What is a pro-forma invoice? A Practical Guide for Your Business

Learn what is a pro-forma invoice, when to use it, and how it differs from a real invoice to streamline quoting and budgeting.

A pro-forma invoice is essentially a "good faith" quote sent to a client before any work begins or goods are shipped. Think of it as a detailed preview of the final bill. It lays out the agreed-upon prices, quantities, and terms, making sure everyone is on the same page before the deal is officially sealed.

What Exactly is a Pro-Forma Invoice?

Imagine you've commissioned a local artisan to build a custom bookshelf. Before they even think about picking up a saw, they hand you a document. This paper details everything: the cost of the oak, the hours they'll spend crafting it, the price of the drawer handles, and the delivery charge. This isn't the final bill, but it’s a formal estimate to avoid any shocks later on.

That’s precisely the role a pro-forma invoice plays in the business world. It's a financial heads-up, giving your client a crystal-clear, itemised breakdown of what's to come. While it might look nearly identical to a final, commercial invoice, its job is fundamentally different. Its main goal is to establish clear expectations and get a nod of approval, all without creating a legal demand for payment.

To give you a clearer picture, here’s a quick rundown of its core characteristics.

Key Characteristics of a Pro-Forma Invoice

| Characteristic | Description |

|---|---|

| Non-Binding | It’s a quote, not a demand for payment. The terms can still be negotiated. |

| Issued Pre-Transaction | Sent before goods are dispatched or services are completed. |

| No Accounting Entry | It is not recorded in your accounts receivable or the client's accounts payable. |

| Sets Expectations | Clearly outlines costs, quantities, and terms to align both parties. |

| Labelled Clearly | Must be explicitly marked "Pro-Forma Invoice" to avoid confusion. |

This table shows how a pro-forma acts as a crucial preliminary step, ensuring transparency without locking either party into a financial obligation just yet.

So, What’s the Point of a Pro-Forma?

This document is surprisingly useful for a few key business scenarios. For example, a customer might request one to:

- Get internal budget approval from their finance department before officially committing to the purchase.

- Apply for financing or a letter of credit, especially for larger, more significant transactions.

- Smooth out the customs process for international shipping by declaring the value of the goods ahead of time.

It’s crucial to remember that because this is a provisional document, it has no place in your official accounting records like accounts receivable. It’s not a tax document. As your business scales, knowing the difference between document types becomes vital. Many businesses are now digitising these workflows, and you can get a better sense of this by reading about the move towards e-invoicing in our detailed guide.

A pro-forma invoice is really a gesture of trust. It communicates to your client, "Here is exactly what you can expect to pay," building confidence and transparency long before any money actually changes hands.

