A Practical Guide to Procure to Pay Software

Discover how procure to pay software transforms your business operations by automating purchasing, enhancing financial control, and driving efficiency.

At its core, procure to pay software is a system that brings your entire company purchasing process under one digital roof. It takes everything from an employee first requesting a new laptop to the final payment being sent to the supplier and manages it in a single, connected workflow. Think of it as the central nervous system for your company's spending, replacing chaotic spreadsheets and paper trails with clarity and control. For platforms like Mintline, the goal is to make this process seamless right through to the final bank reconciliation.

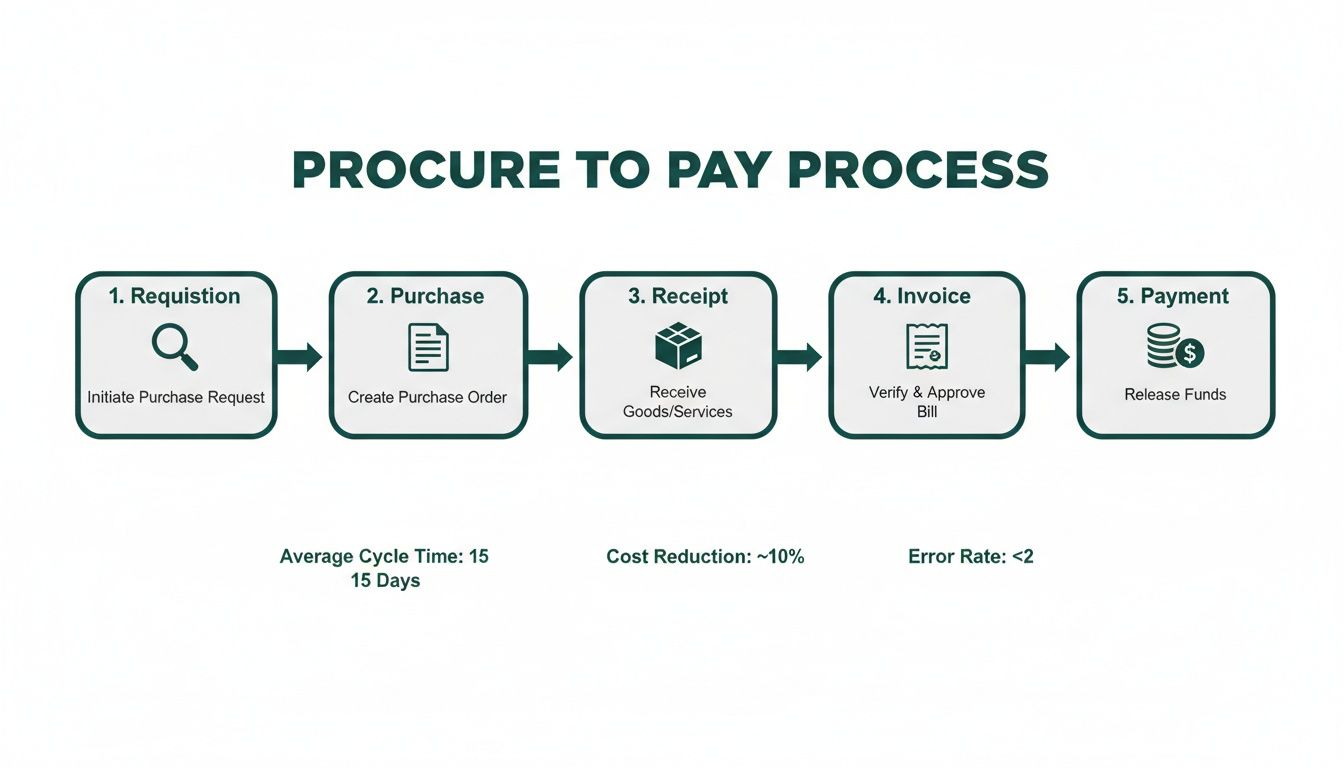

Unpacking The Procure To Pay Process

If your company's spending feels like a series of disconnected, manual tasks, you're not alone. The procure-to-pay (P2P) process is the framework designed to fix that. It’s the complete end-to-end journey that starts the moment a need is identified and only finishes when the final invoice is paid and reconciled in your bank account.

