A Practical Guide to Robotics Process Automation in Finance

Discover how robotics process automation in finance transforms tedious tasks. Learn key use cases, ROI, and how modern tools streamline accounting.

When you hear "Robotics Process Automation," you might picture a physical robot sitting at a desk. The reality is a bit different—and a lot more practical for your finance department. At Mintline, we see RPA as specialised software 'bots' programmed to take over the repetitive, rule-based tasks that clog up your team's day. These aren't machines; they're intelligent scripts designed to mimic how a person interacts with a computer. Think data entry, transaction processing, and report generation. The goal? To free up your finance experts for work that actually requires a human brain.

What Exactly Is Robotics Process Automation in Finance?

Picture a digital assistant who never needs a coffee break, never makes a typo, and works 24/7. That's the essence of robotics process automation in finance. We're talking about sophisticated software built to follow a strict set of instructions for handling routine financial work.

This technology creates a virtual workforce. These bots can log into your accounting software, navigate through different applications, and move data from one place to another just like a person would, only much faster and with near-perfect accuracy. For freelancers, startup founders, and bookkeepers who use Mintline, this is a game-changer, handing back countless hours previously lost to administrative grind.

The Digital Workforce in Action

At its core, an RPA bot is a "doer," not a "thinker." It shines when dealing with tasks that are predictable and happen over and over again. Its rapid adoption is no surprise; the global RPA market is set to grow at a compound annual rate of 39.9% between 2023 and 2030.

Let's get practical. Think about matching receipts to bank transactions—a classic bookkeeping chore and a core feature of Mintline. Done manually, the process looks something like this:

- Open the bank statement PDF.

- Find that one transaction for €45.80 from a specific supplier.

- Dig through a folder of scanned receipts to find the right one.

- Copy and paste all the details into a spreadsheet or your accounting platform.

An RPA bot turns this entire sequence into a background task, running through each step perfectly without you lifting a finger.

Distinguishing RPA from AI

It’s easy to lump RPA and Artificial Intelligence (AI) together, but they play very different roles. While they often collaborate, understanding their distinct functions is key, especially with the ongoing discussion around AI vs RPA.

RPA is all about following explicit instructions to complete a defined process. Think of it as a macro on steroids. AI, on the other hand, is built to learn, reason, and make decisions, mimicking human intelligence to tackle more complex and unpredictable tasks.

For instance, a simple RPA bot can process 1,000 invoices without a problem, as long as they all use the exact same layout. But if a new invoice format shows up, the bot will get stuck. An AI-powered system like Mintline could analyse the new layout, learn how to read it, and process it correctly. This difference is vital for choosing the right automation tool and setting realistic expectations for what it can achieve.

The Real-World Gains of Automating Financial Tasks

Putting robotic process automation to work in your finance department isn't just a theoretical exercise; it delivers tangible, day-to-day improvements you can feel. It's not about simply doing things faster. It's about fundamentally changing how your financial operations work for the better. The impact ripples across accuracy, efficiency, costs, and compliance, finally freeing up your team to focus on strategic growth instead of getting buried in administrative tasks.

Ultimately, these benefits give your team the breathing room and the reliable data they need to help grow the business, not just manage its paperwork. When you automate the predictable, you unlock your people's potential to handle the exceptional. For a broader look at how this fits into the bigger picture, check out our guide on AI in accounting.

Boosting Accuracy and Consistency

Let's be honest: human error is just a fact of life in manual data entry. A single misplaced decimal or an incorrect vendor code can kick off hours of frustrating detective work to find the source of the problem. RPA bots sidestep these costly mistakes completely.

Because they follow pre-defined rules with absolute precision, bots ensure data is captured and entered correctly every single time. Imagine a bot processing hundreds of invoices overnight. Each one is read and its data is fed into your accounting system flawlessly, preventing those painful reconciliation headaches before they even start.

This consistency is the bedrock of financial integrity. Bots don’t get tired or distracted, meaning the quality of work at 3 AM is identical to the quality at 9 AM. Your financial records become consistently reliable.

