How Matching Works

Mintline uses AI to automatically match receipts to bank transactions. Here's how it works.

The Matching Process

When you have both receipts and bank statements, Mintline compares them using:

- •Amount - Does the receipt total match a transaction?

- •Date - Is the receipt date close to the transaction date?

- •Vendor - Does the vendor name appear in the transaction description?

Each potential match gets a confidence score from 0-100%.

Confidence Scores

90-100%

High confidence - Amount, date, and vendor all align.

70-89%

Medium confidence - Most signals match.

<70%

Lower confidence - May need manual review.

Match Statuses

Proposed

AI found a match, awaiting your review.

Confirmed

You confirmed the match.

Rejected

You rejected the match.

Unmatched

No matching receipt found.

Reviewing Matches

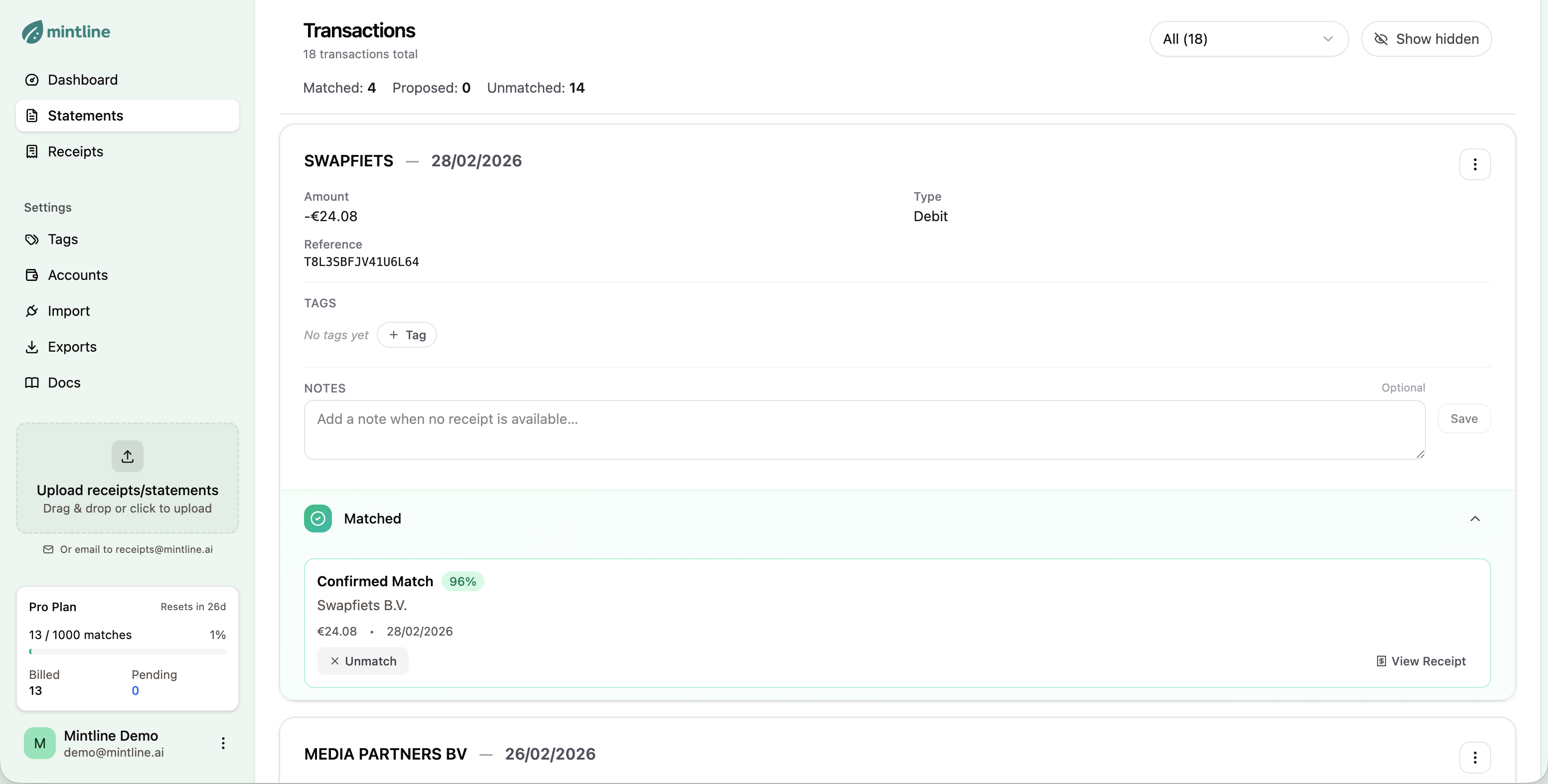

In any statement, transactions are grouped by status. Click the Matched section to expand and see:

- •Confidence score (e.g., "96%")

- •Linked receipt details

- •View Receipt button

- •Unmatch button (to undo)

Matched transaction with confidence score and receipt details

Confirming and Rejecting

For proposed matches:

- 1Review the confidence score and details

- 2Click Confirm if correct

- 3Click Reject if wrong (they won't be suggested again)

Manual Matching

If AI doesn't find a match:

- 1. Open the receipt

- 2. Click "Match manually"

- 3. Search for and select the correct transaction

Unmatched Transactions

Some transactions won't have receipts (ATM withdrawals, bank fees). For these:

- •Add a Note explaining why

- •Optionally Hide from matching

Next Steps

Automate receipt collection by connecting your Gmail.

Connect Gmail to auto-import receipts →