Essentially, it’s a structured system that bridges the gap between your procurement team and the accounts payable department. The goal? To make sure every single purchase is transparent, properly authorised, and recorded accurately.

Without a well-defined P2P cycle, businesses often fall victim to problems like rogue spending, late payment penalties, and a frustrating lack of visibility into where the money is actually going. A formalised process, especially when powered by dedicated procure to pay software, brings much-needed order to this chaos.

A Simple Analogy: Ordering at a Restaurant

To get your head around the P2P cycle, just think about ordering a meal at a restaurant. It's a surprisingly accurate analogy for what happens in a business, breaking a complex-sounding process down into simple, familiar steps.

- Requisition: You look at the menu and decide what you want to eat. In business terms, this is an employee identifying a need and creating a purchase request.

- Purchase Order: The waiter takes your order and formally sends it to the kitchen. This is the equivalent of creating an official purchase order (PO) and sending it to your supplier.

- Goods Receipt: The kitchen prepares your food, and it arrives at your table. This is you receiving the goods or services you ordered and confirming everything is correct.

- Invoice: After the meal, the bill arrives. This is the supplier's invoice, which details what you owe them.

- Payment & Reconciliation: You settle the bill and check your bank app later to see the transaction. This is the final payment processing and bank reconciliation step that closes out the transaction.

This logical flow—from initial need to final proof of payment—is the very heart of the procure to pay process.

The flowchart below shows you exactly how these stages connect, moving from one logical step to the next.

As you can see, each stage acts as a crucial checkpoint. It's all about making sure a purchase is legitimate and properly documented before it can move on to the next step.

Why This Process Matters

Putting a proper procure to pay process in place does so much more than just keep your purchasing organised; it builds the foundation for real financial control. It guarantees that every pound spent is approved, budgeted for, and accounted for correctly—all of which is vital for healthy cash flow and making smart business decisions.

By standardising the P2P workflow, organisations can reduce processing costs by as much as 80%. That's a huge saving that goes straight to the bottom line, all by getting rid of manual data entry, cutting down on errors, and speeding up approvals.

Ultimately, getting the procure to pay process right is about gaining strategic command over your company's finances. And while P2P software is brilliant at managing these steps, the job isn't truly finished until the payment is reconciled against your bank records. This is where a tool like Mintline comes in. It automates that final, critical piece of the puzzle: matching every bank transaction to its invoice, giving you a perfect, audit-ready financial picture.