This isn't just a niche trend. In the Netherlands, financial services firms are at the forefront of AI and RPA adoption, with 29.4% of companies with 10 or more employees already using key AI technologies. A significant 31.7% are applying machine learning for predictive tasks, which shows just how vital RPA has become for automating workflows like invoice matching and payroll. This adoption leads to real wins, helping accountants slash spreadsheet errors and agencies streamline vendor payments.

Gaining Unprecedented Efficiency

When people talk about RPA, efficiency is often the first thing that comes to mind, and for good reason. Tasks that might take a small team days to complete—like matching a month's worth of transactions to receipts—can be knocked out by bots in a fraction of the time. This reclaimed time is where the true value lies.

It’s not just about cutting labour costs. It's about reinvesting your team’s brainpower. Instead of chasing down missing documents or re-keying data, your finance professionals can start analysing spending trends, forecasting cash flow, and providing strategic insights that actually drive business decisions.

One area where RPA truly shines is in optimising financial reporting. You can learn more about how financial reporting automation leads to a faster close and smarter growth for your company.

Achieving Effortless Compliance

For any business that has to face an audit, compliance is a non-negotiable. RPA becomes a powerful ally here by creating perfect, unchangeable audit trails for every single action a bot takes.

- Immutable Records: Every step, from pulling data off a document to entering it into your ERP, is logged automatically. This creates a detailed, time-stamped history that makes an auditor's job simple.

- Reduced Risk: By taking manual data handling out of the equation, you immediately lower the risk of both accidental errors and intentional fraud, which strengthens your internal controls.

- Standardised Processes: Bots guarantee that every transaction is processed using the exact same compliant procedure. Company policies are enforced without exception or deviation.

This automated documentation provides serious peace of mind. It can turn the stress of audit preparation into a straightforward review of clear, organised, and trustworthy records.

How RPA Actually Works in Finance Departments

The real magic of Robotics Process Automation (RPA) in finance isn't some high-level theory; it's what happens when you apply it to the daily grind. It stops being just a concept and becomes a hands-on tool that fixes the kind of persistent problems that eat up your team's day. For a bookkeeper drowning in spreadsheets or a startup founder trying to keep up with invoices, automation offers a clear way out.

These aren’t futuristic pipe dreams. They're practical, real-world applications that businesses are using right now to get back precious time and resources. Let's dig into some of the most common areas where RPA bots are making a real difference.

Taming Accounts Payable and Receivable

Managing the cash coming in and going out is the lifeblood of any business, but it's so often stuck in manual, error-prone routines. RPA steps in to automate this whole cycle, turning a source of constant headaches into a smooth, predictable operation.

An RPA bot can:

- Extract Invoice Data: It automatically scans incoming invoices—whether they show up as PDFs, emails, or even image files—and pulls out key details like the vendor name, invoice number, amount due, and payment date.

- Perform Three-Way Matching: The bot then cross-references the invoice against its matching purchase order and the delivery receipt, making sure everything lines up perfectly before a payment is even considered.

- Flag Invoices for Payment: Once everything checks out, the bot pushes the invoice data into your accounting system and schedules the payment, flagging any exceptions or oddities for a human to review.

This automation slashes processing time, cuts down the risk of late payment fees, and dramatically reduces the chance of paying for an incorrect or fraudulent invoice.

Putting an End to Manual Bank Reconciliation

For most finance professionals, bank reconciliation is a tedious monthly chore. It’s that painstaking process of comparing every single line on a bank statement against the company's own books to hunt down discrepancies. This is a perfect job for a bot.

Instead of a person spending hours poring over documents, a bot can knock out the entire reconciliation in minutes. It logs into the company’s bank portal, downloads the latest statements, and methodically matches every transaction against the entries in the general ledger. Any items that don't match are instantly flagged and put into a clean exception report for the finance team to investigate.

This isn't just about saving time; it's about a faster, more accurate monthly close. By handing this chore over to a bot, teams can stop looking for yesterday's mistakes and start planning for tomorrow's growth.

The momentum here is clear. The Netherlands' robot software market, which powers these RPA solutions, ballooned to USD 152.9 million in 2023 and is expected to reach USD 754.8 million by 2030. That explosive growth shows just how eagerly Dutch businesses are embracing automation for these kinds of repetitive financial tasks. For Mintline users like independent contractors and small agencies, this means turning hours of monthly admin into just a few minutes of review.