Pro-Forma vs. Commercial Invoice vs. Quote

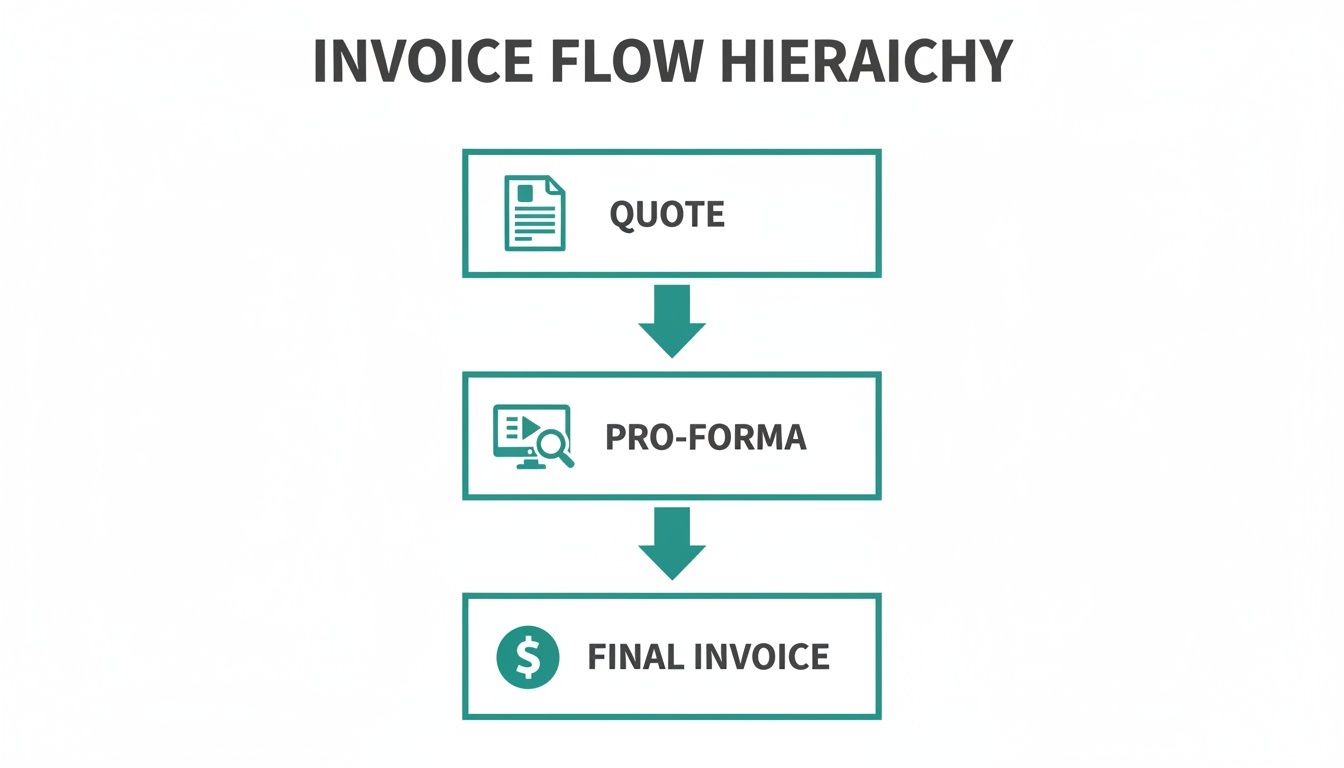

Getting your head around the differences between a quote, a pro-forma invoice, and a commercial invoice is essential for keeping your business running smoothly. At first glance, they might all look a bit similar, but each one has a very specific job to do at different points in a deal. Mixing them up is a surefire way to cause accounting headaches and confuse your clients.

Think of it like building a relationship with a customer. It starts with a handshake, moves to a firm agreement, and ends with the final transaction.

The first step is the quote. This is your opening offer, a 'let's talk' document. It’s perfect for the early negotiation phase because it’s not set in stone. You can tweak prices, adjust quantities, and hammer out the details with the client before anyone commits to anything. It’s basically the start of the conversation.

From Handshake to Formal Agreement

Once you and your client have agreed on the basics in the quote, it’s time to make things a bit more official. This is where the pro-forma invoice comes in. It’s a good-faith commitment that lays out all the agreed-upon details: what’s being sold, how much of it, and the final costs.

But here’s the crucial part: a pro-forma is not a demand for payment. Its real job is to get everyone on the same page and confirm the deal before you ship the goods or start the work. It’s the business equivalent of “Just to confirm, this is what we agreed on, right?”

This distinction is more than just semantics; it has real legal and financial weight. In the Netherlands, for example, the Belastingdienst (the Dutch tax authority) has strict rules differentiating a pro-forma from a final factuur (tax invoice). A final invoice needs to include at least 12 mandatory details, like a KVK-nummer (Chamber of Commerce number) and precise VAT rates. Getting this wrong can mean your customer can't claim their VAT deduction—a mistake that flags a surprising number of invoices in official audits.

This flow chart gives you a clear picture of how these documents lead into one another, moving from a casual offer to the final bill.

As you can see, the pro-forma is that critical link in the chain, turning a simple quote into a confirmed order before the real invoice is sent.

The Final Step: It's Time to Pay

The last document in the sequence is the commercial invoice. You send this out after you’ve delivered the goods or completed the service. This is the real deal—the final, legally binding bill.

Once issued, it officially goes into your books as accounts receivable and into your client's as accounts payable. Unlike the pro-forma, this document formally requests payment and is the one you’ll use for your tax records. Understanding what makes up a commercial invoice is key, especially when you're dealing with international trade where it's a non-negotiable part of the process.

Comparing Key Business Documents

To make it even clearer, here’s a side-by-side look at how these three documents stack up.

| Attribute | Pro-Forma Invoice | Quote / Offer | Commercial Invoice |

|---|---|---|---|

| Purpose | A good-faith agreement before sale | An initial, negotiable price estimate | The final, official bill requesting payment |

| Timing | Before goods/services are delivered | During initial negotiations | After goods/services have been delivered |

| Binding? | Not legally binding for payment | Not binding; an invitation to negotiate | Legally binding; creates a debt |

| Accounting Entry | No; does not create a receivable/payable | No; not an accounting document | Yes; creates accounts receivable and payable |

| Key Function | Confirms sale details, used for customs/payment | Provides a starting point for discussion | Finalises the transaction, used for tax purposes |

Ultimately, using the right document at the right time protects both you and your client, ensuring clarity and professionalism from the first conversation to the final payment.