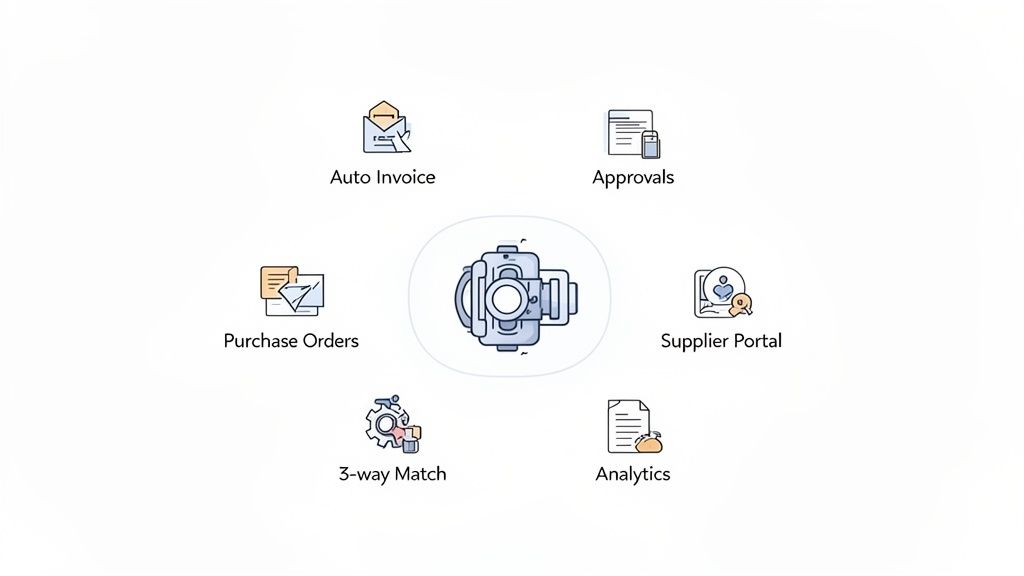

What Are the Core Features of P2P Software?

Modern procure-to-pay software isn't just a digital filing cabinet—it's the engine that drives financial control and efficiency. Think of it as a connected system where each component automates and secures a different part of the purchasing journey. To really get the most out of a P2P platform, you need to understand how these core features work together.

Each one is designed to solve a specific headache from the old, manual way of doing things, whether that’s stopping unauthorised spending or getting rid of mind-numbing data entry. In the end, they create a single, reliable source of truth for every penny your company spends.

Automated Invoice Processing

At the heart of any decent P2P system is the ability to process invoices without someone having to key in every last detail. A critical part of this is automated invoice extraction, which dramatically cuts down on manual work and the errors that come with it. The software uses Optical Character Recognition (OCR) to "read" and digitise all the important information from a supplier's invoice.

This means details like invoice numbers, dates, amounts, and line items are captured accurately in seconds. Getting rid of manual data entry doesn't just save a ton of time; it also prevents costly mistakes that can mess up supplier payments and throw your financial records off balance. You can dive deeper into how this works in our guide to automated accounts payable software.

Dynamic Approval Workflows

One of the biggest strengths of P2P software is how it enforces your company's spending rules through customisable approval workflows. Forget about chasing down managers for a signature or sending a dozen email reminders. The system automatically routes purchase requests and invoices to the right people based on rules you’ve already set.

These rules can be as simple or as complex as your business needs. For instance, you could set up rules based on:

- Spend Amount: Any request over a certain value gets automatically sent to a senior manager.

- Department or Project: Purchases are routed directly to the person who holds the budget.

- Supplier Category: A new software purchase might need a sign-off from the IT department first.

This setup ensures that no payment goes out the door without the proper authorisation, giving you complete control over your budget.

Robust Purchase Order Management

Purchase orders (POs) are the bedrock of controlled spending, and P2P software gives you a central hub to create, send, and track them. Your team can generate official POs directly from approved requests, which are then sent straight to suppliers.

This creates a formal record of what you agreed to buy, including quantities, prices, and delivery terms. It's a simple but powerful way to prevent "rogue spending," because every purchase is tied to an approved PO. That makes it much easier to track what you’ve committed to and manage your cash flow.

Centralised Supplier Portal

Trying to manage supplier details across different spreadsheets and email threads is a recipe for disaster. A good P2P platform usually includes a supplier portal where your vendors can manage their own information, like updating their contact or bank details in a secure environment.

This takes a huge administrative load off your team and actually improves supplier relationships by making communication more transparent. Suppliers can also use the portal to submit their invoices or check on a payment’s status, which means fewer "where's my money?" calls for your accounts payable team to handle.

These tools are becoming standard practice. In the Netherlands, the P2P software sector is growing fast, tied to the country's booming software development industry, which hit a €42.6 billion market size. It shows just how much Dutch businesses are investing in automation, with Europe as a whole making up 27.28% of the global P2P market.

Key Takeaway: The ultimate defence against payment errors and fraud is the three-way match. The software automatically compares the purchase order, the goods receipt note, and the supplier's invoice to ensure they all align before any payment is scheduled.

If there are any discrepancies—like wrong quantities, incorrect prices, or duplicate invoices—they get flagged for review immediately. This kind of automated check is a critical control that's almost impossible to maintain consistently when you’re doing it all by hand.