Here’s a quick look at how these tasks change with automation.

Table: Manual vs RPA-Automated Financial Tasks

This table compares common financial tasks performed manually versus how they are transformed with Robotics Process Automation, highlighting the improvements in speed, accuracy, and efficiency.

| Financial Task | Manual Process | RPA-Automated Process |

|---|---|---|

| Invoice Processing | Manually keying in data from PDFs/emails, physically matching with POs and receipts. Prone to typos and takes hours. | Bot automatically extracts data, performs a three-way match in seconds, and flags exceptions. |

| Bank Reconciliation | Line-by-line comparison of bank statements against the general ledger, often taking days at month-end. | Bot downloads statements and matches thousands of transactions in minutes, generating an instant exception report. |

| Expense Reporting | Manually checking receipts against policy, verifying totals, and entering data for reimbursement. Inconsistent and slow. | Bot scans receipts, validates expenses against company policy, and processes reimbursement automatically. |

| Financial Reporting | Analyst manually pulls data from ERP, CRM, and spreadsheets to build reports. Time-consuming and risky. | Bot logs into multiple systems, aggregates data, and populates report templates on a set schedule. |

As you can see, the difference isn't just incremental; it fundamentally changes the nature of the work, freeing up humans for more valuable analysis.

Streamlining Expense Claim Processing

Processing employee expense claims is another classic administrative bottleneck. It’s a thankless job of checking receipts, making sure claims follow company policy, and manually entering everything for reimbursement. RPA automates this entire workflow.

An employee submits their expense report, and a bot takes it from there. It scans the receipts, checks that the expenses are within spending limits and follow policy, and—if everything is in order—processes the reimbursement automatically. This gets employees paid faster and ensures policies are applied consistently across the whole company.

Accelerating Financial Reporting

Putting together regular financial reports like P&L statements or cash flow analyses usually means pulling data from several different systems—the ERP, the CRM, and a bunch of spreadsheets. This manual copy-and-paste routine is slow and a recipe for errors.

An RPA bot can be programmed to log into all these different sources, collect the necessary data, consolidate it, and neatly populate a predefined report template. A task that once took a financial analyst half a day can now be done in minutes, ensuring decision-makers always have timely and accurate numbers to work with. These use cases are often powered by more specialised tools; you can learn more about how intelligent document processing complements RPA by helping it understand and extract data from all sorts of complex documents.

Your Roadmap for Implementing Finance Automation

Getting started with robotic process automation in finance doesn't have to be a massive IT project or a drawn-out, multi-year strategy. With a clear plan and the right tools, any business can start winning back time and drastically improving its accuracy. This roadmap breaks the journey down into four straightforward stages, making automation both accessible and effective.