When to Use a Pro-Forma Invoice

Knowing when to pull out a pro-forma invoice is what separates savvy business owners from the rest. It's a fantastic tool that sits in that sweet spot between an informal quote and a final, binding invoice. Think of it as a way to get the ball rolling, manage expectations, and lock in commitments before any money officially changes hands or gets logged in your books.

Essentially, its job is to kick-start a process or get the necessary approvals lined up. It’s the green light that lets everyone involved move forward with confidence.

Securing Deposits or Advance Payments

Let's say you're a consultant kicking off a big three-month project. You need a deposit to cover your initial time and costs, but you can’t send a final invoice because the work hasn't been done yet. This is a classic case for a pro-forma.

You can send your client a pro-forma invoice that clearly lays out the agreed-upon retainer. It gives them a professional, official-looking document they can use to process the advance payment. This gets cash in your bank account without messing up your books by recognising revenue you haven’t earned yet. For many companies, this is a standard step in their procure-to-pay process.

Clearing International Customs

If you're shipping goods internationally, a pro-forma invoice is your best friend. Customs officials need a clear declaration of the shipment's value to figure out the right duties and taxes. A pro-forma provides this information upfront, even before the sale is final, which helps avoid frustrating delays at the border.

Even though B2B e-invoicing isn't mandatory across the board in the Netherlands, pro-formas are critical for customs in both EU and non-EU trade. To give you an idea, in 2023 alone, Dutch Customs handled 2.8 million import declarations where pro-forma data was used to get goods cleared quickly. For a deeper dive, you can learn more about the specifics of customs valuation in the Netherlands.

Gaining Internal Budget Approval

In bigger companies, getting a purchase approved can feel like navigating a maze. A supplier can make this much simpler by sending a pro-forma invoice to their contact person. That person can then take this formal document to their finance department to get the green light.

A pro-forma acts as a placeholder in the budget, confirming the exact cost and scope so the client can allocate funds. It turns a potential purchase into a concrete, approvable expense.

What to Include in a Pro-Forma Invoice

While a pro-forma invoice isn't the final bill, getting it right is crucial. A well-put-together pro-forma gives your client everything they need to approve the budget, arrange for customs, or simply make a decision. It’s also your first impression, so it needs to look professional.

Think of it as the blueprint for the real invoice. It has to be detailed and accurate to prevent any confusion down the line. Missing information can cause delays or misunderstandings, which defeats the whole purpose of sending one in the first place.

The Essential Components

To make sure your pro-forma is crystal clear and does its job effectively, you’ll need to include a few key pieces of information. Here’s a quick checklist of what every pro-forma invoice should have:

-

A Clear Title: Right at the top, make sure it says "Pro-Forma Invoice". This simple label is incredibly important because it stops anyone from confusing it with a final, legally binding invoice that needs immediate payment.

-

Seller and Buyer Details: You'll need the full name, address, and contact info for both your business and your client. No shortcuts here.

-

Itemised List of Goods or Services: Be specific. Break down exactly what you're providing, including clear descriptions, quantities, and the price for each item. Transparency is key.

-

Prices and Totals: Show the subtotal for all items, then add any applicable taxes (like VAT) and shipping costs. Finish with the final total amount so the client knows exactly what to expect.

-

Payment Terms and Expiration Date: Outline your proposed payment terms (for instance, "Payment due upon receipt of final invoice"). It’s also wise to add an expiration date. This puts a timeframe on the offer, protecting you if your own costs go up later.

A golden rule: never use a number from your official invoice sequence. Giving a pro-forma a standard invoice number can create a real mess in your accounting records. It makes a non-binding document look like a real sale. Instead, use a unique prefix, like "PF-001," to keep it completely separate from your legally recognised financial documents.