Finally, P2P software comes with powerful reporting and analytics dashboards. These tools give you a real-time view of company-wide spending, letting you break it down by category, supplier, or department. With this data-driven insight, you can spot opportunities to save money, negotiate better deals with suppliers, and make smarter financial decisions. And while P2P systems are great for managing everything up to the payment, a solution like Mintline is vital for that final step: reconciling those payments with your bank transactions to close the loop perfectly.

The Real-World Benefits of P2P Automation

Bringing in procure-to-pay software is much more than a simple tech upgrade. It’s a smart business move that pays for itself over and over again. The benefits aren't just about cleaning up messy workflows; they deliver real, tangible value that strengthens your entire financial operation from the ground up.

When you ditch the manual, paper-shuffling systems of the past, you unlock a whole new world of efficiency and control. The real win? You transform your finance team from people who react to problems into proactive, strategic partners for the business.

Driving Significant Cost Savings

The most obvious and compelling reason to automate P2P is the direct impact on your bottom line. Manual processing isn't just slow—it's expensive. Every hour your team spends chasing down an approval, manually typing in invoice data, or correcting a simple mistake is a direct cost draining your resources.

Procure-to-pay software tackles these expenses by automating the most repetitive, time-sucking tasks. This shift translates directly into several key areas of savings:

- Fewer Processing Hours: When invoice data is captured automatically and documents are routed for approval without anyone lifting a finger, you dramatically cut down on the manual labour needed for every single transaction.

- No More Late Fees: Automated workflows and timely reminders ensure invoices are processed and paid on schedule. This puts an end to those frustrating—and completely avoidable—late payment penalties from suppliers.

- Capturing Early Payment Discounts: With faster processing, you can consistently take advantage of early payment discounts. Suddenly, your accounts payable team isn't just a cost centre; it's actively generating value.

Enhancing Financial Control and Compliance

Without a central system, keeping a tight rein on finances feels like a constant battle. Spending can happen without proper oversight, and digging up documents for an audit can turn into a full-blown nightmare. P2P automation brings a sense of calm to this chaos.

A core strength of procure-to-pay software is its ability to create a clear, unalterable digital audit trail for every single purchase. From the initial request to the final payment, every action is logged, time-stamped, and stored in one secure location.

This digital record-keeping makes audit season faster and a lot less stressful. Instead of rifling through filing cabinets and scattered email threads, you can give auditors instant access to a complete transaction history. This not only simplifies compliance but also gives leadership true visibility into company-wide spending, helping you stop budget overruns before they even happen.

Building Stronger Supplier Relationships

Your suppliers are vital partners, and how you manage payments directly affects those relationships. Paying on time, every time, and keeping communication clear builds trust and makes you a customer they want to work with.

P2P software strengthens these partnerships by making the entire payment process transparent and efficient. Many platforms even offer a supplier portal where vendors can submit their own invoices and check payment statuses in real-time. This self-service approach cuts down on endless back-and-forth emails and phone calls, saving both your team and theirs a lot of time.

The numbers really tell the story here. Automation in P2P can slash invoice processing costs by up to 80%, freeing up your bookkeepers for much more valuable work. In the NL, this aligns perfectly with EU directives on supply-chain transparency. Businesses that get on board with P2P early often report 20-30% gains in efficiency—a massive advantage where cash flow is everything.

Transforming Your Finance Team

Ultimately, one of the greatest benefits is what it does for your finance team. When they're no longer buried under a mountain of mind-numbing, repetitive tasks, they can finally apply their skills to more strategic activities. For more on this, check out our guide on process and automation in finance.

Embracing P2P automation doesn't just make operations smoother; it leads to huge improvements in compliance and business performance. You can learn more about how automation drives business efficiency and compliance in the modern workplace.

How to Choose the Right P2P Software

Picking the right procure-to-pay software isn't just another IT decision—it's a move that will shape your company's financial health and efficiency for years to come. The market is packed with options, and it’s easy to get bogged down by flashy demos and long feature lists. The secret is to ignore the noise and zero in on what your business actually needs to thrive.