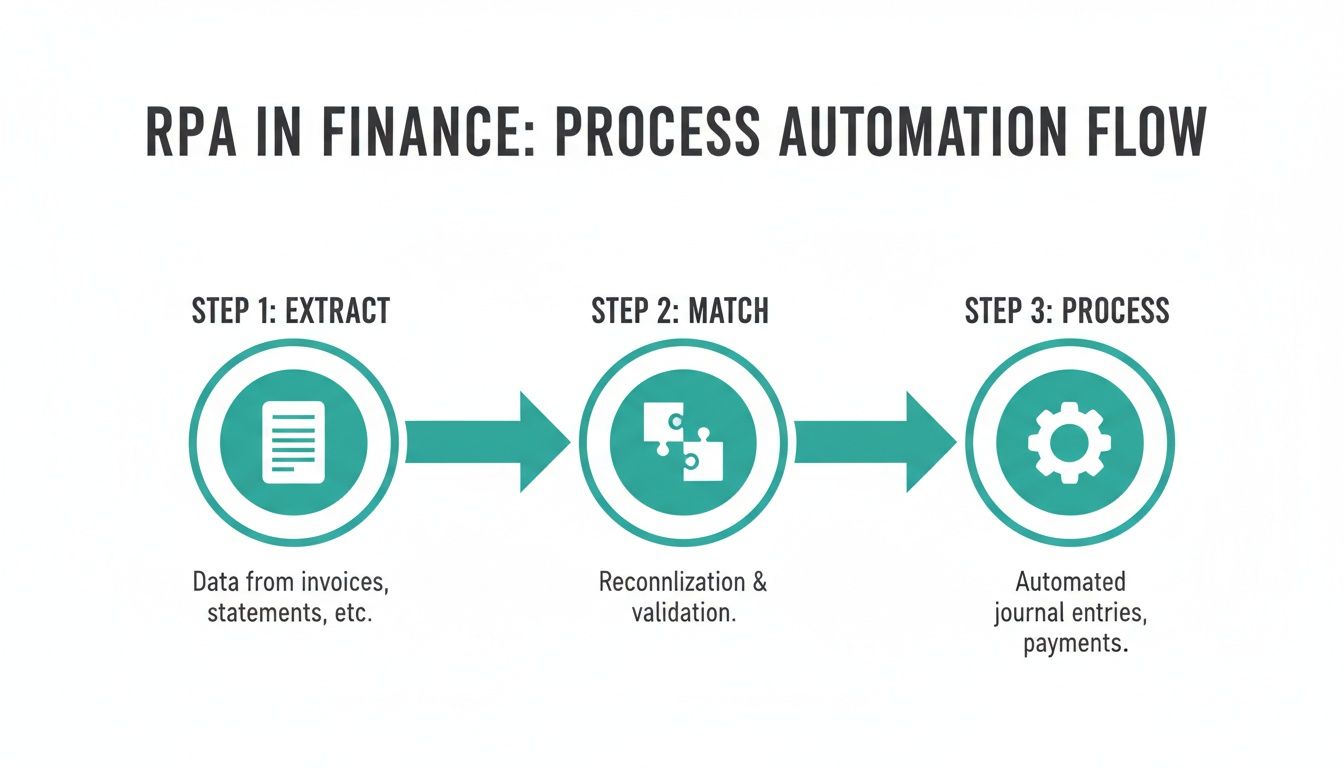

The process usually kicks off by finding those high-volume, repetitive tasks and using specialised tools to digitise and handle the related documents automatically. This simple flow shows how a typical automation cycle works, from pulling the data to final processing.

This simple three-step sequence—extract, match, and process—is the engine behind most financial RPA applications, whether you're tackling invoicing or managing expenses.

Stage 1: Identify Your Best Opportunities

Before you jump in, the first step is to figure out which processes will give you the biggest wins. You’re looking for tasks that are:

- Rule-Based: The process follows a clear set of "if this, then that" instructions with very few curveballs.

- High-Volume: The task happens over and over again, meaning automation will save a serious number of hours.

- Prone to Human Error: Anything involving manual data entry is a perfect candidate, as bots don't make typos or mix up numbers.

For most businesses, accounts payable is the perfect place to start. The workflow of receiving an invoice, matching it to a purchase order, and getting it ready for payment is highly structured and repetitive. It’s a textbook case for automation that promises an immediate and obvious return on your investment.

Stage 2: Choose the Right Tools

The automation market is huge, but the tools generally fall into two camps. You have the large-scale enterprise platforms that offer everything but often require specialised developers and a lot of setup. Then you have focused solutions, like Mintline, that are designed to solve specific pain points brilliantly without all the overhead.

For freelancers, startups, and small finance teams, a specialised tool is almost always the smarter choice. It zeros in on a direct need—like matching receipts to transactions—and delivers value from day one without a massive learning curve. The goal here is to solve a problem, not create a new IT project.

Choose a solution that fits the scale of your problem. You don't need an industrial crane to lift a box. A dedicated tool offers a faster, more direct path to achieving your automation goals.

By focusing on one well-defined area, you can see results quickly and build momentum. If you're looking to get your payables in order, you can learn more by exploring the benefits of a dedicated AP automation solution.

Stage 3: Launch a Pilot Project

Instead of trying to automate your entire finance department all at once, start small. Pick one well-defined process to test, like processing invoices from a single supplier or reconciling one specific bank account. A pilot project is crucial for a few reasons.