Streamlining Your Pro-Forma Workflow

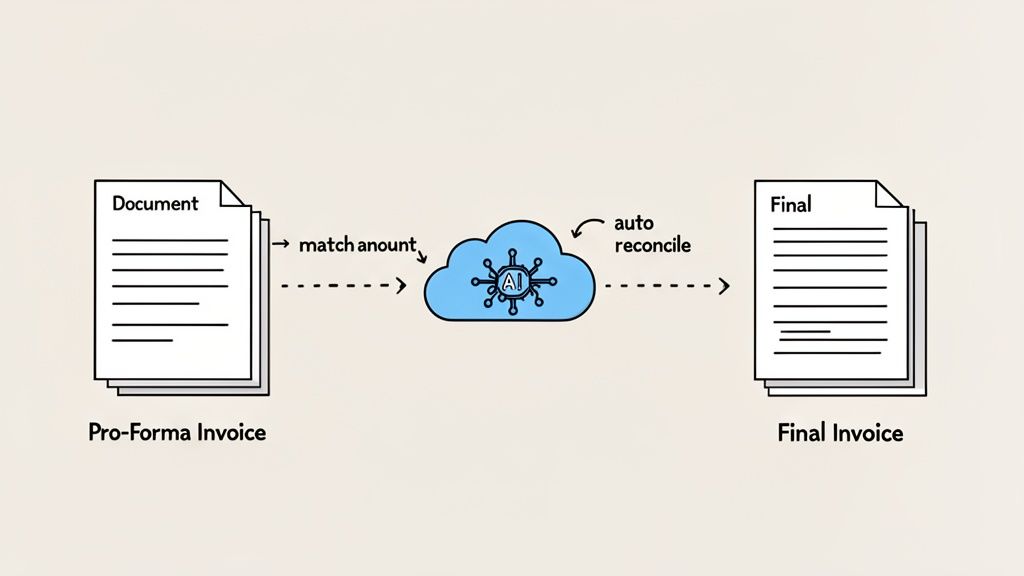

While pro-formas are a fantastic tool, they often introduce manual work into your financial processes. You send a pro-forma, get an advance payment, do the work, and then create a final invoice. Suddenly you have two separate documents for a single transaction, and you're left trying to manually connect the dots in your bookkeeping software.

This extra step can really complicate your financial reconciliation. Every time you have to match a payment to multiple documents, you’re not just wasting precious time; you're also opening the door to potential errors. For freelancers and small businesses, this can quickly turn clean accounting into a frustrating puzzle.

Solving the Reconciliation Puzzle with AI

This is exactly where a smart financial platform like Mintline makes a difference. Instead of a fragmented process, Mintline creates a seamless, automated workflow. Our system intelligently matches key details—like the vendor, amount, and date—to automatically link the advance payment from the pro-forma to the final invoice it belongs to.

Think of it as creating a clear, digital paper trail. Mintline connects the initial agreement (the pro-forma), the money that came in, and the final bill, all without you having to lift a finger. No more guesswork or manual data entry.

This kind of automation is a huge advantage, particularly here in the Netherlands. In 2022, data from the Dutch Chamber of Commerce (KVK) revealed that over 65% of small businesses involved in cross-border trade relied on pro-formas for advance payments. For businesses that use Mintline, AI-powered tracking slashes the manual errors that affect an estimated 40% of SMBs, turning messy bank statements into clean, audit-ready records in minutes.

Ultimately, a more organised approach ensures your financial records are consistently accurate and up-to-date. Understanding how pro-formas fit into your overall financial picture is key, especially when building efficient Accounts Payable workflows. By adopting tools that simplify these steps, you can get back to focusing on your clients, not your paperwork. Ready to upgrade your entire process? Dive into our guide on automated invoicing software.

Frequently Asked Questions About Pro-Forma Invoices

Even when you've got the basics down, a few tricky questions about pro-forma invoices tend to pop up. Let's clear the air on some of the most common ones so you can use them correctly and avoid any messy financial mix-ups.

Is a Pro-Forma Invoice a Legally Binding Contract?

In short, no. A pro-forma invoice is not a legally binding document or an official demand for payment. Think of it more as a handshake agreement on paper—a seller's promise to deliver specific goods or services at an agreed-upon price.

The buyer isn't legally on the hook to pay based on this document alone. It's really a finalised quote, setting the stage for the deal before any real transaction takes place. It confirms the terms, but it doesn't create a debt.

Can I Use a Pro-Forma for My VAT Records?

This is a hard no. Tax authorities, like the Belastingdienst here in the Netherlands, do not recognise pro-forma invoices as official fiscal documents. You cannot use them to claim or declare VAT.

A pro-forma doesn't represent a completed sale, so it has no place in your official tax accounting. Always use a final, compliant tax invoice for your books to avoid compliance headaches or penalties down the line.

How Do I Turn a Pro-Forma into a Final Invoice?

Once your client gives you the green light and you're ready to make it official, you’ll create a brand-new document based on the pro-forma. The process is straightforward: just change the title from "Pro-Forma Invoice" to "Invoice."

Here's the crucial part: you must assign it a unique, sequential number from your official invoice log. Don't forget to update the date and give all the details one last check to make sure they're still accurate. This new document is now the real deal—the legally recognised bill.

This is exactly where manual bookkeeping gets complicated. An advance payment comes in against a pro-forma, but the final invoice is issued later, leaving you with a reconciliation puzzle to solve.

With Mintline, you can forget about trying to connect the dots manually. Our platform automatically links payments from pro-formas to their final invoices, giving you a clean and complete audit trail without the administrative grind. See how you can turn a fragmented workflow into a seamless one by visiting Mintline's official website.