The whole process starts with a good, honest look in the mirror. There's no one-size-fits-all solution, so the "best" software is simply the one that fits your company's scale, industry, and current ways of working.

Assess Your Core Business Needs

Before you even think about scheduling a demo, you need to do a bit of internal homework. This isn't about creating a massive report; it's about getting a clear picture of what you truly need from a P2P system. This simple step stops you from either overspending on a complicated beast of a system or, just as bad, picking a tool you'll outgrow in six months.

Start with a few practical questions:

- Transaction Volume: Are we talking 50 invoices a month or 500? A small business has wildly different needs than a mid-sized company when it comes to processing volume.

- Team Size and Roles: Who’s going to be using this thing every day? Think about everyone from the person requesting a new laptop to the finance team member who clicks "pay". If it’s not easy for all of them, it won’t get used.

- Industry Demands: Does your industry have any quirky compliance or reporting rules? A generic platform might miss the specific procurement headaches common in construction or healthcare, for example.

Nailing down these answers first gives you a filter. It lets you immediately cross off vendors that aren't a good fit and focus your energy on the ones that are.

Create a Vendor Evaluation Checklist

With a clear picture of your needs, you can now build a checklist to size up potential software providers. This turns a subjective "gut feeling" decision into an objective, data-driven one, ensuring you compare every option on a level playing field. A solid checklist goes beyond features to look at the entire relationship you’ll have with the vendor.

Your list should have a few non-negotiables to make sure the implementation is smooth and your team is happy long-term with the chosen procure-to-pay software.

Crucial Tip: The most powerful software in the world is useless if your team hates using it. Always prioritise a clean, simple, and intuitive user interface. A clunky system just encourages people to go back to their old, inefficient spreadsheets.

Here are the essentials to put on your checklist:

- Ease of Use: Can someone who isn't an accountant figure it out? A great user experience is the single biggest factor for getting everyone on board.

- Integration Capabilities: How well does it play with your existing accounting software, like Xero or QuickBooks? This is non-negotiable for keeping all your financial data in one place.

- Scalability: Can this software grow with you? Check that the pricing and features won't hold you back when your business starts to take off.

Look Beyond the Core Features

Finally, it’s time to think about the long game. The factors that create real, lasting value are things like security, customer support, and honest pricing. Cutting corners here can lead to massive headaches later on.

Dig into these areas:

- Data Security: How are they protecting your financial data? You want to see strong encryption and clear policies on where your data is stored, especially if you have customers in the EU.

- Customer Support: What happens when you get stuck? Good, responsive support is worth its weight in gold, particularly when you're first getting set up.

- Pricing Transparency: Are there hidden fees for setup, support, or adding new users? A straightforward pricing model means no nasty surprises on your bill. For a deeper understanding of how modern tools handle documentation, you might find our guide on intelligent document processing helpful.

By taking this structured approach—first understanding your needs, then using a checklist, and finally looking at the long-term picture—you can confidently select a P2P solution that does more than just clean up your workflows. You'll find a genuine partner for your company's growth.