First, it lets you test your chosen tool in a low-risk environment. Second, you can measure the impact directly, giving you a clear case study with real numbers, like hours saved or errors eliminated. Most importantly, a successful pilot builds confidence within your team and gets everyone comfortable with the new way of working. This initial win is absolutely key to getting buy-in for more automation down the road.

Stage 4: Scale and Integrate Your Automation

Once your pilot has proven its worth, it's time to scale up. This means applying the same automation principles to other high-impact areas you spotted back in the first stage. You might expand from one supplier to all of them, or move from bank reconciliation to processing expense claims.

The final piece of the puzzle is integrating these automated workflows with your core accounting software. Modern tools are built to connect seamlessly with popular platforms, ensuring the data your bots capture and process flows directly into your general ledger. This creates a true end-to-end automated system that maintains a single source of truth for your financial data, closing the loop on a successful rollout.

Keeping Your Financial Data Safe in an Automated World

Giving a bot the keys to your sensitive financial processes can feel a bit unnerving at first. It’s a completely normal reaction. The good news is that modern platforms offering robotics process automation in finance are designed from the ground up with security at their core, not as a bolt-on feature.

In fact, a properly implemented automation system doesn't just avoid creating new risks; it actively closes existing security gaps. Think about it: by reducing the number of human touchpoints with sensitive data, you instantly lower the chance of accidental leaks or internal fraud. Bots do exactly what they’re told, accessing only the information they absolutely need. This is a far more controlled and secure way of working compared to having multiple people handling confidential invoices and bank details.

What Modern Security for Your Data Looks Like

Any reputable automation platform will guard your data with multiple layers of defence, treating your financial information with bank-level seriousness. At Mintline, we build security into every facet of our service because we know how critical it is.

Here are the non-negotiable security features to look for:

- Advanced Data Encryption: Your information must be protected at all times, whether it’s being sent across a network or sitting on a server. AES-256 encryption is the gold standard here—it’s the same protocol trusted by banks and governments for top-secret files.

- Secure Cloud Infrastructure: The physical location of your data is paramount. Platforms using top-tier providers like Amazon Web Services (AWS) and storing data on EU-based servers give you peace of mind, as your information is protected by some of the world's most robust security and privacy laws.

- Strict Privacy Policies: The platform's commitment to privacy should be crystal clear. Mintline, for instance, operates under a strict policy: your data is never shared with third parties. Full stop. It belongs to you and you alone.

Creating the Perfect Audit Trail, Every Time

One of the most powerful, yet often unsung, benefits of RPA is the way it enhances compliance. Automation doesn't complicate audits; it makes them incredibly straightforward. Every single action a bot performs is logged in detail, creating a complete and unalterable record of all its activities.

From processing a transaction to moving data or generating a report, every step is captured with a timestamp and associated details. This creates a tamper-proof audit trail that offers total transparency and makes proving regulatory compliance a simple exercise.

This kind of immutable log is an auditor’s dream. Forget digging through messy email threads and spreadsheets to prove a process was followed. You can just pull up the bot’s activity log. This detailed record-keeping makes adhering to financial regulations much easier and turns the annual audit from a frantic marathon into a routine check. When done right, automation doesn’t just manage risk—it systematically engineers it out of your financial operations.

Measuring Success and Avoiding Common Pitfalls

So, you’ve decided to bring robotic process automation into your finance department. That's a great move, but how do you know if it's actually working? The real win isn’t just about cutting costs upfront; it’s about making lasting, positive changes to how your financial operations run. To do this, you need to track the right things and be smart about the common traps that can trip up even the best-laid automation plans.

It's one thing to feel like things are running more smoothly, but it's another thing entirely to prove it with solid numbers. This is where key performance indicators (KPIs) become your best friend.

Defining Your Key Performance Indicators

Forget fixating only on cost reduction. A much better approach is to focus on metrics that show the real impact on your team and their day-to-day work. These KPIs tell a much more complete story of your automation success.

- Time Saved Per Week: This is probably the most tangible metric. Add up the hours your team used to spend on manual tasks that are now handled by bots. Every hour saved is a direct boost to your team's capacity.

