need to know exactly who can access your data and what kind of activity logs are kept.

- Do you share my data with any third parties? For maximum security, a clear "no" is the only acceptable answer here.

- Are you compliant with relevant data protection regulations? Look for explicit mentions of GDPR or other key standards that matter to your business.

Asking these sharp questions from the start ensures you end up with a partner who takes your data security just as seriously as you do.

Making a Seamless Switch to Automation

Thinking about moving away from cluttered spreadsheets or a manual data entry service? It might feel like a huge step, but switching to an automated platform is designed to be surprisingly painless. The whole point of Mintline is to remove friction from your workflow, not add more. It’s less about a complicated technical setup and more about a simple, powerful change to how you work.

The entire experience is built to be intuitive, so you can upgrade your operations without a massive learning curve. Forget about drawn-out implementation projects or technical hand-holding. You can be up and running in minutes, using the very same documents you already have.

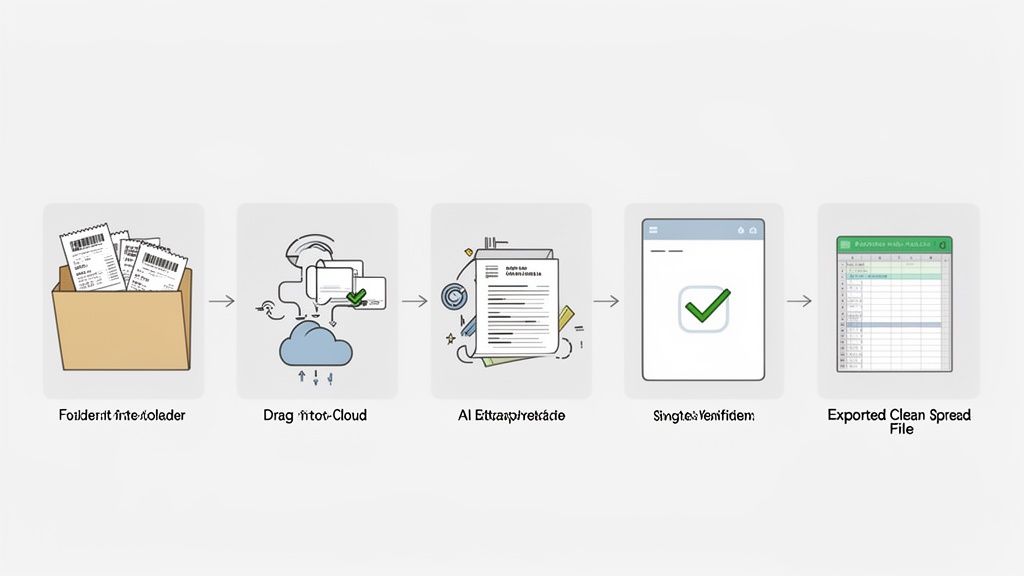

This visual shows just how clear the path is from a pile of paperwork to clean, usable data.

As you can see, the journey takes what was once a manual chore and turns it into an efficient, automated sequence where you’re always in control.

Your Simple Five-Step Migration Path

Making the switch really is as simple as following a few logical steps. There's no need to tear down your existing systems; you just need to point your financial documents into a smarter pipeline.

Here’s the entire process from start to finish:

-

Gather Your Existing Documents Start by rounding up all your current financial paperwork. This means your PDF bank statements, folders of digital receipts, and any invoices you have saved on your computer.

-

Upload Your Files Instantly Use a simple drag-and-drop interface to upload everything at once. Don't worry about sorting them first—the system is designed to handle a mix of different document types without any fuss.

-

Let the AI Do the Heavy Lifting As soon as your files are uploaded, Mintline’s AI gets to work. It automatically pulls key details from each document and starts matching receipts to bank transactions by looking at the vendor, date, and amount.

-

Quickly Verify the Suggestions Next, you’ll see the AI's proposed matches on a single, clean screen. This step is where automation's speed meets your expertise. You can confirm matches with a single click, giving you the final say.

-

Export Clean, Audit-Ready Data Once everything is matched and verified, you can export perfectly organised data that's ready to go straight into your accounting software or financial reports. You're left with a clean, reliable dataset, minus all the manual grind. To see a bit more on this, check out how you can extract data from a table with modern tools.

Sample Workflows in Action

To give you a better feel for how this works in the real world, let’s look at a couple of common scenarios.

-

For a Freelance Consultant: A consultant uploads their monthly bank statement and a folder full of receipts. Mintline automatically finds the right receipt for every client dinner, software subscription, and travel expense, saving them hours of tedious admin they’d rather spend on billable work.

-

For a Small Agency's Finance Team: The finance lead at a small agency connects the company bank accounts directly. As transactions appear, the platform prompts the team to upload the matching invoices. This keeps the books constantly up-to-date and ready for month-end closing, eliminating that familiar last-minute scramble.