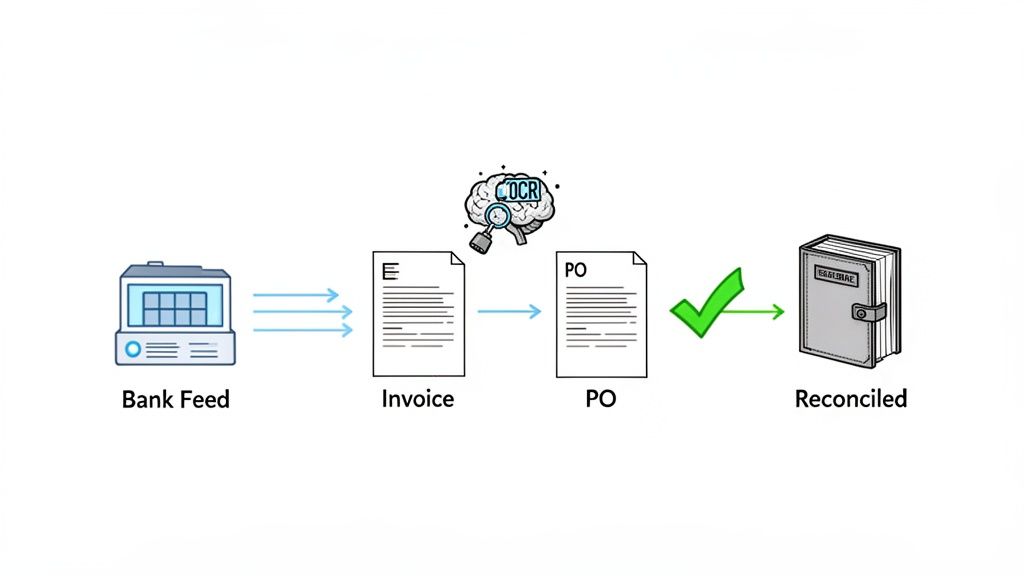

Completing the Cycle with Financial Reconciliation

Most procure-to-pay software does a brilliant job of managing the journey right up to the point of payment. These systems give you a clear, controlled path for company spending, from the initial request to the final invoice approval. But even after an invoice is stamped "paid," there's often a loose end that leaves your financial story hanging.

The final piece of the puzzle is tying the actual bank transaction back to that original invoice. Without that connection, you have a record of a payment you intended to make, but no hard proof the money actually left your account and cleared. This last step is the very essence of financial reconciliation—making sure the numbers in your books perfectly match the numbers in your bank.

Why Standard P2P Systems Often Fall Short

Let's be clear: traditional P2P platforms are designed to manage the procurement workflow. Their core purpose is to approve what should be paid. Once the payment instruction is sent off to the bank, their job is essentially done. They weren't built to pull in live bank feeds and automatically match cash leaving your account to the right invoices and purchase orders.

This creates a frustrating disconnect. It forces finance teams to revert to tedious, manual work, exporting payment files from one system and bank statements from another, then trying to match them line by line in a spreadsheet. It's slow, mind-numbing, and a recipe for human error, leading to inaccurate reports and a painful month-end close.

Closing the Loop with AI-Powered Automation

This is exactly where a specialised tool like Mintline comes in. It’s built specifically to bridge that final, crucial gap in the procure-to-pay cycle. Think of it as an intelligent layer that works with your P2P system to automate the one thing it can’t do: the final bank reconciliation.

Mintline swaps spreadsheets for smart automation, using advanced Optical Character Recognition (OCR) and machine learning to finish the job. Here's how it closes the loop:

- Automated Data Ingestion: It connects directly to your bank feeds or lets you upload statements, pulling in every transaction automatically.

- Intelligent Document Matching: The AI then gets to work, sifting through the data to match each bank transaction to its corresponding invoice or receipt based on cues like the vendor name, amount, and date.

- A Centralised Review Hub: Instead of juggling different files and windows, your team gets a single, clean dashboard to quickly review and confirm the matches suggested by the AI.

This process ensures every penny is accounted for, creating a perfect, unbroken audit trail that runs from the initial purchase request all the way to the reconciled transaction in your bank account.

This kind of visual interface means finance teams can see the status of all transactions at a glance, chase up missing documents, and manage the entire reconciliation workflow without the usual chaos.

Key Insight: Real financial control isn't achieved when an invoice is approved. It's achieved when that payment is confirmed and reconciled against your bank records, leaving zero room for doubt or discrepancies.

By adding a solution like Mintline into your setup, you’re not just buying another tool; you’re unlocking the full value of your entire procure-to-pay software investment. It turns a disjointed process into a seamless, closed loop, giving you a complete and trustworthy picture of your company's finances. The result? Faster month-end closes, incredible audit readiness, and the kind of strategic financial clarity every business needs to thrive.

Got Questions About Procure-to-Pay Software? We've Got Answers.

When you start digging into how to get a better handle on company spending, a lot of questions pop up. Procure-to-pay software sounds great in theory, but how does it actually fit into your day-to-day operations?