- Error Rate Reduction: Look at the number of errors you were catching before automation versus after. A bot doesn’t have a bad day or make typos, so you should see a dramatic drop in things like reconciliation mismatches and data entry blunders.

- Days to Close the Books: A faster month-end close is a massive victory for any finance team. Track how long it takes to finalise the books each period. Automation should consistently shave days off that cycle.

Platforms like Mintline can make this tracking painless with a live dashboard. You get an instant view of your automation rate and can spot issues holding you back, like missing documents. It turns abstract goals into concrete, visible progress.

Avoiding Common Automation Pitfalls

Even with the best technology and intentions, automation projects can hit a snag. Knowing what the common roadblocks are is the first step to navigating around them and making sure your project pays off for years to come.

A bot is an instruction-follower, not a problem-solver. If you give it a flawed process to automate, it will just execute that flawed process faster, amplifying the existing problems.

1. Automating a Broken Process This is, without a doubt, the number one mistake people make. Before you even think about building a bot, take a hard look at the manual workflow you want to automate. Is it efficient? Are there steps that don't make sense? Fix the process first. Automation should lock in a great process, not put a digital coat of paint on a bad one.

2. Forgetting About Your Team Dropping new technology on your team without any explanation is a recipe for anxiety and resistance. You have to communicate the ‘why’ behind the change. It's crucial to frame automation as a tool to get rid of the boring, repetitive work, freeing people up for the more interesting, strategic parts of their jobs. Getting your team on board from day one makes all the difference.

3. The "Set-It-and-Forget-It" Mentality While RPA bots are incredibly reliable, they aren't totally hands-off forever. Your business will change, systems will get updated, and suppliers will send invoices in new formats. Your bots will need a little TLC now and then to keep running perfectly. Plan for some ongoing monitoring and tweaking to make sure your automated workflows stay in sync with your business.

By thoughtfully navigating these challenges, you can ensure your robotics process automation in finance initiative is a true and lasting success.

Your Top Questions About RPA in Finance Answered

It's completely normal to have a few questions when you first start looking into robotics process automation for your finance work. After all, it’s a different way of doing things. To help you get comfortable, we’ve put together answers to the questions we hear most often from business owners and finance professionals.

Will RPA Replace My Finance Team?

This is probably the biggest myth out there. The short answer is no. RPA isn't here to replace people; it's here to help them. Think of it as giving your team a digital assistant for the repetitive, high-volume tasks that take up so much time but don't need a human touch.

When you automate things like data entry or reconciliations, you free up your team for the work that really matters. They can finally focus on strategic financial analysis, planning for the future, and building stronger client relationships—the kind of high-value work that grows the business and truly requires their expertise.

Is RPA Only for Large Corporations?

Not anymore. While it’s true that big companies were the first to adopt RPA, today’s tools have made it accessible and affordable for everyone. Platforms like Mintline are built specifically for freelancers, start-ups, and small to medium-sized businesses.

You no longer need a massive IT budget or a team of developers to get started. Focused tools can solve specific problems, like matching receipts to transactions, delivering a significant return on investment without the complexity of enterprise-level software.

This shift means that even a solo entrepreneur can get the same boosts in efficiency and accuracy that were once only available to the giants of the industry.

How Secure Is RPA with Sensitive Financial Data?

Security is non-negotiable, and any good RPA platform is built with that principle at its core. In many ways, automation actually makes your data more secure by reducing the number of times people have to handle sensitive information directly. Plus, every single action a bot takes is logged, creating a clear and unchangeable audit trail.

Modern tools use serious security measures to protect your data around the clock. Mintline, for example, uses AES-256 encryption, which is the same gold standard trusted by banks. All data is also stored on secure, EU-based servers, ensuring it meets strict privacy laws. This tightly controlled process lowers the risk of human error and internal fraud, ultimately making your financial operations safer.

Ready to see how much time you can save? Mintline automatically links every bank transaction to its receipt, eliminating manual work and giving you perfect, audit-ready books. Start for free and turn hours of admin into minutes at https://mintline.ai.