These examples show how an automated data entry service can adapt to different business needs, making the switch feel effortless and the benefits immediate.

Why Automated Data Entry Is the Future

Moving on from a traditional manual data entry service to AI-driven automation isn't just another tech trend. It's a fundamental shift in how smart businesses are starting to operate. This is a strategic move, trading the soul-crushing admin for operational excellence and letting your team focus on growth, not paperwork.

The whole movement is fuelled by the undeniable perks automation brings to the table. We're talking about speed, accuracy, security, and the ability to scale up without hiring an army. These aren't just empty words; they are the pillars of a business that can withstand anything. When you automate, you're not just pushing documents through a system faster—you're building a solid foundation of trustworthy, real-time financial data. That kind of data sharpens your decision-making and gives you a real leg up on the competition.

Reclaiming Your Most Valuable Asset

At the end of the day, the future of data entry is all about getting your time back and taking complete control. For a founder, that means more hours to think about the big picture and innovate. For a finance team, it means closing the books faster each month and having the headspace to analyse numbers, not just chase down receipts.

The real goal here is to turn your financial operations from a reactive, paper-pushing chore into a proactive, strategic powerhouse. Automation is what makes that possible.

And this isn’t some niche idea; it’s happening across the board. The data processing and hosting industry in the Netherlands, which includes data entry services, has exploded into a massive €18.3 billion market. The fact that it's seen a 14.2% compound annual growth rate from 2020-2025 speaks volumes about the demand for smarter data solutions. With thousands of companies in this space, the tide is quickly turning against manual, error-prone work. AI-powered precision is becoming the new standard.

Your Partner in Business Efficiency

Getting on board with this modern approach sets your business up for what's next. Platforms like Mintline aren't just another piece of software; they become partners dedicated to helping you build a leaner, more resilient operation. By offloading the tedious grunt work to intelligent automation, you're free to focus on the things that actually move the needle.

The choice is pretty stark. You can either stay bogged down in the administrative quicksand of manual data entry or step into a future where your financial data is an asset, not a liability. To really get a handle on what this technology can do for you, it’s worth taking a closer look into what AI automation is and how it works. It’s time to take back your time and build a stronger business.

Frequently Asked Questions

Exploring modern data entry services often brings up a few common questions, especially as more businesses look to move from tedious manual work to smarter, automated systems. Let's tackle some of the most frequent queries we hear from people considering a platform like Mintline.

How Accurate Is AI Data Entry Compared to a Human?

For repetitive tasks, AI-powered platforms consistently outperform human accuracy. Think about it: a person is great at deciphering a crumpled, handwritten receipt, but they also get tired. Distractions happen, and simple typos can lead to surprisingly costly errors down the line.

An AI system, on the other hand, processes every single document with the same unwavering focus, 24/7. Technologies like advanced optical character recognition (OCR) and machine learning—the brains behind Mintline—pull out key details with incredible precision. The system then proposes matches, letting a human expert simply verify the output. It's this blend of AI speed and human oversight that produces cleaner, more reliable data than manual work alone ever could.

Is It Hard to Switch from Spreadsheets to an Automated Service?

Not at all. The transition is designed to be as smooth as possible. Modern platforms are built to get rid of complexity, not add to it. With Mintline, for instance, you can be up and running in minutes just by dragging and dropping your existing PDF bank statements and folders full of receipts.

There’s no complex setup or technical know-how required. The system gets to work straight away, reading your documents and starting the matching process. If you want ongoing automation, you can simply connect your bank accounts directly. The whole experience is intuitive, so anyone from a freelance consultant to a seasoned accountant can start cutting down their workload from the very first day.

Think of the switch to automation less as a difficult migration project and more as a quick adoption. The goal is to deliver immediate value by working with the documents and processes you already use.

What Businesses Benefit Most from This Type of Service?

Honestly, any business that deals with financial transactions will feel an immediate, measurable impact. But the benefits are especially game-changing for a few key groups:

- Freelancers and small business owners who are desperate to win back the hours they lose to administrative chores.

- Scaling businesses that need accurate, real-time financial data to make smart growth decisions on the fly.

- Finance teams and bookkeepers who want to close the books faster each month with far fewer mistakes.

- Accounting firms that manage multiple clients and can use automation to boost their own efficiency and offer more valuable advisory services.

The great thing about an automated data entry service like Mintline is its flexibility. It’s built to fit the specific needs of any business, no matter the size, turning a necessary chore into a simple background process.

Ready to stop chasing receipts and get hours back every month? With Mintline, you can automate your financial data entry and focus on what truly matters—growing your business. Try Mintline for free and see how easy it is.