Let's break down some of the most common questions we hear from business owners and finance teams. Getting these details straight is the key to picking a system that genuinely helps your business, rather than just adding another layer of complexity.

What's the Difference Between P2P and AP Automation?

This is a great question. Think of AP automation as the final leg of a long-distance race, while procure-to-pay (P2P) software is the entire marathon.

AP automation is fantastic at what it does: it zeros in on the finish line. It takes over once an invoice arrives, handling the processing and payment steps. It's a huge help for cutting down manual data entry and getting suppliers paid faster.

P2P software, on the other hand, covers the whole journey from the starting gun. It kicks in right when someone needs to buy something, managing the purchase request, finding the right supplier, and creating the purchase order. From there, it flows naturally into the invoice and payment stages that AP automation handles. Simply put, AP automation is a vital component within the broader P2P ecosystem.

How Long Does It Take to Get a P2P System Up and Running?

For small and medium-sized businesses in the Netherlands, you'll be glad to hear we're not talking about a massive, months-long project anymore. Modern cloud-based P2P systems are designed to get you going surprisingly quickly, often within a few weeks or even days.

Of course, the exact timeline will hinge on a few things:

- How complex your internal approval rules are.

- The number of people on your team who need to be set up.

- Which accounting platform you need to connect with.

The best advice is to look for a vendor who gives you a clear, realistic implementation plan and has a solid support team ready to help you get started without disrupting your entire business.

Will P2P Software Work with Xero or QuickBooks?

Yes, absolutely. Any P2P software worth its salt is built to integrate seamlessly with popular accounting systems like Xero, QuickBooks, and Sage. This isn't just a "nice-to-have" feature; it's essential.

This direct link is what makes the whole system work. It ensures all your approved spending and payment information syncs automatically to your general ledger. You can finally say goodbye to manually typing data from one system into another, which not only saves a ton of time but also slashes the risk of costly mistakes. The result is a single, reliable source of truth for your company's finances.

How Does P2P Software Make Audits Easier?

Honestly, P2P software is an auditor's dream. It creates a perfect, centralised digital paper trail for every single purchase. Every action, from the first request to the final payment, is meticulously logged and stored in one secure place.

This means that when auditors come knocking, they can trace the entire history of a purchase without anyone needing to dig through filing cabinets, messy spreadsheets, or endless email chains. The story of each transaction is crystal clear:

- The employee's initial request is recorded.

- Every manager's approval is time-stamped.

- The official purchase order is attached.

- The supplier's invoice is linked right there.

- The final payment record completes the picture.

This kind of transparency makes audits faster and infinitely less stressful, and it’s a massive help in keeping you compliant with financial regulations.

Is Procure-to-Pay the Same Thing as Source-to-Pay?

Good question—they're related, but they cover different ground. Procure-to-pay (P2P) is all about the operational side of buying things. It deals with the transactional flow: from the moment an employee needs something to the moment the supplier is paid.

Source-to-pay (S2P) is a much broader, more strategic process. It includes everything in P2P, but it also covers all the "upstream" work that happens first. We're talking about activities like finding and vetting new suppliers, negotiating contracts, and managing those crucial vendor relationships over the long term. In short, P2P is a key part of the larger S2P cycle.

What’s the Final Step After the Payment Is Made?

While most P2P software gets you all the way to payment, the job isn't truly finished until that payment is reconciled against your bank statement. This is the crucial last mile that confirms the money has left your account and matches the invoice you approved. It's what closes the loop for good.

This is exactly where a specialised tool like Mintline comes into play. While your procure-to-pay software perfectly manages the purchase and approval workflow, Mintline steps in to automate that final, critical reconciliation step. It automatically links every bank transaction to its corresponding receipt or invoice, ensuring your books are always 100% accurate and ready for an audit at a moment's notice.

Ready to close that final gap in your financial workflow? With Mintline, you can automatically match every bank transaction to its receipt, eliminating manual reconciliation and messy spreadsheets for good. See how it works.